Wells Fargo: A Stock Investors Lesson In Dealing With Fear

InvestorEducation / Learning to Invest Mar 05, 2014 - 09:54 AM GMTBy: Fast_Graphs

What would you do if we told you that a financial crisis was coming? Specifically, let's drill down to a single bank stock and say that we knew for certain that Wells Fargo's (WFC) share price would drop by more than 70%. Moreover, this price decline wasn't necessarily going to be capricious in nature as Wells Fargo's earnings would also drop by roughly 75% for the year. We didn't know when this time would come, but rest assured it was coming.

What would you do if we told you that a financial crisis was coming? Specifically, let's drill down to a single bank stock and say that we knew for certain that Wells Fargo's (WFC) share price would drop by more than 70%. Moreover, this price decline wasn't necessarily going to be capricious in nature as Wells Fargo's earnings would also drop by roughly 75% for the year. We didn't know when this time would come, but rest assured it was coming.

What would your course of action be? Would you avoid shares of Wells Fargo like the plague or last year's trend? We believe that most people would - or updated for the present, most people would have avoided Wells Fargo had they known what was coming. Yet we would like to express caution on this front. What seems like a disaster could simply be a folly of short-term judgment. Consequently, in thinking about the future, it's important to recognize that fears are often fleeting while long-term business partnership decisions are regularly lasting. Said differently, even if you come up with a classic "bad news" investing story (in this case Wells Fargo in 2009) it's possible that one's memory could simply be too short.

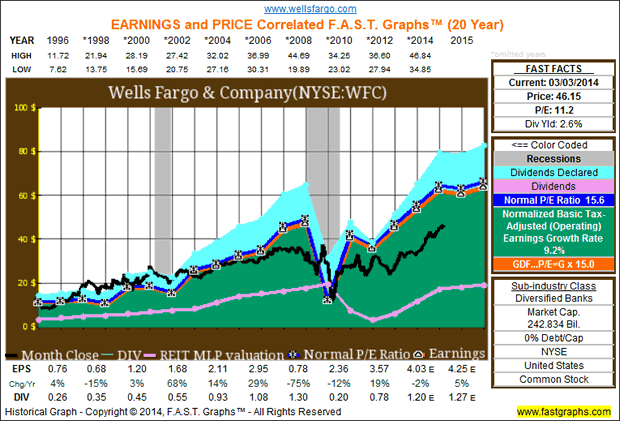

Let's begin with some history. Below we have included an Earnings and Price Correlated F.A.S.T. Graph for Wells Fargo dating back to the end of 1995 - which, incidentally, is about a century and a half after the company started doing business. Here you can observe that the financial crisis did indeed have a dramatic one-year effect on the company's profitability and consequently the share price reacted violently.

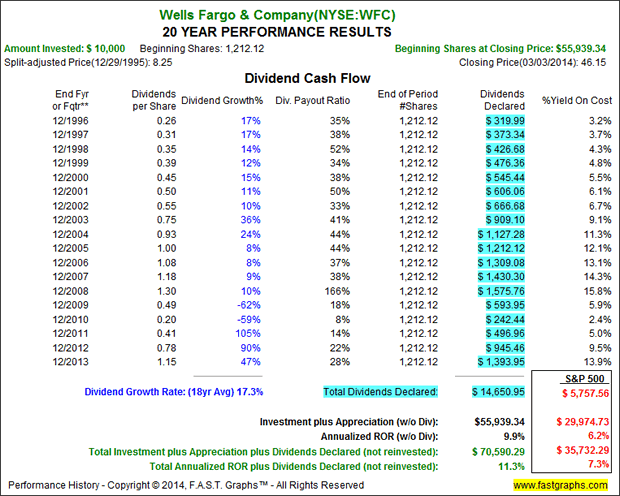

Yet let's take a look at the performance results for a long-term partner in this business. Since the end of 1995, an investor would have received total returns of 11.3% against the S&P 500's return of 7.3% during the same time period. Expressed in another way, a hypothetical $10,000 investment would now be worth about $70,000 if invested in Wells Fargo while it would "only" be worth $35,000 in the index. In observing the yearly dividends, it's clear that a dramatic cut took place. Yet the patient investor still would have seen their dividend grow by over 8% per annum in total.

Now some might point to this as a "cherry picked" example whereby the return results happened to oust the index returns. In reality, it's actually much more difficult to find a period where shares of Wells Fargo underperformed the index rather than outperformed. If you bought shares at the end of any year ranging from 1996 until today, not only would you have a positive return, but also Wells Fargo would have beat or tied the performance of the index in 94% (17 out of 18) of the occurrences.

