Worst of the Credit Crisis May be over as Investors Switch from Bonds to Equities on Inflation Concerns- Part 2

Stock-Markets / Financial Markets Apr 27, 2008 - 05:50 PM GMTFinancial Times: Treasury market mood swings

“The vanguard of US monetary policy, the Treasury bond market, is calling time on further interest rate cuts after next week.

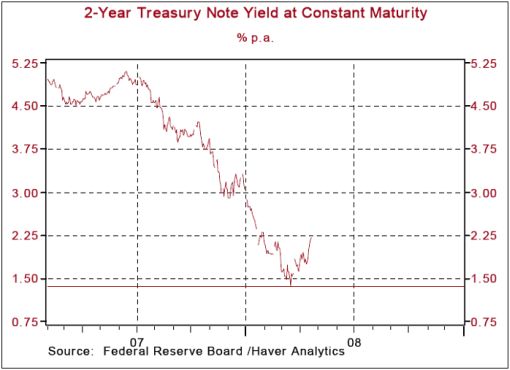

“While many economists expect the US Federal Reserve to continue to cut the benchmark Fed funds rate to 1.5% from the current 2.25%, recent shifts in the interest rate-sensitive 2-year Treasury bond yield suggest another course.

“Bond yields imply the Fed will lower rates to 2% this month and then signal a pause in policy. In recent weeks, the yield on the 2-year note has risen relentlessly as safe-haven buying, which peaked last month, has faded.

“Last week, the yield briefly traded above the Fed's key borrowing rate of 2.25%, the first time the funds rate has been below that of two-year notes since June 2006.

“There are reasons, however, to doubt the signal of the 2-year note. Yes, the Fed appears to have contained the fires of the credit crisis with its liquidity provisions, but the financial state of banks and US consumers are still not looking healthy. The sharp jump in future loan-loss provisions being taken by banks in their latest earnings numbers is a warning that Main Street is buckling as the job market deteriorates.

“Measures of money market stress for one-year remain highly elevated, another sign that banks and the economy face protracted credit strains. As traders have cut risk quickly, the 2-year yield has risen much faster than that of the 10-year note since March.

“The Treasury market is renowned for its mood swings. Traders could be just one bad employment number away from becoming big buyers again.”

Source: Michael Mackenzie, Financial Times , April 23, 2008.

Asha Bangalore (Northern Trust): What is the 2-year Treasury Note yield indicating?

“This rapid increase in yield [of the 2-year US Treasury Note] has occurred in the face of bearish economic news – significant drop in nonfarm payrolls, higher unemployment rate, weak auto and non-retail sales, decline in housing starts and permits, upward trend of jobless claims, a loss in momentum conveyed in the national ISM report for March and Federal Reserve Bank of Philadelphia's factory survey of April, decline in consumer sentiment measures, and the drop in home sales and prices and the elevated level of unsold inventories of homes. The most likely message from this movement is the possibility of the Fed pausing after April 30.”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary , April 23, 2008.

Financial Times: US regulator fears wave of bank failures

“US bank failures could rise above ‘historical norms' as a weakening economy puts pressure on badly underwritten loans, particularly in commercial real estate, according to a bank regulator.

“In an interview with the Financial Times, John Dugan, who oversees about 1,700 national banks as comptroller of the currency, said the growing problems for lenders follow a period of almost four years in which no institution regulated by his agency had failed.

“‘We're going to have some more bank failures that will come back more to historical norms and may go above that with time,' he said. ‘That is a natural consequence of the economy going from historically exceptionally benign credit conditions to something that is more normal to something you would get in a downturn.'

“Mr Dugan's Office of the Comptroller of the Currency (OCC) is particularly worried about lending by smaller banks to commercial real estate developers for condominiums and other projects. More than a third of smaller community banks have made commercial property loans that exceed 300% of their capital, the OCC says. By comparison, in 1987, when hundreds of banks failed amid a commercial property collapse, such banks had commercial property loans equal to 175% of their capital.

“‘Banks are better capitalised going into this … but the flip side is they are more concentrated,' Mr Dugan said. ‘Part of it depends on the depth of the downturn and duration of the downturn.'”

Source: Daniel Pimlott, Krishna Guha and Joanna Chung, Financial Times , April 22, 2008.

