U.S. Non-Farm Payrolls Fizzle, Gold and Silver Held in Check

Commodities / Gold and Silver 2014 Feb 09, 2014 - 04:54 PM GMTBy: Jesse

Friday was an exceptionally interesting day, with a lot of things going on from the very start.

Friday was an exceptionally interesting day, with a lot of things going on from the very start.

The premiere event was the US Non-Farm Payrolls Report, which pretty much sucked out loud, coming in with an underestimated 113,000 jobs versus a 175,000 expected. This was mitigated a bit by the 'private jobs' added of 142,000 which was closer to estimates. And it could make some feel good because it was in 'government jobs' that much of the shortfall occurred.

I didn't see how much play was given to the complete revision of all the employment numbers going back as far as I normally look. They even revised the CES Birth-Death model which is a plug, or imaginary jobs, if you prefer. How do you revise stuff you pretty much swagged (made up) in the first place?

So anyway, I was cranky off the get go, because I had to go and manually revise my spreadsheets everywhere, in addition to making minor corrections on the graphs for the first report of a new year. So I did not get a chance to do any serious analysis of the changes that the revisions made. I'll try to get to that later next week unless I find someone who does a good job of describing the effects that I can simply show to you. Why do extra work?

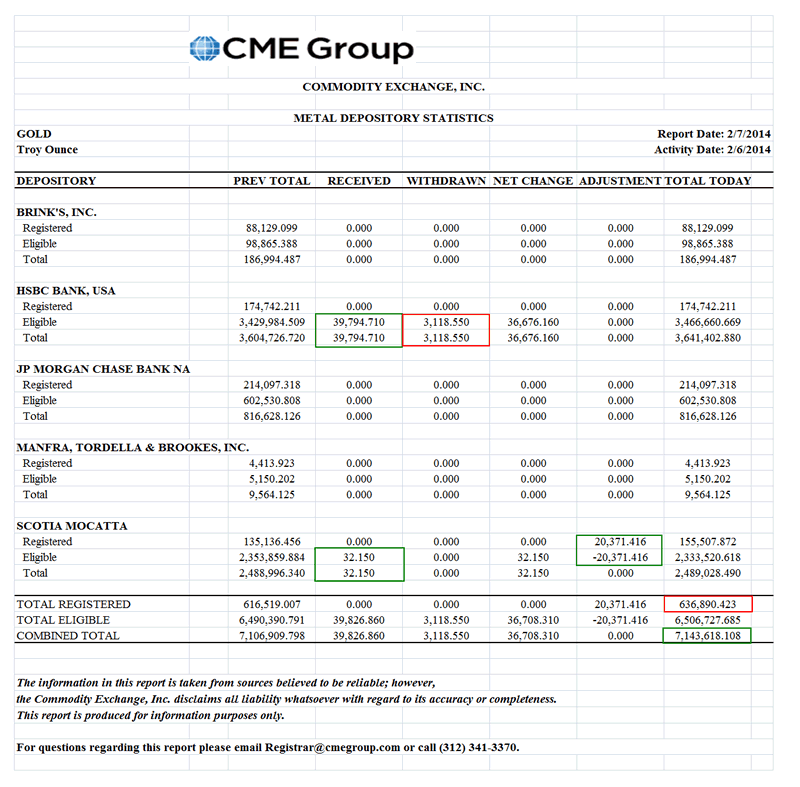

But then someone passed around a nice textbook description of how bullion banks work, and it prompted me to write something that I had been thinking about, but wasn't quite ready to do. That was put up intraday here. I hope it is of some value to you, if in no other way than to help you order the things you would like to know.

I probably said far too much in an attempt to be even-handed, and circumspect, in trying not to colour a particular situation with the broader brush of revulsion against a tendency of the TBTF Banks, some of whom are bullion banks as well, to misprice risk. And of their one percent owners who promote abhorrent social policies and predatory 'capitalism' through fine sounding economic rubbish.

It would probably be better for those who are trying to defend their particular groups against unjust attacks to not attempt to justify the broader financial landscape which they might inhabit, because this financial system is so profoundly fouled that it will be like trying to clean the Augean stables.

Some days one might become discouraged at how the United States of Amnesia so quickly forgets the lessons, not from history, but from just a few years ago. This applies to both foreign policy and financial chicanery. It really is amazing at times.

Remember we are in a currency war, almost a kind of new cold war at times, and great changes are occurring in the international currency structures. In times like these, some hysteria is not uncommon,. There is propaganda, and sometimes not very subtle if you have a discerning eye for it, even in some seemingly petty and unrelated things. And the deceitful are emboldened because they think they are operating with official sanction, and indeed sometimes it seems as though they are.

What, for example, was the Bank of England thinking when it turned a blind eye to trading desks actively gaming the foreign exchange markets to the point of cheating their customers? Is this some professional courtesy, or a sense of perverted noblesse oblige that entitles an entire financial class to an innovative seigniorage that exploits the difference between earning paper wealth and the ease by which one can steal it, if you are in the know.

What a world. This too shall pass.

Have a pleasant evening.

By Jesse

http://jessescrossroadscafe.blogspot.com

Welcome to Jesse's Café Américain - These are personal observations about the economy and the markets. In plewis

roviding information, we hope this allows you to make your own decisions in an informed manner, even if it is from learning by our mistakes, which are many.

© 2014 Copyright Jesse's Café Américain - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jesse Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.