Gold as a Deflation Hedge

Commodities / Gold and Silver 2014 Jan 16, 2014 - 07:44 PM GMT (The following is the first of a five part series on how gold performs during periods of deflation, chronic disinflation, runaway stagflation and hyperinflation. The first installment examines gold’s safe-haven role during a deflationary event like the global 1930s economic depression.)

(The following is the first of a five part series on how gold performs during periods of deflation, chronic disinflation, runaway stagflation and hyperinflation. The first installment examines gold’s safe-haven role during a deflationary event like the global 1930s economic depression.)

“The inability to predict outliers implies the inability to predict the course of history. . .But we act as though we are able to predict historical events, or, even worse, as if we are able to change the course of history. We produce thirty-year projections of social security deficits and oil prices without realizing that we cannot even predict these for next summer — our cumulative prediction errors for political and economic events are so monstrous that every time I look at the empirical record I have to pinch myself to verify that I am not dreaming. What is surprising is not the magnitude of our forecast errors, but our absence of awareness of it.”

- Nicholas Taleb, The Black Swan — The Impact of the Highly Improbable, 2010

“Having been mugged too often by reality, forecasters now express less confidence about our abilities to look beyond the immediate horizon. We will forever need to reach beyond our equations to apply economic judgment. Forecasters may never approach the fantasy success of the Oracle of Delphi or Nostradamus, but we can surely improve on the discouraging performance of the past.”

- Alan Greenspan, The Map and the Territory, 2013

Introduction

This short study examines gold’s performance under the four most commonly predicted worst-case economic scenarios — a 1930s-style deflation, chronic Japanese-style disinflation, a 1970s-style runaway stagflation, and a Weimar-style hyperinflation. “That men do not learn very much from the lessons of history,” Aldous Huxley once wrote, “is the most important of all the lessons of history.” Though I agree with Huxley’s assessment when applied to contemporary policymakers and central bankers, I do not agree with it when applied to their counterparts in the private sector, i.e., the individual investors. As justification, I offer the ongoing (and long-term) success of the USAGOLD website as well as the soaring statistics of late on private gold ownership both here and abroad, most of which has been accumulated for safe-haven purposes. Individually, we can and do learn the lessons of history even if we do not always do so collectively.

Black Swans, Yellow Gold is dedicated to those who believe, like Nicholas Taleb, that it is just as important to prepare for what we cannot foresee as what we can. Some might put their money on the latest Oracle of Delphi or the contemporary reincarnation of Nostradamus — or even an all-seeing eye plug-in that can be downloaded from the internet — but in the end, such notions are the dreams of government planners and retired central bankers. For the rest of us, a solid hedge in gold coins, as your are about to read, is the more sensible and reliable alternative — a wealth haven for all seasons.

We invite you to return to these pages periodically for the second installment in this series which we plan to publish next week.

Gold as a deflation hedge (United States, 1929)

WEBSTER DEFINES DEFLATION A “CONTRACTION IN THE VOLUME of available money and credit that results in a general decline in prices.” Typically deflations occur in gold standard economies when the state is deprived of its ability to conduct bailouts, run deficits and print money. Characterized by high unemployment, bankruptcies, government austerity measures and bank runs, a deflationary economic environment is usually accompanied by a stock and bond market collapse and general financial panic — an altogether unpleasant set of circumstances.

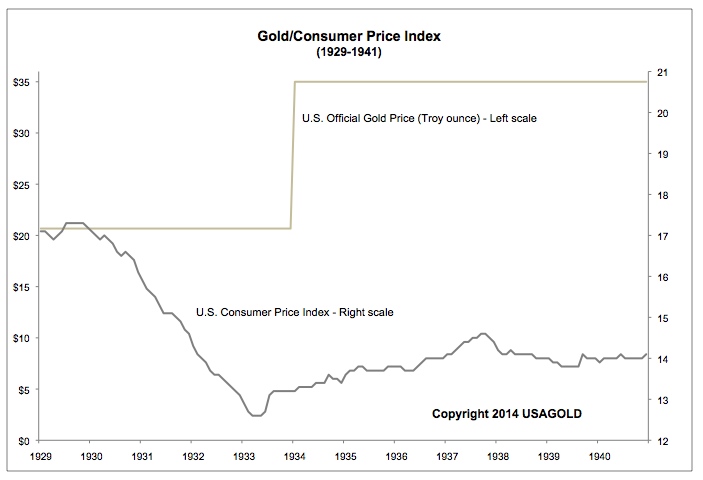

The Great Depression of the 1930s serves as a workable example of the degree to which gold protects its owners under deflationary circumstances. First, because the price of gold was fixed at $20.67 per ounce, it gained purchasing power as the general price level fell. In 1933, when the U.S. government raised the price of gold to $35 per ounce in an effort to reflate the economy through a formal devaluation of the dollar, gold gained even more purchasing power. President Franklin D. Roosevelt also confiscated gold bullion by executive order in concert with the devaluation, but exempted “rare and unusual” gold coins which later were defined by regulation simply as items minted before 1933. As a result, only those citizens who owned gold coins dated before 1933 were able to reap the benefit of the higher fixed prices. The accompanying graph illustrates those gains, and the gap between consumer prices and the gold price.