Asha Bangalore (Northern Trust): Labor market – firms remain reluctant to hire

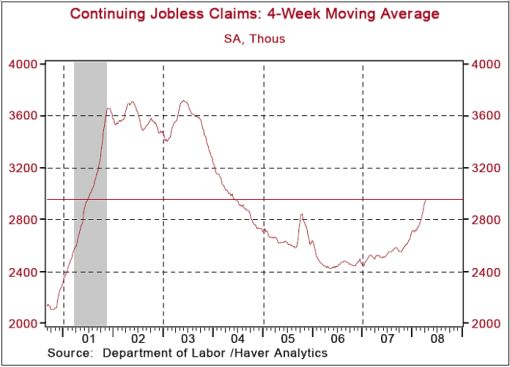

The 4-week moving average of continuing jobless claims (2.959 million) is the highest since May 2004. The marked upward trend of continuing claims indicates that firms are reluctant to expand payrolls.

Source: Asha Bangalore, Northern Trust - Daily Global Commentary , April 24, 2008.

The Wall Street Journal: Foreclosure-relief plan gains

“A House panel Wednesday approved $15 billion in loans and grants for local governments to purchase the growing number of foreclosed homes throughout the country.

“The House Financial Services Committee voted in favor of the bill, part of a broader package of housing legislation being pushed this week by House Democrats to address the housing crisis. Earlier Wednesday the panel voted to provide legal protection in certain circumstances for mortgage servicers that work with borrowers facing foreclosure.

“Committee Chairman Barney Frank, said that provisions of the bill, including a requirement that purchased homes be at least 60 days into the foreclosure process, would prevent abuse. More importantly, he said, lawmakers need to do more to help local governments dealing with eroding tax bases and maintaining foreclosed homes.

“‘Cities are being badly hurt and this is the only vehicle proposed that goes to the aid of the cities and counties,' Mr. Frank said.”

Source: Michael R. Crittenden, The Wall Street Journal , April 24, 2008.

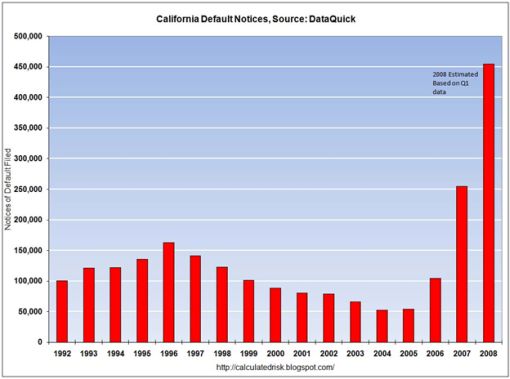

Housing Wire: Two-thirds of California defaults end in foreclosure

“Borrowers in California – always the Golden State, but now also the center of possibly the worst housing crisis since the Great Depression – are finding loan workouts increasingly tough to come by as price depreciation has put millions upside down on their existing mortgage debt.

“Among homeowners in default, only an estimated 32% emerged from the foreclosure process by bringing their payments current, refinancing, or selling the home and paying off what they owed during the first three months of 2008; the rest – that's more than two-thirds of troubled borrowers – ended up losing their homes on courthouse steps throughout the state.

“Compounding the problem, DataQuick said, was a massive reliance by California borrowers on multiple-loan financing during the housing boom – so-called ‘piggyback' loans, where a borrower takes out a second (and perhaps even a third) mortgage in order to finance their home purchase. Multiple-loan financing peaked in Q4 of 2006 at 60.9% of all financed home purchases, DataQuick said. Last quarter it was 15.9%.

“Not surprisingly, the number of homes lost to foreclosure in the first quarter of 2008 was the highest in DataQuick's records, which go all the way back to 1988. Trustees Deeds recorded, or the actual loss of a home to foreclosure, totaled 47,171 during the first quarter, up nearly 50% from the fourth quarter alone.”

Source: Paul Jackson, Housing Wire , April 23, 2008.

Bill King (The King Report): US housing – “it will take several years for the system to cleanse itself”

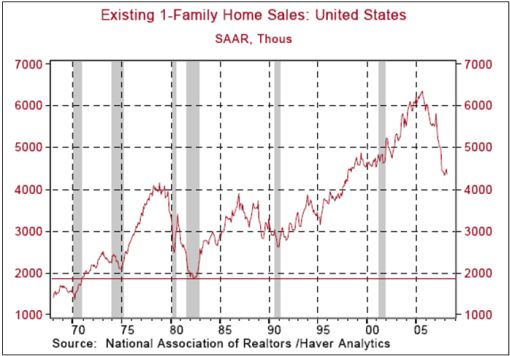

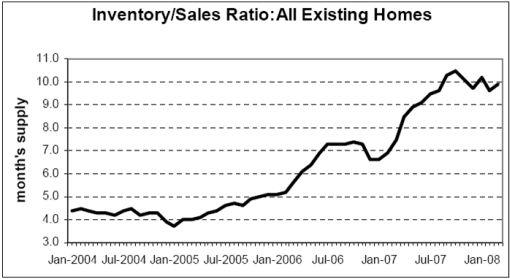

“March new home sales were abysmal, the lowest sales in 17 years – the last real recession. Sales fell 8.5%, more than four times the consensus estimate. Inventories increased to an 11 months supply, an almost 27-year high (September 1981). Prices plunged 13.5%y/y. But homebuilders rallied sharply because the NAR says recovery will occur in Q3.

