Bankers Can [Will] Steal Your Cash But Cannot Touch Your Gold and Silver

Commodities / Gold and Silver 2014 Feb 15, 2014 - 12:23 PM GMTBy: Michael_Noonan

Bankers can and will steal your cash, but there is no way they can take your personally owned and personally held gold and silver. The ongoing plan for 2014 is to buy and hold even more gold and silver and reduce your exposure to cash held in any bank. Just keep enough to cover week by week expenses, and keep the rest of your cash at home, under the mattress, in a safe, buried in the backyard, anywhere but in a bank.

Bankers can and will steal your cash, but there is no way they can take your personally owned and personally held gold and silver. The ongoing plan for 2014 is to buy and hold even more gold and silver and reduce your exposure to cash held in any bank. Just keep enough to cover week by week expenses, and keep the rest of your cash at home, under the mattress, in a safe, buried in the backyard, anywhere but in a bank.

ANYONE who keeps money in any banking system in the Western world is sending an RSVP to bankers to access your funds, and they will not disappoint. The confiscation of Cyprus banking accounts was bandied about as a template for other countries. "No, that would never happen," was a constant refrain. Well, it was just the beginning.

If there is one thing about which you can be certain, concerning cash held on deposit, the government, [pick a country], has plans to steal it. The bankers new motto: "What's yours is ours."

You think Cyprus was a single event? It was an elite trial balloon. The blowback from it? Not much, really. Financial shock and awe, to be sure, especially for Cypriots, but just like every other banker-created scam, there are no real consequences. The elites carefully monitored world response and learned one thing: more of the same, in some fashion or similar form will work, and we [the bankers] will get away with it.

Another example: Read this excerpt from the IMF October publication "Taxing Times" which states on page 49: A One Off Capital Levy:

The sharp deterioration of the public finances in many countries has revived interest in a "capital levy" -- a one-off tax on private wealth -- as an exceptional measure to restore debt sustainability. The appeal is that such a tax, if it is implemented before avoidance is possible and there is a belief that it will never be repeated, does not distort behavior (and may be seen by some as fair).

The cunning and planning goes on behind closed doors on an ongoing basis. Then there was this article from Reuters: EU Executive See Personal Savings Used To Plug Gap.

"the savings of the European Union's 500 million citizens could be used to fund long-term investments to boost the economy and help plug the gap left by banks since the financial crisis," an EU document says.

In other words, all of the trillions of $$$ used to prop up every single insolvent bank in the Western world has failed to boost any economy, and the reason why it has failed is because the bankers are keeping the money for themselves, not lending it out. Every economy is being starved of capital.

The solution? "The Commission will ask the bloc's insurance watchdog in the second half of this year for advice on a possible draft law "to mobilize more personal pension savings for long-term financing," the document said."

Doesn't that sound economically viable?! It is EU doublespeak: to mobilize more personal savings, in normal words means "confiscate," or more to the point, "steal." The central planners never stop planning, and your savings and deposits are in their crosshairs.

The bankers are not stopping there, however. The ultimate goal? All pensions, IRAs, 401ks, whatever form your retirement funds are in will be switched, for your own good, of course, to the safety and guaranteed security of government bonds. You will be assured of a few percentage points of interest. What, 1, 2, 3 percent? With inflation running at 8 to 10 percent, minimum, at least in the real world? Such a deal.

Obama has introduced the MyRA account, and just like Obamacare, it is for the "benefit" of the public good. It is the prelude for eventually taking over the country's entire pension programs, taking over all the accounts, [stealing your lifetime savings], and exchanging them for the US Treasury Bonds the Fed cannot sell to countries anymore. This is the only way the US government can cover its trillion $ [and growing] deficit spending.

What is wrong with this picture?

Who elected the bankers? Who elected the EU members that run Europe like their own ATM? They all are empowered by the elite shadow rulers. What is worse, people are not rebelling. Instead, all acquiesce to the whims of the central bankers.

"All" is close but not quite accurate. There are the relatively few who own and hold silver and gold, immune, to that extent, from the theft of banking funds/pension funds/ mutual funds/corporate and government bonds, any form of paper thought to have value.

Rest assured that those who impose [steal] "special situations" are exempt themselves. All of your hard-earned money and life savings are needed to prop up the insolvent banks, pay for all the banker bonuses and lavish lifestyles, because the bankers will never be held accountable to the financial problems they created, and you must now pay for their mistakes for no bankers are ever held accountable, just you and your neighbors.

We are all free to make choices. From what we can determine, financially smart people own and personally hold, and continue to buy gold and silver, the most durable "wealth" preserver of all. The word "wealth" is used for lack of a better choice in the asset class of precious metals. There has been no wealth preservation owning gold and silver for the past few years, stated and acknowledged. However, that is a very short time frame from which to measure.

The choice is simple: paper or hard assets? Owning gold or silver ETFs or futures are paper and not a claim on the physical. Accept no substitutes. For those who choose to remain within the banking system, the risks are known, and if accepted for what the central bankers are planning, made public by the way, there can be no complaining when funds are lost.

