Energy and Resources Boom Investing

Commodities / Resources Investing Apr 01, 2014 - 05:48 PM GMTBy: Frank_Holmes

Commodity returns vary wildly, as experienced resource investors can attest and our popular periodic table illustrates. This inherent volatility can spell opportunity for the nimble investor who can look past the mainstream headlines to identify hot spots. Our global resources expert, Brian Hicks, CFA, identified four we believe are revved up for a resources boom.

Commodity returns vary wildly, as experienced resource investors can attest and our popular periodic table illustrates. This inherent volatility can spell opportunity for the nimble investor who can look past the mainstream headlines to identify hot spots. Our global resources expert, Brian Hicks, CFA, identified four we believe are revved up for a resources boom.

1. Plenty in the Tank for Energy Stocks

Because of the previously low expectations of global growth and oil demand, energy stocks have been shunned by investors and have languished in recent years. In fact, according to Goldman Sachs, oil equities held in the Energy Select Sector SPDR ETF have underperformed the broader market by 32 percent since 2008!

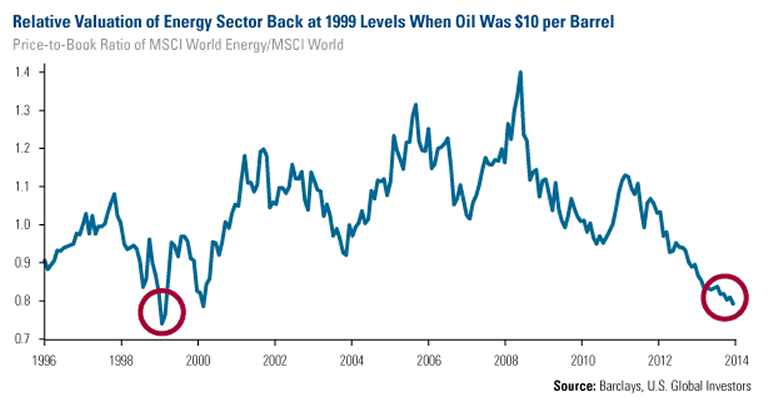

Global energy stocks have also suffered: In a comparison of the price-to-book valuations of the MSCI World Energy Index to that of the MSCI World Index, the ratio is at a level we haven’t seen since the late 1990s and early 2000s. Back then, crude oil plummeted to a very low price of $10 per barrel.

Today, with oil hovering around $100 a barrel and improved economic conditions in the U.S., energy stocks appear to be a tremendous bargain compared to overall stocks.

When it comes to natural gas, the cold, snowy winter has caused inventories of the commodity to rapidly decline. As the U.S. is experiencing the coldest winter in 13 years – some parts of the country have had the coldest weather in nearly three decades – natural gas inventories have been drawn down to levels we haven’t seen in 10 years.

Still, Old Man Winter hasn’t been persuasive enough for companies to respond with supply.

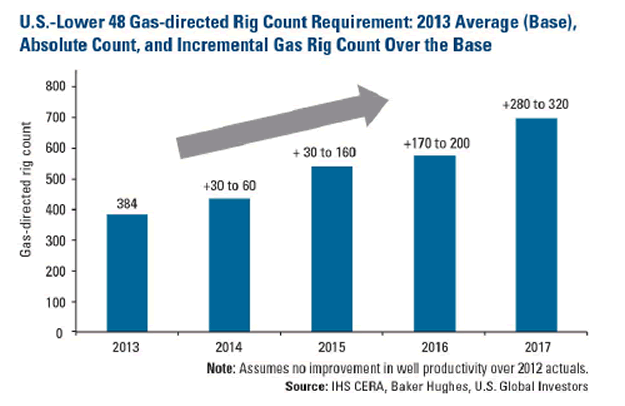

Based on data from the research firm IHS, 384 gas-directed rigs were online in the lower 48 states to refill storage and meet new demand coming online from the industrial sector in 2013. However, looking ahead over the next few years, the rig count is going to have to rise dramatically “as the gas market tightens in late 2014 and 2015,” which is a tremendous opportunity for investors, says IHS.