“Forget the fact that the NAR forecast is self-serving but contemplate who will buy the record inventory of homes given that US income does not support housing prices and more importantly who will provide the credit to the millions of people that never should've qualified for mortgages and those now encumbered by financial and economic hardship? Bueller? Bueller? Anyone?

“The current housing depression will unwind similarly to the energy depression of the eighties. Every quarter pundits and experts will forecast bottoms and formerly ‘smart' investors will pick bottoms. But they will all be punished because it will take several years for the system to cleanse itself … Think the Houston housing market of the eighties but on a national basis.”

Source: Bill King, The King Report , April 25, 2008.

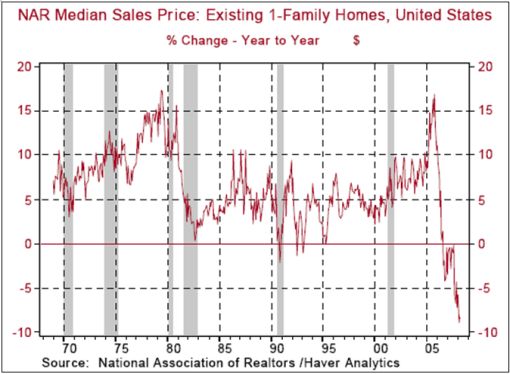

Asha Bangalore (Northern Trust): US homes – additional price declines likely

“The large inventory of unsold homes suggests that additional declines in prices should not be surprising. With regard to sales, the fundamentals supporting purchases of homes, such as income and employment, have to improve significantly to bring about a meaningful pickup. Also, the tightening of mortgage underwriting standards is playing a role in holding back sales of homes.”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary , April 22, 2008.

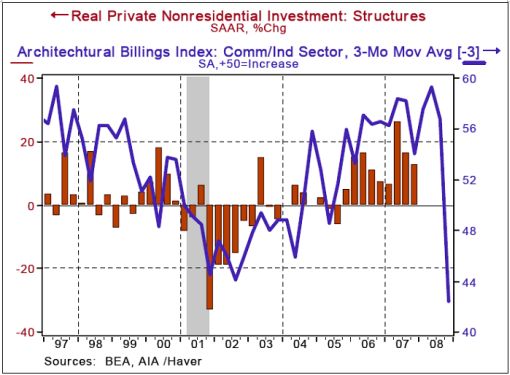

Asha Bangalore (Northern Trust): Bearish news about non-residential construction

“Consumer spending and residential investment expenditures are two components accounting for projections of weak economic growth in 2008. How about other components of GDP? Going down the list, the poor performance of profits and the sharp drop in the CEO Confidence Index bode poorly for equipment and software spending. Exports and federal government spending (state and local governments are in a tight spot) are most likely to add to GDP in the quarters ahead. Weak demand conditions imply firms are not too keen on piling up inventories.

“We are left with non-residential structures, a component that has shown significant gains for nine consecutive quarters. The latest Architectural Billing Index suggests that non-residential investment will join the group of decliners. The overall Architectural Billings Index fell to 39.7 in March, the lowest on record for this series that commenced in November 1995. The index contains residential and nonresidential components.

“The story about the housing sector is widely known; the residential sector is most likely to show positive momentum only in early-2009. The 3-month moving average of the index measuring architectural billing activity in the non-residential sector dropped to 38.3 in March, the lowest reading in the short history of the series.

“The Architectural Billings Index is a leading indicator of construction activity. The index according to the American Institute of Architects has a nine to twelve month lead with respect to construction activity. The Architectural Billings Index of the commercial/industrial sector (advanced 3 quarters) closely tracks the non-residential structures component of GDP and is indicative of notable weakness in the rest of the year.”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary , April 23, 2008.

Richard Russell (Dow Theory Letters): Sun may be rising on housing picture

“I just read a really frightening piece entitled ‘The Coming Mortgage Meltdown'. And I think to myself, ‘Yeah, but the market has to know all about this and more.' So I have to wonder, am I seeing things? C'mon, Mr. Market, don't play tricks with me. No these aren't tricks, they're charts, and charts, unlike politicians and Fed statisticians, don't lie.

“So I punch out the chart below, XHB (I follow this chart closely), and darned if it doesn't look as though it's turned bullish. XHB is the S&P's Homebuilders exchange traded fund. Could the homebuilders be turning bullish in the midst of a time of countless foreclosures and widespread bearishness in housing?

