The End Game - Case for Deflation is Quietly Strengthening

Stock-Markets / Deflation Jan 24, 2014 - 03:45 PM GMTBy: Jonathan_Davis

It is interesting that, nearly 5 years after the setting of the EMERGENCY interest (Base) rate of 0.5% we are still at 0.5% and our illustrious ‘capitalist’ government is borrowing £110 Billions per annum (to add to the admitted-to debt of £1100 Bns and the off balance sheet further liabilities of £4000 Bns). Carney, at the Bank of England, and Osborne, the Chancellor and Alexander, his puppy, tell us the recovery is locked in. And most believe them.

It is interesting that, nearly 5 years after the setting of the EMERGENCY interest (Base) rate of 0.5% we are still at 0.5% and our illustrious ‘capitalist’ government is borrowing £110 Billions per annum (to add to the admitted-to debt of £1100 Bns and the off balance sheet further liabilities of £4000 Bns). Carney, at the Bank of England, and Osborne, the Chancellor and Alexander, his puppy, tell us the recovery is locked in. And most believe them.

And yet we have an emergency interest rate and the govt is borrowing £110Bns pa. Locked in??? It is all about bailing out bankers, the hyper rich and the political establishment. This is not capitalism. It is socialism for the rich and powerful. And I very much doubt we will see capitalism again for at least a generation, if at all. This is step by step encroaching Marxism and surely everyone knows how that ends?

Either we move to higher and higher inflation and interest rates, and the economy dies…

Or we are, in fact, turning Japanese, rates stay low (go even lower to effectively NIL%) and we are mired in deflation and the economy dies.

There is no way out. Either of these will last the best part of a generation, at least.

Think about it.

They tell us we cannot take higher rates. They are right. Given the vast amount of debt around, it will create business busts (not banks…) and home repossessions by the hundred thousand. The economy would melt down. To avoid it, if they can, they’ll print money in ever increasing quantities. £110Bns pa will become £200 Bns, then £500 Bns and so on per annum. Our currency would be decimated. We would not stop at mild inflation. We would go to hyper inflation. Think wheelbarrows and an economy in ruins like Zimbabwe or Argentina, in the last decade or two, or Venezuela right now – the result of Marxists who cannot abide admitting they got it wrong.

Remember when all the British Socialists in the Guardian and the BBC were lauding Hugo Chavez as a conquering hero with all the right answers. Well have a look at what he did to his people and what his successor Maduro is doing to them. As at the end of last year the inflation rate in Venezuela was 56% per annum. It will probably go into the hundreds of percent per annum – literally. Just yesterday they devalued their currency (again). This time by 40%. Overnight, food and fuel rose in price 40%. There is practically nothing in the shops. Those of you, reading this thinking that inflation is not actually a bad thing, have never lived through hyper inflation caused by Marxist zealots. As if people like us didn’t say over the years that it would end in repression of liberties, mass murder and poverty. But the Socialist media knew better… NB. I couldn’t find the Venezuelan situation on the BBC site. But Justin Bieber was on the News front page…

So, do you want to move to higher and higher inflation along with higher and higher interest rates? What would happen to the economy and house prices if businesses had nothing to sell, they went bust and unemployment went stratospheric? The answer is pretty obvious.

On the other hand, staying in deflation will drive us also to continuing slow or no economic growth while successive governments continue to use taxes to pump money into banks and do so by cutting welfare and public spending – including reneging on welfare and health etc promises as well as public sector salaries and pensions. That is effectively what happened in Japan in the 1990s and 2000s. For the last 5 years we have done exactly what they did in their first 5 years of the quarter century bust. And there’s more to come of this. The result in Japan, may I remind you, was an equal 80% collapse in Japanese property prices and their stock market. Unemployment rose in Japan but did not go stratospheric. This is because they have ridiculously inefficient employment practices eg the Salarymen who do little work, during all the hours God sends. Yeah, that’ll help the economy grow. Also, even now, the norm is when a woman marries she has to leave work. Thus, you solve the unemployment crisis. Of course, you lose the experience and expertise of half the working population.

