Corporate Capex Fallacies and Why You Shouldn’t Rely on CNBC

Companies / Corporate Earnings Mar 14, 2014 - 01:03 PM GMTBy: F_F_Wiley

We get experts on everything that sound like they’re scientific experts … They’ll sit at a typewriter and make up all this stuff as if it’s science and then become an expert … Now, I might be quite wrong, maybe they do know all these things. But I don’t think I’m wrong. You see I have the advantage of having found out how hard it is to get to really know something … how easy it is to make mistakes and fool yourself. I know what it means to know something. And therefore, I see how they get their information and I can’t believe that they know it. They haven’t done the work necessary. They haven’t done the checks necessary. They haven’t done the care necessary … and they’re intimidating people. -Richard Feynman, Nobel Prize-winning physicist

We get experts on everything that sound like they’re scientific experts … They’ll sit at a typewriter and make up all this stuff as if it’s science and then become an expert … Now, I might be quite wrong, maybe they do know all these things. But I don’t think I’m wrong. You see I have the advantage of having found out how hard it is to get to really know something … how easy it is to make mistakes and fool yourself. I know what it means to know something. And therefore, I see how they get their information and I can’t believe that they know it. They haven’t done the work necessary. They haven’t done the checks necessary. They haven’t done the care necessary … and they’re intimidating people. -Richard Feynman, Nobel Prize-winning physicist

The excerpt is from a 1981 BBC documentary about Richard Feynman that was linked in a Zero Hedge post several years ago. Unfortunately, Feynman passed away in 1988 and never had the chance to watch the “experts” on financial television. We would have particularly liked to hear the great physicist’s thoughts on economics punditry.

To understand economics experts in Feynman’s absence, the best analogy that we can think of is to the methods of a magician. Magicians operate by showing their audience a small window on reality, and then tricking people into mentally filling in the rest incorrectly. Because the economy has so many moving parts, a similar approach also works in economics. Pundits can draw our attention to a couple of indicators, ignore everything else, and make claims that sound realistic even though they make little sense in the bigger picture. One difference between economists and magicians, though, is that economists are often unaware of their trickery because they fool themselves before fooling others.

To be clear, we don’t claim to be immune to such deceptions, but we do try to root them out as best we can and will do that here.

We’ll look at capital expenditures (capex), in particular. You can’t take in much media commentary today before finding someone arguing that capex is lower than it should be. Crystal ball gazers predict a capex resurgence that lifts the economy into a robust recovery, while pundits with an activist bent implore businesses (and public officials) to ramp up their investments.

There’s usually some combination of four pieces to what we’ll call the “CNBC” story:

- Corporate cash is high

- Net investment is low

- Bond yields are low

- Corporate profits are high

These four observations are said to demonstrate that businesses are behaving irrationally or improperly by not pushing capex higher. And the story may sound reasonable on the surface, but is it really that simple?

To dig deeper, we’ll critique the proposition linked to each observation, while testing them with over 60 years of data. Our results show that the CNBC story is yet another careless economic illusion.

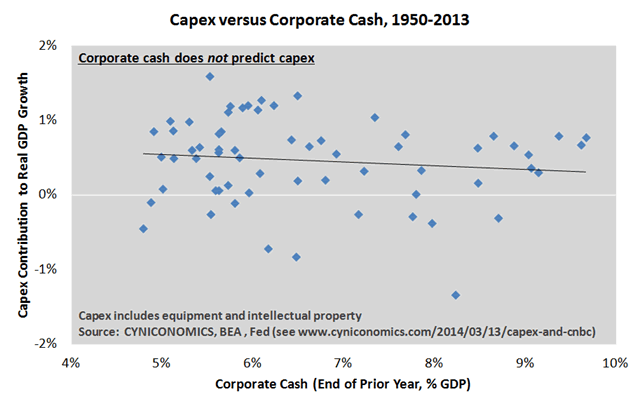

Proposition 1: Corporate cash is high, and therefore, businesses should put that cash to work through capex.

Comments: This is the most obviously deceptive of the four propositions, hence Mark Spitznagel’s incredulous response when asked to address cash balances by Maria Bartiromo last week. As Spitznagel explained, it makes little sense to isolate the cash that sits on corporate balance sheets without netting the credit portions of both assets and liabilities. We last updated corporations’ net credit position here, showing that gradual increases in cash balances are dwarfed by rising debt.

A longer history further disproves the proposition; it shows that there’s no correlation between capex and corporate cash:

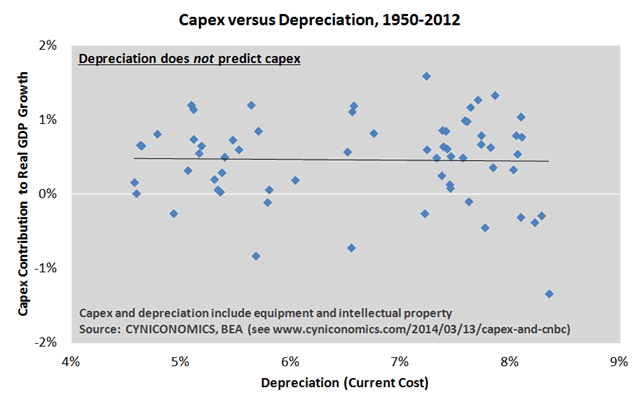

Proposition 2: Net investment (capex less depreciation) is unusually low and should be much higher at this point in the business cycle.

