Current Jakarta Composite Stock Index Index Run Up Sustainable?

Stock-Markets / Stock Markets 2014 Apr 07, 2014 - 10:57 AM GMTBy: Sam_Chee_Kong

The recent run-up of the Jakarta Composite Index has nothing to do with improving fundamentals in the Indonesian economy but more towards an election play. For all is known, the Indonesian economy is far from out of the woods. Although recently the Indonesian economy managed to record trade surpluses, it is mainly due to the rise in exports. Exports are brought forward from the mining sector as a result of an anticipated ban on mineral exports after Jan 12, 2014. Moreover the sudden surge in the economic activity for the past few months has mainly due to the increased public spending geared towards the run up of the elections. Whatever it is, the Indonesian economy is still very weak and will have problem maintaining the momentum as soon as the elections ends next week.

The recent run-up of the Jakarta Composite Index has nothing to do with improving fundamentals in the Indonesian economy but more towards an election play. For all is known, the Indonesian economy is far from out of the woods. Although recently the Indonesian economy managed to record trade surpluses, it is mainly due to the rise in exports. Exports are brought forward from the mining sector as a result of an anticipated ban on mineral exports after Jan 12, 2014. Moreover the sudden surge in the economic activity for the past few months has mainly due to the increased public spending geared towards the run up of the elections. Whatever it is, the Indonesian economy is still very weak and will have problem maintaining the momentum as soon as the elections ends next week.

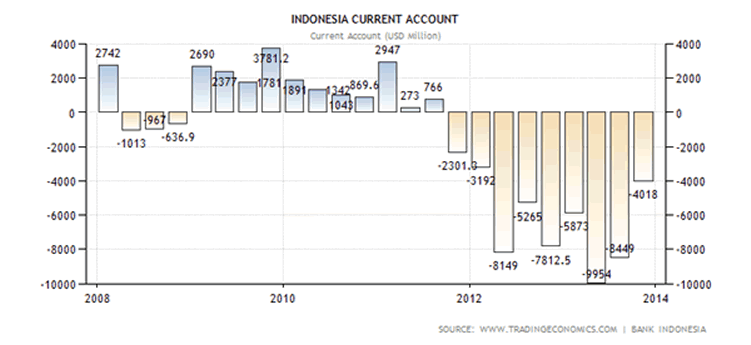

Current Account and Balance of Payment

Despite scoring positive growth in its trade balance, however the current account is still in the red due to an increase in the net income transfer out of the country. The following is Indonesia’s current account as from 2008 till March 2014. As can be seen, Indonesia’s Current Account has been in deficit since the end of 2011. The current account has in totality a deficit of $28.45 billion for the year 2013.

Thus, this helped contribute to a Balance of Payment deficit of $7.32 billion as shown below. This is the first balance of payment deficit since 2008 and it shows that the Indonesian economy has started to slacked.

Indonesia Balance of Payment from 2008 - 2013

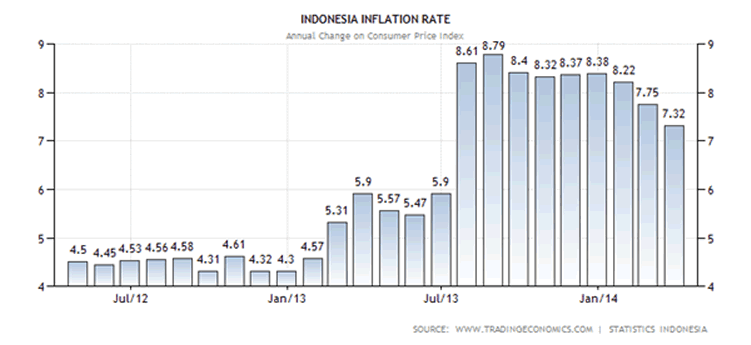

Inflation Rate

The Indonesian economy recorded an inflation rate of 7.32% in March 2014. As seen from the inflation chart below, Indonesia’s inflation rate has risen quite aggressively since July 2013. The overall inflation rate for the Indonesian economy has jumped to about 6.97% in 2013.This coincides with the depreciation of the Rupiah in July 2013 when there was a capital flight from emerging market economies. Thus the rise in the imported goods especially the fuel segment has contributed to the rise in the inflation rate. Whatever it is an inflation rate of about 7% is considered high and thus will negate any increased in the standard of living due to a rise in the income level of ordinary Indonesians.

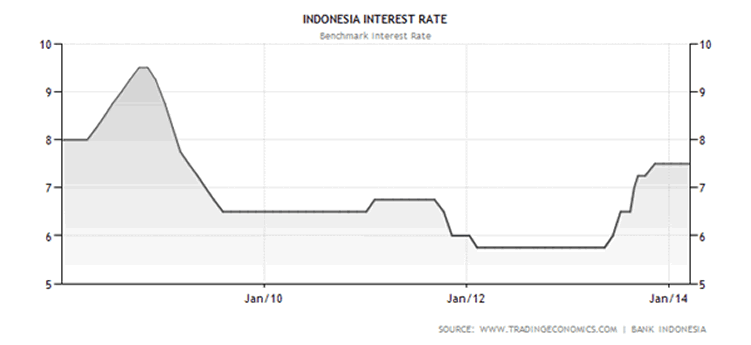

Interest Rate

Interest rates had risen from a low of 5.75% in 2012 to 7.5% since July last year. Raising the interest rate level is unavoidable because it was one of the stop go policies adopted by the Indonesian Government to stem the outflow of foreign capital last year. Since the last Global Financial Crisis in 2008, Central Bankers has been intervening into the credit market by lowering the interest rate. What happens when interest rates starting to creep up again as in the case of Indonesia shown by the following graph?

