Silver Lagging Gold Price Rally

Commodities / Gold and Silver 2014 Jan 27, 2014 - 05:28 AM GMTBy: Clive_Maund

While gold has rallied across its downtrend channel in recent weeks to arrive at its top boundary, silver has arrived at the upper boundary of its channel by limping sideways. Next week is decision time - either it breaks out upside from the channel or it drops into another downleg. The technicals suggest that it will do the latter, but also that this will likely mark the drop into the final low before an important reversal to the upside takes place.

While gold has rallied across its downtrend channel in recent weeks to arrive at its top boundary, silver has arrived at the upper boundary of its channel by limping sideways. Next week is decision time - either it breaks out upside from the channel or it drops into another downleg. The technicals suggest that it will do the latter, but also that this will likely mark the drop into the final low before an important reversal to the upside takes place.

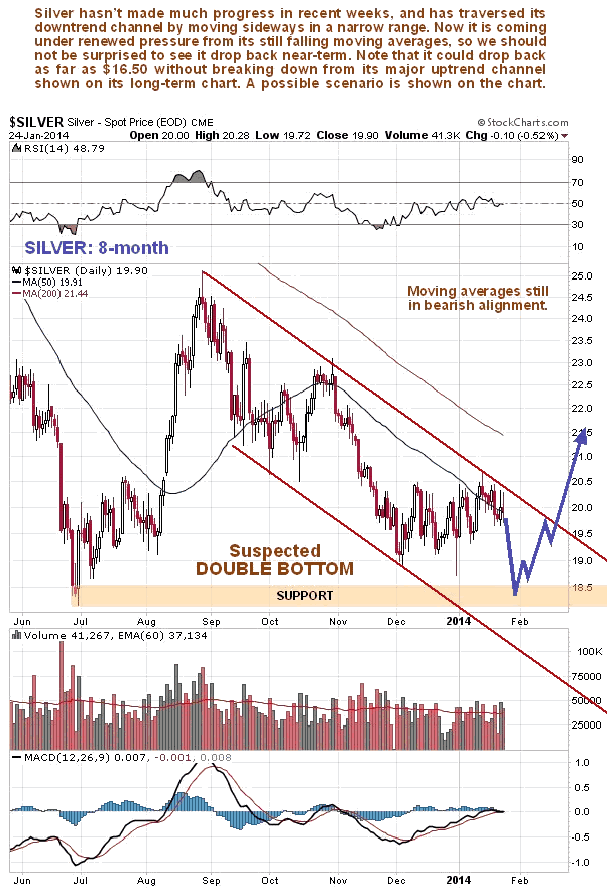

On silver's 8-month chart we can see how the price has struggled to rally over the past few weeks, but has gotten nowhere. Given that it has now arrived at the upper boundary of this channel, and that its moving averages are bearishly aligned and pressing down on the price from above, it looks likely that it will be beaten back next week, especially as a "dash to cash" started to spread across the markets late last week. The market may be about to spring a trap, first on over-confident longs by dropping, and then on shorts who pile in on failure of the late June lows, only to be hit by a rapid reversal to the upside. To see why such a scenario is likely, we will now move on to look at the long-term chart.

