Gold Stocks What to Expect in 2014

Commodities / Gold and Silver Stocks 2014 Jan 08, 2014 - 05:12 AM GMTBy: Frank_Holmes

After three years of pain, can gold stocks break their losing streak and see a gain in 2014?

After three years of pain, can gold stocks break their losing streak and see a gain in 2014?

History says chances are good.

The most recent string of losses in the gold mining industry has been brutal, causing many investors to give up on the sector and sell their holdings. Since the beginning of 2011, the NYSE Arca Gold Miners, the FTSE Gold Mines, and the Philadelphia Gold & Silver Indices all declined more than 60 percent.

But ditching this sector may not be the best action to take this year because miners are approaching the historical limits of multi-year declines.

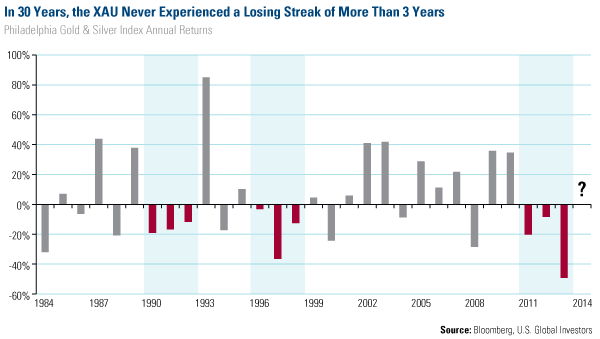

Take a look at the Philadelphia Gold & Silver Index (XAU) during prior periods of stress. While gold stocks have a history of higher volatility compared to the overall U.S. market, consecutive periods of declines are rare. In 30 years, the XAU never had a losing streak of more than three years.

In fact, there were only two previous times in these three decades in which the XAU saw a trio of losses.

One was back in the early 1990s, when the index fell 19.09 percent, 16.75 percent and 11.75 percent in 1990, 1991 and 1992, respectively.

What's striking about this period is the incredible rebound that followed. The XAU rallied 85 percent in 1993. U.S. Global Investors' Gold and Precious Metals Fund (USERX) climbed even more, increasing a whopping 124 percent in 1993. See recent performance of USERX.

Could we see a repeat performance?

Perhaps. A key is watching government policies, as they can be a precursor to change.

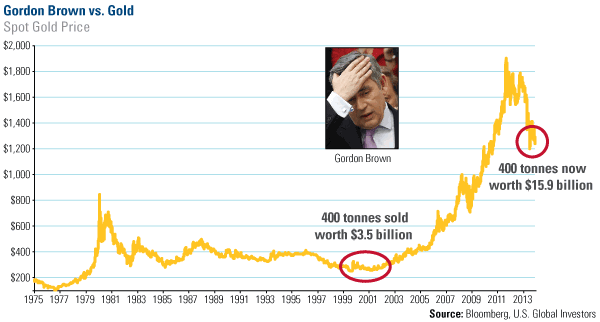

Let's take a look at the other period of weakness. This three-year loss occurred in the late '90s, with a muted rebound in 1999. However, at that time, the Bank of England (BOE) was auctioning off a significant amount of its gold reserves when bullion prices were at their lowest in 20 years. From 1999 to 2002, the central bank in England sold off 400 tonnes at a value of about $3.5 billion.

If the BOE had held onto this gold, it'd be worth nearly $15.9 billion today.

Following the period when the BOE sold its gold, the XAU rebounded. While the index gained only about 6 percent in 2001, gold stocks rose 41 percent in 2002 and about 42 percent in 2003.

During this period, gold and gold stocks were again influenced by a change in government policy. In this case, the liberalization of gold purchases was occurring in China, which was positive for gold.

So what about 2014?

What catalysts could turn gold stocks around and end the losing streak? Investors have multiple possible events to choose from that could cause gold and gold companies to rally. In a recent Mineweb article, Lawrie Williams listed several:

-

Gold ETF sales have slowed. See our chart that shows how gold ETF redemptions ceased to be the main driver of falling prices.

-

The COMEX warehouse is "running out of available physical gold," which is causing more traders to demand delivery of additional gold, says Lawrie.

-

Chinamay continue to build its gold reserves. Lawrie speculates that China could have its first gold conference backed by "a slew of government organisations."

-

Indiacould ease its gold import restrictions. In a recent Investor Alert, we highlighted the commerce ministry's request to ease restrictions, which would relieve jewelers hurt by import curbs.

-

Unrest in the Middle East likely could persist.

-

There may be a "major hiccup" in U.S. growth. Read U.S. Global's special report, which takes a closer look at how to evaluate unemployment and inflation numbers.

-

Newly mined gold supply may be underwhelming.

Lawrie mentions a few downsides as well, which would result in an unprecedented fourth year of declines for gold stocks. For example, as the Federal Reserve cuts back on bond purchases, it could come "without adverse general stock market reaction." In addition, there may continue to be improvements in the unemployment situation in the U.S. and Europe.

Ralph Aldis, portfolio manager of U.S. Global's gold funds, the Gold and Precious Metals Fund (USERX) and the World Precious Minerals Fund (UNWPX), believes the best time to buy gold is when the market hates it. He recently talked with The Gold Report about gold, junior explorers and what investors should expect in the new year. When asked his thoughts about gold's direction in 2014, Ralph remarked:

"I think pessimism has reached a maximum, particularly in the gold space. Historically, when pessimistic consensus is this strong and gold stocks are hated this much, these are turning points.

"The opportunity is here; don't get discouraged."

Want to receive more commentaries like this one? Sign up to receive email updates from Frank Holmes and the rest of the U.S. Global Investors team, follow us on Twitter or like us on Facebook.

By Frank Holmes

CEO and Chief Investment Officer

U.S. Global Investors

U.S. Global Investors, Inc. is an investment management firm specializing in gold, natural resources, emerging markets and global infrastructure opportunities around the world. The company, headquartered in San Antonio, Texas, manages 13 no-load mutual funds in the U.S. Global Investors fund family, as well as funds for international clients.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.Standard deviation is a measure of the dispersion of a set of data from its mean. The more spread apart the data, the higher the deviation. Standard deviation is also known as historical volatility. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The NYSE Arca Gold BUGS (Basket of Unhedged Gold Stocks) Index (HUI) is a modified equal dollar weighted index of companies involved in gold mining. The HUI Index was designed to provide significant exposure to near term movements in gold prices by including companies that do not hedge their gold production beyond 1.5 years. The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar.

Frank Holmes Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.