But we don’t have Salarymen and it is illegal to sack a newly married woman. Do you think unemployment here would be stable in a deflationary depression? And if they have no income, due to rising unemployment, how will they pay their mortgages however low the borrowing rate? They won’t. So what will happen to non-performing mortgages? The houses will be repossessed. I have reminded you many times that the one thing those in power cannot do the next time we have a recession is slash interest rates. They’re already near rock bottom and 0.5% to 0.05% will not make the blindest bit of difference to anyone.

So, in summary, I put it to you we are near the end game. Either higher interest rates or deflation and in both cases the economy is … toast. If anyone can convince me otherwise I shall inform you immediately.

This is why we remain bearish in our outlook though we are, currently, bullish on certain asset classes.

The case for deflation is quietly strengthening.

The chart below is the interest rate at which the US government borrows, over 30 years. (The UK rates are very similar.) Over the last 30+ years it has fallen from over 15% to just 2.5% in the Summer of 2012. The pundits and bankers say that the rise to 4%, in the last few months, presages the great multi year (multi decade?) rise in interest rates. Indeed, with reduction of QE, announced just before Christmas, they said that rates would now soar. We, however, have been highly sceptical of that. As of yesterday, the rate has fallen, since the start of the year, from c4% to c3.68%. Not a huge fall you may say. Agreed. However, it points strongly to the notion that rates will fall and inflation will fall contrary to what the media has been selling.

If rates fall, this would show, beyond much doubt, that we are heading into long term deflation – in interest rates, stocks and property – just like Japan.

Similarly, as Government borrowing rates are falling, so the prices of Bonds (the generic term for loans to Governments or companies) are rising.

We have been saying for months that we can expect the 30 year rate to fall to c 3 – 3.2%. Similarly, that means TLT should rise to $115 give or take.

THEN we will be intrigued to see what happens next. Do rates turn back up and keep on rising, bringing the price of Bonds down and down and down – over years or decades.

Or the opposite? Intriguing, no?

My gut tells me the latter but we shall let the market tell us.

Inflation or deflation? Good question but, as I say, I cannot see any result but that they bring the same to economies and real people’s experiences.

So, if Treasuries are rising what does that normally mean for equities? Normally – though by no means does it happen religiously – if bonds fall, shares rise and vice versa. During 2011, bonds rose and equities fell and the opposite occurred right through to a few weeks ago. There is, potentially, a change developing in the relationship. It appears, as 2014 gets going, the markets may be seeing shares are overpriced and bonds as underpriced. So, the former is being sold and the latter bought. The chart is the relationship between TLT and the S&P 500 shares index. If this develops, bonds will soar in price while shares collapse – absolutely to the contrary of what all the pundits said would happen. On verra.

As you see, below, TLT just might have bottomed in price, long term. If the case, this would confirm the ‘Turning Japanese’ prospect. For the last 10 years you can see the price of long term bonds rising each time it hits the (green) trend line. If this line is again the bounce point, and prices rise again significantly from here, interest rates and inflation will fall. As will risk assets such as stocks and property. Significantly.

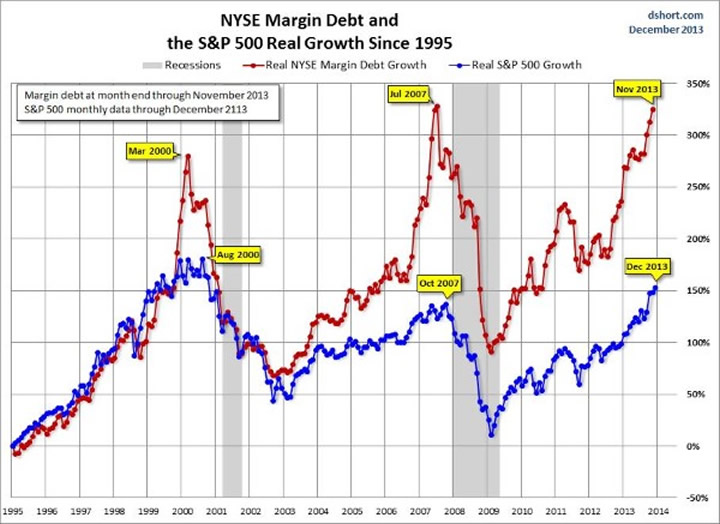

The following chart is another reason why we remain extremely bearish on US shares (there are other reasons too).

