Is the Stock Market Correction Over?

Stock-Markets / Stock Markets 2014 Feb 10, 2014 - 09:41 AM GMTBy: Andre_Gratian

Current Position of the Market

Current Position of the Market

SPX: Very Long-term trend - The very-long-term cycles are in their down phases, and if they make their lows when expected (after this bull market is over), there will be another steep decline into late 2014. However, the Fed policy of keeping interest rates low has severely curtailed the full downward pressure potential of the 40-yr and 120-yr cycles.

Intermediate trend - The next week should decide if SPX has completed its correction, or if more time - and possibly new lows - is required.

Analysis of the short-term trend is done on a daily basis with the help of hourly charts. It is an important adjunct to the analysis of daily and weekly charts which discusses the course of longer market trends.

IS THE CORRECTION OVER?

Market Overview

According to the Trader's Almanac, the market trend in January sets the trend for the rest of the year!

It's too soon to tell, but the correction is probably not over for the reasons that I will mention in this report. The top distribution pattern on the Point & Figure chart had given us a potential target of 1678 IF the entire span was considered. It is not infrequent for only a part of the span to be filled (especially if the projection is on the downside) in a bull market. (As discussed before, there is still no indication that the bull market is over.) What was a little misleading about the current pattern is that the trend normally continues until a complete phase has been filled. Reliable counts are taken from "wall to wall" and a count to the next wall gave a target of 1720. Instead of progressing down to that level, SPX found strong support at the 1738/1740 level and refused to go lower. When we analyze the hourly chart, we will see that this was fairly predictable because of the positive divergence which developed in the hourly oscillators on the second test of that level. The result was a rally which started slowly only moving up to the top of the trading range the first day, but then it exploded the next day... and the next, for a total of 60 points in three days!

By Friday's close, there were signs that the index was ready for a pause, even though it closed near the high of the day. But there has been enough accumulation above 1740 to take the rally higher, unless enough selling takes place at 1798 to prevent it from reaching its full count. Short of that, a consolidation should be followed by a move higher before the rally which started at 1738 exhausts itself.

If it does move beyond 1798, the SPX will have overcome an important resistance level and that will increase the odds that the correction is over. But that does not mean that we can move to a new high right away. The cycles due to make their lows toward the end of the month still could, at the very least, cause a strong retracement which could even take the index down to 1720 before an attempt is made at making a new high.

The rally from 1738 to 1798 was undeniably a strong rally by the SPX, but since it was not embraced with the same vigor by other indexes, it has to be a little suspect. I will start my analysis by showing that this burst of strength was not shared equally by everyone.

Chart Analysis

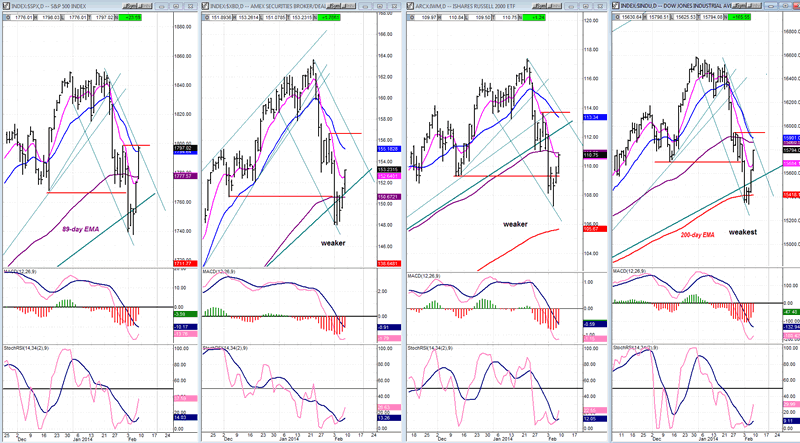

Below, I have posted four charts side by side (all 4 courtesy of QCharts, as well as the next 3). From left to right, we have SPX, XBD, IWM, and DJIA. They are arranged in order of strength to weakness, SPX being the strongest.

Their relative strength is determined by a couple of factors: 1) how close their decline came to their 200-DMA, and 2) how much of a rally they had to the top of their resistance level (red horizontal line). Although the DJIA had the next best rally to the SPX, I still consider it the weakest because it declined to slightly below its 200-DMA before rallying. I also considered whether or not they were able to rally above their 89-DMA and by how much.

