The Unsustainable Distortion That is America

Politics / US Debt Apr 06, 2014 - 04:51 PM GMTBy: Gordon_T_Long

The Peril of a Two Class Society

The Peril of a Two Class Society

Since the end of WWII the US might be considered as being divided into two eras. The first from after the war untill 1979 and the second from 1979 until today. The era's are determined by the growth of family income.

As dramatically different as these two eras are, they are even worse when we consider the structural change, where the US family income shifted from a single to a two family income, which closely mirrors these two eras.

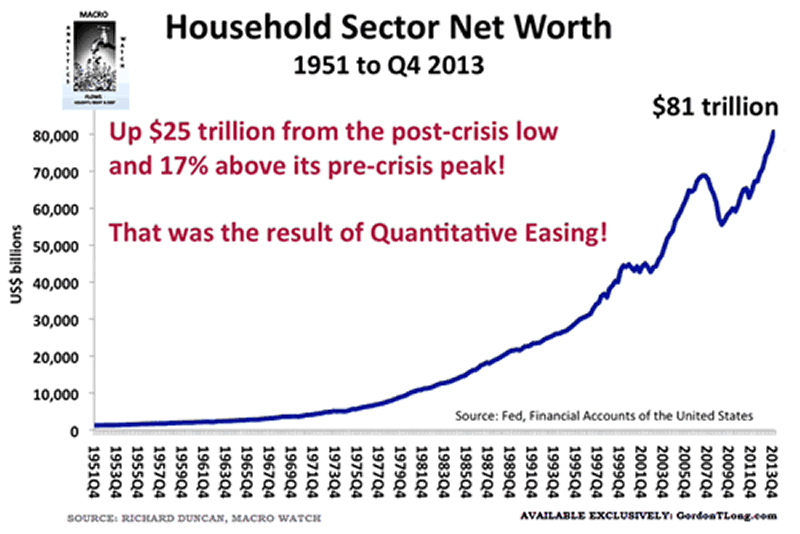

The good news, at least on the surface, is that while topping $81 Trillion, the US Household Sector Net Worth is now at a historic high after recovering dramatically from the 2008 financial crisis. It is up over $25T from the post-crisis low and 17% above its pre-crisis peak.

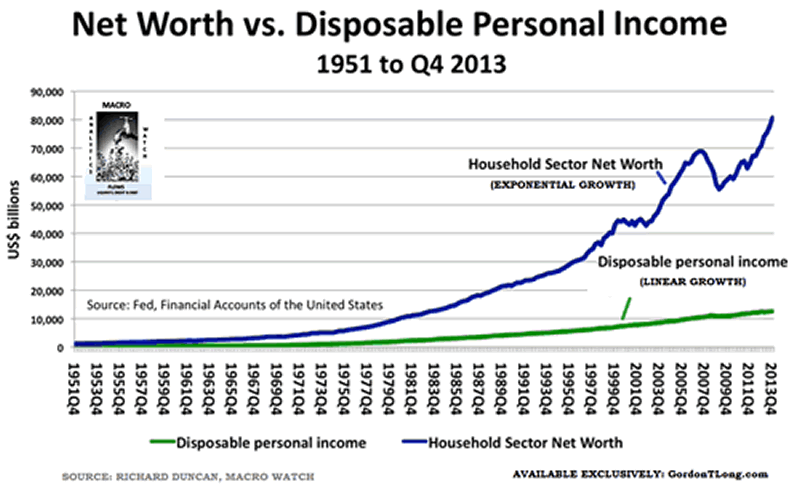

According to global macro strategist Richard Duncan at Market Watch, this is actually a major concern! Why? Because though the Federal Reserve has engineered a "required" Wealth Effect recover since the dotcom bubble implosion, the Household sector net worth is moving up geometrically, while US Disposable Personal Income is only marginally rising on a linear basis.

Mathmatically, something has to give because they are connected.

When we consider that Household Net worth is rising primarily due to housing price increases and financial market performance, it becomes apparent that real disposable income will at some point no longer be able to sustain nor afford elevated asset price levels. History has show us that this is a pattern to be most concerned about.