Comments: This argument implies that businesses should invest more when depreciation is higher, as that’s the only way to drive the net amount of investment towards “normal” levels. Our criticism is that it combines current capex with an accounting measure of depreciation on past capex. This is extremely misleading after periods of malinvestment, in particular, when the capital stock is too high for the level of demand. Unusually high depreciation after such periods is a sign that capex should be managed carefully to keep the capital stock from further outpacing fundamentals, not increased blindly to maintain an assumed margin over depreciation. Therefore, net investment fails to tell us anything about the “right” amount of capex.

Turning again to the last six decades, data confirms that the second proposition is just as faulty as the first:

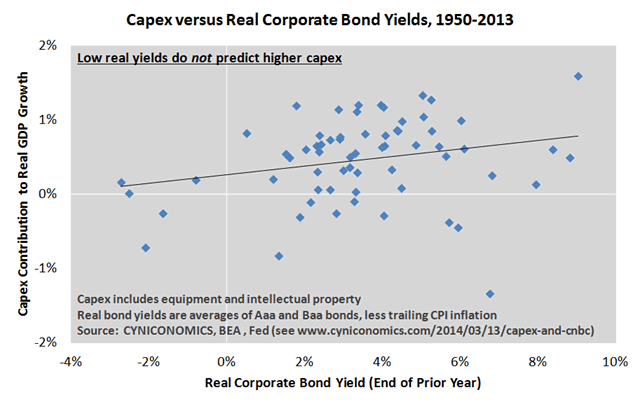

Proposition 3: Low interest rates should encourage more capex.

Comments: This is a trickier proposition than the first two, since low rates should certainly spur higher spending when other factors are held constant. The problem is that other factors are never constant. On the contrary, low rates are typically associated with a challenging economy, and this is especially true in today’s highly manipulated markets. The Fed seems to be discouraging long-term investment in some respects by holding rates well below where they would otherwise be. As perceived by us and many others (including Spitznagel per the interview linked above), the Fed’s approach raises long-term risks while drawing capital into short-term financial strategies.

Needless to say, this isn’t the ideal environment for capex. It’s not that companies aren’t taking advantage of low rates; they’ve increased borrowing substantially as noted above. It’s just that the proceeds of that borrowing aren’t flowing into capex as much as they would in less manipulated markets.

Moreover, history once again refutes the proposition. Adjusting corporate bond yields for inflation, the chart below shows that capex has tended to be slightly lower than average when real yields are low:

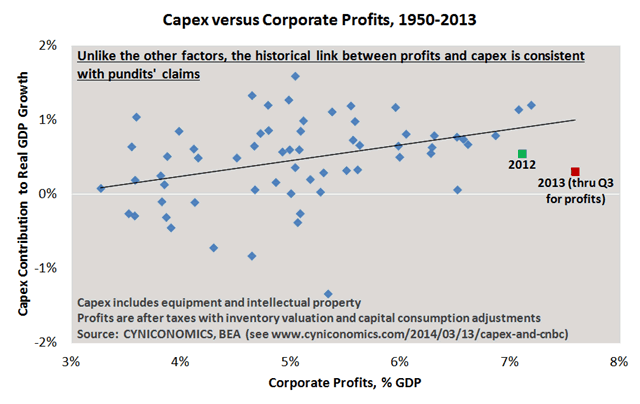

Proposition 4: Record corporate profits should encourage more capex.

Comments: Here’s a proposition with empirical support, finally. Although the relationship isn’t especially strong, the chart below shows that high profits have tended to coincide with high capex, and visa-versa. We highlighted the latest figures to show that they sit below the regression line:

There are two reasons not to get too carried away, though. First, the surge in profits is explained mostly by extremely high margins and tight controls on expenses. When businesses boost profits though expense reductions instead of revenue growth, there’s more than a little circular logic in the idea that their success calls for higher spending.

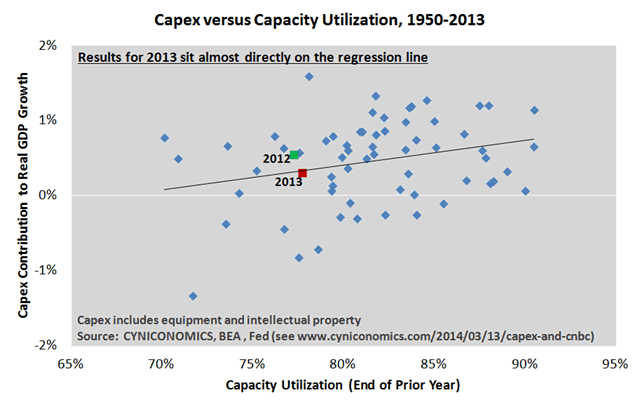

Second, there are other, offsetting considerations suggesting that businesses are wise to limit capex growth to a modest pace. In “What Needs To Happen Before We See a Big Recovery,” we listed four reasons to doubt the capex boom that many pundits predict: ample unused capacity, tepid overseas growth, growing financial risks and President Obama’s bumbling incursions into private markets. Unfortunately, the financial risk and policy factors aren’t as testable as the propositions above. We tested capacity utilization, though, and here are our results:

Lo and behold, 2013 capex fell almost directly on top of the regression line. This shows that businesses may not be so irrational after all, in view of the excess capacity that still remains after the last decade’s overinvestment. And together with the first three charts above, it tells us that capex fundamentals aren’t as simple as “CNBC” would have you believe.

F.F. Wiley

F.F. Wiley is a professional name for an experienced asset manager whose work has been included in the CFA program and featured in academic journals and other industry publications. He has advised and managed money for large institutions, sovereigns, wealthy individuals and financial advisors.

© 2014 Copyright F.F. Wiley - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.