The charts remain the most viable way of keeping a pulse on the price of gold and the gold price. Some make a distinction, but the effect has been of no consequence from a pragmatic point of view. Our weekly charts and assessment follow:

As a reminder, the charts are in contradistinction to physical gold and silver. Everyone should be buying physical gold and silver as often as possible, and price is not the most important issue, owning it is. The charts reference the paper form of gold and silver, but they relate to the price of the physical, by extension, as a general guide.

The past two weeks have been the best for gold in several months. We maintain the belief that extraordinarily higher prices for gold and silver are not going to happen, in the near term. Maybe sometime in 2014, it is too soon to tell. What is more important are the events like those discussed above that are setting the stage for eventual higher prices.

What should be of primary concern for buyers of the physical is the availability. It may not always be readily available, as it is now, and that should be a driving motivation for their acquisition. For those who already own PMs, particularly at higher prices, do not fret. Their value will go back to levels paid, and much higher. Just be patient. It is short- sighted to measure one's holdings based on price as opposed to the reason for buying them in the first place.

If you do not complain about paying for car or house insurance that does not get used, why complain about PM holdings from higher prices? Stay focused. Events are unfolding in an alarming manner, and people should be very worried about what is going to happen. Look at Cyprus, Greece, Venezuela, Ukraine to get an idea of how ugly things can, and will get.

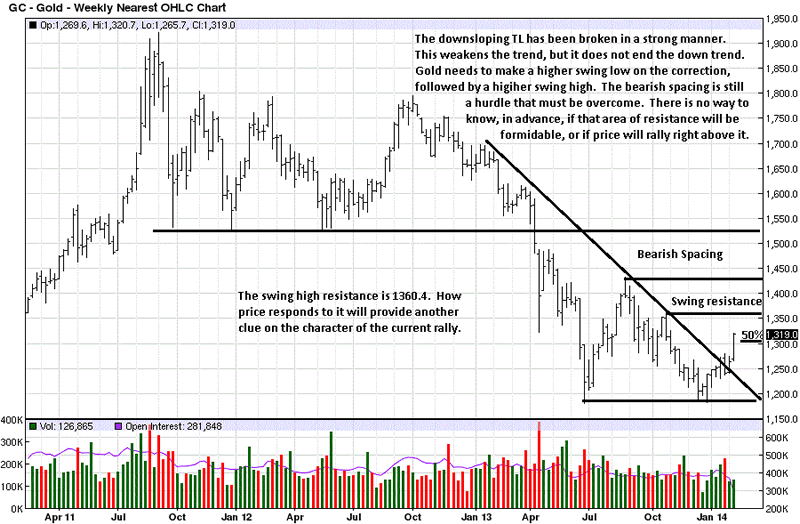

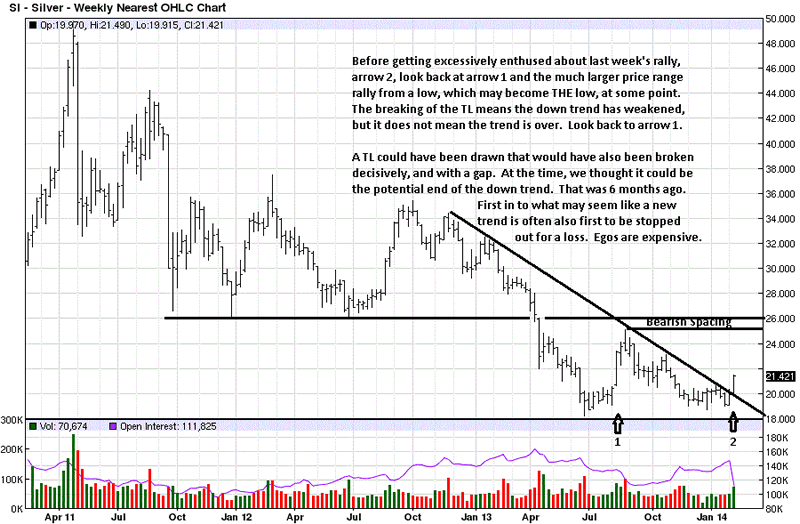

The weekly chart shows the current down trend weakening but not ending. As is pointed out in the weekly silver chart, one only need look at the rally that began in June, 2013. If anyone thought the breaking of a TL [Trend Line] meant the end of a bear market, look again. It takes time for a trend to change, and with the exception of a "V-Bottom," there are a few phases that mark trend changes.

The Bearish Spacing still stands out for what could be formidable resistance, yet to be determined. As a reminder, bearish spacing exists when the last swing high, August 2013, fails to reach the lows of the last swing low, May 2012. It indicates sellers did not feel the need to see how the swing low would be retested. They aggressively embarked upon their selling campaign certain that lower prices were next.

The August swing high will be defended by those who sold at that level, which will make it resistance. There is a relatively smaller resistance level, marked on the chart, at 1360.4, a smaller swing high. How the market responds to the known resistance levels will give an indication of the character of the existing trend.

