Gold’s Comeback and Bitcoin’s Silent Crash

Commodities / Gold and Silver 2014 Feb 18, 2014 - 10:25 AM GMTBy: Clif_Droke

It's the tale of two assets: gold, which was largely shunned by investors for most of last year, has made an impressive comeback in recent weeks. Meanwhile Bitcoin, the white-hot "investment" of 2013, has lost value in recent weeks and threatens to violate an important long-term trend line.

It's the tale of two assets: gold, which was largely shunned by investors for most of last year, has made an impressive comeback in recent weeks. Meanwhile Bitcoin, the white-hot "investment" of 2013, has lost value in recent weeks and threatens to violate an important long-term trend line.

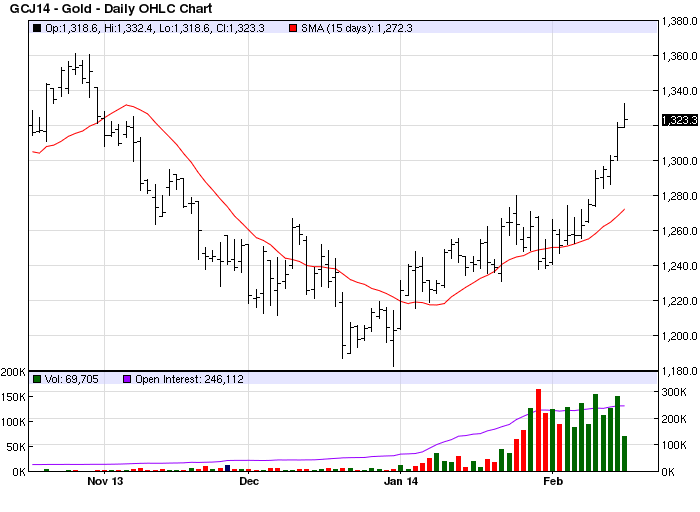

Gold made its return to the headlines after exceeding the psychological $1,300 level for the first time since November. Trading volumes have hit their highest level since May as U.S. investors gradually awaken to the attractiveness of gold in the near term.

In contrast to bullish U.S. investors, higher gold prices over the past few days have resulted in curtailed bullion purchases from China, the world's largest gold consumer, according to Reuters. China has been one of the key drivers of gold's burgeoning turnaround, so this development bears watching.

Despite the temporary curtailment of China's gold demand, though, the overall interim trend is being fueled by high debt levels and a perceived overvalued renminbi currency which have resulted in increased gold imports into China. According to a report from Lombard Street Research, China's authorities may possibly be moving in the direction of using gold in a plan to make the yuan an international currency. Recent data shows that China imported and produced more gold in 2013 than consumers bought. This has led to speculation that China's authorities used the 28% price plunge last year to increase holdings of the metal.

Speaking of China, Dr. Michael Haigh, head of commodities research at investment bank Societe Generale (SocGen), has asserted in a report that uncertainty over China's economic growth prospects is driving gold prices. Haigh wrote that the relationship between China uncertainty - as measured by an index of relevant articles in the South China Morning Post - and U.S. gold prices "became significant in the summer of 2011," and that by August 2013, "the relationship rose to levels never seen before."

Dr. Haigh also asserted that gold prices "would first rise on a flight to quality, and then fall as Chinese demand flagged," if China's economy weakens in 2014 as many economists expect. He added, however, that investor uncertainty over Beijing's policy response to a recession could "underpin" gold prices. "A 20% increase in uncertainty could drive gold prices 3% higher," the SocGen report concludes.

There is probably some truth to SocGen's proposition. It's clear that volatility in China's equity market has spilled over into the gold price in recent weeks. As investor uncertainty over China and the emerging markets continues to be a market-moving factor in the near term, gold should be able to benefit.

Technically speaking, gold is finally starting to build some forward momentum thanks to this investor uncertainty. The first two key chart resistance levels have already been overcome on the upside, namely the $1,300 and $1,320 benchmarks. As previously noted, this level would be a natural profit-taking point for many traders and investors.

The yellow metal's near-term forward momentum looks to propel the price higher above $1,320, however. In view of this potential, the next near-term resistance level for gold (basis April futures) is the area immediately surrounding the $1,340-$1,350 area (see above chart). Traders should be prepared for a possible pullback as gold approaches the $1,340-$1,350 area.

