The Coming Silver Storm: The Public Is Not Prepared

Commodities / Gold and Silver 2014 Feb 24, 2014 - 01:41 PM GMTBy: Steve_St_Angelo

The financial sky is growing dark. The stock markets are experiencing volatile trade winds. The barometer of the economy grows weak as indicators point to another recession looming on the horizon.

The financial sky is growing dark. The stock markets are experiencing volatile trade winds. The barometer of the economy grows weak as indicators point to another recession looming on the horizon.

The Precious Metal Storm is coming... unfortunately, the public is not prepared.

I believe the U.S. and world are heading toward an economic collapse that civilization has never witnessed before. Even though we have suffered greatly through World Wars and global depressions, we have always been able to pull ourselves out of the chaos and destruction by regrouping and rebuilding.

As I have stated several times before... this time will be different.

After reading the work of various precious metal and energy analysts, I am quite surprised how many of these individuals can posses a high degree of intelligence while making some seriously flawed forecasts and assumptions.

One of my readers asked me a question via an email, "How could I provide a lot of quality analysis and data... while being BULLISH ON SILVER?" This person couldn't understand why I could be fundamentally in favor of silver when typical orthodox analysis points to a bearish deflationary outcome for the shiny metal.

And... there lies the rub.

The U.S. and world are heading down the toilet because analysts, intellectuals and the movers & shakers running the show, have allowed their ignorance-greed rather than their intelligence-wisdom to guide monetary, economic and governmental policy.

FIAT CURRENCY ASSETS: The Great Bamboozle

The chart below shows where the majority of U.S. personal sector monetary cash assets are allocated. These do not include retirement or security investments, but are rather paper assets we may label as "Cash or Cash Equivalents."

According to the Federal Reserve Q3 2013 Statistical Release, the U.S. public held $1,174 billion in Money Market Fund Shares, $1,332 billion in Checkable Deposits & Currency and $7,723 billion in Time & Saving Deposits. Thus, there is a total of $10,229 billion or $10.2 trillion in these paper cash assets.

You will notice on the left side of the graph a small pathetic figure of $14 billion. This represents the total value of all the Global Silver ETF's as of Q3 2013. The data for that figure comes from GFMS Thomson Reuters Nov. 2013 Silver Update.

The next chart below details the holdings of the different Silver ETF's from around the world:

As we can see there are 655 million oz of silver held in these Silver ETF's. If we multiply the 655 million oz by $21, we would get a figure of $13.7 billion. I rounded the figure to $14 billion in the first chart.

If we assume that this is the largest store of physical silver in the world (not including the LBMA or COMEX), its total value ($13.7 billion) pales in comparison to $10.2 trillion held in U.S. personal cash assets.

Now, if we were to include the current 182 million oz of silver at the Comex and let's say there is another 200 million oz at the LBMA, that would add another $8 billion to the figure... giving us a total of $22 billion.

Whoopee...

The U.S. public has $7.7 trillion stashed away in digital Time & Savings Deposits. I am going to disregard the other two categories as they are fiat currency assets that the public may use on a more "day-to-day" basis.

However, Time & Savings Deposits are "extra or surplus" funds that are generally not used in the day-to-day business of Americans. Thus, the total value of the Global Silver ETF's are 0.2% (one fifth of one percent) of the value of all U.S. Time & Savings Deposits.

This may not seem so strange to the typical American today, but just fifty years ago (when I was a kid), the U.S. Dollar was backed by gold and the coinage had a great deal of silver in it.

After President Lyndon Johnson signed the "Coinage Act of 1965", which removed silver from circulation, within a few years... it was difficult to find a silver coin. Once silver was removed from official U.S. coinage, it went into hiding.

The term "went into hiding" means the public instinctively understands the implications of Gresham's Law -- bad money drives out the good. When the U.S. Government starting minting base metal slugs as official money, it didn't take long for the public to withdraw the real money (silver) from circulation.

A few years after the signing of 1965 Coinage Act (removing silver from circulation), the next shoe to drop was gold. On August 15, 1971, Nixon closed the gold window, which meant foreign governments could no longer exchange U.S. Dollars for physical gold.

Because the U.S. was printing so much money in the 1960's to cover the costs of social programs and the war in Viet Nam, foreign countries were exchanging paper Dollars for physical gold. During the 1960-1968 time period, the U.S. was a part of the London Gold Pool that attempted to hold the price of gold at $35 by selling thousands of tons of gold on the market.

The biggest loser in the London Gold Pool was the U.S. as it exported over 4,700 metric tons during that nine-year time period. Here again was another example of bad money driving out good.

If we fast forward to today, Gresham's Law is alive and well as the East continues to exchange worthless fiat Dollars for physical gold. Not only did the Chinese import a record amount of gold in 2013, they also imported a stunning 247 metric tons in January.

