Stocks Bull Market Continues

Stock-Markets / Stock Markets 2014 Mar 24, 2014 - 02:52 PM GMTBy: Tony_Caldaro

The market started the week gapping up after last Friday’s decline to SPX 1840. The rally carried it into FOMC Wednesday to SPX 1874. Then right after the FOMC statement was released the market dropped to SPX 1850. Another rally carried the market to match the all time high at SPX 1884 on Friday. Then right after the open Techs sold off and the market pulled back again. Another choppy week, only this time to the upside. For the week the SPX/DOW were +1.45%, the NDX/NAZ were +0.7%, and the DJ World index rose 0.7%. Economic reports for the week were positive. On the uptick: NY/Philly FED, capacity utilization, industrial production, NAHB, housing starts, building permits, CPI, leading indicators and the monetary base. On the downtick: existing home sales, and weekly jobless claims edged higher. Next week: Q4 GDP, Durable goods orders, and more Housing reports.

The market started the week gapping up after last Friday’s decline to SPX 1840. The rally carried it into FOMC Wednesday to SPX 1874. Then right after the FOMC statement was released the market dropped to SPX 1850. Another rally carried the market to match the all time high at SPX 1884 on Friday. Then right after the open Techs sold off and the market pulled back again. Another choppy week, only this time to the upside. For the week the SPX/DOW were +1.45%, the NDX/NAZ were +0.7%, and the DJ World index rose 0.7%. Economic reports for the week were positive. On the uptick: NY/Philly FED, capacity utilization, industrial production, NAHB, housing starts, building permits, CPI, leading indicators and the monetary base. On the downtick: existing home sales, and weekly jobless claims edged higher. Next week: Q4 GDP, Durable goods orders, and more Housing reports.

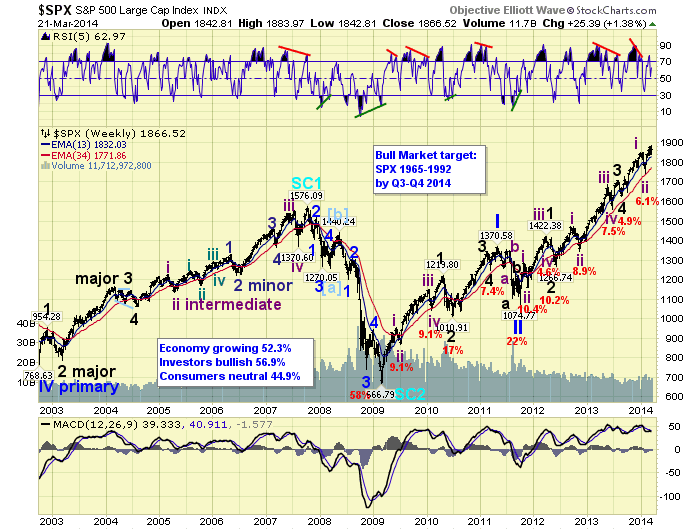

LONG TERM: bull market

We continue to count this bull market as a five Primary wave Cycle wave [1]. Primary waves I and II completed in 2011 and Primary wave II has been underway since then. Primary I divided into five Major waves with a subdividing Major wave 1. Primary III has also divided into five Major waves. However, Major waves 1 and 3 subdivided and likely Major 5 is subdividing as well.

From the Major wave 4 low in August 2013, we have labeled Intermediate wave one at SPX 1851, Int. two at SPX 1738, and Int. three underway now. Int. wave three has already made a new bull market high at SPX 1884, and the NDX/NAZ have made new highs too. However, the DOW continues to lag as noted with the three chart illustration in last weekend’s report. The DOW has still not exceeded its December 2013 high. Nevertheless, we see Primary wave III continuing in at least the SPX/NDX/NAZ in the coming months.

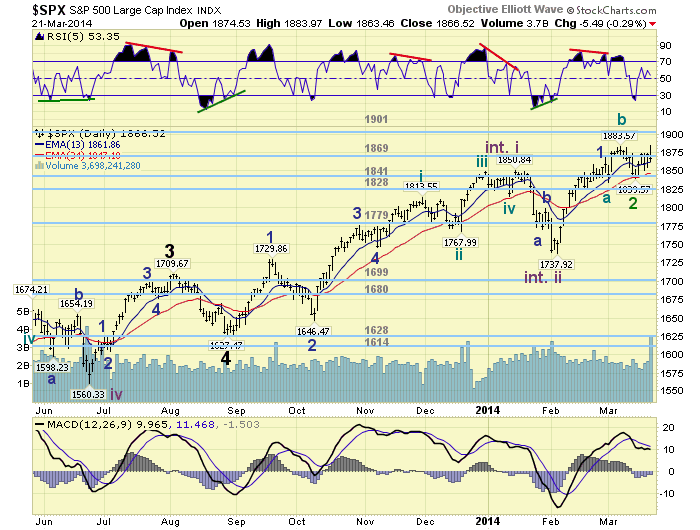

MEDIUM TERM: uptrend

The bull market in the SPX matched its all time high this week, but the DOW/NDX/NAZ did not. As a result the market remained choppy for the fifth week in a row. This may make sense to some as the first wave of this uptrend, Minor 1, was quite strong and unfolded in less than three weeks. Some choppiness was then expected, as we have been anticipating this uptrend to last for a few months with only an upside target of SPX 1962+.