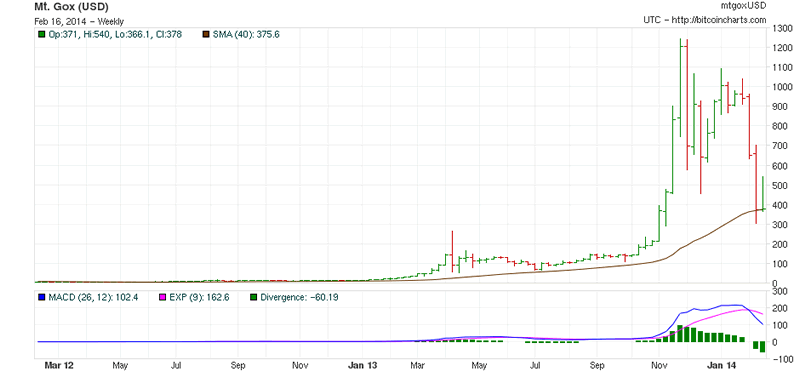

Now let's turn our attention to recent developments in the Bitcoin market. Bitcoin has recently suffered what may be termed a "silent crash" after a stellar performance in late 2013. After a blow-out performance in November, the Bitcoin price suffered a sharp pullback in December and spent most of January in a temporary holding pattern above the 900 level before finally sinking under the weight of selling pressure in February. As of Feb. 14, the Bitcoin price was testing its dominant longer-term 40-week moving average, which answers to the widely followed 200-day MA. This marks the first major test of a significant trend line for Bitcoin since last July.

The sell-off in the last two weeks has occurred under a veil of near silence among the mainstream media. The same financial press which so vigorously praised the virtual currency's prospects earlier this year has largely ignored the slide in value since Feb. 6. This can be largely attributed to the recent equity market sell-off, which stole the spotlight from other investment vehicles.

It's nevertheless unusual that the media continue refusing coverage of the loss of Bitcoin's value. This leads us to speculate as to a possible motive. One possibility is that the hedge funds which recently entered the Bitcoin market are using the decline as cover for accumulating a large stake in the market. It's no secret, after all, that many members of the financial press are in the employ (if not the outright ownership) of hedge fund moguls. It's therefore possible that the media silence on Bitcoin's recent crash is bought and paid for by those who intend to ultimately profit from it.

Of course another reason for the lack of media interest in Bitcoin's latest swoon is perhaps that the virtual currency has been temporarily overshadowed by the rally of the gold price. Gold's rally is a testament to its demand as a safe haven among investors spooked by the recent financial market turbulence, as well as the media hype regarding an emerging markets "crisis."

Until the media begins talking up Bitcoin's crash in histrionic tones, investors should be wary of assuming the slide in the currency's value has terminated. The Bitcoin bear market is likely to persist until we see gloom-and-doom headlines announcing the currency's demise, at which time we can justly assume a psychological turning point will be made.

High Probability Relative Strength Trading

Traders often ask what is the single best strategy to use for selecting stocks in bull and bear markets? Hands down, the best all-around strategy is a relative strength approach. With relative strength you can be assured that you’re buying (or selling, depending on the market climate) the stocks that insiders are trading in. The powerful tool of relative strength allows you to see which stocks and ETFs the “smart money” pros are buying and selling before they make their next major move.

Find out how to incorporate a relative strength strategy in your trading system in my latest book, High Probability Relative Strength Analysis. In it you’ll discover the best way to identify relative strength and profit from it while avoiding the volatility that comes with other systems of stock picking. Relative strength is probably the single most important, yet widely overlooked, strategies on Wall Street. This book explains to you in easy-to-understand terms all you need to know about it. The book is now available for sale at:

http://www.clifdroke.com/books/hprstrading.html

Order today to receive your autographed copy along with a free booklet on the best strategies for momentum trading. Also receive a FREE 1-month trial subscription to the Momentum Strategies Report newsletter.

Order today to receive your autographed copy along with a free booklet on the best strategies for momentum trading. Also receive a FREE 1-month trial subscription to the Momentum Strategies Report newsletter.

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.