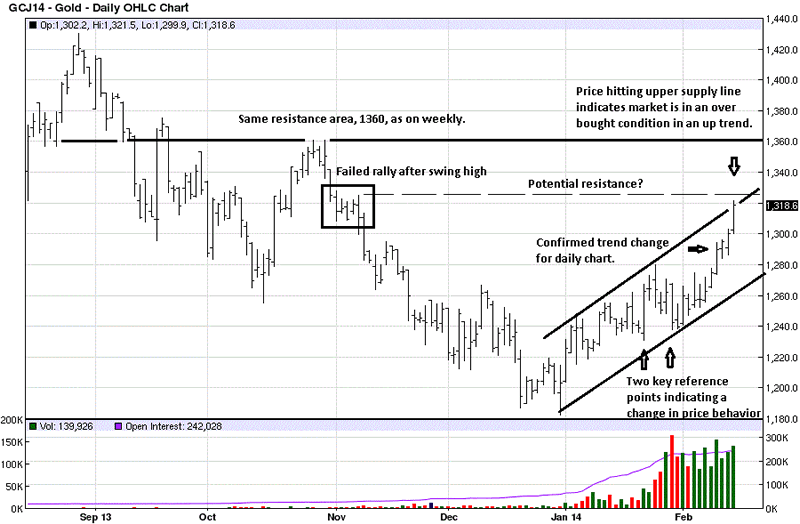

The daily trend is up, as defined by a two higher highs with a higher low in between. Once price rallied above 1280, it formed a higher high and confirmed a change in trend on the daily. Once that was confirmed, it was then easier to put the previous market activity into a context that supported the change in trend. Sometimes, recognizing changes can only be determined in hindsight.

The two wide range bars, with arrows under each, anchored the rally in gold. There was no way to know beforehand that gold would make higher daily lows for 10 days straight, and that left no [normal] reaction in which to buy. This is a decided change in market behavior, and if sustained, will continue building on the up trend just under way.

The primary resistance at 1360 is the same on the daily and weekly, giving greater weight to the daily chart. A lesser, potential resistance level is also shown by the dashed line from a failed retest rally, marked on the chart.

Money is not made buying potential resistance, which the 1280 area represented, and for that reason, we were not buyers and missed the last half of the rally. We did catch some of the earlier portion of it, however.

What we know for certain is that every market will have a normal correction, and it is at that point one can take a position with a more clearly defined risk. For now, we remain on the sidelines in the paper futures.

Pointing out the importance of not jumping to any conclusion that last week's strong rally has change the trend, a look back at the first arrow shows an earlier strong rally that did not change the trend. Everything needs to be confirmed, and the rally from the first arrow was never confirmed as a change in trend. Patience is a virtue in the markets.

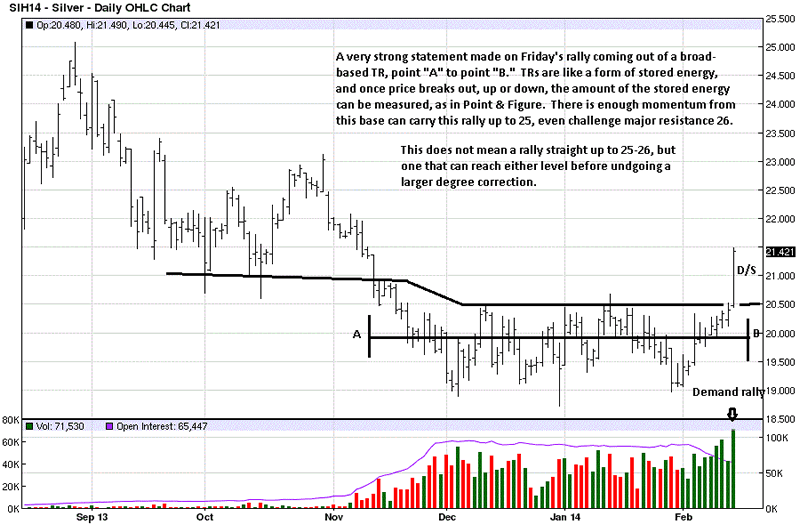

Friday's rally in silver was impressive, coming out of the protracted TR, [Trading Range]. When you measure from point "A" to point "B," that "stored energy" accumulated during the trading range reveals that the upside rally potential can carry silver to the 25 area, and even challenge the all important 26 resistance.

Silver also has bearish spacing, shown on the weekly chart, but it is not as great as the gold bearish spacing. There is a good possibility that silver can outperform gold, on the next important rally.

The "D/S" designated Demand overcoming Supply, and the sharp volume increase is very supportive of the rally. A great place to get long is on the retest of the breakout, and we will be watching how the next retest unfolds.

By Michael Noonan

Michael Noonan, mn@edgetraderplus.com, is a Chicago-based trader with over 30 years in the business. His sole approach to analysis is derived from developing market pattern behavior, found in the form of Price, Volume, and Time, and it is generated from the best source possible, the market itself.

© 2014 Copyright Michael Noonan - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Michael Noonan Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.