According to Koos Jansen from the "In Gold We Trust" website:

Having said that; How can gold demand (I assume that’s what they mean by usage) be 1176 tons, when China mainland net imported 1123 tons just from Hong Kong, domestically mined 428 tons, and additionally net imported gold through other ports? Regular readers of this blog know the number 1176 tons of demand is false, it was in fact 2197 tons as my research has exposed.

....Withdrawals from the Shanghai Gold Exchange vaults in January 2014 accounted for 247 tons, which is an increase of 43 % compared to January 2013. It’s also more than monthly global mining production and an all-time record! China mainland mines about 35 tons per month which is required to be sold first through the SGE. The other 212 tons (247 – 35) had to supplied by import or recycled gold. My estimate is that scrap couldn’t have been more than 25 tons, so import in January was a staggering 187 tons. China is still draining the vaults in the west BIG TIME.

Currently, China and many other Eastern countries are focusing on acquiring physical gold... as it is the king of monetary metals. However, this does not mean that silver will miss the huge transfer of wealth show because it is now just a supposed "Industrial Metal."

Silver is still a valued monetary metal due to the fact that the Official Mints continue to produce both Gold & Silver Eagles, Maples, Philharmonics, Koalas, Kangaroos, Pandas and Libertads. Do you see these Official mints producing these coins in copper??

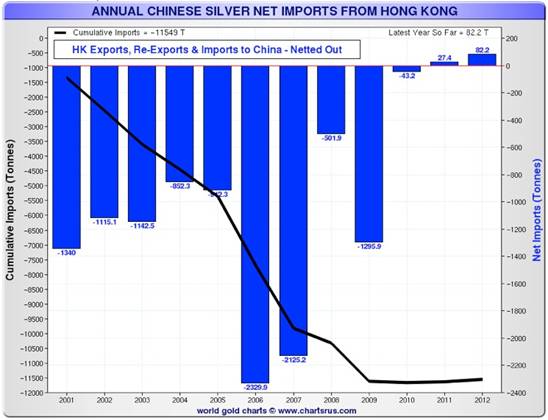

Regardless, demand for silver is picking up as both India and China have increased their net imports of silver over the past several years. This chart is from Nick Laird's Chartsrus.com:

Here we can see that China has gone from being a big net exporter of silver, to a net importer since 2010. In 2009, (last year being a net exporter), China had net exports of 1,260 metric tons. However, in 2012, China became a net importer of 82 metric tons.

While this may seem like an insignificant figure presently, it is the beginning of another trend change that will more than likely continue to a greater degree in the future.

Furthermore, when the Indian Government cracked down on gold imports in 2013, its citizens switched to buying silver. Indians imported a record 5,400 metric tons of silver in 2013:

This was a record amount of silver imported by India, estimated to surpass the 5,049 metric tons set in 2008. This provides proof that citizens of the world will instinctively purchase silver if they cannot acquire gold. When one monetary metal is unavailable, demand for the other will increase.

Did the Indians LOAD UP ON COPPER when they couldn't buy gold? Of course not. Maybe at some point, the public will realize the monetary value of silver.

Unfortunately, the realization will be too late as available supplies of physical silver will dry up and blow away when the GREAT FIAT CURRENCY RESET finally arrives.

If we consider that the U.S. public holds $7.7 trillion in Time & Savings Deposits while the world has a paltry $13.7 billion in total Global Silver ETF's, something is very wrong with the public's ability to understand the wisdom of "real value."

Again, less than fifty years ago, gold and silver were legal forms of money in the United States. Today, if you talk about the positive attributes of gold and silver on CNBC, you become the laughing-stock on the set.

Gold and silver will become some of the best stores of value in the future as Peak Energy destroys the ability for the Global Fiat Monetary system to continue.

We must remember the KEY INGREDIENT that keeps a Ponzi Scheme alive is the ability to hoodwink a new batch of POOR UNWORTHY SLOBS to part with their hard-earned fiat currency. When I say SLOBS, I am not trying to be harsh here (as I am one of the SLOBS myself), but rather to offer a term that the banking elite would use in describing their clients -- the public.

If a typical Ponzi Scheme needs a new supply of victims' funds to keep it going, the Global Fiat Monetary Ponzi needs a growing supply of energy to keep it from collapsing. That is why a peaking global oil supply will destroy the ability for the Elite to continue manipulating the system.

The Fiat Monetary System and Derivative's Monster are heading toward certain death.... it's just a matter of time.

Please check back at the SRSrocco Report as I will be providing a new REPORTS PAGE including my first paid report, THE U.S. & GLOBAL COLLAPSE REPORT. You can also follow us at Twitter at the link below:

© 2014 Copyright Steve St .Angelo - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.