How will Gold respond to global Deflation?

Commodities / Gold and Silver 2014 Apr 09, 2014 - 12:52 PM GMTBy: Clif_Droke

With economies slowing down in China, Japan, Eastern Europe and other regions of the globe, many investors wonder if 2014 will deliver another global deflationary epidemic. As I’ll explain in this commentary, the next six months has the potential to be the most exciting period for investors since the 2010 financial crisis in Europe.

With economies slowing down in China, Japan, Eastern Europe and other regions of the globe, many investors wonder if 2014 will deliver another global deflationary epidemic. As I’ll explain in this commentary, the next six months has the potential to be the most exciting period for investors since the 2010 financial crisis in Europe.

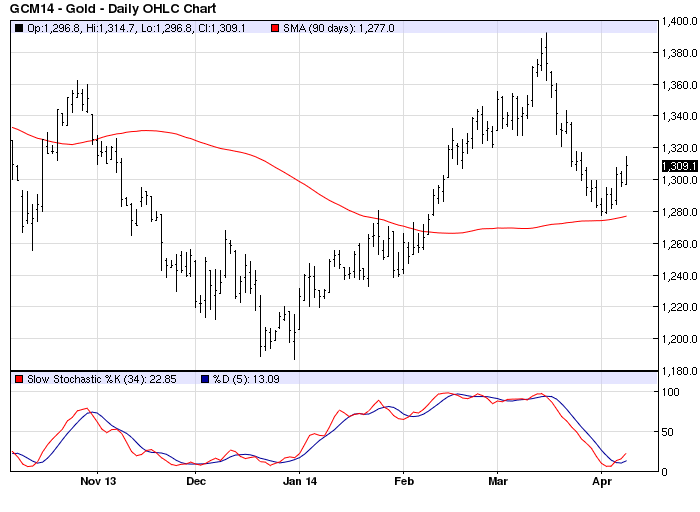

After the disappointment of last week’s European Central Bank (ECB) meeting, investors continue to wait in vain for a policy shift announcement from the bank’s president Mario Draghi. Without a major news headline to sink its teeth into, the gold price has been slowly hovering above its recent low of $1,280 after finding support above its 90-day moving average.

Meanwhile the European Union’s producer price index dropped 0.2% in February and was down 1.7% year-on-year, as reported Wednesday. The year-over-year decline was the largest since late 2009 and is part of a growing body of evidence that deflation is rearing its ugly head in Europe and in other regions of the globe. “The PPI report puts more pressure on the ECB to ease its monetary policy in order to jumpstart economic growth in the EU,” according to Jim Wyckoff of Kitco News. Yet the ECB’s Draghi refuses to act to head off the growing specter of deflation.

The Markit data firm has reported that the EU’s composite purchasing managers index fell to 53.1 in March from 53.3 in February. A reading above 50.0 suggests expansion. The survey said businesses reduced their prices for the 24th month in a row, however, further underscoring the increasing deflationary pressure.

Larry Elliott of The Guardian observed that Draghi rejected the International Monetary Fund;s call for immediate action to combat growing deflationary pressures as the ECB has adopted a “wait-and-see approach” before taking drastic measures to stimulate growth. “Despite warnings from the fund and the Paris-based Organisation for Economic Co-operation and Development of the risks to the eurozone's fragile recovery,” wrote Elliott, “the ECB president said it was still thinking about whether to embrace the unconventional approach to monetary policy used by the Bank of England, the US Federal Reserve and the Bank of Japan.” It’s precisely that kind of hesitation that will allow the final “hard down” portion of the deflationary Kress cycle to bottom with maximum impact later this year. This should have definite repercussions for the gold price, as we’ll discuss later in this report.

Last week, China’s government announced a $24 billion economic stimulus plan in the form of railway construction spending. The move was in response to recent data which show a noticeable slowdown in China’s economic indicators. The country’s GDP is forecast to decline again to 7.4 per cent in 2015, even though the rest of the world is expected to recover and increase its demand for Chinese goods, according to the Asian Development Bank. Providing some perspective on the China slowdown is a graph published on Thursday by Ed Yardeni (http://blog.yardeni.com). The graph shows just how far China’s manufacturing sector has contracted recently.

Yardeni also pointed out in an earlier posting that Japan’s government is in the process of making a critical blunder, one that led to a previous bout with deflation in the 1990s. In 1997, Japan raised its sales tax from 3% to 5%, a move which caused consumer spending to plummet. “Today,” Yardeni reports, “the government is doing it again, raising the tax from 5% to 8%.”

Recent economic data in the land of the rising sun suggests deflationary pressures are returning. Household spending in Japan declined 2.5% year-over-year for February; housing starts are down nearly 13% over the past two months. Industrial production dropped 2.3% month-over-month in February.

With central banks all over the world slow to respond to the growing threat of deflation, the chances are increasing that this summer will witness another bout of global market volatility – not unlike the one that spread like wildfire in the summer of 1998. That mini-global deflationary crisis, you may recall, occurred during what was an exceptionally bullish year for the U.S. stock market and economy. It affected everything from stocks to commodities to currencies. By the time the ‘98 global deflationary wave hit U.S. shores, the Dow Jones Industrial Average topped in July and was on its way to an almost 20% drop in a 2-month period in what was one of the shortest bear markets on record.

The lesson learned back then was that deflation can spread very quickly in a reticular, interrelated global economy. And that was in 1998, a time when the 30-year cycle was still peaking. With the 30-year cycle down until October of this year, deflation won’t need much prodding at all to do its worst, especially if the world’s central banks fail to act in a timely manner.

Earlier this year, gold reaffirmed its status as a safe haven du jour when it benefited from emerging market volatility as well as geopolitical instability in Eastern Europe. At the next outbreak of global market turbulence, gold should be in a good position to once again benefit from investor uncertainty.

Kress Cycles

Cycle analysis is essential to successful long-term financial planning. While stock selection begins with fundamental analysis and technical analysis is crucial for short-term market timing, cycles provide the context for the market’s intermediate- and longer-term trends.

While cycles are important, having the right set of cycles is absolutely critical to an investor’s success. They can make all the difference between a winning year and a losing one. One of the best cycle methods for capturing stock market turning points is the set of weekly and yearly rhythms known as the Kress cycles. This series of weekly cycles has been used with excellent long-term results for over 20 years after having been perfected by the late Samuel J. Kress.

In my latest book “Kress Cycles,” the third and final installment in the series, I explain the weekly cycles which are paramount to understanding Kress cycle methodology. Never before have the weekly cycles been revealed which Mr. Kress himself used to great effect in trading the SPX and OEX. If you have ever wanted to learn the Kress cycles in their entirety, now is your chance. The book is now available for sale at:

http://www.clifdroke.com/books/kresscycles.html

Order today to receive your autographed copy along with a free booklet on the best strategies for momentum trading. Also receive a FREE 1-month trial subscription to the Momentum Strategies Report newsletter.

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.