Flash Crash, Rigged Markets - What’s the Frequency Zenith?

Stock-Markets / Market Manipulation Apr 15, 2014 - 04:00 PM GMTBy: John_Mauldin

By Grant Williams

By Grant Williams

WARNING: This week’s Things That Make You Go Hmmm... is going to run a little longer than usual, I’m afraid, so if you have some time to kill, strap yourself in for the ride.

Yes. I have read it.

For the last couple of weeks those have been the five words I have used the most — by a country mile.

The second most-used five-word combination during that time has been “I know, what a tool.”

The subject to which the first group of words pertains is, of course, Michael Lewis’s new book, Flash Boys; and the second phrase refers to a certain president of a certain exchange, who made a complete fool of himself during the fierce media debate that has surrounded the book since it burst upon the public consciousness in the space of what ironically felt like a few nanoseconds. (The particular piece to which I refer has to be seen to be believed; but if you somehow missed it, you’ll have your chance. Stick around.)

The subject to which the first group of words pertains is, of course, Michael Lewis’s new book, Flash Boys; and the second phrase refers to a certain president of a certain exchange, who made a complete fool of himself during the fierce media debate that has surrounded the book since it burst upon the public consciousness in the space of what ironically felt like a few nanoseconds. (The particular piece to which I refer has to be seen to be believed; but if you somehow missed it, you’ll have your chance. Stick around.)

Now, before we get started, let’s get a few things straight right off the BAT(s).

Firstly, I am an enormous fan of Michael Lewis’s work. I think he is an incredible storyteller with a gift for narrative worthy of a place alongside many modern greats. I have read each of his books and enjoyed them all tremendously. Michael has an ability to weave complex subject matter into a tapestry that can be understood and enjoyed by many who might otherwise find such material utterly incomprehensible.

Secondly, I am no expert in high-frequency trading, but I have had some experience of it in recent years; and I have spent some considerable time analyzing it from a business perspective, which has given me a reasonable understanding of its mechanics.

Thirdly, whilst I have limited direct experience of HFT, I DO have almost thirty years’ hands-on experience of equity, bond, and commodity markets in the US, UK, Singapore, Hong Kong, Australia, and Japan, as well as in another dozen or so countries across Asia Pacific; and having watched markets of all types move in strange ways for seemingly no reason until, a few moments later, the cause of the move revealed itself, I feel I have developed enough of an understanding about how the markets work and, perhaps more importantly, about the people who MAKE them work, to venture an opinion or two about the subjects raised by Michael Lewis inFlash Boys.

But before we get to the book that is on everybody’s Kindle, we’re going to turn to sport for a little lesson. Let’s go back in time to Game 6 of the American League Championship Series between the Boston Red Sox and the New York Yankees in 2004, and recall the actions of another “Flash Boy,” Alex Rodriguez, the Yankees’ star third baseman.

Now, at this point, I’m sure the thousands of non-baseball fans amongst you are tuning out in your droves; but in order to try to keep you engaged, let me also tell you a parallel story from the football (or “soccer,” if you must) 2002 World Cup in South Korea, a tale that features one of its brightest stars of that era, the Brazilian midfielder Rivaldo ... and some decidedly unsavory antics.

Let’s see how we get on with this whole parallel story thing, shall we? I know Michael Lewis would do a phenomenal job of weaving the two stories together. Me? I’m not so sure...

Deep breath.

In 2002, Rivaldo Vitor Borba Ferreira was a footballer at the very top of the world game. He had helped Brazil reach the final of the 1998 World Cup (where they lost to France), and four years later he was one-third of the renowned “Three Rs,” alongside Ronaldo and Ronaldinho (sadly NOT referred to as “the Two Ronnies”), who spearheaded the dynamic Brazilian team that was rightly installed as the prohibitive favourite to win the trophy that year.

In Brazil’s opening game against Turkey on June 3rd, Rivaldo scored a goal in the 87th minute to give Brazil a 2-1 lead with only three minutes to play, and was on his way to earning the Man of the Match award (think “MVP,” baseball fans). With seconds of added time left, Brazil won a corner, which Rivaldo wandered across the pitch to take at a pace which could, at best, be described as “lacking a degree of urgency.” The ball was at the feet of Turkish defender Hakan Ünsal, who most certainly WAS in a hurry...

(Cue Michael Lewis-like change of scene to increase the dramatic tension.)

Game 6 of the 2004 ALCS, played at Yankee Stadium on October 19, 2004, had urgency to spare, as the Boston Red Sox, having lost the first three games of the series to their hated rivals from New York, needed a win to tie the series at 3 games each and force a Game 7 decider, which would be played at The Stadium the following night. One more loss and their season was over. (No team had ever come from 3 games down to take a Championship Series.)

