Reasons To Buy Gold NOW!

Commodities / Gold and Silver 2014 Jan 14, 2014 - 10:18 AM GMTBy: Money_Morning

Peter Krauth writes: Gold fell by 28% in 2013. That's a huge reversal of a decade-plus trend.

Peter Krauth writes: Gold fell by 28% in 2013. That's a huge reversal of a decade-plus trend.

Between 2001 and 2012, gold managed positive gains every single year, a track record unmatched by any major asset.

The precious metal went from a low of $255 in April 2001 to a high of $1,900 in September 2011, for a peak return of 745%.

Since then, gold has given back 35% from its $1,900 high, leading many to call the end of the gold bull market.

But is it really finished?

By looking at history and numerous indicators, I've found a different story.

One that will jumpstart your 2014 profits...

Simple Economics Guarantees a Gold Rally

Fundamental drivers for gold are so numerous I hardly know where to start.

Unprecedented quantitative easing (money printing) and ultra-low interest rate policies imposed by central banks - especially in the United States, Japan, Europe and China - are in the news every day.

Here are several others that aren't grabbing headlines yet, but shouldn't be ignored.

Shuttering Operations: It's no secret that falling gold prices have made numerous mines unprofitable. That's pressured management at those mining companies to rationalize their operations. Producing gold at a loss doesn't make for happy shareholders.

So mines are being put on care and maintenance, seriously cutting into gold production worldwide. Evy Hambro, who manages BlackRock Inc.'s $8 billion World Mining Fund, said gold supply could fall "quite rapidly" as producers restrict output at higher-cost mines.

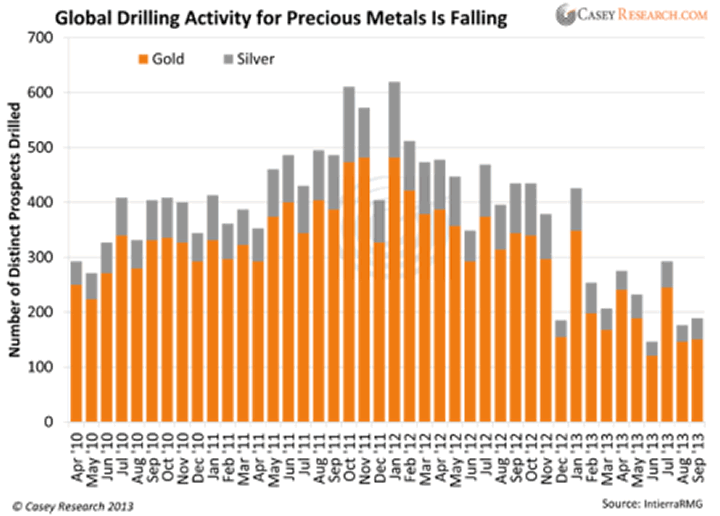

Fewer Discoveries: Lower gold prices have meant, of course, lower profits. So, miners are cutting back on expenses that aren't immediately accretive, affecting the development of mine expansions, new projects, and exploration. That's inevitably going to mean fewer ounces available to mine in the near and medium terms than would have been the case without this gold price rout. There were half as many drills looking for precious metals in the first 9 months of 2013 versus 2012.

High-Grading: In response to lower prices, gold miners have resorted to mining higher-grade ores while leaving behind low-grade ores. That allows them to be more profitable on ounces produced this way, but it means much higher prices will be needed to go back to the lower-grade ores. In some cases, these may never even be mined out at all.

Physical Asian Buying: Asia loves gold, and that trend continues. In the first nine months of 2013, India and China together had bought 1,500 tonnes (1,653 short tons) of gold, easily dwarfing Western purchases. When Indian, Chinese, and central bank buying are combined, they account for nearly the entire annual world gold production.

Overall, gold fundamentals have not only remained intact, they've continued to improve. So it's easy to project them to push higher gold prices in the future. They've got the laws of economics behind them...

Gold Hits the Same Bottom - Twice

An important part of technical analysis involves analyzing price action. And gold's had plenty of that over the past year.

Most significant was the massive price drop in mid-April when a black swan crash-landed on the gold market.

Over just two trading days, gold futures prices shed 13%, falling from $1,575 to $1,375. That $200 cliff dive was the largest two-day drop in 33 years.