What it shows is the amount of leverage (borrowings) stock market participants have taken on to invest (!) in the shares of the S&P 500 index. It stretches back nearly 20 years. It shows that the debt level peaked in 2000 and 2007 either exactly at or within weeks of the then massive peak in the stock market. It also shows where we are now (or at least at the end of last year). Clearly, traders are so manic they are at extreme levels of borrowings. Can it go higher? Sure. Is it likely? I doubt it. I am by no means the only person on the plant who has seen this chart. On the contrary, it is freely available on the web. Thus, ‘everyone’ knows it and many will be concerned about it.

This is but one example of how markets often do the opposite of what the bulk want, just at the time they are most exposed. As I have written, markets which are ‘loved’ often crash and burn. Markets which are ‘hated’ often rally hard.

How would a stock market crash affect the thing the media are always banging on about – ‘confidence’? And how would it affect other assets? That is ‘intermarket analysis’ and the powerful school of thought that informs much of our thinking.

There is a some way to go but the big-picture deflation case is building. You need to consider this when making medium to long term financial decisions. I am not saying that I KNOW that we are in a deflationary depression. (How can I possibly know?) I am saying the evidence is building. We had 40 years of rising debt and falling interest rates. In effect, those days are over.

What our view on this is – we would argue – is irrelevant. If, on the other hand, rising inflation and interest rates come what will that do to the economy and assets?

‘All the money printing in the World’ for the past 5 and a half years HAS NOT BROUGHT INFLATION because taxes are rising, incomes are flat or falling and few are prospering whereas most are just getting by or losing their standard of living.

We have said for ‘ever’ QE was not likely to succeed in bringing inflation. Sure, there has been incredible inflation in UK, US and German share prices – much to our great surprise – but that does not mean a) presaging a future of plenty nor b) the rises are sustainable. We reiterate our extreme caution on US etc share prices. Indeed, while these soared most other assets were flat or collapsed. This is extremely uncharacteristic of sound markets.

The last recession we had was 2008. I thought the next one would have started by now as it did all over the EU (except Germany) and many other parts of the World. In any case, these things come in cycles. The next one is (over) due. We expect a recession in share prices and a recession (global economic shock) in the economy. However, actually, they may come at different times. If the latter comes, please please remember the policy makers cannot slash interest rates.

China

A quick word about the ‘Great White Hope for the World’ economy. What an ugly joke China is. In this Marxist paradise studies now show that senior people there have stashed $4 TRILLIONS (THAT’S $4,000 BILLIONS) in the Cayman Islands and the British Virgin islands etc, tax free havens used by all our friendly non-tax paying multinationals and billionaires.

Last year alone saw £3.5 Billions of London property bought by Chinese.

Those who say China cannot collapse should perhaps wonder why all the top people have moved their ill gotten gains out of China.

They should also wonder what those people will do when China collapses. If it were me I’d take my money back out of London and the Caymans and buy buy buy at 10c in the $, back home.

Turkey

One absolutely final point. If you’re wondering where to go for your holidays this year, from a financial point of view, you may wish to consider Turkey. The Turkish Lira has fallen in value by A HALF over the last 3 and a half years. Thus, everything should be dirt cheap out there for a Sterling/Euro/Dollar/Swiss Franc payer.

No doubt the tour operators’ margins have widened markedly by cutting prices far less than they truly have fallen in cost. However, no doubt there are ways of obtaining true prices. Also, the advertised prices look attractive nonetheless.

By Jonathan Davis

http://jonathandaviswm.wordpress.com/

25+ year veteran of the world of financial services, the last 10 doing the same thing under his own name. We work with families all over the UK and in Switzerland and, indeed, on 2 other continents. If interested in our Wealth Management work, cast a glance at the firm’s website.

From time to time media folk call me and ask me to rant live or in the press. JD in the media.

I don’t buy hype. I don’t believe it’s the end of the world but I do believe, within a generation, the West will have no welfare state. The maths don’t lie. We’re toast. It’s obvious if you think about it.

© 2014 Copyright Jonathan Davis - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.