The Yankees were led by their talismanic third baseman, Alex Rodriguez, who had almost joined the Red Sox earlier that year after the team had suffered a heart-breaking Game 7 loss in the 2003 ALCS — to whom else but the Yankees — only to have the deal voided at the last minute by the players’ union, a move which opened the door for the Yankees to steal the highest-paid and, at the time, most prolific player in the game from under the noses of the seemingly cursed Red Sox. (You can see how that whole situation played out in the excellent ESPN short documentary The Deal).

Rodriguez had been on a tear in 2004 and would end the season with 36 home runs, 106 RBIs, 112 runs scored, and 28 stolen bases. (Soccer fans, I’d give you a comparison, but there isn’t one. Think: doing everything. Really well.) This made Rodriguez only the third player in the 100+ years of baseball history to compile at least 35 home runs, 100 RBIs, and 100 runs scored in seven consecutive seasons (joining two other players with names that even soccer fans would know [kinda]: Babe Ruth and Jimmie Foxx). (No, NOT the actor who won an Oscar for Ray, soccer fans.)

During the playoffs, Rodriguez had dominated the Minnesota Twins, batting .421 with a slugging percentage of .737. (Soccer fans, let’s face it, baseball owns statistics. You got nuthin’. Nuthin’. Take it from me, Rodriguez was Messi with a bat.) He had also equaled the single-game post-season record by scoring five runs in Game 3 as the Yankees seized a 3-0 lead.

But in Game 6, Messi with a bat was about to get messy with at-bats as his form deserted him and he found himself at the plate in the 8th inning, facing Red Sox relief pitcher Bronson Arroyo, in the game for starting pitcher Curt Schilling, who had battled heroically through seven innings with a torn tendon sheath in his right ankle.

With the Yankees down 4-2 and team captain Derek Jeter on first base, Rodriguez represented the tying run...

On that steamy night two years prior, in a purpose-built stadium in Korea, Rivaldo stood by the corner flag, hands on his knees, waiting oh so patiently for the clock to run down Ünsal to pass the ball to him. The fans whistled their derision at the Brazilian’s delaying tactics. Sadly, time wasting in such situations is commonplace in football, and though the referees are obliged to add additional seconds to negate these tactics, they seldom do so effectively.

Ünsal was no doubt frustrated at the Brazilian’s gamesmanship and kicked the ball towards him at some pace in an attempt to speed things up.

Rivaldo flinched and tried to turn away from the incoming ball, which struck him roughly two inches above his right knee.

With the linesman (baseball fans, think: third base umpire) standing no more than two or three feet from the Brazilian, Rivaldo collapsed to the ground, clutching hisface as if he had pole-axed by the incoming projectile, and writhing around as if every bone in his face had been shattered by the evil Turk.

To the astonishment of everybody in the stands, commentators from over a hundred countries, hundreds of millions of fans around the world, and, above all, Ünsal himself, the Turkish player was shown a red card and sent off (baseball fans, think: ejected) for his “crime.”

Rivaldo, having made a miraculous recovery, took the resulting corner, and Brazil held on against the ten men of Turkey for the victory.

Back in the Bronx, with the count at 2-2 (soccer fans, that’s two balls and two strikes, which means... oh, to hell with it. Baseball is so much trickier to explain. From here on in, you’re on your own), Alex Rodriguez swung his bat, made contact with Arroyo’s pitch, and sent it bobbling down the first-base line. As soon as he hit it, Rodriguez set off in a furious foot race that he had absolutely no chance of winning as he tried to beat the ball to first base. He knew it. We knew it.

Sure enough, Arroyo, with a head start, got to the ball first and took the two or three steps necessary to tag the Yankee with the ball (before he reached first base, which would render him “out” and send him back to the dugout, bringing the Yankee inning closer to an end).

However, as he reached out to tag Rodriguez, the ball spun loose from Arroyo’s glove and bobbled into right field, keeping the play alive and letting Jeter score from second and throw the Yankees a lifeline.

Rodriguez continued to second base, where he stopped, called time out, clapped his hands, and whooped.

Cue pandemonium.

Everybody in the stadium — except the first-base umpire ... and presumably the millions at home — had seen Rodriguez intentionally slap the ball from Arroyo’s glove, a move which in baseball parlance is known as “cheating.” (Soccer fans, think: cheating.)

After a strong protest from Red Sox manager Terry Francona and a lengthy consultation among the various umpires, justice was done. Rodriguez was called “out,” Jeter was returned to second base, and the score remained 4-2.

The Red Sox would go on to win the game and, the following night, become the first team in baseball history to win a series after losing the first three games. They would go on to defeat the St. Louis Cardinals 4-0 in the 100th World Series (soccer fans, think: national championship with no “world” connotation whatsoever) and to vanquish a famous “curse” that had persisted for 86 years.