I chose these 3 indexes to compare to the SPX because they are normally considered leading indexes. XBD and IWM did not do such a good job warning of the impending correction this time, since they made new highs just before the decline, which made them obviously stronger than SPX over the short term. But now, they and the DJIA are definitely lagging, and that raises some questions about the legitimacy of the rally as a sign that the correction has ended.

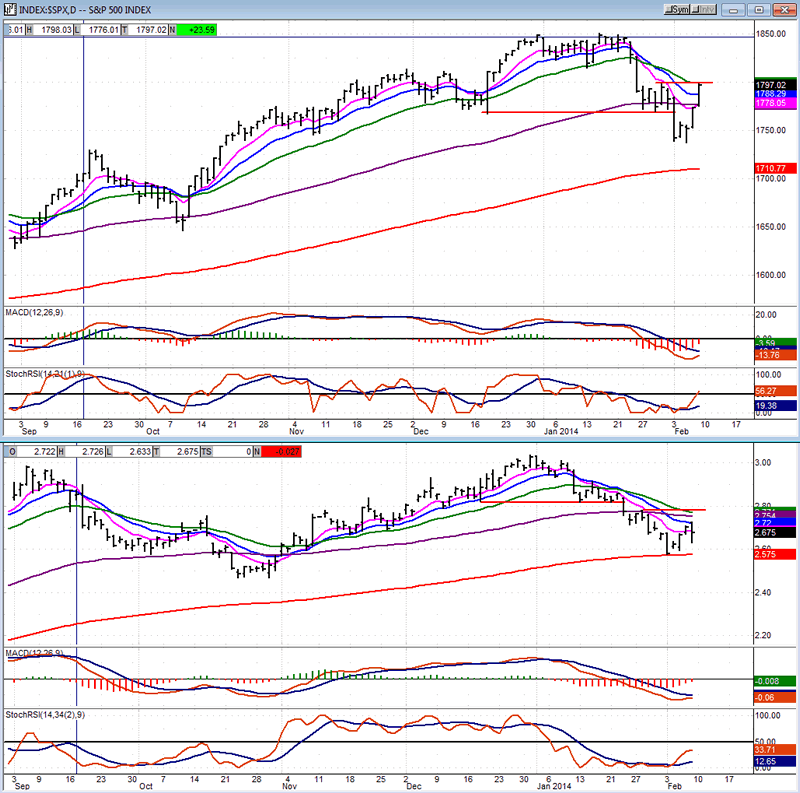

Another index whose relative strength is worth comparing to SPX is TNX, the 10-yr treasury yield. It does not always give us a timely warning but, right now, this is precisely what it may be doing.

First, note that it started to decline ahead of SPX, and dropped to its 200-DMA while SPX did not. It also started to rally 3 days before SPX but then it failed to match SPX in the extent of its rally and, by Friday, was displaying strong negative divergence. Is it warning us about the legitimacy of the rally?

I am only pointing out some discrepancies between the relative strength of various leading indexes and the SPX. This may not give us an instant answer to whether the correction is over, but it will bear watching if SPX pulls the rest of the market higher, or if the market pulls it back down to complete the correction that started at the beginning of January.

In all fairness, I should point out that the QQQ -- which also has leadership qualities -- is even stronger than SPX and may be partially responsible for strength in the latter. So the tug-of-war is really three against two, and not three against one and we'll have to see how it turns out between now and the end of the month.

I'll skip analyzing the daily SPX and move on to the hourly chart.

I have marked various channels that define various phases of the corrective trend. Prices quickly moved out of a minor one (red) but appeared to meet with resistance at the top of the intermediate channel (dark blue) by the end of the day. If the low has been reached, the main channel will consist of a wide channel (purple) sloping at a shallow angle. Only when prices move out of that wide channel -- whose top line is currently at about 1836 -- can we say that the correction is over and that the SPX is most likely on its way to making a new high.

Let's get back to the middle channel (dark blue) at the top of which prices came to rest at Friday's close. The channel resistance is reinforced by the top of the former short-term high, an interior parallel to the top line of the broader channel, and the 200-hr EMA. It also happens to mark about a 50% retracement of the entire decline. It would be surprising if this combined set of resistances did not bring at least a pause to the rally which started at 1738. Besides all the resistance that the index faces at this level, it has created overbought conditions in SRSI and the A/D MACD which is also showing some negative divergence.

