Gold Contrarians’ Wildest Dream Coming True

Commodities / Gold and Silver 2014 Jan 15, 2014 - 05:51 PM GMTBy: Jeff_Clark

As most readers know, Doug Casey's most notable characteristic as an investor is his highly successful contrarian nature. It's how he bagged some of his biggest wins—not just doubles and triples, but 10- and 20-fold returns.

As most readers know, Doug Casey's most notable characteristic as an investor is his highly successful contrarian nature. It's how he bagged some of his biggest wins—not just doubles and triples, but 10- and 20-fold returns.

There's only one way to realize these kinds of gains: You must buy when the asset is out of favor. Buying an investment that has already run up is at best chasing momentum and at worst a portfolio wrecker.

So, what's the greatest contrarian investment today? Consider this pictorial data…

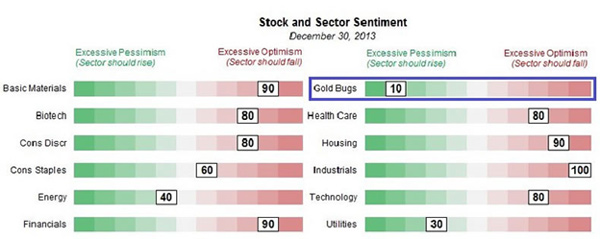

At the end of 2013, the sector with the highest level of pessimism, as measured by SentimenTrader, was the gold industry. It actually registered "zero" in mid-December.

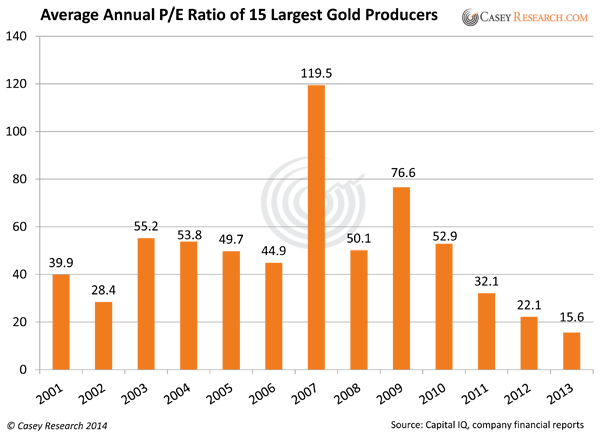

Meanwhile, price-to-earnings ratios of the 15 largest gold producers are at their lowest level in 14 years, and less than half what they were when the bull market got under way in 2001.

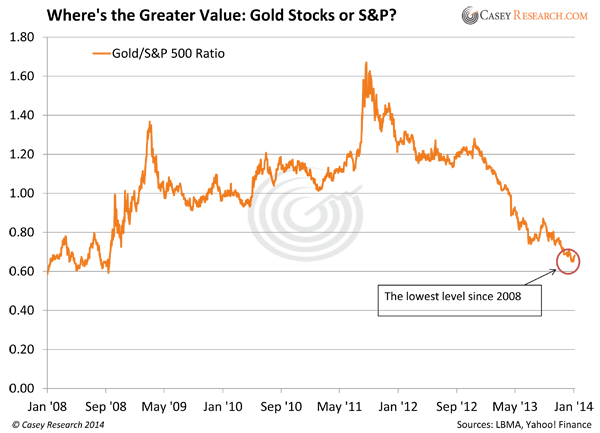

The ratio of gold to the S&P 500 Index is currently at 0.66, its lowest level since the market meltdown of 2008.