“XHB turned up in January, and as of today I see that XHB has rallied above both its 200-day and 50-day moving averages. That doesn't seem logical or possible, not in the current state of real estate pessimism. I need more proof. So I turn to IYR for confirmation.

“No, I wasn't seeing things. Below is IYR, the D-J US Real Estate Index Fund. This Index is turning up as well. It turned up from a January low, and as of today's close, IYR is above both its 50-day and 200-day moving averages.

“Could the stock market be telling us that it has discounted the worst of the housing disaster – and that real estate is fated to turn up in the months ahead? That would be counter to all the bearish housing talk that is now filling the newspaper and TV. Is this possible? You see the charts. Yes, it's possible. And what a bullish shocker that would be. Hey, the sun may be rising on the whole housing and real estate picture. If so, you probably won't hear about it until maybe this summer. Remember, the market is always first to see a turn.”

Source: Richard Russell, Dow Theory Letters , April 25, 2008.

John Hussman (Hussman Funds): Stock market – risk of a free-fall is significant

“… the recent shift toward greater speculation continues to appear very fragile. Trading volume has become dull when it should be expanding, the spread between commercial paper and Treasury bills has widened to the highest spread year-to-date (despite modest improvement in CDS spreads), and unlike robust speculative markets, we continue to observe divergent industry group behavior and selective leadership (still primarily materials and cyclicals).

“Indeed, to the extent that we can take any information signal from developing market action, it is that we should revise our expectations to allow for a much more significant slowdown in consumer spending than we have anticipated thus far. If anything, the evidence suggests revising our expectations about consumer spending and economic prospects downward.

“Divergent internals have historically been unfavorable for the overall market – sustained advances typically feature broad uniformity across industry groups and security types and price/volume behavior indicative of strong demand and conviction – not simply a ‘backing off' of sellers in the face of short-covering.

“As I've often noted, about the only point where I have an opinion about near-term market action is when the market is either overbought in an unfavorable market climate, or oversold in a favorable climate. Given that the market is once again overbought in an unfavorable climate, my impression is that the risk of a free-fall is significant. Aside from short-term speculative pressures (largely driven by relief about Bear Stearns), nothing in recent data suggests a material abatement of recession risk, mortgage risk, profit margin risk, or dollar risk.”

Source: John Hussman, Hussman Funds , April 21, 2008.

David Fuller (Fullermoney): Little downside for S&P Index

“Although the S&P 500 Index is well above its January – March lows as we near the end of April, it is still down since the beginning of November. This is due to two factors: the made-on-Wall-Street credit crisis and the Fed's blunder last October, when Bernanke said: ‘…the upside risks to inflation roughly balanced the downside risks to growth.' This showed that the Fed was behind the curve of events and put Wall Street into a tailspin, until Bernanke & co began to catch ups in late January by slashing interest rates dramatically.

“Looking at the S&P 500 Index, it obviously does not have significant gains to consolidate as we enter the historically weaker seasonal period. Instead, the pattern shows base formation development, so the worst that I expect between now and November is a sideways extension of this pattern. However there is a reasonable chance that the S&P will sustain an upward move, outperforming the November 2007 through April 2008 period. This latter prospect will be helped by election year optimism.

“Meanwhile, a number of other stock markets, underpinned by better GDP growth prospects, are leading on the upside.”

Source: David Fuller, Fullermoney , April 25, 2008.

Financial Times: Equity bulls are winning argument for now

“The solid bounce in global equities from their lows of mid-March is reaching a crucial stage. Soon we may discover whether recent gains are sustainable or nothing more than a classic bear market rally.

“Since a financial crisis was averted last month, markets in the US, Europe, the UK and Brazil are up by about 10%. Japan has rallied 15% and Hong Kong climbed more than 20%.

“As far as relief rallies go, it has been impressive – and some argue this is just the start. Talk that stocks have seen the worst – or, in market parlance, ‘formed a bottom' – has become popular in recent weeks.

“Calling a bottom or a top in a market is very much a leap of faith. Look at how oil prices have broken through levels that some investors thought would surely mark a top.

“The bullish case for stocks is that they are cheap, dividend yields are much better than paltry government bond yields and a second-half recovery in the US economy beckons. Average earnings estimates for S&P 500 companies still remain very high for the third and fourth quarters.

“The counter-argument is that the US economy faces a tough road this year. The pain inflicted by housing, which shows no sign of abating judging by Thursday's fall in new-home sales for March, remains a significant weight on consumers and banks.

“Employment and profit forecasts are going to follow house prices lower, say the bears. At the end of the year, a wave of corporate defaults could make a mockery of those lofty earnings projections.