If prices pull back from 1798, they could find support at the lower dotted line which defines a less steep trend. Should this happen, the index could then attempt to move through the top of the dark blue channel. The odds of SPX pushing a little higher after a short correction are increased by the strength being displayed in the hourly MACD.

Next week should be very interesting. We should see how SPX resolves all the various conditions cited above. But before we move on, I want to point out the positive divergence which showed in the oscillators when SPX re-tested its low. That was a warning that that level would hold.

Cycles

It is likely that one of the minor cycles bottomed on Tuesday and started the rally which was then picked up by the bulls and carried into the end of the week with, undoubtedly, the help of many shorts being covered.

A more important cycle is due in a couple of weeks which could bring prices back down into that time frame after the current rally has been exhausted.

Breadth

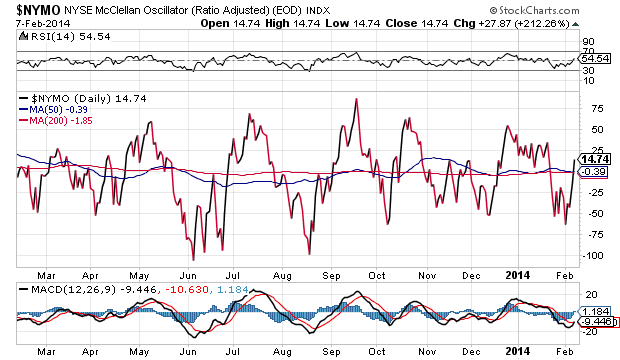

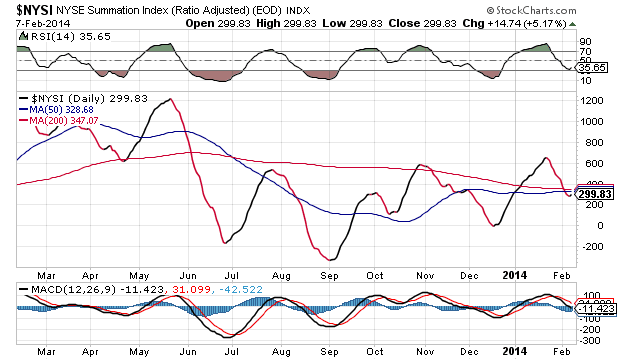

The McClellan Oscillator and Summation Index (courtesy of StockCharts.com) appear below.

The McClellan Oscillator held at around -50 and rallied to a slight positive. This is not decisive enough to convince us that the correction is over.

The performance of the Summation index has improved. It is back in a shallow uptrend, the most important feature of which is positive divergence vs. the recent correction lows of the indices. This has bullish overtones for the future pointing to a good possibility of higher prices occurring after the correction is over.

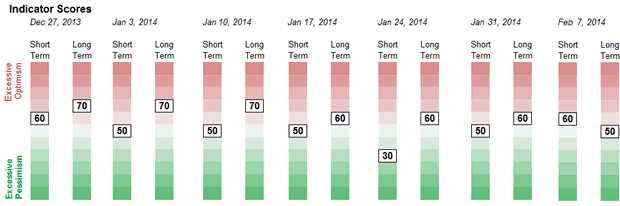

Sentiment Indicators

The SentimenTrader (courtesy of same) long-term indicator dropped to 50 on Friday -- the first time that it has shown a neutral reading in a long, long time. It could be a warning that we have not yet seen the top of the bull market and that the bullish trend will resume before too long.

