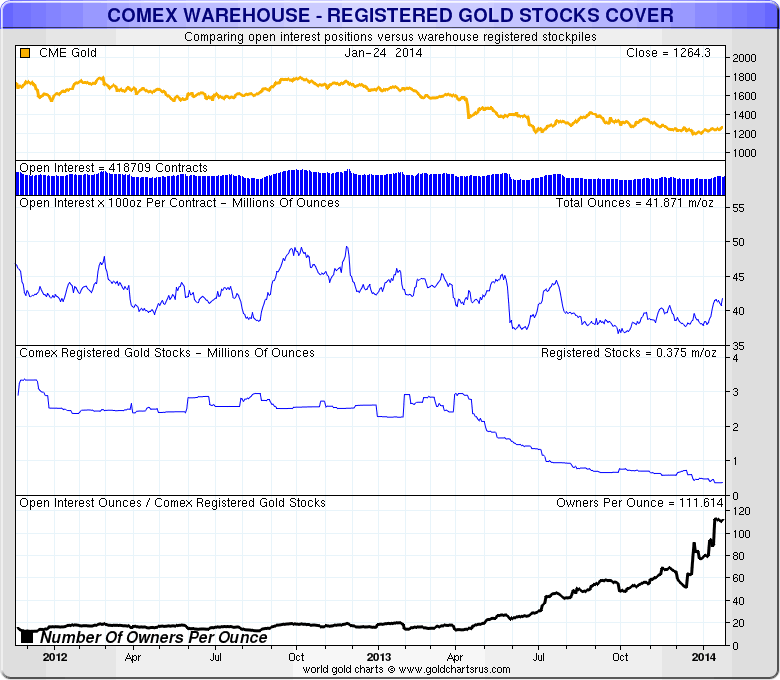

Comex Gold Potential Claims Per Deliverable Ounces Rise to 112 to 1

Commodities / Gold and Silver 2014 Jan 26, 2014 - 05:04 PM GMTBy: Jesse

As you know January is a non-active month for gold on the Comex, but February tends to be quite lively.

As you know January is a non-active month for gold on the Comex, but February tends to be quite lively.

