Are Bank Stocks Sending an SOS Signal?

Stock-Markets / Banking Stocks Mar 31, 2014 - 06:35 PM GMTBy: EWI

If you turn on CNBC first thing in the morning, you hear a lot about market indicators. Consumer behavior, GDP numbers, the Fed, interviews with CEOs -- it's all in the mix.

If you turn on CNBC first thing in the morning, you hear a lot about market indicators. Consumer behavior, GDP numbers, the Fed, interviews with CEOs -- it's all in the mix.

Instead, Steve Hochberg of Elliott Wave International looks at important indicators that mainstream finance often overlooks.

For example, consider this insight from the latest, March issue of Steve's Financial Forecast.

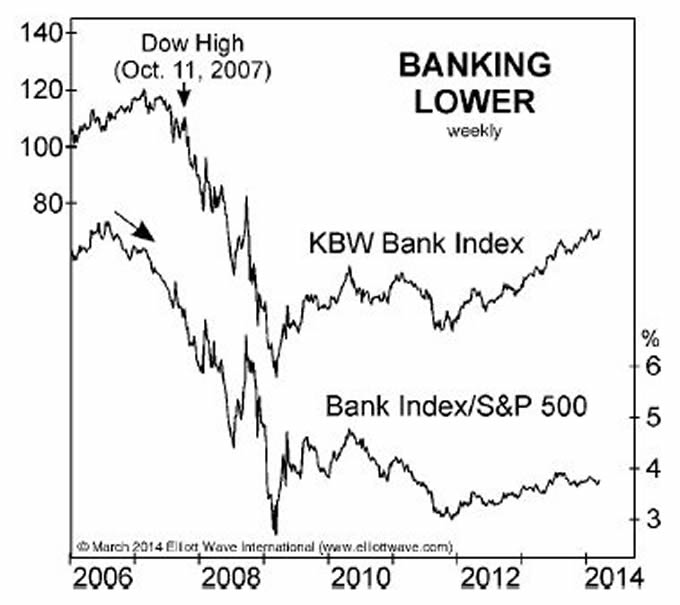

This chart shows you that banks have dramatically underperformed the broad market since the Great Credit Crisis began. The top line is the KBW Bank Index. The bottom line is the ratio between the Bank Index and the S&P 500. Notice how the decline in the ratio came before the February 2007 reversal in the Bank Index. And the Bank Index reversal itself anticipated the October 2007 reversal in the broad stock market.

Most importantly, this chart shows you that

"...the Bank Index's underperformance is even more pronounced now than it was in 2007. While the S&P moved to a new all-time high, the bank index has managed to retrace only 51% of its 2007-2009 decline!"

The bottom line is: Relative to the S&P, bank stocks made a high four years ago. So the question is, are the financials once again a leading signal of an impending credit contraction?

Discover the answer for yourself in Elliott Wave International's new special report, "The Financial Forecast "Nuggets" Report." You can get it -- FREE -- right now. See below for full details.

Gain an Advantage Over 99% of U.S. Investors - in Just 15 Minutes You can put yourself among an elite group of investors who step away from the herd. Investors who play by their own rules. Investors who protect their money from little-known risks yet still manage to catch and ride opportunities that no one else even sees coming. Investors who consistently prove that it PAYS to be ahead. That's why we created the just-released Financial Forecast Nuggets Report. It delivers some of the latest juicy nuggets from our most popular service for U.S. investors. How can our 15-minute nuggets report be so valuable? It's 100% FREE! |

This article was syndicated by Elliott Wave International and was originally published under the headline Are Bank Stocks Sending an SOS Signal?. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

About the Publisher, Elliott Wave International

Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.