Gold Miners Red Alert Or All Clear?

Commodities / Gold and Silver Stocks 2014 Mar 21, 2014 - 11:16 AM GMTBy: GoldSilverWorlds

Its getting really bad when you can’t trust the criminals in power to do what you you think they are going to do!

Its getting really bad when you can’t trust the criminals in power to do what you you think they are going to do!

Above we see on the XAU Chart that When the close of the XAU gets more than 10%(Gold Line) above it’s 50 Day Moving Average (three red circles make that very clear), it becomes vulnerable to a correction, which is where we are now. In the GREEN Box in the lower right hand margin of the XAU Chart we see the entirely unhearalded GOLDEN CROSS (except for a few PM Bulls). Now for those practicing and loving “Hill Billy” TA, that is a perfect indicator EXCEPT that it comes at a time when the close of the XAU has gotten 10% of its 50 Day Moving Average.

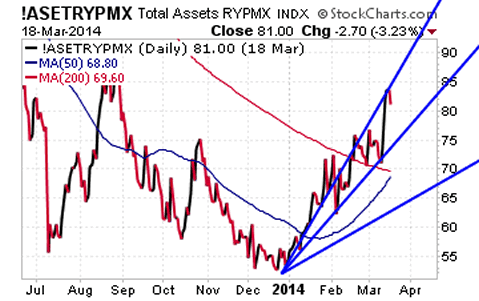

Now from Cicero, we have this quote: “The Sinews of War are Infinite Money”, which we know to be true whether it is in the Industrial Stocks or the PM Stocks or whether it comes from Gvt Printing (Counterfeiting) or honest capital. Notice the Speed Resistance Lines (lower ones) 1 & 2, indicating where the capital in-flow rate will slow down before re-asserting itself.

So far, IMO, its been Investor Capital fueling this run, and will be again once the Correction & Consolidation have run their course.

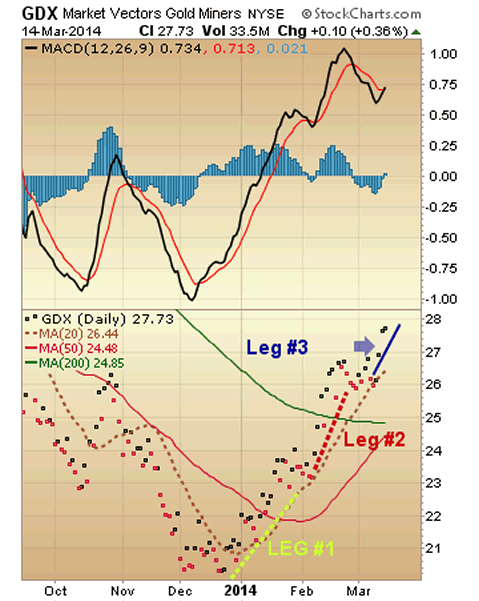

What has struck me like the North Wind, cutting my face as it speeds off the Bay, is the ALL CLEAR called by a number of PM Analyst / Writers, classicaly at the end of the Third Leg in a Bull Movement started in early December, fully exploited by early Bull Riders. Now we have that “Spikey” top movement that like Circe and the Sirens, lure late comers into dangerous waters with their song of easy profits. Precisely when we are ripe for a correction.

NOW the question becomes WHAT of this Leg & Rally ?

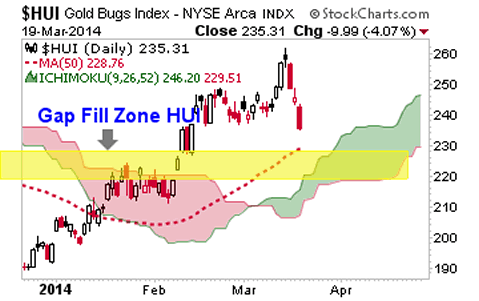

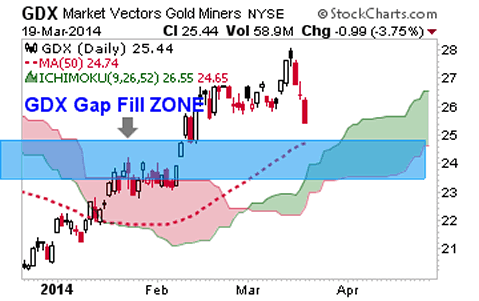

The Breadth in this rally has slowed down in both daily and weekly measures and the rally has lost its Momentum, within its Longer Term TREND (which is still UP). A number of logical Support areas are in place by virtue of GAPS that opened on the way up. They are:

KEEPING in mind that certain dates can act like magnets, as I look at this, I recall the Great Gold TAX DAY (US) MASSACRE of April 15, 2013. I also note that on the Anniversary Week of that event, Good Friday of the Christian Easter Season occurs, which to me, given the events associated with it, is never a good time for a rally. In addition, as a Lunar determined occasion, Easter, it is noted that the Full Moon peaks on Mon, April 15. Based on cycles commonly occurring whose combined Nadir occurs during this week, I give weight to probabilities we see very poor market action the Week ending Friday, April 18th.

If I were a wagering man, I’d lay odds that, any correction in the PM Complex, under the weight of a correction, would END its Correction in this week. Given as a very general rule that corrections tend to extend their moves to half the TIME of the move they are correcting, another case can be made for it ending in this time frame. So being Skeptic in my approach to Technical Analysis, I will be keeping a weather eye on the XAU, GDX & HUI as they settle back into “Correction” Mode. I ignore no hint or bit of Intell but treat each skeptically as if I were assembling a great puzzle, and thus I include the possible Support & Rebound Zones for the GDX and HUI in these Charts.

If you’d like to have this level of Savvy at your fingertips and in your mail box, you may wish to Subscribe to PEAK PICKS.

If you are more concerned where the PM Stocks can go rather than interminable analysis of where they have been, you may choose PEAK PICKS.

Find Juniors, Micro-Caps, Break Outs, and some stocks of which you have never heard by SUBSCRIBING to PEAK PICKS, using option #1 or #2. Subscribe using one of the two options below (U$D 33.97/m, no contract, satisfaction guaranteed, immediate refund on request, no questions asked).

Source - http://goldsilverworlds.com/stocks/gold-miners-red-alert-or-all-clear/

© 2014 Copyright goldsilverworlds - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.