Is Stock Market Correction Over?

Stock-Markets / Stock Markets 2014 Feb 16, 2014 - 06:37 PM GMTBy: Nadeem_Walayat

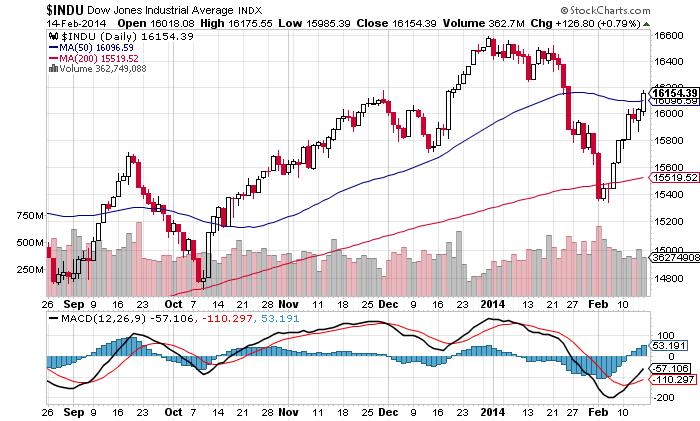

The stock market (Dow) last week confounded the heights of a another new bear market rhetoric by bouncing to close decidedly back above 16k at 16,154, this despite a week of bad economic data such as a suprise fall in industrial production of 0.3% against expectations for a 0.2% increase (polar vortex bad weather effect). Off course for the perma-bear crowd the weeks rally just represents a minor correction to further short into. Therefore was last weeks rally a last gasp before the great bear market resumes? Or was it the end of what amounts to a relatively minor correction that signals the resumption of the stocks 'stealth' bull market?

The stock market (Dow) last week confounded the heights of a another new bear market rhetoric by bouncing to close decidedly back above 16k at 16,154, this despite a week of bad economic data such as a suprise fall in industrial production of 0.3% against expectations for a 0.2% increase (polar vortex bad weather effect). Off course for the perma-bear crowd the weeks rally just represents a minor correction to further short into. Therefore was last weeks rally a last gasp before the great bear market resumes? Or was it the end of what amounts to a relatively minor correction that signals the resumption of the stocks 'stealth' bull market?

My last look at the stock market of 2 weeks ago concluded in the following trend expectation:

03 Feb 2014 - Stocks Bull Market Over? Are the Bears About to Break...even?

The current stock market correction looks set to attempt to revisit 15,000. How close it gets to 15,000 I can't tell, perhaps half way, just that the correction is not done to the downside. Following which the price chart implies that the Dow will enter an upwardly sloping trading range that would target a NEW all time high. However given the nature of trading ranges it is difficult to say how many swings it would take for such an outcome to occur, i.e. the last such trading range comprised 7 swings before breaking higher. This one could be quite brief and just comprise 2 swings as indicated by the chart, which could imply a New Dow high by early April, though that does not mean that the Dow would be able to hold the high as it could remain in the upward sloping range for some time which implies Sell in May and Go away as probable.

So to answer the question - Is the stocks bull market over ?

NO ! No sign whatsoever that this (what people decades from now will look back on as being the greatest bull market in history) bull market is anywhere near being over!

The subsequent price action closely matches my trend expectations for the Dow to bottom around 15,250, and therefore implies that the correction of just 8% should be over. Can you imagine all that doom and gloom that surrounded what amounted to just a minor 8% correction!

In reality, I would have liked the Dow to spend a little more time to the downside by extending a little further lower to perhaps down 10%, i.e. to give the bears a longer noose to hang themselves with. This translates into expectations for a slightly more volatile up-trend going forward towards a new stock market all time high by early April, at which time I will compose my next in-depth analysis and concluding trend forecast. Ensure you remain subscribed to my ALWAYS FREE Newsletter to get this analysis in your email in box.

The bottom line is that this was a relatively minor and healthy stock market correction to help dissipate the froth that had built up during the preceding rally to new all time highs and which now sows the seeds for the next new all time high by early April.

Your getting bored with the housing market analyst.

Source and Comments: http://www.marketoracle.co.uk/Article44456.html

Nadeem Walayat

Copyright © 2005-2014 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 25 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series.that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 600 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 600 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.