G7 Government Malfeasance Results in Huge Transfer of Wealth to Hard Asset Investors

Politics / Money Supply Apr 25, 2008 - 05:29 PM GMTBy: Ty_Andros

This week we are stating some very painful truths about what is unfolding. It is a story of BETRAYAL by the people who run the United States and G7. Make no mistake, I love the United States but despise the government as it embodies the definition of immorality, incompetence, greed and hubris. Government is very competent at gathering power over others and making money for the people who run it and their contributors.

This week we are stating some very painful truths about what is unfolding. It is a story of BETRAYAL by the people who run the United States and G7. Make no mistake, I love the United States but despise the government as it embodies the definition of immorality, incompetence, greed and hubris. Government is very competent at gathering power over others and making money for the people who run it and their contributors.

Combined with the public schools which do not teach anything anymore, the government is a testament to institutionalized malfeasance on every level. Words have become MEANINGLESS to the general public as they no longer know the history of their forefathers or the definitions of the words they speak and hear. We truly have entered the time of George Orwell's 1984 Animal Farm . It is a sorry state of affairs.

Note to readers regarding Tedbits availability: Starting in June, Tedbits publications will be available to registered subscribers 2-3 days earlier than to the general public. If you are not a registered subscriber, sign up now.

However, this state of affairs is offering prepared investors OPPORTUNITIES on a scale rarely seen in history. A transfer of wealth from those who store their wealth by holding paper to those who don't! The “Crack up Boom” looms in the future.

The manner in which the elites transfer wealth is easy to see as it is right before our very eyes; the biggest lies need to be placed right in front of our noses and the truth is seeing the forest through the trees. First we will reprint an essay by Charlie Reese, a former writer for the Orlando sentinel, who was probably fired by his liberal elite bosses for writing the essay you are about to read which pin's the tail on the “donkeys”

The Truth About the Gang of 545

by Charlie Reese

545 People

“Politicians are the only people in the world who create problems and then campaign against them.

Have you ever wondered why, if both the Democrats and the Republicans are against deficits, we have deficits?

Have you ever wondered why, if all the politicians are against inflation and high taxes, we have inflation and high taxes?

You and I don't propose a federal budget. The president does.

You and I don't have the Constitutional authority to vote on appropriations. The House of Representatives does.

You and I don't write the tax code, Congress does.

You and I don't set fiscal policy, Congress does.

You and I don't control monetary policy, The Federal Reserve Bank does.

One hundred senators, 435 congressmen, one president and nine Supreme Court justices - 545 human beings out of the 300 million - are directly, legally, morally and individually responsible for the domestic problems that plague this country.

I excluded the members of the Federal Reserve Board because that problem was created by the Congress.

In 1913, Congress delegated its Constitutional duty to provide a sound currency to a federally chartered but private central bank.

I excluded all the special interests and lobbyists for a sound reason. They have no legal authority.

They have no ability to coerce a senator, a congressman or a president to do one cotton-picking thing.

I don't care if they offer a politician $1 million dollars in cash. The politician has the power to accept or reject it. No matter what the lobbyist promises, it is the legislator's responsibility to determine how he votes.

Those 545 human beings spend much of their energy convincing you that what they did is not their fault. They cooperate in this common con regardless of party.

What separates a politician from a normal human being is an excessive amount of gall.

No normal human being would have the gall of a Speaker, who stood up and criticized the President for creating deficits.

The president can only propose a budget.

He cannot force the Congress to accept it.

The Constitution, which is the supreme law of the land, gives sole responsibility to the House of Representatives for originating and approving appropriations and taxes.

Who is the speaker of the House?

She is the leader of the majority party.

She and fellow House members, not the president, can approve any budget they want.

If the president vetoes it, they can pass it over his veto if they agree to

It seems inconceivable to me that a nation of 300 million cannot replace 545 people who stand convicted -- by present facts - of incompetence and irresponsibility.

I can't think of a single domestic problem that is not traceable directly to those 545 people.

When you fully grasp the plain truth that 545 people exercise the power of the federal government, then it must follow that what exists is what they want to exist.

If the tax code is unfair, it's because they want it unfair.

If the budget is in the red, it's because they want it in the red.

If the Marines are in IRAQ , it's because they want them in IRAQ

If they do not receive social security but are on an elite retirement plan not available to the people, it's because they want it that way.

There are no insoluble government problems.