“As US stocks rose on Thursday, Vix, a measure of volatility known as Wall Street's fear gauge, flirted with closing below 20 – the level that had set the ceiling for fear until the credit crunch began to bite last July. Vix below 20 tells us the bulls are winning the argument for now.”

Source: Michael Mackenzie, Financial Times , April 24, 2008.

GaveKal: Asian stock markets offer attractive value

“Amid all the noise in the market – oil at US$116/bb, the sharp rally in equity markets around the world, the spike in rice prices – the recent movement in the US two-year Treasury bonds should be calling out the loudest. After having traded way below the Fed funds rates (thus implying that the Fed was hopelessly behind the curve), yields have bounced to the point where they are now nearly on par with the Fed funds rate. In turn, this has a number of important implications:

• No more rate cuts? As the effects of the vicious credit crunch are starting to abate, the Fed's need to cut rates is dwindling, regardless of the fact that many economic indicators are pointing to a US recession.

• No more ‘Plan B' measures? As government bond markets start to stop announcing Armageddon, the Fed will feel less compelled to come out with sweeping (and controversial) measures such as the bail-out of Bear Stearns creditors. Outside of the US, however, we may yet see more aggressive policies put in place – one recent example being the BoE's decision to swap government bonds for MBS to help unfreeze Britain's mortgage market.

“Overall, the rise in short-dated UST yields confirms our belief that the US financial crisis is no longer the key challenge facing global markets. Instead, inflation is now the main threat – and this is particularly true in Asia, where 1) a greater percentage of household expenses is dedicated to food and 2) manufacturers' margins continue to be eroded by the continued spike in commodity prices.

“So how will we overcome the rising inflation problem? The first way is to cross one's fingers and hope that commodities roll-over. Thus far, this strategy has been met with very limited success. The second way is to tighten monetary policy. And the third is to invest significantly in the hope of large productivity gains.

“… it is no easy task to read the tea leaves in Asia. However, we do know that most Asian markets are now trading at very attractive valuations – including Singapore, Taiwan, Thailand, Japan and Hong Kong small caps. Thus, Asian markets have already discounted a fair amount of the bad news that keeps coming out. And meanwhile, US news may be getting better …”

Source: GaveKal – Checking the Boxes , April 21, 2008.

Financial Times: Euro's rise make increase in ECB interest rates unlikely

“‘Our big problem is to ensure that inflation returns below 2% next year,' Christian Noyer, France's central bank governor, told French radio. ‘If needed, we will move interest rates.'

“The comments reveal a fresh determination by the European Central Bank to talk tough on eurozone inflation, which hit a 15-year high of 3.6% last month, as well as policymakers' faith in the robustness of economic growth.

“The euro's dramatic appreciation makes an actual rise in ECB interest rates seem unlikely in coming months. But, in a significant turnround, markets have priced in a small chance of an increase later this year. The ECB believes economic uncertainty makes the direction of its next interest rate move unclear.”

Source: Ralph Atkins and Ben Hall, Financial Times , April 22, 2008.

John Hussman (Hussman Funds): Commodities – best to panic before everyone else does

“… materials and cyclical stocks currently rely on sustained commodity price strength and ‘decoupling' between the US and foreign countries. I continue to view commodities as cyclical, and decoupling as implausible – indeed, my impression is that the commodity surge will likely be turned on its head within a few months, about the point where 10-year Treasury yields move above the year-over-year CPI inflation rate. Having spent the mid-1980's working at the Chicago Board of Trade, I was always impressed how much more ‘V-shaped' commodity price charts were than equities or bonds. Spike tops, spike bottoms, and steep reversals are common. Investors overly tied to the commodity boom and ‘global demand' as drivers of investment positions would do well to examine that behavior. It is often initially painful, but ultimately worthwhile to remember that it's best to panic before everyone else does.”

Source: John Hussman, Hussman Funds , April 21, 2008.

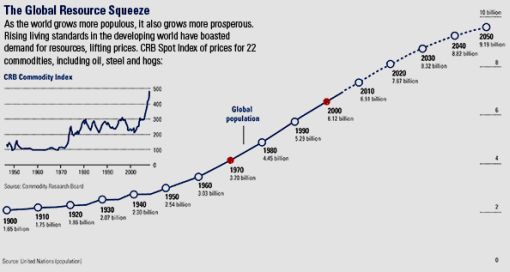

Frank Holmes (US Global Investors): Long-term commodities trend intact

“Many factors support long-term commodity prices and the current secular bull market in commodities. This is true across the commodity spectrum, from energy and metals to agricultural products.

“According to the United Nations, the proportion of the world's population living in urban areas will reach 50% this year. That urban population will be larger than the entire world population in 1965.