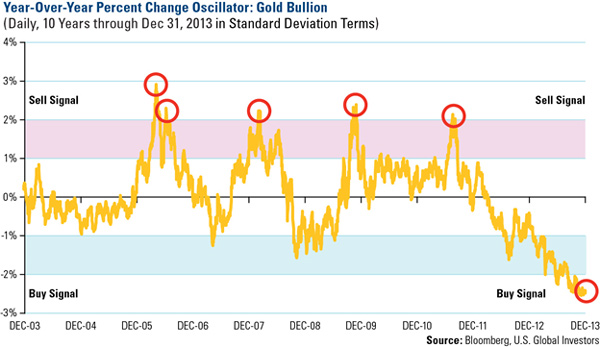

The next chart, from our friend Frank Holmes at US Global Investors, measures gold's 60-day percent change in standard deviation terms. It shows the metal's actual gain or loss in relation to its average price change—and it's never been this low.

Another chart from US Global Investors demonstrates that last year's decline in the Philadelphia Gold and Silver Index (XAU) was the greatest on record, and further, that consecutive annual declines are rare. The XAU is one of the two most-watched gold stock indices in the world, and in 30 years it's never had a losing streak of more than three years.

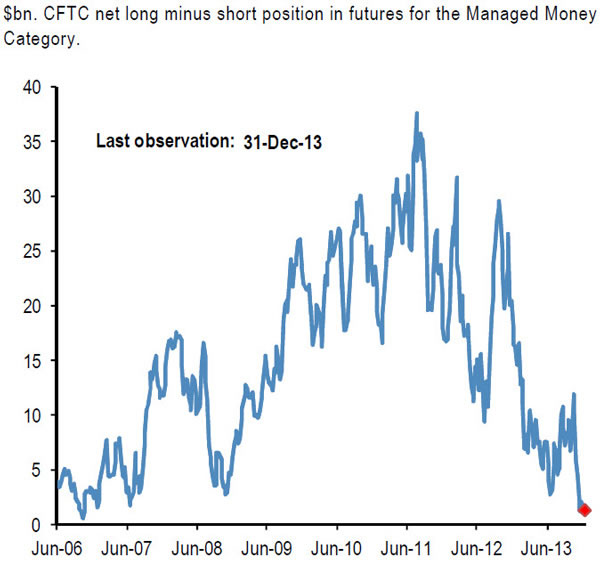

Also, JPMorgan noted last week that speculative positions in gold (defined as net longs minus shorts) dropped to record lows at the end of 2013.

(Source: Zero Hedge)

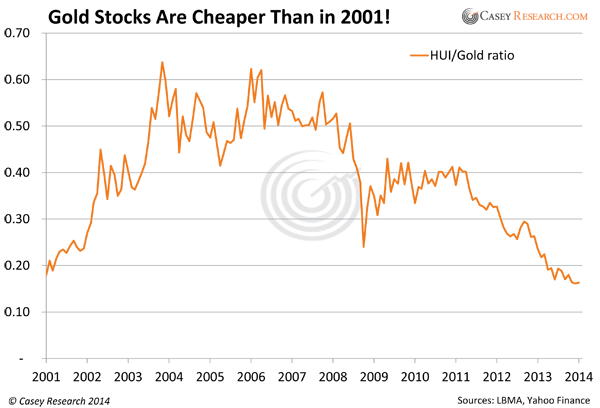

Finally, the XAU/gold ratio is at its lowest point in history, and the HUI/gold ratio—the other major gold stock index—shows that gold stocks are now cheaper than they've been since the beginning of this secular bull cycle in 2001.

Of course, just because something is cheap today doesn't mean it will soar tomorrow. But given gold's historical role as money, butted up against monetary recklessness today, the outcome seems all but certain.

As Casey Editor Kevin Brekke recently put it: "We are in this sector because of our belief that monetary and fiscal excesses have consequences. The only variable is the timing. We may not know where we're going in the short term, but the long term is inevitable."

And right now, some of the most successful resource speculators and investment pros are seeing the early hallmarks of a turnaround in the gold sector—which makes this the best time to invest in the yellow metal as well as top-quality, undervalued gold mining stocks.

New to the gold market? Don't despair: the FREE 2014 Gold Investor's Guide, a Casey Research special report, gives you all the basics on precious metals investing. Click here to get it now.

© 2014 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Casey Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.