Do not let these 545 people shift the blame to bureaucrats, whom they hire and whose jobs they can abolish; to lobbyists, whose gifts and advice they can reject; to regulators, to whom they give the power to regulate and from whom they can take this power.

Above all, do not let them con you into the belief that there exists disembodied mystical forces like 'the economy,' 'inflation' or 'politics' that prevent them from doing what they take an oath to do.

Those 545 people, and they alone, are responsible.

They, and they alone, have the power.

They, and they alone, should be held accountable by the people who are their bosses - provided the voters have the gumption to manage their own employees.

We should vote all of them out of office and clean up their mess!”

Thank you Charlie Reese for these simple truths! Whether it is student loans or Biofuels, destructive tax and regulations discovered in retrospect, their destruction of capitalism and the policies of wealth creation threaten us all. Please understand that at NO TIME do these public servants REVIEW, REVISE, or REFORM their previous efforts so policy mistakes have never been FIXED and they want it to be so….

Predators

"Let me issue and control a nation's money supply and I care not who makes its laws." -- Mayer Amschel Rothschild, Founder of Rothschild Banking Dynasty

Of course this is where we have descended to in the G7. With the big money center and investment banks fully in charge of the 545 people mentioned above. The G7 is now just banks run riot over us all. Recently a public servant decried PREDATORY the lenders and mortgage brokers. But the rot extends far, far wider than just those souls to encompass the person who uttered those words and, at this point, the current financial system itself. The US Congress and public servants are bought and paid for throughout the G7, and this is why we know our fate even now. To know our destination is to know history and the nature of men.

Public Servants and the current banking systems are stripping the G7 to the bone and the economy is the victim. Its hollow carcass on the verge of collapse and the gorging on it by the aforementioned groups must moderate to regain health or accelerate to keep it alive like a brain dead person is kept alive through artificial means. The current sub-prime debacle is just the tip of an iceberg of immoral banking practices condoned and enshrined in law, and paid for by campaign contributions to the 545 people mentioned above. Or the public servants wherever you reside in the G7.

The banking and financial systems have been robbing people for so long that this robbery is now just taken for granted. Let's take a look at the current state of affairs. Keep in mind the essay you just read.

The constituents of the G7, the US and Britain in particular have been hooked up by the banking systems like mice on a spinning wheel. Taught by the public servants and banks that they can have today what they cannot afford till tomorrow by signing a loan agreement for a credit card, which can be used to buy or consume anything, a home loan, a car, etc., whether you can afford it or not . Once on this spinning wheel of debt it becomes almost impossible to get off. Borrowers' interest rates are set so high in what can be called legalized loan sharking. Low rates on credit cards can be 9 to 15%, but average rates are 21 to 35%. Using the rule of 72 we can then calculate that if you buy something and are charged 21% then you have doubled the price if it takes a year to pay for.

From your public servants, bought and paid for by the banking industry. New bankruptcy laws make it virtually impossible for you to break their chains of debt. Product vendors no longer make money selling their goods and services; they make their money FINANCING the purchase.

I recently bought a late-model used car and the guy looked at me as if I was insane when I told him I would be paying for it in full. He then proceeded to tell me how much of a better deal I could have on the price if I FINANCED the purchase. Of course by financing the purchase the cost of the car would have been appreciably HIGHER and their wallets appreciably FATTER!

I abhor debt and am extremely allergic to it. It is a type of indentured servitude to the lender at USURIOUS rates. Never borrow money on things that go down in value or consumption items. Only borrow for things that appreciate or naturally PAY for themselves. I will borrow money for only two things: a home or to finance an expansion of my business or career (education fits into this) which can be repaid from my growing income. Nothing more . There is over $2.5 trillion dollars of credit card debt in the United States and the vast majority of it is charged 30% for those balances. Furthermore, the borrowing never recedes and it is, for the most part, ALWAYS rolled over. When one uses the rule of 72 one discovers the lenders are doubling their money on these loans every 2.4 years. It used to be called usury now it is called convenience and “living richly” as Citibank advertising says. Our cousins in the UK are also on this spinning wheel and it is a wheel they cannot get off. They can never get anywhere except deeper in debt to the bankers and their public servant handmaidens.