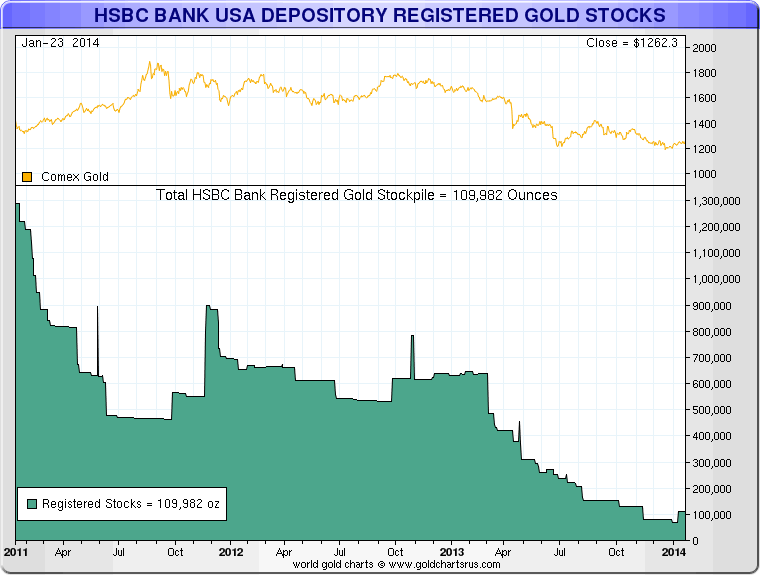

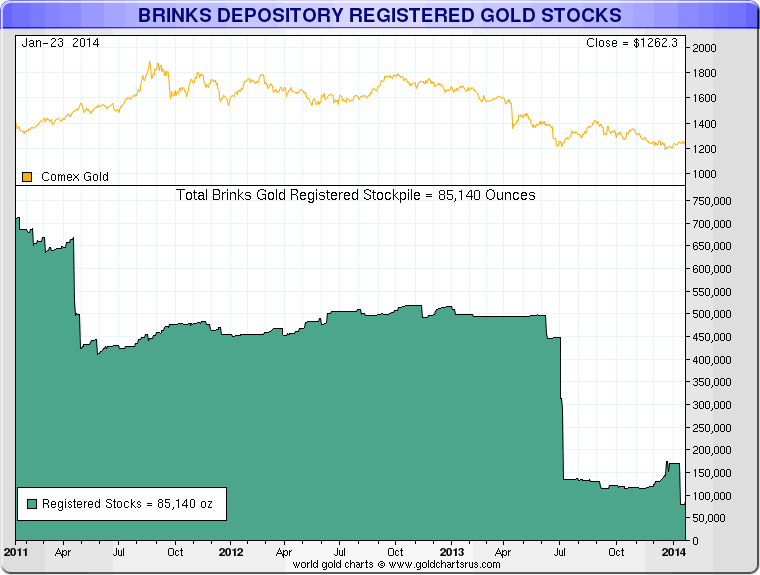

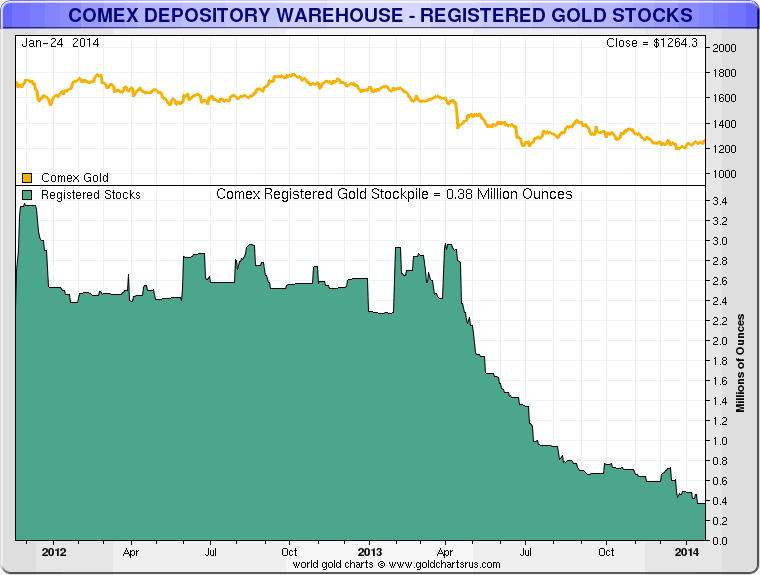

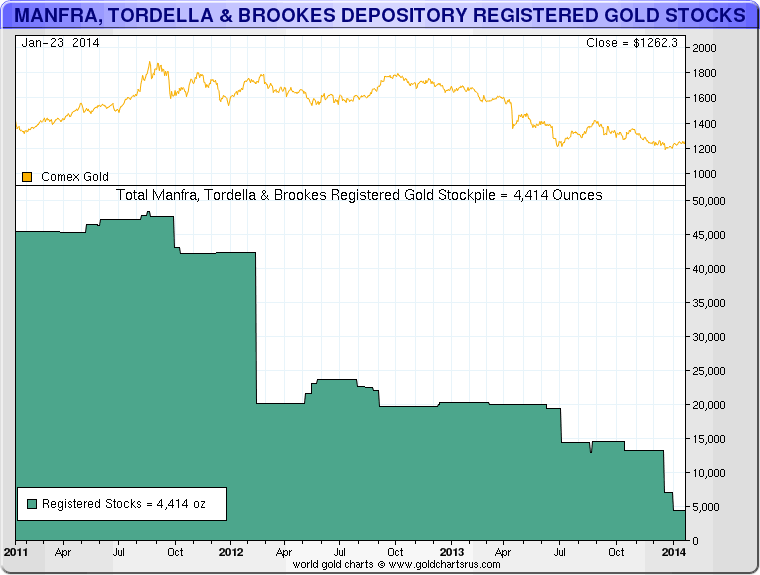

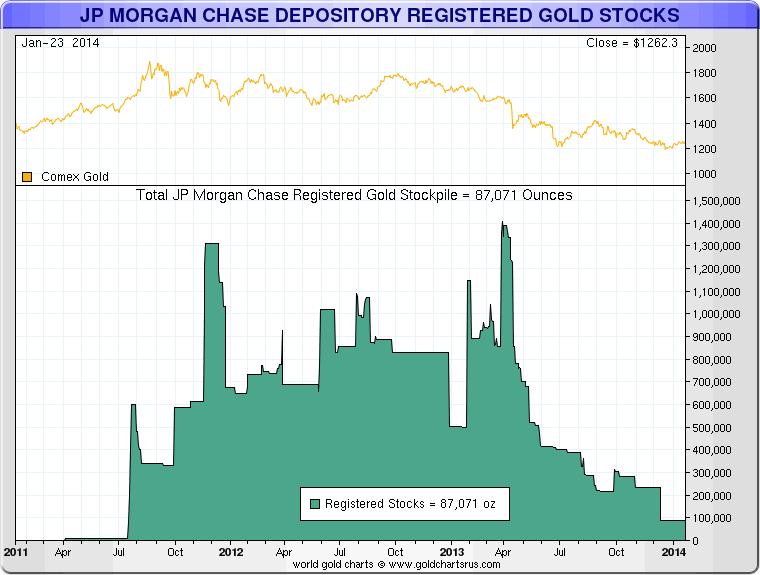

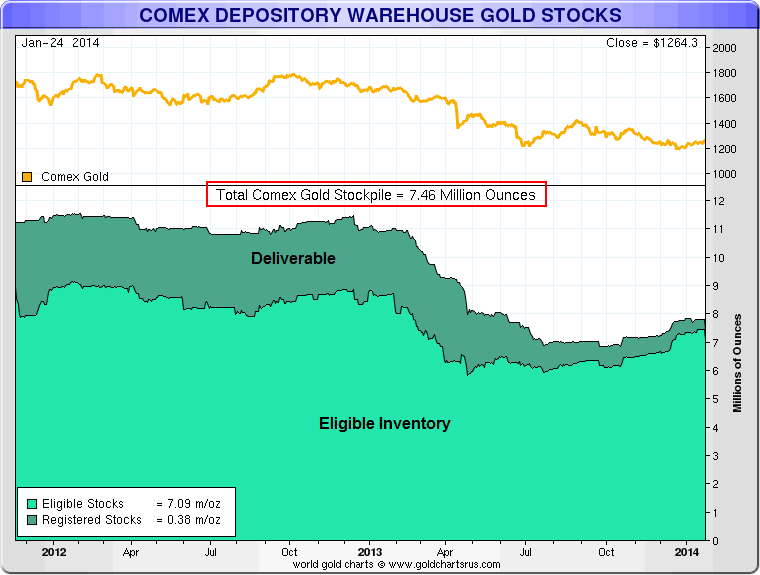

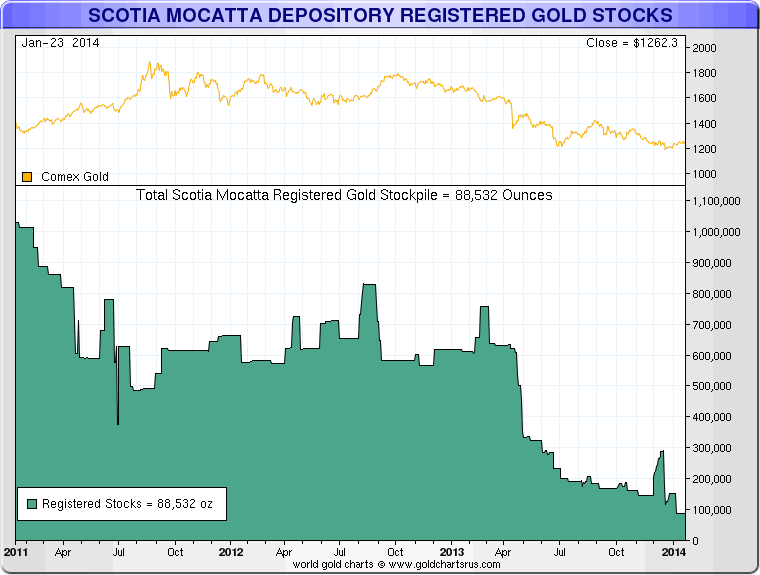

Here is the warehouse inventory picture for registered (deliverable) gold ounces. As you can see without exception the levels of bullion ready to be sold is quite low.

As a reminder, that is only one side of the picture. There is an additional category of gold held in these warehouses in 'eligible' bullion form that can be transferred to deliverable with the issuance of some fairly simple paperwork.

So I think that those who talk about a default on the Comex are probably missing the bigger picture. Supply and demand suggests that higher prices might be required to persuade profit maximizing bullion holders to make the switch from storage to sale.

But then again it is not bad to recall that not everyone who is trading bullion is making their profits on the Comex, especially by actual bullion sales. The great bulk of trading traffic is what the FT calls 'pixelated' or paper gold, claims upon rehypothecated claims.

Therefore I have suggested that if there is a break in the gold market, it will not be likely to originate on the Comex, but rather in some physical delivery market in Asia, and even perhaps at the LBMA in London. Any failure at the Comex would most likely be collateral damage to a panic run on bullion, either in a fail to deliver from a bullion bank or exchange, resulting in a massive up limits short squeeze deleveraging.

The current structure of the market looks a bit dodgy. JPM has the clear whip hand on the paper markets. But Asia and the Mideast are dominating the physical delivery markets.

India demand is being throttled by the government sahibs that seem quite eager to accommodate the Anglo-American Banks, which is too bad for their people. I doubt that posture will be sustainable for long.

So let's see what happens. But it looks as though February could be interesting. And if not, then the next active month is not far away.

At the end of the day the market structure must be allowed to reach its clearing prices, and that does not seem to be the current case judging by the relationship of paper to physical.

As always, a special thanks to chartsmaster and data wrangler Nick Laird of sharelynx.com.

By Jesse

http://jessescrossroadscafe.blogspot.com

Welcome to Jesse's Café Américain - These are personal observations about the economy and the markets. In plewis

roviding information, we hope this allows you to make your own decisions in an informed manner, even if it is from learning by our mistakes, which are many.

© 2014 Copyright Jesse's Café Américain - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jesse Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.