“Growing cities will be a major driver for infrastructure creation. According to Booz Allen Hamilton, modernizing and enlarging water, electricity and transportation systems for all of the world's cities would cost more than $40 trillion between 2005 and 2030.

“Even as this urbanization has increased demand for commodities, supply is not keeping up. Copper prices have soared over the past few years; yet, actual new mine production has fallen well short of expectations. Global production of gold has fallen, despite rising prices.

“Costs have increased. So have production lead times, due to power supply and regulatory issues. RBC Capital Markets analysts see ‘no end in sight for capital cost inflation.' Estimated capital costs have climbed at an annualized rate of more than 55%.

“As Americans, we must be aware that 95 percent of the world's population lives outside of North America and is striving for the same modern luxuries that we often take for granted – amenities such as heating and air conditioning, reliable electricity and efficient transportation. A global land grab is under way as countries like China and India shore up their commodity supplies, often in countries the United States has shunned. As resource prices rise, so has countries' desire to take a bigger share of resource production, either through renegotiation or outright nationalism.”

Source: Frank Holmes and John Derrick, US Global Investors – Weekly Investor Alert , April 25, 2008.

Interfax: For first time, Central Bank buys gold from producers

“For the first time, the Central Bank of Russia purchased gold for its international reserves from gold producers, a source in banking circles told Interfax.

“Previously the Central Bank had always purchased gold on the interbank market.”

Source: Interfax , April 18, 2008.

GaveKal: Continued rise in oil price not comforting

“… oil seems to be rising in a vacuum, breaking US$117/barrel yesterday. How can we explain this?

1) Peak oil theorists are right : While we are not believers in peak oil, OPEC's latest decision not to raise production levels gives ammunition to adherents of this Malthusian scenario.

2) Governments are stockpiling : There are some concerns that governments are helping to bid up oil today through inventory building. Some of this buildup is for the purpose of meeting changing economic needs (China is supposed to have added +1.2 billion tons of oil reserves in 2007) and some is designed to insulate against further supply shocks.

3) OPEC is right—and speculators are to blame : Officially, OPEC refused to raise production because the cartel argues that speculation (rather than supply shortages) is behind the bull market in crude. This may be true, at least in the latest leg up in oil – as investors were caught out in the options market (selling calls with US$100+ strikes was a popular recent trade) and drove up prices as they rushed to cover these short positions.

4) Resilient demand from emerging markets : The International Energy Agency forecasts that global oil demand will rise +2% this year, despite declining consumption in the world's biggest gas guzzler, the US. They predict that demand in emerging markets, including China and India, will more than make up for declines elsewhere.

“The continued rise in oil is not comforting. After all, this puts more money in the hands of governments, and takes money away from the private sector. This is never a good trend … especially when we need big productivity gains to offset the recent inflationary pressures.”

Source: GaveKal – Checking the Boxes , April 22, 2008.

Hugo Navarro (Capital Economics): Oil price could see sharp correction

“Brent crude oil could rise as high as $125 a barrel in the current quarter … although it is likely to ease back to $85 by the end of the year, says Hugo Navarro at Capital Economics.

“He says crude prices have staged a dramatic rally … this year in dollar terms, despite a further deterioration in the outlook for global growth.

“‘The recent stream of bad press about economic prospects in the US has led to a fall in the dollar and a corresponding rise in dollar-denominated oil prices that has more than offset the effect of a weaker outlook for demand.'

“But he says the three key drivers of the recent rise in oil prices – a falling dollar, tight fundamentals and speculative pressures – look set to ease and probably reverse as the year progresses. ‘As the US economy bottoms out in the second half of the year, we expect the dollar to recover,' he says.

“‘Fundamental factors will also be at play and easing market tightness should add to the downward pressure on oil prices.'

“He adds that the strong inflow of capital from investors, partly as a hedge against general inflation, is likely to abate as fundamental demand and supply conditions reassert themselves.

“‘As general inflationary pressures ease, speculative positions in oil should also be unwound, potentially leading to a sharp correction.'”

Source: Hugo Navarro, Capital Economics (via Financial Times ), April 23, 2008.

Bloomberg: Brazil oil finds may end US's reliance on Middle East

“Brazil's discoveries of what may be two of the world's three biggest oil finds in the past 30 years could help end the Western Hemisphere's reliance on Middle East crude, Strategic Forecasting said.

“Saudi Arabia's influence as the biggest oil exporter would wane if the fields are as big as advertised, and China and India would become dominant buyers of Persian Gulf oil, said Peter Zeihan, vice president of analysis at Strategic Forecasting in Texas.