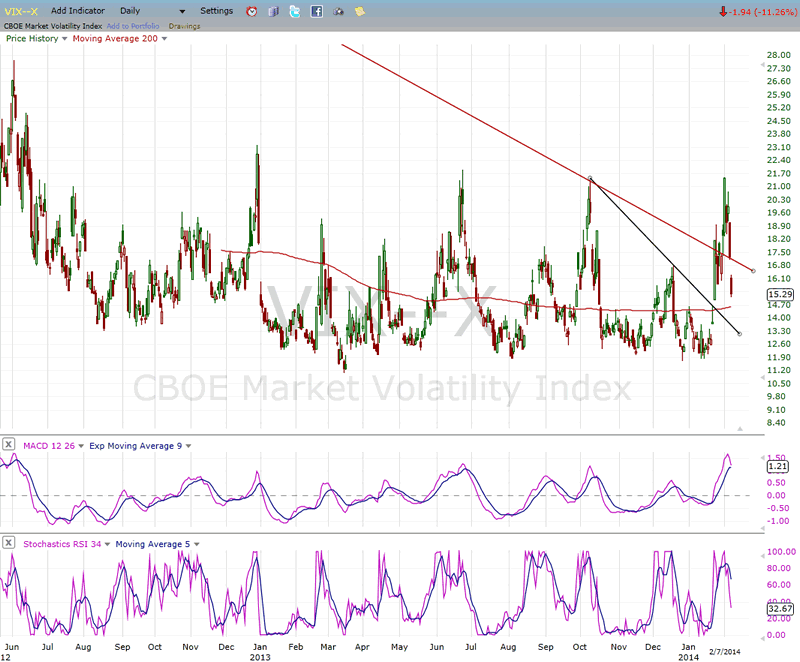

VIX (Velocity Index)

VIX could not get past its last short-term top and has pulled back sharply. The base that it established on the P&F chart met with its minimum fulfillment. Higher prices are indicated by the chart but, just as the top distribution area in the SPX may not meet its full decline potential, the same may hold true for VIX. If it consolidates above its 200 DMA and starts up again it could then attempt to rise beyond its recent high. The next couple of weeks will decide its fate and that of the overall market.

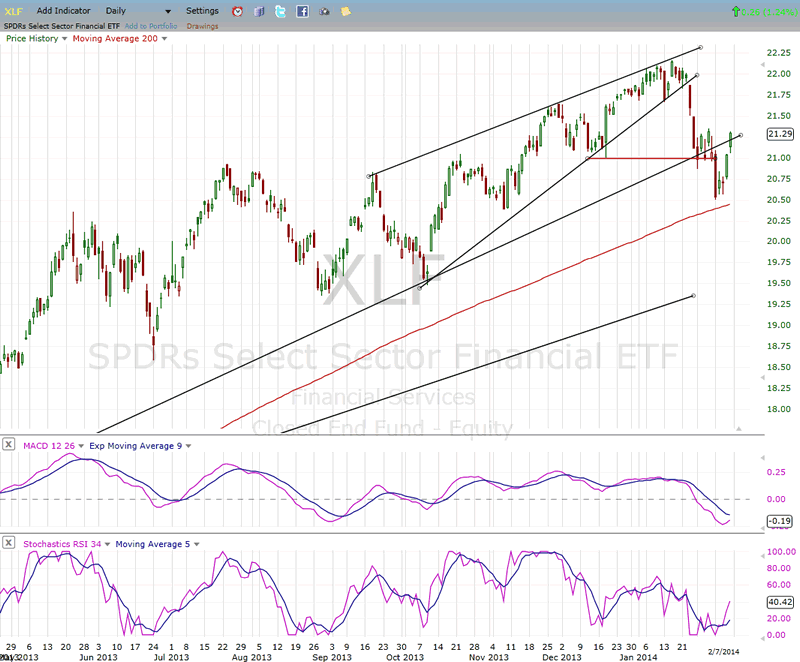

XLF (Financial Index)

The price action in XLF is somewhere in between that of SPX and DJIA. The correction took it to the vicinity of its 200-EDMA and the rebound is closer to that of SPX. At this time, it is simply going along with the rest of the market and does not have any predictive value.

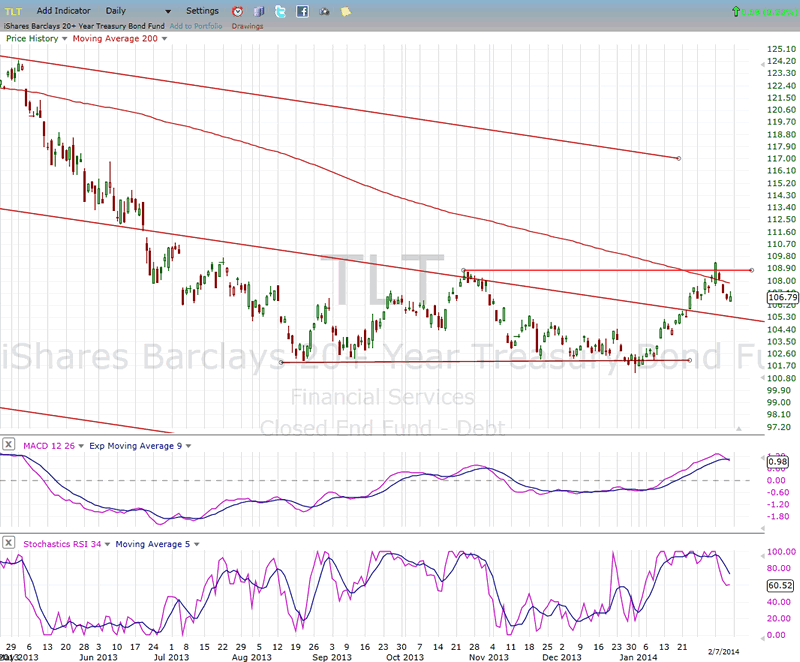

TLT (Barclays 20+ year Treasury bond fund)