Gold as a deflation hedge

Second, since gold acts as a stand-alone asset that is not another’s liability, it played an effective store of value function prior to 1933 for those who either converted a portion of their capital to gold bullion or withdrew their savings from the banking system in the form of gold coins before the crisis struck. Those who did not have gold as part of their savings plan found themselves at the mercy of events when the stock market crashed and the banks closed their doors (many of which had already been bankrupted).

How gold might react in a deflation under today’s fiat money system is a more complicated scenario. Even one under a fiat money system, the general price level would be falling by definition. Economists who make the deflationary argument within the context of a fiat money economy usually use the analogy of the central bank “pushing on a string.” It wants to inflate, but no matter how hard it tries the public refuses to borrow and spend. (If this all sounds familiar, it should. This is precisely the situation in which the Federal Reserve finds itself today.) In the end, so goes the deflationist argument, the central bank fails in its efforts and the economy rolls over from recession to a full-blown deflationary depression.

How the government treats gold under a deflationary scenario will play heavily into its performance:

- If gold is subjected to price controls and restricted ownership, as it was in the 1930s deflation, it would likely perform as it did then, i.e., its purchasing power would increase as the price level fell. Under such circumstances, the ownership of “rare and unusual” gold coins might once again come into play.

- If ownership is not restricted, it would turn out to be the best of all possible worlds for gold owners. Its purchasing power would increase as the price level fell, and the price itself could rise as a result of increased demand from investors hedging systemic risks and financial market instability.

Note: That, by the way, is the primary reason governments tend to restrict gold ownership when confronted with widespread bank runs and failing financial markets. Governments seize gold not because they need the money; they seize it to cut off the escape route and force capital flows back into banks and financial markets. As an aside, that is precisely the reason why governments have an interest in controlling the price of gold. Former Fed chairman Paul Volcker, it has been copiously reported, once said, “Gold is my enemy. I’m always watching what it is doing.” Though there is no direct evidence I know of that the Fed or Treasury Department intervened directly in the gold market during Mr. Volcker’s tenure, his statement does reflect the acute interest in gold on the part of monetary policy-makers. Alan Greenspan voiced a similar interest in gold throughout his Fed chairmanship and still does today, though unlike Volcker he has always defended gold and expressed an appreciation for its use as a form of money or final payment or reconciliation. Gold, in the end, is not just competition for the dollar; it is competition for the bank deposits, stocks and bonds most particularly during times of economic stress, and that is the source of enduring interest among policy-makers.

The disinflationary period leading up to and following the financial market meltdown of 2008 serves as a good example of how the second scenario might unfold. The disinflationary economy is a close cousin to deflation, and is covered in the next installment in this series. It provides some solid clues as to what we might expect from gold under a full deflationary breakdown.

If you are looking for a gold-based analysis of the financial markets and economy, we invite you to subscribe to our FREE newsletter – USAGOLD’s Review & Outlook, edited by Michael J. Kosares, the author of the preceding post, the founder of USAGOLD and the author of “The ABCs of Gold Investing: How To Protect And Build Your Wealth With Gold.” You can opt out any time and we won’t deluge you with junk e-mails.

By Michael J. Kosares

Michael J. Kosares , founder and president

USAGOLD - Centennial Precious Metals, Denver

Michael J. Kosares is the founder of USAGOLD and the author of "The ABCs of Gold Investing - How To Protect and Build Your Wealth With Gold." He has over forty years experience in the physical gold business. He is also the editor of Review & Outlook, the firm's newsletter which is offered free of charge and specializes in issues and opinion of importance to owners of gold coins and bullion. If you would like to register for an e-mail alert when the next issue is published, please visit this link.

Disclaimer: Opinions expressed in commentary e do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. Centennial Precious Metals, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD - Centennial Precious Metals does not warrant or guarantee the accuracy, timeliness or completeness of the information found here.

Michael J. Kosares Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.