GDXJ Signals Imminent Breakout Into Major Gold and Silver Stocks Sector Uptrend...

Commodities / Gold and Silver Stocks 2014 Feb 24, 2014 - 01:03 PM GMTBy: Clive_Maund

A lot of investors are going to miss out on the huge bullmarket advance in the Precious Metals sector that is just starting as this is written, because they are frightened of the impact of the broad market on the sector, but as we will see, the sector itself is signaling that it is going up, big time.

A lot of investors are going to miss out on the huge bullmarket advance in the Precious Metals sector that is just starting as this is written, because they are frightened of the impact of the broad market on the sector, but as we will see, the sector itself is signaling that it is going up, big time.

If the broad market looks set to go up, then many investors think that the Precious Metals sector will be ignored and drift lower again, as the broad market continues to rise. If the broad market tanks, then they think that the PM will get dragged down with as in 2008.

Actually, the way that it is looking now is that the broad market will continue higher and higher and the PM sector will soar. Why would that happen? - because we are on the road to hyperinflation, that's why. It is becoming increasingly apparent that either the Fed will chicken out of significant tapering, or that even if they do backpedal it will be too late, as the huge overload of extra money that has been injected into the system since 2008 wreaks havoc.

Fortunately, as far as investing in the PM sector is concerned, we don't have to bother to extrapolate fundamental scenarios, we just have to follow the message of the market itself, via Technical Analysis as applied to recent action in the PM sector.

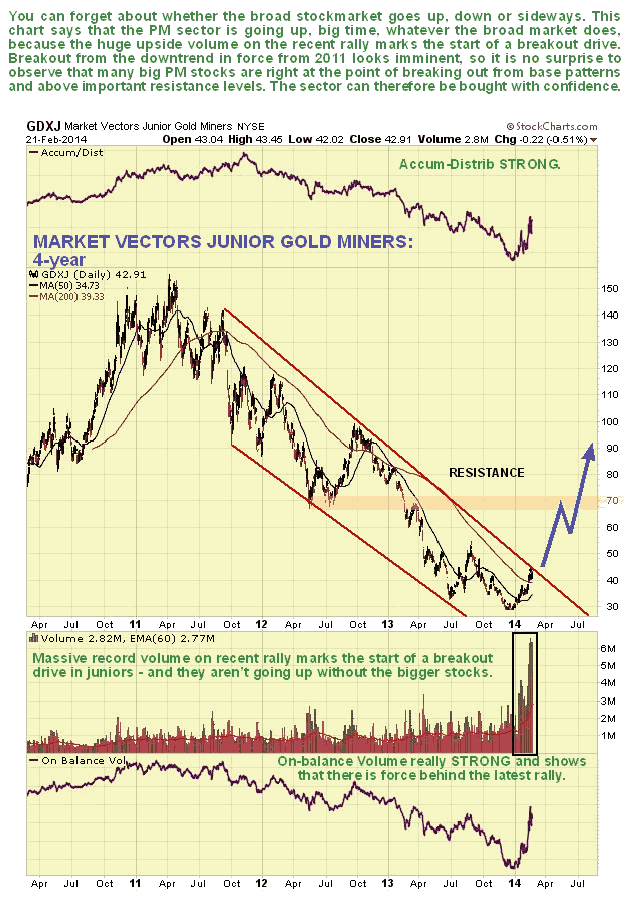

It is no coincidence that the Market Vectors Junior Gold Miners ETF, GDXJ, is right on the point of breaking out from its downtrend in force from 2011 at the same time as many PM stocks are right at the starting line of major uptrends, being at key resistance at the top of base patterns that have formed since last June or on the point of breaking out of long-term downtrend, or both.

We don't have to wait for breakout to occur before taking positions, because the volume pattern and volume indicators in the GDXJ have already signaled that it is going to break out to the upside soon, or imminently, to commence a major uptrend, and this junior ETF is highly unlikely to enter an uptrend without the large and mid-cap stocks taking off higher with it.

Just look at the stupendous record upside volume in the GDXJ on the rally this year on its 4-year chart above, and how its volume indicators are spiking. This tells you all you need to know - it is sending the clearest possible message that the sector is going up big time, because this dynamic volume action signifies the start of a breakout drive that should shortly take the GDXJ clear out of its downtrend and launch it - and the entire sector - into a vigorous bullmarket advance. For this reason there is thought to be little point in waiting for breakout to occur before establishing positions, and it is on this premise that we have "backed up the truck" on clivemaund.com and been loading up with the better stocks as fast as we can. Why not join us, if you haven't already, and get your nose in the trough ahead of the mob?

Market Vector Junior Gold Miners ETF, GDXJ on NYSE, closed at $42.91 on 21st February 14.

By Clive Maund

CliveMaund.com

For billing & subscription questions: subscriptions@clivemaund.com

© 2014 Clive Maund - The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maunds opinions are his own, and are not a recommendation or an offer to buy or sell securities. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications.

Clive Maund Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.