TLT rallied to the top of its previous short-term high and then started to correct. Its move in the opposite direction of the equity markets is consistent with historical patterns. What is of note is that its mild pull-back of the last few days does not match that of the rally strength in the SPX. This is another potential warning that there is more correction to come. This warning would increase in importance if TLT were to continue its uptrend without correcting any farther.

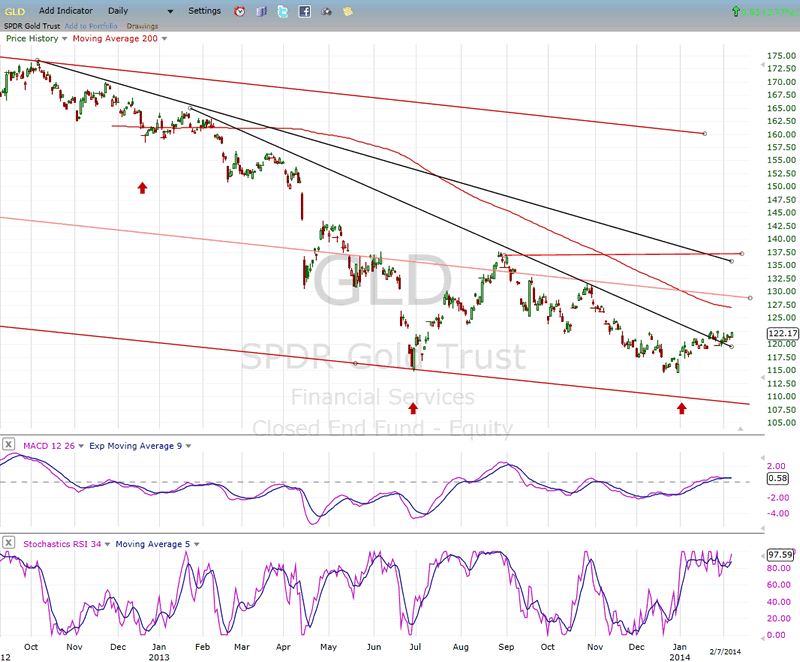

GLD (ETF for gold)

In spite of a favorable cyclical environment, GLD has made little progress since the bottoming of its 25-wk cycle. This will disappoint the gold bugs, but the cycle should be in its up-phase for a while longer, and there is still time for GLD to rise to the level of its former short-term high.

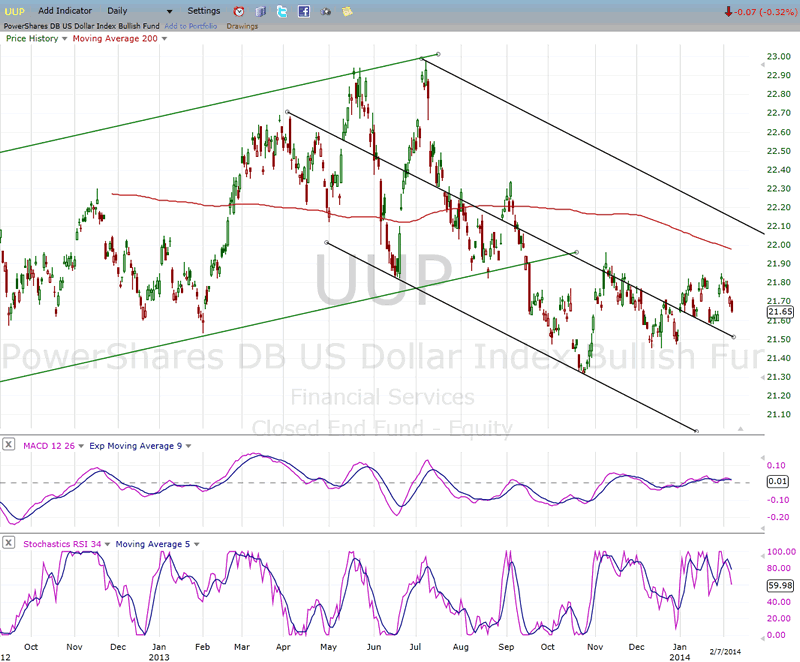

UUP (dollar ETF)

UUP is going nowhere and it may take a few more rounds of tapering before it responds positively to the Fed's change of policy. The current price action is neutral and it may remain that way for a few more weeks. I don't think there is much danger of its continuing its intermediate downtrend, although it could still re-test its low.