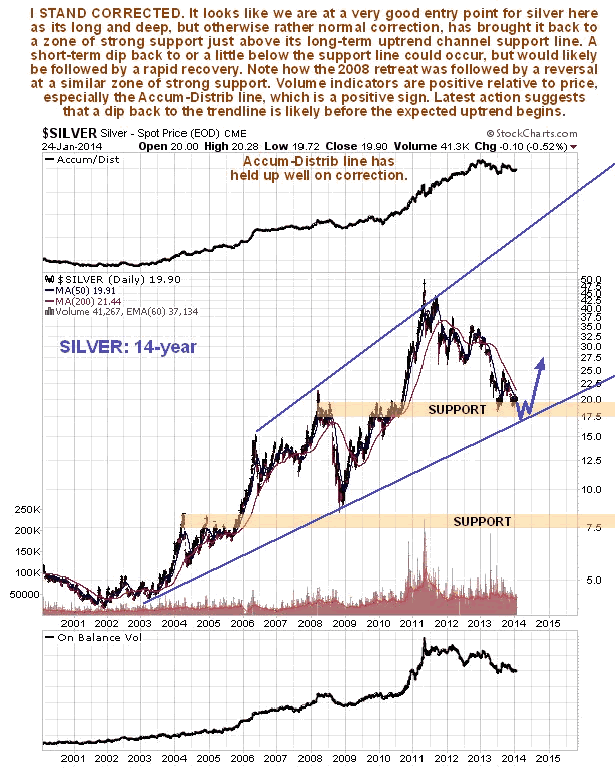

On silver's 13-year chart we can see that it still hasn't arrived at the support line of its major uptrend in force from 2003, although it is now in a zone of strong support. A scenario that thus looks likely here, is that it now drops below its lows of December and last June, but then reverses at the trendline, where the zone of major support will still be operative. If silver breaks down below this trendline and we see a general market crash, then it is possible that it will dive down towards the next major support level, but at this point, for various reasons, this scenario is assigned a low probability.

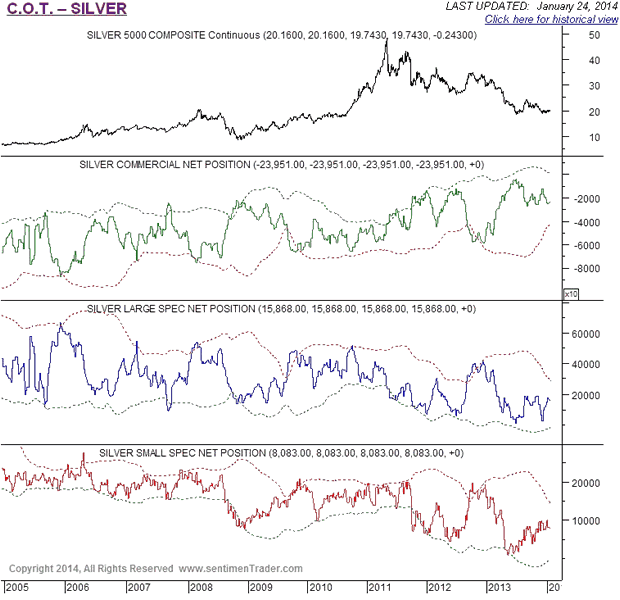

The silver COT is in middling ground, less bullish than at the time of the last update, and it now allows for a sizeable move in either direction.

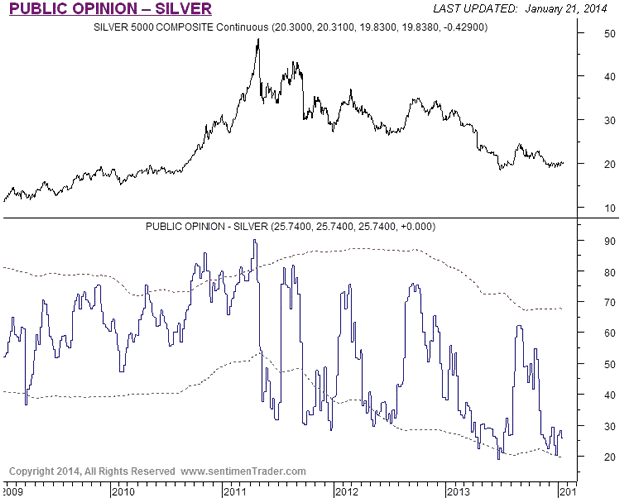

Public Opinion on silver is still pretty much in the basement, which is one reason why, after a likely short-term pullback from the trendline, which may involve a drop to new lows, a strong rebound is likely that should mark the start of the expected new uptrend.

By Clive Maund

CliveMaund.com

For billing & subscription questions: subscriptions@clivemaund.com

© 2013 Clive Maund - The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maunds opinions are his own, and are not a recommendation or an offer to buy or sell securities. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications.

Clive Maund Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.