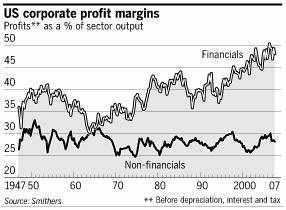

The public servants have been bought and paid for, for decades now. This chart of the financial industry shows from where the growth of the economy has come since the abomination known as Bretton Woods II in the early 1970's. Take a look at how this sector has BALLOONED and come to dominate the G7 economies, courtesy of Martin Wolf and the Financial Times:

This is a picture of asset-backed economies being born and the ascendance of the banking industry as master of the G7. This is a graph of the US but I promise you the G7 is a reflection of it. This has been accomplished with the assistance of the gang of 545 and the public servants near you who have legislated this into existence at the hands of the banking and financial industry. These financial companies are the most powerful constituents of the political class and masters of them. Look no further than the regulators who IGNORE their crimes against their customers.

This is a picture of asset-backed economies being born and the ascendance of the banking industry as master of the G7. This is a graph of the US but I promise you the G7 is a reflection of it. This has been accomplished with the assistance of the gang of 545 and the public servants near you who have legislated this into existence at the hands of the banking and financial industry. These financial companies are the most powerful constituents of the political class and masters of them. Look no further than the regulators who IGNORE their crimes against their customers.

As the financial and banking industry is failing, the remedy is confiscation of wealth through one means or another. We have suffered one recession since 2000 and the current one has not yet been recognized by the powers that be. The solution in both cases and really since the mid-sixties is to lower interest rates on savings while letting the financial system keep rates high.

They are punishing the virtuous behaviors of saving and investing and putting a high price on those who borrow. After 300 basis points of reductions virtually none have filtered through to the public. Credit card rates have been jacked up, home equity lines have been rescinded and people who save have been robbed of their incomes to create wider margins for the banking industry. This spread is enormous and a recipe for bank balance sheet repair, of which there is much to do.

Kind of a reverse robin hood, they are taking from the public and the poor and transferring to their rich masters in the banking and financial systems.

What is the cost of this help from public servants? It is measured two ways: BEFORE AND AFTER!

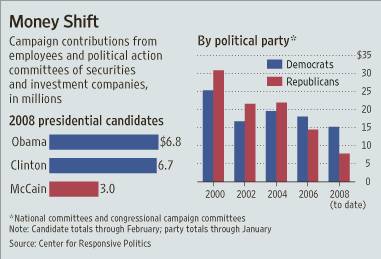

Before as measured by the campaign donations and the political action committees which put these public servants into power. The public servants become wholly owned subsidiaries of their supporters. In this case it is the financial industry and the banks. Look at the lists of donors who support MoveOn.org or the other side of the aisle. It's a good deal for them as campaign finance law creates opportunities for large industries to string together lots of little donations which then become the manure for the public servants to spread around to fertilize their careers.

The returns on dollars pledged to assist public servants' elections and their ability to make laws over others has the potential to return as much as the 10,000 % reaped by Hillary Clinton's cattle trading. They make relatively little donations and reap 100's of millions from permanent policy changes which accrue to the contributor FOREVER! Take a look at this chart of the financial industry, not including banks:

This does not include the banks which also prowl both sides of the aisle. It is a small amount in exchange for the regulatory favors it engenders for BIG established firms.

This does not include the banks which also prowl both sides of the aisle. It is a small amount in exchange for the regulatory favors it engenders for BIG established firms.

How in the world is the banking and financial industry dodging the bullet for the premeditated FRAUD that is the securitization industry known as CDO's, CLO's, MBS, and other issuances which are mislabeled? Both borrower and lender were defrauded. Gretchen Morgenstern of the NY Times outlined some of the gotcha clauses in mortgages and the servicing of them; it is a minefield of weasel words and they carry huge punitive charges for one misstep which usually happens to all mortgage owners at one time or another. How in the world are the ratings agencies, which participated in this fraud, escaping virtually unscathed? Where are the Regulators and the Justice Department? In the tank for their masters at the money center and investment banks…

What really need regulation are not hedge funds, but the OVER-THE-COUNTER derivatives markets known as Credit Default Swaps, with their trillions and trillions of dollars worth of daisy chains of unknowable counterparties and their ability to meet their obligations. This is the reason Bear Stearns was rescued; otherwise the Pandora's Box markets of Credit Default Swaps would have unwound in a frightening game of dominoes. Centralized clearing must be done soon or that will be the blowup we will not survive; it must commence immediately, but don't hold your breath as it is one of the few income streams which has RISEN for the financial sector during this crisis as over $50 trillion dollars of them have been written since this credit debacle began.