How does it affect both investors and companies?

Low interest rates acts as a stimulant to economic growth because it help to provide cheap credit to businesses and consumers. When borrowing costs is cheaper, businesses can afford to invest in technologies, machineries and other factors of production to expand their business. Consumers are more willing to take on a bigger credit so that they can spend on big ticket items such as cars, houses, travels and other luxury items. More are willing to put their money into the stock market instead on term deposits in order to increase their return. Thus, a virtuous cycle of economic activity has begun and everyone benefits.

What happens when rates starting to climb?

Obviously, businesses will start to re-evaluate their business plans as they are uncertain on how long the higher rates will prevail. Thus, they will be holding back their expansion plans and adopt a wait and see attitude. As for the consumers, they too will be cutting back on their spending especially on credit cards, big ticket items and investments that are directly affected by the rise in the interest rates. But what will happen to asset prices?

Most asset prices move inversely with interest rates. As for the corporates, a rise in the interest rates will affect the yield of their bonds and hence raising money through the issuance of bond will be prohibitive and so does bank credits. As for the investors, it will negate their attitude towards the stock and real estate investment as they are very sensitive to rate hikes. This is because not only alternative investment such as term deposits offers higher returns but it is also very prohibitive for investors to borrow money from their margin account to bet on stocks. As a result, they will either unwilling to commit or delay their purchase of real estate due to the higher costs of borrowing. Inevitably, this will help slow down the economy in the short and medium term.

GDP Growth

The Indonesian economy recorded a GDP growth of about 5.8% in 2013 which is a slight drop from 2012 recorded 6.2%. In essence, this can be considered quite an achievement since most Western economies are growing at less than 3%. But what is reported is the nominal GDP meaning it hasn’t taken into consideration the inflation rate. To obtain the real GDP, the nominal GDP will have to minus the inflation rate. Indonesia recorded a slowest growth in its GDP in 2013 (5.78%) since 2009. This is mainly due to the rise of the inflation rate in the past few months as seen above. Thus it can be concluded that the Indonesian economy is experiencing a negative growth rate.

Conclusion

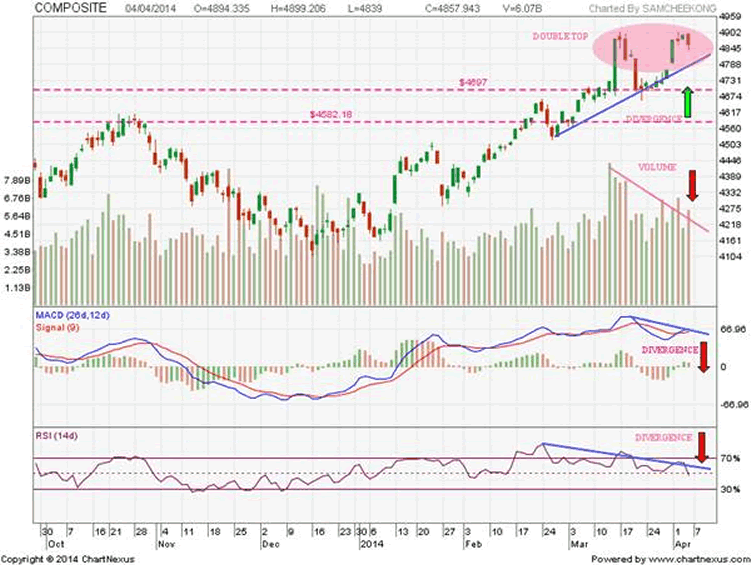

The recent run-up of the Jakarta Stock Exchange has nothing to do with the so-called improving fundamentals although recently the Indonesian Government announced that they are running a trade surplus. These are part of election gimmicks designed to boost the popularity of the incumbents. The following is the Jakarta Composite Index from October 2013 till April 2014. If you are a sharp investor, a glimpse will tell you that the chart is in trouble. Why is it so?

Firstly, the ticker price and indicators are already showing divergence. The JCI kept going up while both the MACD and RSI indicators kept going down. This shows weakness in the trend and it is about to turn very soon.

Secondly, the current rise in the Composite index is not being followed through with much confidence as volume keeps tapering off. Lack of volume shows there is a lack of commitment from investors and distribution is also underway. Thus, it can be concluded that smart money are already on the way out.

Thirdly, It seems like a double top is forming and with heavy volume. It coincides with the panic sell level that was set way back in June 2013. The panic sell level will act as the resistance and will prevent the market from going any higher. Unless the market overcomes the resistance with heavy volume, it will risk heading for a correction next week. Looking at the volume traded for the past few weeks a sharp correction will be in the offering very soon.

Thus, what we are seeing in the Indonesian scenario is where we are witnessing how a bad economy is support a strong stock market. Needless to say, such a scenario is not sustainable in the short and medium term. I reckoned the Jakarta Stock Exchange will have a rather large correction as soon as next week.

by Sam Chee Kong

cheekongsam@yahoo.com

© 2014 Copyright Sam Chee Kong - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.