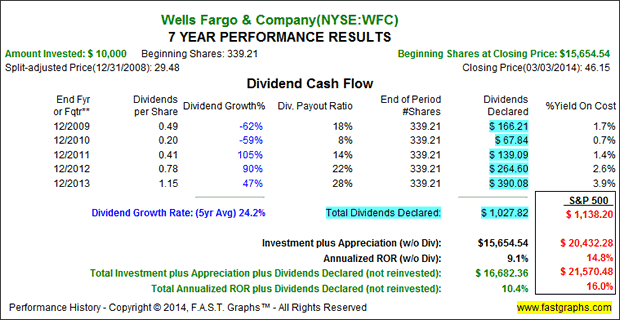

An astute reader might imagine that the one period of "underperformance" for Wells Fargo was directly prior to the company's 70% price decline. Yet even this seemingly worst case scenario isn't quite the bad news story it's cracked up to be in the intermediate term. Below we have included the performance result table starting from 12/31/2008. Here we see that Wells Fargo had total returns of "only" 10.4% against the S%P 500's result of 16% per annum. Granted this represents a decently sized gap, but keep in mind it's the only example in the past 18 rolling periods.

So this, missing out on 10% annualized returns, is the benefit of being "right" about the temporary share price collapse of Wells Fargo. True, Wells Fargo's share price and earnings dropped by more than 70% in a year. Moreover, the dividend was handily slashed and has yet to return to its pre-crisis level. But it stands that if you bought shares at one of the "worst" possible times and simply watched all of this happen, you would still be sitting here today - just over half a decade later - with a 10% yearly total return. To us, that speaks to the importance of viewing your partnerships as long-term decisions.

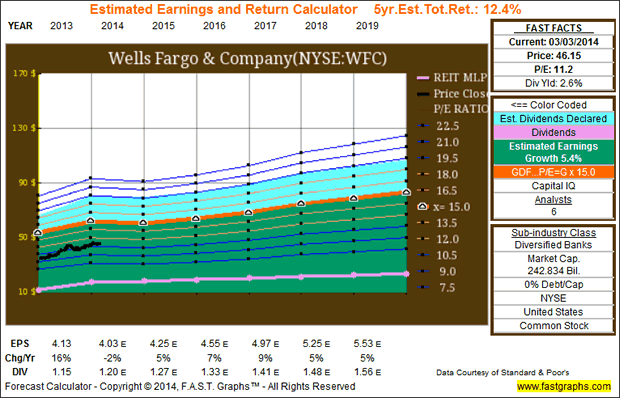

With the above being said, let's move on to the potential future prospects of the business. Below we have included the Estimated Earnings and Return Calculator to illustrate how analysts are presently viewing this company. Specifically, the calculator uses the consensus median estimates from analysts reporting to S&P Capital IQ for the next four fiscal years along with a long-term growth rate. In reviewing other sources, these estimated earnings numbers appear more than reasonable. If Wells Fargo were to keep its current dividend payout ratio, the estimated earnings materialize as forecast and Wells Fargo trades at 15 times earnings, this would equate to a 12.4% yearly return for the next 5 years.

Now, it is paramount to underscore the idea that this is simply a calculator. Specifically, it relies on analysts' consensus estimates and a default P/E ratio. If, for instance, the same earnings estimates materialize but Wells Fargo shares are trading at the same P/E as today, this would only indicate an annual expected return of roughly 8%. However, it does provide a solid baseline for how analysts are presently viewing the company. In addition, a F.A.S.T. Graphs' subscriber has the ability to change these forecasts to fit their own expectations or scenario analysis.

Now don't misunderstand us: today there are reasons to not like Wells Fargo. We didn't dive too deep into the underlying business model, but the company lists no less than 26 separate risk factors in its annual report; perhaps you could even imagine a couple more. You might believe that another financial crisis is round the bend or perchance the share price could drop 30%, 40% or even 70% next week, next year or next decade - at the very least in your lifetime. There are always going to be reasons and times when it was better or worse to own a security.

Yet the important part - the takeaway - is that even if one of these times comes, an investor could still do quite well in the long-term. As long as you don't panic and sell, you might take solace in the fact that Wells Fargo made it through the worst financial crisis we have seen and is now pumping out stronger profits. We think there's a lesson in there. Instead of trading on fear, if you simply partnered with the company there wasn't a bad time to own the stock. There were bad times to sell. But despite the major - and seemingly catastrophic events that occurred - shares held today have provided returns that have not only been positive, but are also respectable. Whether you like the company or not, we believe Wells Fargo provides a solid case study on how to deal with short-term fears.

Disclosure: Long WFC at the time of writing.

By Fast Graphs

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.