After is measured by asking certain ex-presidents, prime ministers, vice presidents, public officials and congressmen how in the world they amassed vast fortunes since retiring? Are they so smart that they have become financial and business geniuses? Hardly. If they were geniuses our economies would be booming. Rather, it is because of what the first essay in this Tedbits answers. They knew what they were doing, they DID IT ON PURPOSE and now it is payback time for those OFFICIAL favors.

The next big market upon which the banks have their sites is CARBON TRADING as the G7 public servants and their masters implement their latest schemes to fleece you since they have run up against the limits of confiscation of wealth through printing press and taxes. Global warming is nothing but the taxman in disguise. Carbon trading is just the latest iteration of methods to remove money from your pockets and transfer it to themselves to protect you.

The Bank of England as I write this has just announced a new $100 billion facility for buying mortgage securities in order to get banks lending again; thus creating $100 billion in Gilts “out of thin air”. Shoving money to banks so people get more mortgages, car loans or credit cards they cannot afford, nor are not qualified for, so they may buy over priced housing, new cars and consumer spending sprees of one sort or another. Getting the citizens in debt and milking them for life is now the main business of the United States and the UK . Credit card commercials are everywhere here and in the UK .

Rather than create the policies for savings, growth and wealth creation, the G7 is fixated on growth through asset inflation. The printing press will be used to rescue the banking elites from the reckless lending decisions they made in search of never ending, higher profit margins. The US banks raised over 75 billion dollars in the 1 st quarter in Long Term Unsecured Notes at rates which DO NOT allow them to make money; it was done to have access to funds for long periods regardless of short term credit market ills. They have a lot more of it to do, as does the Federal Reserve in coming money and credit creation to SAVE their most powerful constituents while sacrificing the public.

The next injection of funds in one form or another lies somewhere near as the spreads of Libor (London Interbank Lending Rates) and TED (T-Bills versus Eurodollars) indicate balance sheets on fire in the G7 financial and banking systems. These actions to rescue the banks, investment brokers and primary dealers is GOING to happen as their failure to do so is a fate too horrible to contemplate. So hi ho, hi ho it's off to the printing press we go. Invest accordingly….

Recession

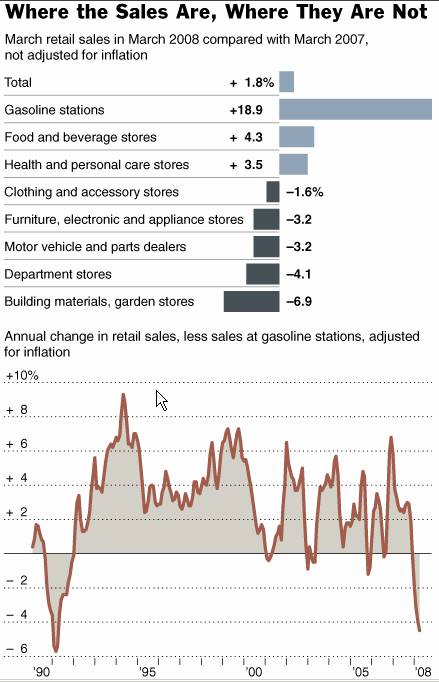

Inflation is the only thing holding up the illusion of economic growth; take a look at this recent chart from Floyd Norris of the New York Times:

Regardless of what next week's preliminary 1 st quarter GDP report is, the reality of the economy is one of relentless inflation in the cost of essential everyday items and core inflation measures are the HEADLINES used to fool you. The economy is shrinking at an incredible rate and the consumer is going into a cocoon. As Dennis Gartman so aptly puts it, “you must be in long necessities and short accessories” and this illustration is a testament to it. What he means is you must invest long in those things you use everyday and short in the accessories. Fake inflation numbers will create the illusion of something else, thank you George “Pinocchio” Bush and the gang of 545.

In conclusion: The public sector in the G7 is destroying the private sector, as Clyde Harrison so correctly notes, “the parasites have outgrown the host”. Whether it's saving the financial and banking system or supporting their relentless spending growth nothing will stop them. Student loan lending is completely frozen due to an idiotic law restricting the ability of a lender to make money, so there now is virtually NONE of it. So they are passing a law to buy student loans which have no ability to provide a return to the lender and instead are going to buy them (essentially the taxpayer). So it's off to the printing press they will go. To believe that the credit crisis has ended is NONSENSE. The sub prime elements of the credit card, auto and construction industries have yet to be addressed and the bill will be enormous.

