Crude Oil Trading Alert: Oil Price Hits Fresh Monthly High

Commodities / Crude Oil Feb 10, 2014 - 04:13 PM GMTBy: Nadia_Simmons

Trading position (short-term): In our opinion no positions are justified from the risk/reward perspective.

Trading position (short-term): In our opinion no positions are justified from the risk/reward perspective.

On Friday, crude oil gained 2.27% as the U.S. dollar weakened against major currencies after a monthly U.S. employment report came in weaker than expected. Thanks to these circumstances, light crude extended gains and rose above $100 per barrel for the first time in more than a month.

The U.S. Labor Department showed that the U.S. economy added 113,000 jobs in January (well below expectations for a 185,000 increase). It’s worth noting that it was the weakest two-month stretch of job creation in three years as inclement weather contributed to a slowdown in hiring. Friday’s report also showed that 142,000 jobs were added in the U.S. private sector last month, below the 189,000 that economists had expected.

These lower-than-expected numbers have helped push the price of light crude higher by weakening the dollar, making crude oil cheaper for buyers using foreign currencies. Thanks to the recent increases, light crude climbed 2.78% in the previous week and it was the fourth consecutive weekly gain.

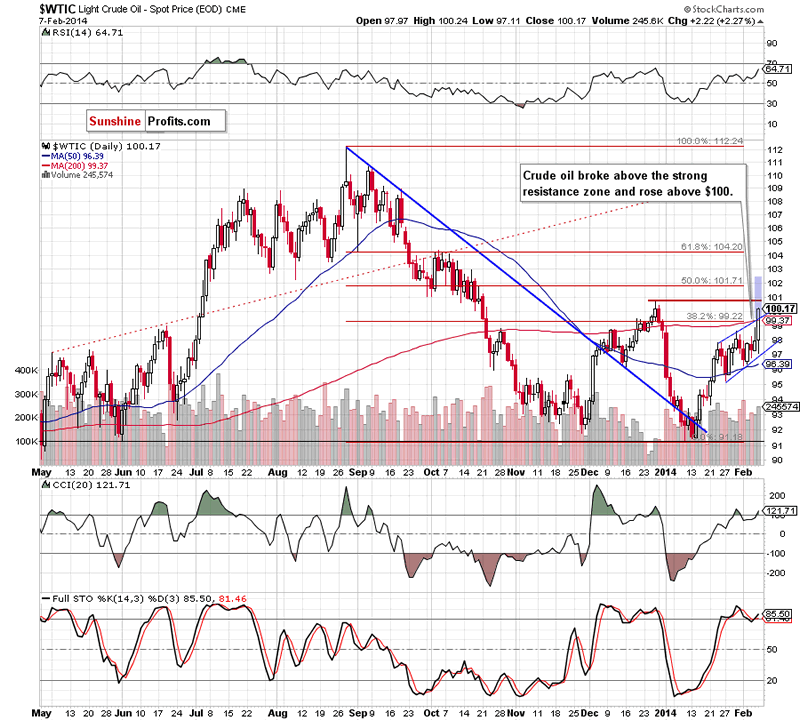

Having discussed the above, let’s move on to the technical changes in crude oil (charts courtesy of http://stockcharts.com).

Looking at the above chart, we see that the situation has improved significantly as crude oil broke above the strong resistance zone (created by the 200-day moving average, the 38.2% Fibonacci retracement level based on the entire Aug.-Jan. decline and the upper border of the rising trend channel), which is a strong bullish signal. According to theory, if the breakout is not invalidated, we may see further improvement and the upside target would be the 50% Fibonacci retracement. Nevertheless, we should keep in mind that although crude oil climbed above $100, it still remains below the December high, which serves as the nearest resistance at the moment. Additionally, when we take a closer look at the indicators, we see that there are negative divergences between the CCI, Stochastic Oscillator and light crude. On top of that, both indicators are overbought, which suggests caution.

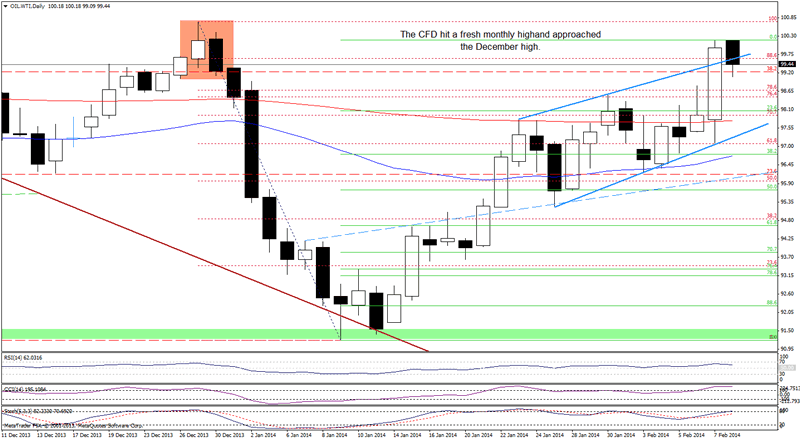

Having discussed the current situation in light crude, let’s take a look at WTI Crude Oil (the CFD).

Looking at the above chart, we see that the CFD extended gains and hit a fresh monthly high of $100.18. With this upswing, WTI Crude Oil broke not only above the previous high, but also above the strong resistance zone created by 38.2% Fibonacci retracement level based on the entire Aug.-Jan. decline, the upper blue line (which is also the upper border of the rising trend channel) and the 173.2% Fibonacci projection.

Similarly to what we wrote in the case of crude oil, this is a strong bullish signal. However, despite this growth, the CFD still remains below the December high (which is reinforced by a bearish engulfing candlestick pattern). As you see on the daily chart, earlier today, this resistance level encouraged oil bears to act and we saw first attempt to invalidate the breakout above the upper border of the rising trend channel. If the buyers fail and the CFD closes the day below this support line, it will be a strong bearish signal that will likely trigger further deterioration. At this point it’s worth noting that the CCI and Stochastic Oscillator are overbought, which may encourages sellers to act. Nevertheless, as long as WTI Crude Oil remains above the upper border of the rising trend channel, another attempt to move higher can’t be ruled out.

Summing up, the situation has improved significantly as crude oil broke above the strong resistance zone and climbed above $100 on relative high volume. With this upswing, light crude (and also the CFD) approached the December high. If this resistance level is broken and the breakout above the upper border of the rising trend channel is not invalidated, we may see further improvement and the upside target would be the 50% Fibonacci retracement. On the other hand, taking into account negative divergences between indicators and light crude, an attempt to return to the trend channel can’t be ruled out.

Very short-term outlook: bullish

Short-term outlook: bullish

MT outlook: bullish

LT outlook: mixed

Trading position (short-term): In our opinion, there were no changes in crude oil that justify opening short or long positions at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Sunshine Profits‘ Contributing Author

Oil Investment Updates

Oil Trading Alerts

* * * * *

Disclaimer

All essays, research and information found above represent analyses and opinions of Nadia Simmons and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Nadia Simmons and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Nadia Simmons is not a Registered Securities Advisor. By reading Nadia Simmons’ reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Nadia Simmons, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.