Before rig counts can increase, higher natural gas prices are needed to incentivize operators to invest in natural gas. Based on last quarter’s earnings reports, many major producers, such as EOG, Southwestern or Pioneer Natural Resources, are not planning on increasing their natural gas budgets. Bill Thomas, Chairman and CEO of EOG Resources, explained his reasoning that is part of the collective thought process across the industry:

“For the sixth year in a row we are not [trying to] grow EOG’s North American natural gas production. This is reflective of our view of low returns on natural gas investments. We won’t drill any dry gas wells in North America during 2014 because we don’t see a change in the gas oversupply picture until the 2017-2018 time frame.”

As we come out of this winter season, the complacency toward adding to rig counts may amplify the deficit in natural gas inventories.

2. U.S. Chemical Industry Has a Competitive Edge

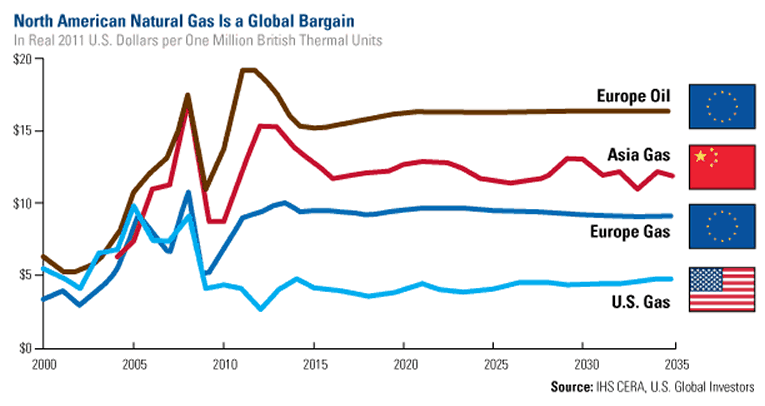

One upside to the low natural gas prices in North America is that it equates to relatively cheap feed stock for U.S. chemical companies. Whether it’s Asia or Europe, gas prices outside of the U.S. tend to be benchmarked to the higher price of crude oil.

Along with the global economic recovery, natural gas is giving the U.S. a competitive advantage. We’re seeing chemical companies coming back to the states, creating jobs, expanding exports out of the U.S., and helping the nation’s current account deficit.

3. Shipping Companies at a Possible Inflection Point

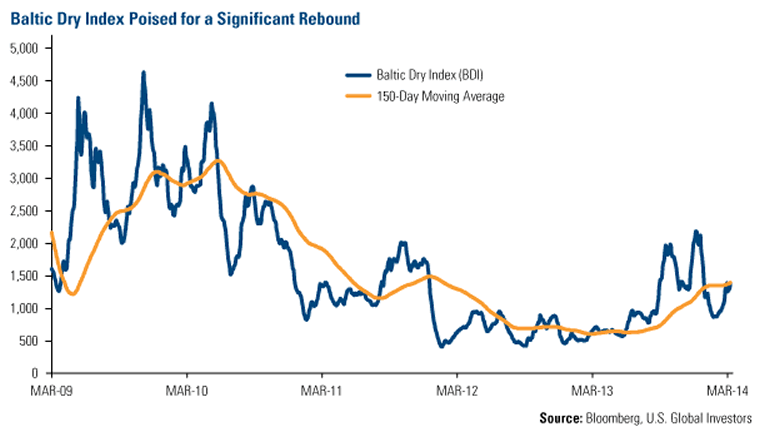

The prices to ship commodities around the world have been hovering around the lowest we’ve seen in five years. However, demand for shipping is starting to overtake the supply of new ships, which bodes well for shipping companies.