The purchase of bad paper by the G7 central banks and treasuries is set to increase enormously. They can call it a swap, but in actuality it is sending the taxpayers the bills for the greed and hubris of the banking industry. People are speculating that interest rate cuts may end after next week, don't bet on it. The balance sheet repair still required is enormous and there is no better place to get it than from savers who will be ROBBED of their income. Every day I speak with people who think they are keeping their money safe in cash and savings vehicles, I cry when I think of the robbery they are undergoing via printing press.

Use of natural resources and energy in the emerging world (BRIC's plus the Middle East ) is now equal to that of the G7 and GROWING at a 7 to 10% rate. And it is not going to cease growing. It may moderate, but emerging middle classes want more of EVERYTHING. People in the G7 may be forced off the road by prices rising due to emerging world citizens getting on the road. Growth of demand in the G7 may slip slightly but this will be eclipsed by SOLID growth in the emerging world.

What does this mean to you? OPPORTUNITIES. As investment assumptions change so do the prices of EVERYTHING! At no time have I been as excited about investing in these changes that are unfolding. Every time investors try and get out of what's working like commodities, natural resources, energy and precious metals and go back into what has worked for decades they are quickly BURNED. You must learn to short circuit the printing press in your investments as the “Crack up Boom” is in its infancy. The demise of crappy paper investments is set to continue as policy makers in the G7 destroy the futures of their children by substituting centralized control and socialism for capitalism and wealth creation.

Reconstructed M3 is still running at an explosive growth rate of approximately 17% plus in the US , so the destruction of the US currency continues, use short term countertrend rallies or pullbacks in commodities to position yourself accordingly. When they are printing money like this it is almost impossible for things to go down or the economy to fall apart . In the EU and the UK runaway money supply is also continuing on the upside, as the most recent Bank of England RESCUE operation demonstrates. Don't be fooled!

When I was young my parents taught me the GOLDEN RULE: “due unto others as you would have them do unto you”, then sometime later they changed the rules to “he who has the gold makes the rules”, and then in the 1990's it was totally corrupted to “he who makes the rules gets the gold”.

Thank you for reading Tedbits if you enjoyed it send it to a friend and subscribe its free at www.TraderView.com don't miss the next edition of Tedbits.

If you enjoyed this edition of Tedbits then subscribe – it's free , and we ask you to send it to a friend and visit our archives for additional insights from previous editions, lively thoughts, and our guest commentaries. Tedbits is a weekly publication.

By Ty Andros

TraderView

Copyright © 2008 Ty Andros

Hi, my name is Ty Andros and I would like the chance to show you how to capture the opportunities discussed in this commentary. Click here and I will prepare a complimentary, no-obligation, custom-tailored set of portfolio recommendations designed to specifically meet your investment needs . Thank you. Ty can be reached at: tyandros@TraderView.com or at +1.312.338.7800

Tedbits is authored by Theodore "Ty" Andros , and is registered with TraderView, a registered CTA (Commodity Trading Advisor) and Global Asset Advisors (Introducing Broker). TraderView is a managed futures and alternative investment boutique. Mr. Andros began his commodity career in the early 1980's and became a managed futures specialist beginning in 1985. Mr. Andros duties include marketing, sales, and portfolio selection and monitoring, customer relations and all aspects required in building a successful managed futures and alternative investment brokerage service. Mr. Andros attended the University of San Di ego , and the University of Miami , majoring in Marketing, Economics and Business Administration. He began his career as a broker in 1983, and has worked his way to the creation of TraderView. Mr. Andros is active in Economic analysis and brings this information and analysis to his clients on a regular basis, creating investment portfolios designed to capture these unfolding opportunities as the emerge. Ty prides himself on his personal preparation for the markets as they unfold and his ability to take this information and build professionally managed portfolios. Developing a loyal clientele.

Disclaimer - This report may include information obtained from sources believed to be reliable and accurate as of the date of this publication, but no independent verification has been made to ensure its accuracy or completeness. Opinions expressed are subject to change without notice. This report is not a request to engage in any transaction involving the purchase or sale of futures contracts or options on futures. There is a substantial risk of loss associated with trading futures, foreign exchange, and options on futures. This letter is not intended as investment advice, and its use in any respect is entirely the responsibility of the user. Past performance is never a guarantee of future results.

Ty Andros Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.