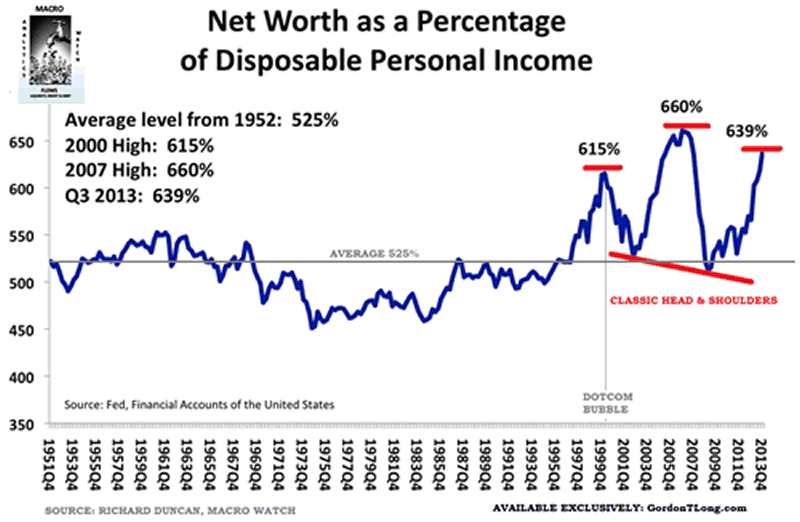

Richard Duncan demonstrates this trigger point (below) by comparing Household Net Worth as a percentage of Disposable Personal Income. The average from 1952 to today has been 525%. With a high during the 2000 Dotcom bubble of 615% and a Housing Bubble high in 2007 of 660%, we now find ourselves at 639%.

The chart is flashing an ominous Head & Shoulders pattern.

Conclusions

A 70% Consumption based economy such as the US cannot support an elevated Household Wealth Effect without Real Disposable Income increasing at a sufficient rate to support elevated asset prices.

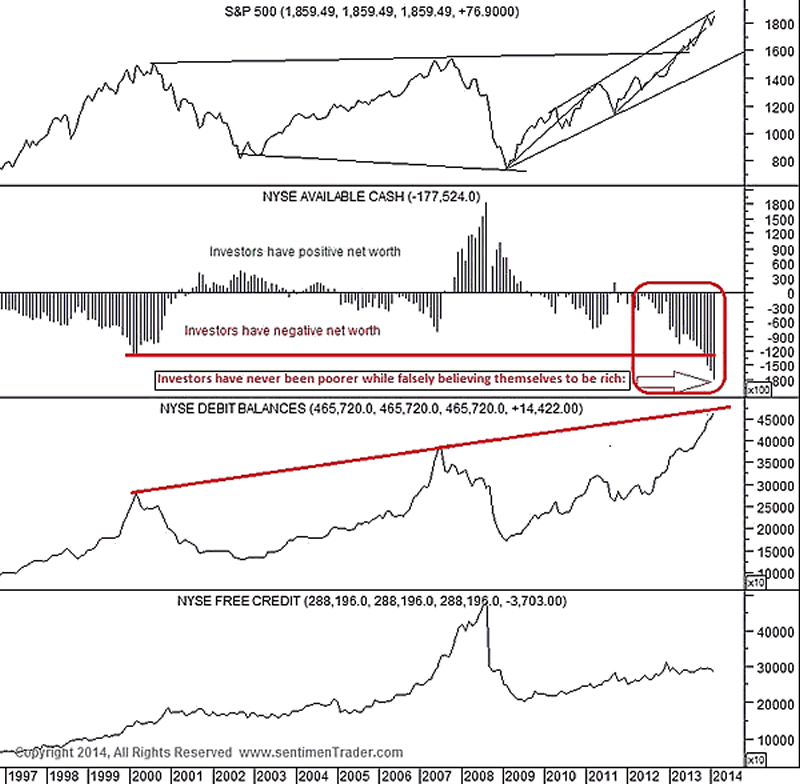

When we additionally consider the degree to which margin is presently being used (once again) in the equity markets, we see not only the excess, but that investors have never been poorer while falsely believing themselves to be rich!

How long can this be sustained? Not that much longer because new credit is steadily generating less GDP growth from which to support an ever increasing debt burden.

For more detail on how this distortion is being orchestrated and sustained, signup for your FREE copy of the GordonTLong.com THESIS PAPER: FINANCIAL REPRESSION

Signup for notification of the next MACRO INSIGHTS

Request your FREE TWO MONTH TRIAL subscription of the Market Analytics and Technical Analysis (MATA) Report. No Obligations. No Credit Card.

Gordon T Long Publisher & Editor general@GordonTLong.com

Gordon T Long is not a registered advisor and does not give investment advice. His comments are an expression of opinion only and should not be construed in any manner whatsoever as recommendations to buy or sell a stock, option, future, bond, commodity or any other financial instrument at any time. While he believes his statements to be true, they always depend on the reliability of his own credible sources. Of course, he recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, before making any investment decisions, and barring that you are encouraged to confirm the facts on your own before making important investment commitments. © Copyright 2013 Gordon T Long. The information herein was obtained from sources which Mr. Long believes reliable, but he does not guarantee its accuracy. None of the information, advertisements, website links, or any opinions expressed constitutes a solicitation of the purchase or sale of any securities or commodities. Please note that Mr. Long may already have invested or may from time to time invest in securities that are recommended or otherwise covered on this website. Mr. Long does not intend to disclose the extent of any current holdings or future transactions with respect to any particular security. You should consider this possibility before investing in any security based upon statements and information contained in any report, post, comment or suggestions you receive from him.

Gordon T Long Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.