“Brazil may be pumping ‘several million' barrels of crude daily by 2020, vaulting the nation into the ranks of the world's seven biggest producers, Zeihan said in a telephone interview. The US Navy's presence in the Persian Gulf and adjacent waters would be reduced, leaving the region exposed to more conflict, he said.

“‘We could see that world becoming a very violent one,' said Zeihan, former chief of Middle East and East Asia analysis for Strategic Forecasting. ‘If the United States isn't getting any crude from the Gulf, what benefit does it have in policing the Gulf anymore? All of the geopolitical flux that wracks that region regularly suddenly isn't our problem.'”

Source: Joe Carroll, Bloomberg , April 24, 2008.

Sign On San Diego: India to take steps to control rising food prices

“India's federal government is planning to take several steps, including banning the exports of some commodities, to control the rising prices of food, cement and steel, the finance minister said Tuesday.

“India's key inflation rate surged to a 3-year high of 7.41% last month, before dropping to 7.14% for the week that ended April 5, according to government data.

“And with the national elections due to be held early next year, Prime Minister Manmohan Singh's government is under pressure to control prices to avoid voters' anger.

“The government is working to rationalize duties on several commodities to ensure their availability, Finance Minister P. Chidambaram told Parliament.

“‘As and when necessary, we will take more fiscal measures. Some fiscal steps have been taken and the government is planning to take more steps,' he said.

“India's central bank has already raised the repurchase, or overnight lending, rate by 150 basis points since January 2006 to 7.75%. It also has raised the amount that banks have to set aside as cash reserves with the central bank to 7.50% of deposits to curb liquidity.”

Source: Sign on San Diego , April 22, 2008.

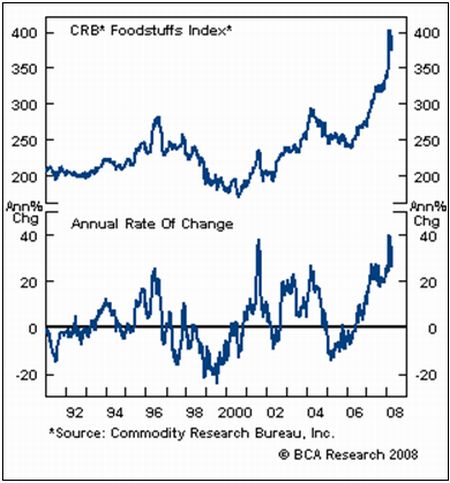

BCA Research: Agflation – A risk for emerging markets

“The main risk to emerging markets is not the US recession or credit crunch, but rising agriculture price inflation (agflation).

“The main risk to emerging markets is not the US recession or credit crunch, but rising agriculture price inflation (agflation).

“Ramifications of agflation are far more important in the emerging world than in the developed economies, given that food makes up a larger share of the consumption basket. In addition to higher inflation and upward pressure on interest rates, rising social tensions could force policymakers to forgo proven market mechanisms, creating distortions that have long-lasting and harmful economic implications. In turn, this can lead to higher risk premiums on asset markets. The negative shock and risk of pass-through from skyrocketing food prices will be greater in the economies with a rigid supply side and low competition. Moreover, countries where the currency has been sliding will feel the effect of rising global food prices much more acutely.

“Bottom line: We are positive on emerging equity markets as a whole, but are concerned about the outlook for South Africa, Argentina, Indonesia, and the Philippines because of the lack of supply side reforms over the past several years and escalating threats from food inflation. Stay underweight these markets.”

Source: BCA Research , April 18, 2008.

Financial Times: £50 billion UK offer for mortgage securities

“The housing market will not see a return to the profligate mortgage lending practices of the past few years, the governor of the Bank of England insisted on Monday as he announced a massive operation to support liquidity in British banks.

“Making an almost unlimited offer to acquire UK banks' mortgage-backed securities for up to three years in return for Treasury bills, Mervyn King said the plan would ‘take the liquidity issue off the table in a decisive way'. But he warned that the objective of the plan was neither to persuade banks to start lending again nor stand in the way of a housing market correction.

“His stern words contrasted with those of Alistair Darling, the chancellor, who told Parliament he hoped: ‘This [scheme] will help alleviate the problems that have seen banks reluctant to lend to each other and in turn support the provision of new mortgage lending.'

“For the next six months, the Bank will offer to acquire asset-backed securities from banks in exchange for Treasury bills. Based on conversations with commercial banks, the Bank expects to swap £50 billion assets in the first couple of months.

“British bankers on Monday agreed that the plan would help to restore confidence to the sector. Stephen Green, chairman of HSBC, said: ‘At an industry level, the Bank of England initiative will help ease some of the current market dislocations in the UK.'

“But there was little sign that the Bank's action would kickstart the faltering mortgage or housing markets.”

Source: Chris Giles and Peter Thal Larsen, Financial Times , April 21, 2008.