Take a look at the chart showing the Baltic Dry Index over the past five years. The index is made up of various sizes of carriers including the Baltic Capesize, Panamax, Handysize and Supramax indices and measures the price of moving raw materials by sea. Primarily, these vessels transport iron ore and grains, i.e., wheat, corn and soybeans, which are especially vital goods for China.

To keep its population of 1.3 billion fed, China needs to import millions of tonnes of wheat, corn, rice and soybeans. As this demand is recognized, shipping companies should benefit.

4. Alternative Energy Could Get You More Green

In China, residents have been dealing with increasing cancer-causing pollutants and vehicle congestion on roads, and public discontent is rising. This winter, as pollution grew to be 10 times higher than the acceptable rate, Beijing University students protested the conditions by putting masks on iconic statues.

The effect that pollution is having on China’s economy benefits certain industries, including renewable energy or clean energy, whether it's solar or wind power

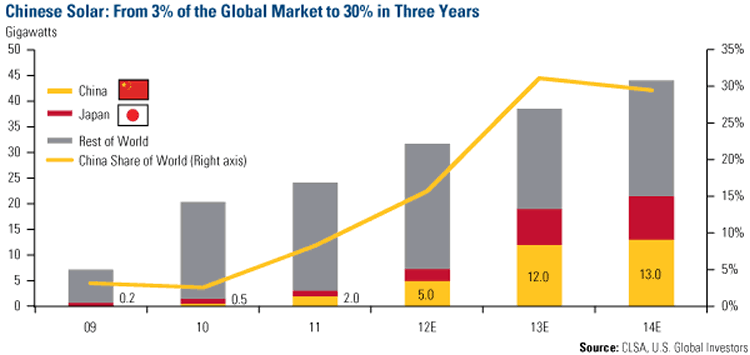

You can see just how dramatic the investment has been over the last five years. Specifically, wind power and solar look especially attractive. Take a look at CLSA data: In 2009, the country had about 0.2 percent of the global market. By 2014, it’s estimated to grow to one-third of the global market.

China isn’t the only country with a growing renewable energy market. With the Fukushima nuclear reactors incident after the massive earthquake in Japan, the solar market is taking off there too.

The Diverse Approach of the Global Resources Fund (PSPFX)

We believe these areas of the market offer the most exciting opportunities today. They have the wind at their back, giving us the confidence to overweight the companies within these areas of the market that are also showing extremely robust fundamentals.

Because of the diversity and volatility of each commodity, we believe investors benefit by holding a diversified selection of commodity stocks actively managed by professionals who understand these specialized assets and the global trends affecting them.

I just flew back from Asia, where I spoke at Robert Friedland’s Asia Mining Club and Mines and Money Hong Kong, with a special stop in Carslbad, CA on my way home to speak at the Investment U Conference. It has been an exhilarating week meeting with global entrepreneurs, mining executives and curious investors. I look forward to sharing their advice and insights with you next week.

P.s. It’s not too late to join me for an investment adventure in Turkey in May.

Want to receive more commentaries like this one? Sign up to receive email updates from Frank Holmes and the rest of the U.S. Global Investors team, follow us on Twitter or like us on Facebook.

By Frank Holmes

CEO and Chief Investment Officer

U.S. Global Investors

U.S. Global Investors, Inc. is an investment management firm specializing in gold, natural resources, emerging markets and global infrastructure opportunities around the world. The company, headquartered in San Antonio, Texas, manages 13 no-load mutual funds in the U.S. Global Investors fund family, as well as funds for international clients.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.Standard deviation is a measure of the dispersion of a set of data from its mean. The more spread apart the data, the higher the deviation. Standard deviation is also known as historical volatility. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The NYSE Arca Gold BUGS (Basket of Unhedged Gold Stocks) Index (HUI) is a modified equal dollar weighted index of companies involved in gold mining. The HUI Index was designed to provide significant exposure to near term movements in gold prices by including companies that do not hedge their gold production beyond 1.5 years. The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar.

Frank Holmes Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.