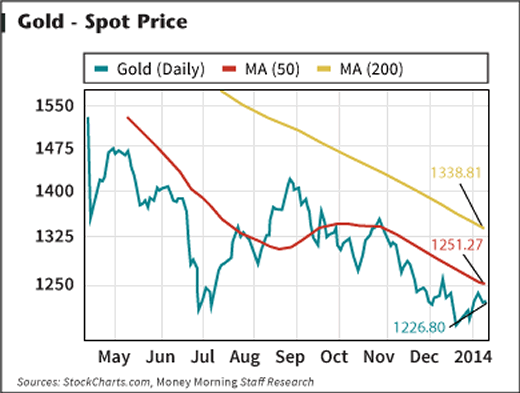

By late June the price had fallen further still, to $1,180 per ounce. So far, that's been the low.

Recent news of the Fed's QE tapering again weighed on gold in late December, causing it to momentarily drop to $1,182, then immediately reverse upward by $32.

While it's still early to say for sure, that may have been a "double bottom" - dropping twice to the same level without moving further down - hit in June then in December. This increases the chances that the $1,180 level is the low for gold prices in this drawn-out consolidation process.

We can see from this chart that gold has now twice "tested" $1,180 and moved higher from there.

Does this mean gold's price is out of the woods? Not necessarily, but the trees are thinning.

Too Many Contract Holders, Too Little Gold

It's fair to say that after a long stretch of falling gold prices, the precious metal's not just hated, it's despised.

gold spot price

And that's often a tremendous contrarian indicator.

Combine that with some recent action in the futures market, and we've got more very bullish indicators for gold.

Recent Commitment of Traders (COT) reports at the end of 2013 showed that hedge funds (large speculators) had a record short position on the Comex in New York; extreme bearishness is a great contrarian indicator.

On the flipside, the large bullion banks have reverted from holding net short positions to holding net longs in the stretch from 2004 until mid-2013.

By late 2012, the four largest banks held a $12.5 billion short futures position. Since then, there's been a massive reversal of some $20 billion, with these same banks now holding a $7 billion long position.

And there's more.

In the week of Dec. 23, 2013, Comex-registered gold inventories (gold available for delivery) dropped to their lowest in a year, with an incredible 92 claims for each registered ounce. What will happen when a few too many contract holders decide to take delivery at maturity?

Just the fact that there are so many claims for each ounce increases the odds that if too many deliveries are requested, the exchange could "default" and be forced to pay out in cash rather than gold.

That would likely be a major shot in the arm for the price of gold.

All of these factors point toward higher gold prices ahead.

Does that mean they'll go straight up? Unlikely, since nothing goes up in a straight line.

So we can expect continued volatility in the gold price this year, with some risk for lower prices, but a strong bias to the upside.

I think we're likely to see gold close the year higher than where it started. Since its bottom in April 2001, gold has compounded at a rate of about 15% annually. Given that it has some catching up to do for the last couple of years, I think we could see the precious metal gain as much as 25% this year, bringing its price to the $1,600 range.

Your Best Move to Start the Year

What's the best way to play gold right now? Like I tell my subscribers, gold's cheap at these prices. If you don't own any, buy some bars or coins. If you feel you don't own enough, this looks like a good time to add to your holdings.

Within gold equities, I really like the royalty companies. Many are cashed up and well-positioned to make strategic moves.

In this trying environment for miners struggling with rising production costs and scant financing options, royalty and streaming companies have the upper hand, able to do financing deals with extremely favorable terms (for them). They have cash when cash is scarce, and that will pay off big time.

Consider Royal Gold Inc. USA (Nasdaq: RGLD), a $3.3 billion royalty company, with interests in more than 200 production, development, and exploration-stage royalties. Royal Gold boasts $680 million in working capital and $350 million in undrawn credit it can put to work.

Needless to say, Royal Gold offers robust leverage to the gold price.

Fundamentals, technical, and the end-around of contrarians are all lined up behind a bull run in 2014. And the timing is right to join the front of the line...

Source : http://moneymorning.com/2014/01/14/1600-reasons-buy-gold-now/

Money Morning/The Money Map Report

©2013 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.