2014 Y-T-D: Gold 1 Fantasies 0

Commodities / Gold and Silver 2014 Feb 07, 2014 - 05:45 PM GMTBy: Ned_W_Schmidt

As we welcomed the beginning of 2014 the advice from "gurus" was rather straight forward. Gold was going to $1,060. At the same time the stock markets would continue to advance. So our life would be financially happy if we sold our Gold and bought the favorites fantasies in the NASDAQ/technology group, such as TWTR. Well, seems the real world was to hold some disappointment for those strategists.

As we welcomed the beginning of 2014 the advice from "gurus" was rather straight forward. Gold was going to $1,060. At the same time the stock markets would continue to advance. So our life would be financially happy if we sold our Gold and bought the favorites fantasies in the NASDAQ/technology group, such as TWTR. Well, seems the real world was to hold some disappointment for those strategists.

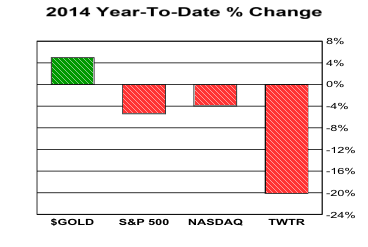

Chart below portrays how the horse race has run thus far in 2014. Results are simple: Gold Bugs 1, Stock Fantasies 0. We suspect that when the race results are in for the full year Gold will be in the winner's circle while stock groupies are tending their wounds.

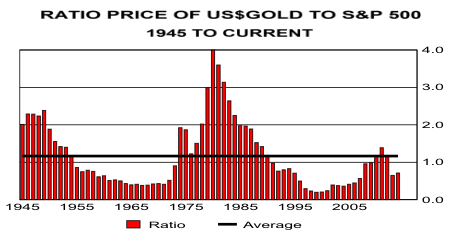

A long list of reasons could be created on why to prefer Gold over popular paper equities so touted by promoters. Topping that list would be valuation. As portrayed in the two charts below, Gold is seriously under valued relative to the S&P 500. Gold is the strong preference over equities, especially the fantasies. Plotted in the chart below is the ratio of the price of $Gold to the S&P 500.

Not since 2008 has Gold been as cheap relative to the S&P 500.

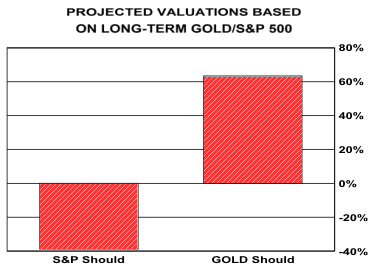

Using the data in the above chart we calculate implied values for $Gold and the S&P 500. Potential returns from those calculated values are portrayed in the chart to the right. If the S&P 500 is correctly valued, $Gold should be 60% higher. If $Gold is correctly priced, the S&P 500 should be 40% lower. Reality will of course be somewhere in between, but the correct investment course is obvious. Based on history, one should be selling U.S. equities and buying $Gold. Note that we are using the S&P 500 for this analysis, but that the negative implications of this analysis for the NASDAQ/technology group of fantasies is likely far stronger.

The catalyst for the above valuation to manifest itself is the growing probability that a bear market is developing in U.S. equities. That bear will vent most of her anger on the NASDAQ/technology group due to the delusional expectations for that group. As $Gold is viewed as the investment alternative to such paper equities, the price of $Gold should advance while equities wither.

In past decades the "Three Steps & a Stumble Rule" gave excellent guidance on when to anticipate the beginnings of a bear market. This monetary rule has, however, needed some revision, or modernization, to fit the modern monetary policy of the Federal Reserve. Two of the three signals required by this rule have thus far been triggered. The rule suggests that an end to the bull market in U.S. equities is developing, if it has not already occurred. If that is the case, then Gold is the preferred investment alternative for 2014, and into the future.

By Ned W Schmidt CFA, CEBS

Copyright © 2013 Ned W. Schmidt - All Rights Reserved

GOLD THOUGHTS come from Ned W. Schmidt,CFA,CEBS, publisher of The Value View Gold Report , monthly, and Trading Thoughts , weekly. To receive copies of recent reports, go to www.valueviewgoldreport.com

Ned W Schmidt Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.