We are counting this Int. wave three uptrend as five Minor waves. Minor 1 completed at SPX 1868. Minor wave 2, however, appears to have formed an irregular failed flat SPX: 1834-1884-1840. The rise above SPX 1868 makes it irregular, and the failure to reach the wave A low at 1834 makes it a failed flat. At the recent SPX 1840 low we had an oversold condition in all four major indices, and a positive divergence on the hourly chart. The market responded by rallying this week. Once SPX 1884 is cleared we will feel more confident about labeling Minor wave 3 underway. Thus far we have maintained tentative green labels for all of the activity since the Minor 1 high at SPX 1868. Medium term support is at the 1841 and 1828 pivots, with resistance at the 1869 and 1901 pivots.

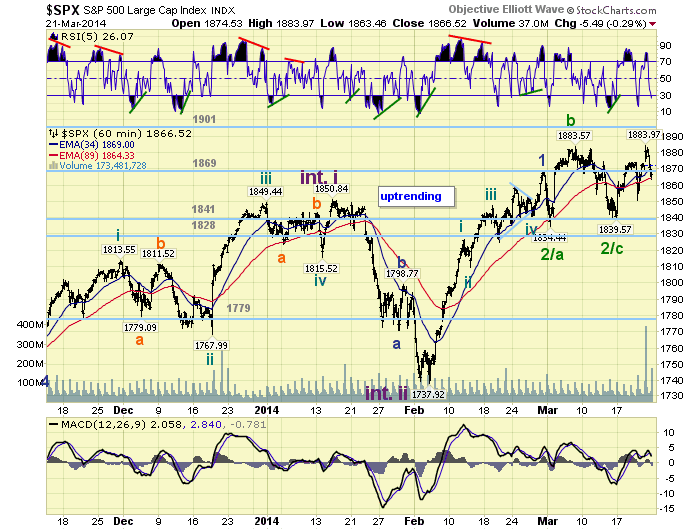

SHORT TERM

Short term support is at the 1841 and 1828 pivots, with resistance at the 1869 pivot and SPX 1884. Short term momentum declined to oversold after hitting quite overbought on Friday. The short term OEW charts have been vacillating of late, ending the week positive with the reversal level still at SPX 1869.

As noted above the market activity from the Minor wave 1 high at SPX 1868, and even before, has been quite choppy. It does look like Minor wave 2 bottomed recently at SPX 1840. The rally from that low, however, is also a bit choppy: 1874-1850-1884-1863. Either the market is setting up, with subdividing waves, for a surge higher. Or this week’s rally is corrective as well, and a retest of SPX 1834-1840 is next. With the SPX hitting its high right after the open on Friday, and then pulling back during options expiration. We lean towards the former rather than the latter. Once SPX 1884 is cleared we will likely label the two recent highs as Minute i at SPX 1874, and Micro 1 at 1884. Best to your trading!

FOREIGN MARKETS

The Asian markets were quite mixed on the week losing 0.4%.

The European markets were all higher on the week gaining 2.3%.

The Commodity equity group also rose gaining 4.3%.

The DJ World index is still uptrending and gained 0.7%.

COMMODITIES

Bonds continues to downtrend losing 1.0% on the week.

Crude appears to be downtrending but gained 0.6% on the week.

Gold appears to entering a downtrend and lost 3.5% on the week.

The USD set up a positive divergence for a potential uptrend, it gained 1.0% on the week.

NEXT WEEK

Tuesday: Case-Shiller, FHFA housing, Consumer confidence and New home sales. Wednesday: Durable goods orders. Thursday: Q4 GDP, weekly Jobless claims and Pending home sales. Friday: Personal income/spending, PCE and Consumer sentiment. On Monday, FED governor Stein gives a speech at 9am. Best to your weekend and week!

CHARTS: http://stockcharts.com/public/1269446/tenpp

http://caldaroew.spaces.live.com

After about 40 years of investing in the markets one learns that the markets are constantly changing, not only in price, but in what drives the markets. In the 1960s, the Nifty Fifty were the leaders of the stock market. In the 1970s, stock selection using Technical Analysis was important, as the market stayed with a trading range for the entire decade. In the 1980s, the market finally broke out of it doldrums, as the DOW broke through 1100 in 1982, and launched the greatest bull market on record.

Sharing is an important aspect of a life. Over 100 people have joined our group, from all walks of life, covering twenty three countries across the globe. It's been the most fun I have ever had in the market. Sharing uncommon knowledge, with investors. In hope of aiding them in finding their financial independence.

Copyright © 2014 Tony Caldaro - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Tony Caldaro Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.