Stock Market Rogue Rally Nearing Completion

Stock-Markets / Stock Markets 2014 Feb 24, 2014 - 06:41 PM GMT Would you believe that the really took 85 hours and 40 minutes from inception to today’s high at 12:20? The Wave (B) analysis still stands, since the Dow, The Russell 2000 and the Trannies have not made new highs, giving a major non-confirmation of this rally. There is negative divergence at all degrees of trend.

Would you believe that the really took 85 hours and 40 minutes from inception to today’s high at 12:20? The Wave (B) analysis still stands, since the Dow, The Russell 2000 and the Trannies have not made new highs, giving a major non-confirmation of this rally. There is negative divergence at all degrees of trend.

This is where analogs tend to fall apart in most analysts’ eyes, since they look for a mechanical reproduction of the prior event that is being compared to the present. In Cycles, you look for the components, not the actual structure to guide you. In this case, I view the January 15 high as the Orthodox high. Today’s Wave (B) was a rogue attempt to take out any shorts.

Remember that virtually all the indexes are in the final stages of an Orthodox Broadening Top, which I have found temporarily turns the expected Cycle tops and bottoms upside-down. Today would normally have been a Trading Cycle low. Instead, it inverted to become a top (and maybe the final one). This still leaves time for a Flash Crash, which has followed every completed Broadening Top since May 6, 2010.

There is no trigger point to go short the SPX until it crosses the trendline at 1832.00. Take your best shot at it if not already short.

I had earlier suggested that any ramp attempt in the SPX would probably push the VIX down to 13.77 again. Well, not quite!

The VIX sell signal is between the 50-day moving average at 14.64 and Intermediate-term resistance at 14.85.

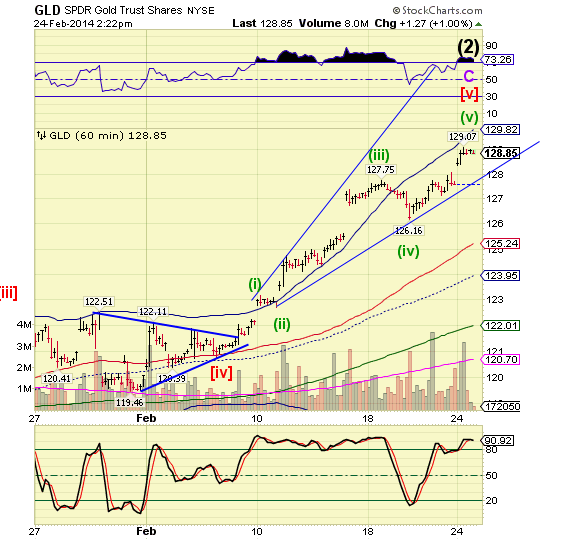

It appears that GLD may be finished with its retracement and ready to go back into its bear market decline. It appears to have completed a broadening Ending Diagonal and today is a pivot day for gold, so it bears close watching, if one is long.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.