Gold Bugs Don’t Fear Strength, Plenty More Upside Ahead for Gold Stocks

Commodities / Gold and Silver Stocks 2014 Feb 21, 2014 - 12:53 PM GMTBy: Jordan_Roy_Byrne

Major bottoms in any market or sector usually produce big rebounds and big gains for those who are correctly positioned. For some, the initial strong gains create trepidation that the market will experience a big correction or revert back to the previous bear market (which created the foundation for the big rebound). I've noticed this trepidation over the past few days from subscribers and other advisors preaching caution or hedging their recent gains. This is all well and fine but the evidence as well as history suggest not to worry because the gains will continue unabated over the intermediate term.

Major bottoms in any market or sector usually produce big rebounds and big gains for those who are correctly positioned. For some, the initial strong gains create trepidation that the market will experience a big correction or revert back to the previous bear market (which created the foundation for the big rebound). I've noticed this trepidation over the past few days from subscribers and other advisors preaching caution or hedging their recent gains. This is all well and fine but the evidence as well as history suggest not to worry because the gains will continue unabated over the intermediate term.

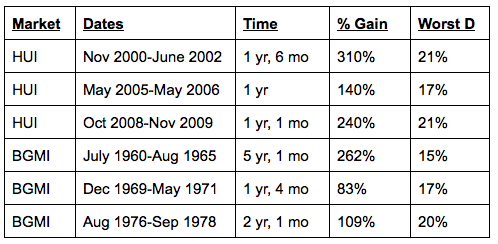

I looked at history to identify the nature of corrections in gold stocks during cyclical bull markets within secular bull markets. I looked at the major bottoms during 1960-1980 (using the Barron's Gold Mining Index) as well as the major bottoms during this bull market (using the HUI Gold Bugs Index) which began in 2000. Essentially I examine how long it took for gold stocks to encounter their first major correction (more than 21%) following a major bottom. The column Worst D refers to the market's worst correction before the first major correction. I found that these initial corrections were limited to 15% to 21%. The first major correction averaged about 30% and occurred at least one year after the major bottom.

The HUI did correct 26% in November 2008 as it retested the October low. We left that out as it occurred instantly after the major bottom.

Look at what happened after the major bottoms of 1960, 1976, 2000 and 2008. If we take the median of those four rebounds then it equates to the market rebounding 251% over one year and nine months before incurring more than a 21% correction.

The only outlier is the 1969 bottom where the market corrected 35% in 1971 and then 23% in 1972 before the market exploded to the upside over the next two years. However, following the 1969 bottom the market did rebound 83% over one year and four months with no more than a 17% correction. It wasn't that much of an outlier.

The lack of a big correction following a major bottom is quite common in all equity markets. Consider how the stock market performed following the 2002 and 2009 bottoms. From October 2002 to January 2004 (16 months) the Nasdaq rallied 93%. Its worst correction was 14%. Following the 2009 bottom, the Nasdaq rallied 99% in 13 months! Its worst correction was 8%.

History suggests that we need not worry about a major correction anytime soon. The HUI is currently up 30% in two months. If it's up 200% in 17 months then it would be time to worry about a significant retracement. In the meantime, we don't foresee any shift in the trend until the gold stocks reach the neckline resistance (GDX $30, GDXJ $51) discussed in our last editorial. From those levels we could get a 15% correction.

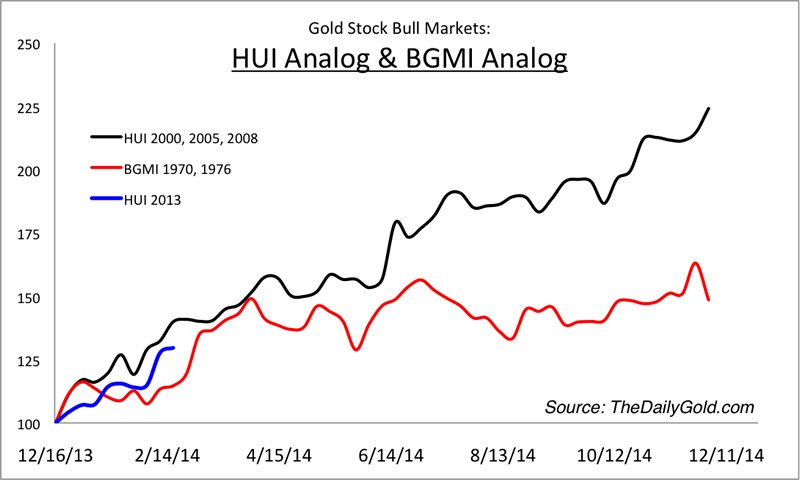

The chart below plots the average of the rebounds in the 1970s as well as the average of the rebounds in the past decade. The current rebound (blue) remains on track according to history.

After a major rebound its natural to want to be cautious and safe. Our emotions react to the recent past. That is why the herd is always too bullish at market tops and way too conservative at market bottoms. Moreover, advisors want to play it safe by hedging their opinions and bets. Everyone is worried subconsciously that the fledgling bull market isn't real and may revert back to a bear market. In this instance, the hardest thing to do is be a raging bull and to buy something that you could have bought 50% cheaper a month or two months ago. Our work leads us to believe that we'll experience continued gains over the coming weeks and months. For now, corrections will be brief. Use them as opportunities. Don't overthink it. Be long, sit tight and have an exit strategy (mental stop loss) in case things play out differently.

If you'd be interested in professional guidance in this endeavor, then we invite you to learn more about our service.

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2013 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.