Edmund Conway (Telegraph): Bank of England hawk sees inflation risk if interest rates cut

“Hopes that the Bank of England will slash interest rates have been undermined after a key policymaker hinted that the Bank's rescue plan for credit markets will free it up to use rates to fight inflation.

“The pound closed in on the $2 mark after Tim Besley's hawkish speech in London stirred fears that Britain is heading towards stagflation, with sluggish growth and high inflation striking the economy simultaneously.

“In a further sign of the chaos the financial crisis is causing in the City, the Bank confirmed yesterday that it is postponing its Financial Stability Report for a week – one of the first times since independence that it has been forced to delay a key publication.

“Mr Besley said he was hesitant about cutting borrowing costs too far from their current level of 5% because of the growing risk that inflation picks up. He said: ‘Monetary policy can smooth some of the adjustment in response to changes in the real economy. However, it cannot, and should not try to, prevent warranted real economy changes taking place.'

“He welcomed the Bank's move this week to swap more than £50 billion worth of government debt with frozen asset-backed securities, adding that this may help resolve the credit crisis without the Monetary Policy Committee (MPC) having to cut rates dramatically.

“‘This should allow the MPC to stay more focused on its task of using monetary policy to target inflation,' he said.”

Source: Edmund Conway, Telegraph , April 24, 2008.

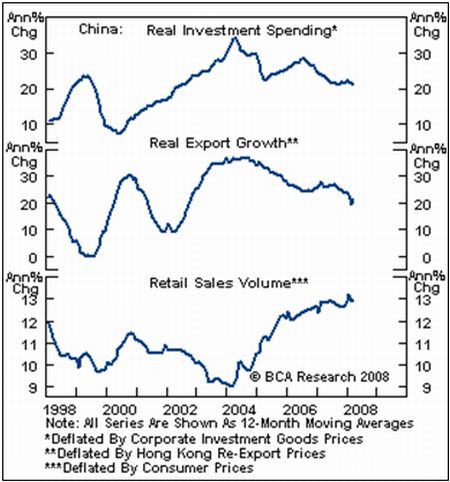

BCA Research: China – fast versus good growth

“The Chinese government's ongoing tightening campaign reflects a strategic policy shift from ‘growth at all costs' to sustainable and desirable growth.

“The Chinese government's ongoing tightening campaign reflects a strategic policy shift from ‘growth at all costs' to sustainable and desirable growth.

“The government's ongoing efforts in growth reorientation and optimization have received desirable responses within the economy. For example, policymakers have been working hard to boost domestic consumption and reduce the economy's dependence on exports and capital spending. This strategy has panned out favorably. Investment spending and export growth have moderated significantly in the past several years, while private consumption has continued to accelerate, due to fast income gains and progress in enhancing the social safety net. Strengthening consumption is providing an important offset for slowing investment and exports. This benign adjustment has allowed growth to downshift, but remain robust.

“Bottom line: The trade-off of quality over quantity suggests the authorities are not targeting an across-the-board growth slowdown. Indeed, sectors that had experienced excessive growth have more recently shown pronounced weakness, but the economy has not lost much of its forward momentum.”

Source: BCA Research , April 22, 2008.

Financial Times: CPI suggests Japan near end of deflation

“Japanese consumer prices, stripped of energy and fresh food, rose 0.1% on-year in March, the first increase since 1998 and a sign that Japan could be close to shaking off 10 years of deflation.

“The headline core CPI rate, which includes fast-rising energy prices, leapt 1.2% on-year, the highest in 10 years and a better reflection of how consumers perceive price changes.

“Of the 1.2% rise in the headline CPI, 0.73 percentage point was due to energy and 0.41 point from food. In yen terms, oil prices are 50% higher than a year ago. Economists have characterised Japan's rising prices as cost-push inflation.

“Hiroko Ota, economy minister, characterised the rise as the wrong kind of inflation. ‘The price rises are being led by upward pressure from higher raw material costs and not by strong demand, so it is not a good pattern,' she said.

“The central bank is faced with a complex set of calculations. The rising headline rate might, in some circumstances, lead it to consider a rate rise. But the difficult international situation in financial markets coupled with the low rate of the so-called ‘core-core inflation', excluding energy and food, means it is far more likely to leave rates where they are at 0.5%.

“If the economy deteriorates, bank watchers are not excluding the possibility of a rate cut.”

Source: David Pilling, Financial Times , April 25, 2008.

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his wife, television producer and presenter Isabel Verwey, and two children in Cape Town , South Africa . His leisure activities include long-distance running, traveling, reading and motor-cycling.

Copyright © 2008 by Prieur du Plessis - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Prieur du Plessis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.