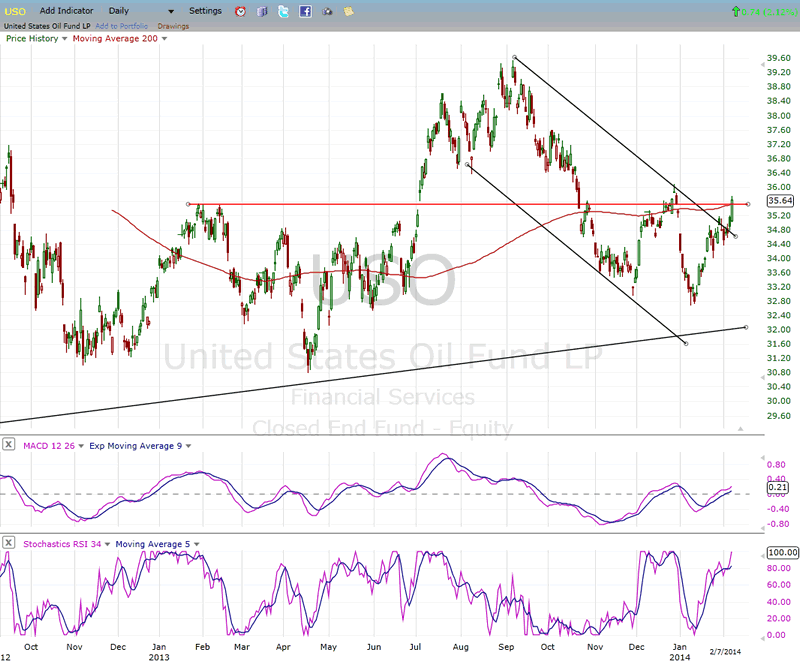

USO (United States Oil Fund)

USO is trying very hard to stay above its bull market trend line. Instead of being repelled by its minor downtrend line, it is trying to push through it; but it has arrived at a important level of resistance which could stop its bullish efforts. The red resistance line is not the only obstacle that it has to overcome. It must also get above its 200-day moving average.

If it can do that, it may have succeeded in delaying its confrontation with the major trend line which lies about 3 points lower. If the bullish effort fails, the day of reckoning (making a new long-term low) will be sooner rather than later.

Summary

In spite of a strong rally by the SPX from 1738 to 1798 in 3 days, it is too soon to call for an end to the correction. The lack of a united front displayed by the various market indexes casts some doubt about this being the beginning of a new uptrend.

What is possible (but by no means certain) is that 1738 will turn out to be the low of the correction, with a re-test of the low and/or some additional consolidation taking place until the cycle due in a couple of weeks has bottomed. A consolidation remaining above the 1770 level could even create an inverse Head & Shoulders pattern which would be a bullish formation.

FREE TRIAL SUBSCRIPTON

If precision in market timing for all time framesis something that you find important, you should

Consider taking a trial subscription to my service. It is free, and you will have four weeks to evaluate its worth. It embodies many years of research with the eventual goal of understanding as perfectly as possible how the market functions. I believe that I have achieved this goal.

For a FREE 4-week trial, Send an email to: ajg@cybertrails.com

For further subscription options, payment plans, and for important general information, I encourage

you to visit my website at www.marketurningpoints.com. It contains summaries of my background, my

investment and trading strategies, and my unique method of intra-day communication with

subscribers. I have also started an archive of former newsletters so that you can not only evaluate past performance, but also be aware of the increasing accuracy of forecasts.

Disclaimer - The above comments about the financial markets are based purely on what I consider to be sound technical analysis principles uncompromised by fundamental considerations. They represent my own opinion and are not meant to be construed as trading or investment advice, but are offered as an analytical point of view which might be of interest to those who follow stock market cycles and technical analysis.

Andre Gratian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.