Now, armed with that background, watch these two defining moments HERE and HERE.

In the aftermath, both players were defiant. Rivaldo, amazingly, tried to paint himself as the victim:

(BBC): Rivaldo had admitted fooling the referee by clutching his face after Ünsal kicked the ball at his leg while he was waiting to take a corner in the closing moments of the Group C match.

But he shrugged off the fine and defended his faking as part and parcel of the game.

The 30-year-old said: “I’m calm about the punishment.

“I am not sorry about anything.

“I was both the victim and the person who got fined.

“Obviously the ball didn’t hit me in the face, but I was still the victim. I did not hit anyone in the face.”

... whilst Rodriguez was, for some reason, “perplexed”:

(NY Times): Alex Rodriguez was standing on second base when the umpires decided that he did not belong there. He folded his hands atop his helmet and screamed, “What?’’

He was, to use his word, perplexed.

After the game, Yankees Manager Joe Torre demonstrated that, when it comes to seeing important plays that go against your team, there is one thing common to both soccer AND baseball: the unreliability of a manager’s eyesight. These guys see EVERYTHING that goes against their team perfectly but somehow always seem to be curiously oblivious when the shoe is on the other foot:

(NY Times): “Randy Marsh was closer than anyone else, and it looked like there were bodies all over the place,’’ Torre said, referring to the fact that first baseman Doug Mientkiewicz was near the play. “There were a lot of bodies in front of me, so I can’t tell you what I saw. I was upset it turned out the way it did for a couple of reasons.”

Presumably neither of those reasons involved the fact that the call was right.

Anyway, the point of these two stories as they pertain to Flash Boys is this:

Both Rodriguez and Rivaldo knew there were dozens of TV cameras on them. They knew there were millions of pairs of eyes on them around the world, and they knew that they were being watched by officials charged with monitoring the games to ensure fairness and punish malfeasance — and yet, knowing all that to be true, they both instinctively cheated to try to gain an edge.

That is how they, as competitors, are wired. Whether it’s right or wrong is irrelevant. (It’s wrong, in case you were wondering.) They were both given a set of rules within which to play, and both chose to step outside those rules in the hope that they would get away with it.

Rivaldo did, Rodriguez didn’t.

It’s a fine line, but the reward for success — even if it does involve bending the rules — is considerable.

Lewis’s media blitz began on Sunday night with an appearance on 60 Minutes, and in answering a simple opening question with a typically florid response, he sparked a media storm the likes of which I haven’t seen in a long, long time.

Steve Kroft: What’s the headline here?

Michael Lewis: Stock market’s rigged. The United States stock market, the most iconic market in global capitalism, is rigged.

Those words sent financial anchors on CNBC and Bloomberg TV into a state of apoplexy at the mere suggestion that the playing field in financial markets is anything but scrupulously fair.

As I watched the circus unpack its tents, erect them, and send a parade of clowns careening into the ring, I was genuinely baffled at what I was seeing.

The first act was Bill O’Brien, the president of BATS (one of the exchanges which, according to Lewis’s book, offers an unfair advantage to high-frequency traders), going toe-to-toe on CNBC with the hero of the book, Brad Katsuyama, once of RBC and now the founder of IEX, an exchange dedicated to leveling the playing field for the average investor.

Until last Sunday, I had never heard of either man, nor had I ever seen them in action.

What followed was extraordinary.

If you haven’t seen the clip, you can (and should) watch it HERE, because excerpts from a transcript cannot do justice to either the defensiveness of O’Brien or the cool confidence of Katsuyama; but from the off, had it been a fight, it would have been stopped before one of the participants embarrassed himself any further:

(CNBC):O’Brien: I have been shaking my head a lot the last 36 hours. First thing I would say, Michael and Brad, shame on both of you for falsely accusing literally thousands of people and possibly scaring millions of investors in an effort to promote a business model.

Bob Pisani (to Katsuyama): You are very respected on the street. I have known you a little while. You are thought very highly of. Do you think the markets are rigged?

Katsuyama (calmly): I think it’s very hard to put a word on it...

O’Brien (animatedly): He said it in the book. You said it in the book. “That’s when I knew the markets were rigged.” It’s disgusting that you are trying to parse your words now. Okay?

Katsuyama (calmly): Let me walk you through an example...

O’Brien: It’s a yes or no question. Do you believe it or not?

Katsuyama (calmly): I believe the markets are rigged.

O’Brien (somewhat triumphantly): Okay. There you go.

Katsuyama (calmly): I also think that you are part of the rigging. If you want to do this, let’s do this.

From there, Katsuyama proceeded to ask O’Brien how his own exchange (the one he, O’Brien, is president of) prices trades:

O’Brien: We use the direct feeds and the SIP (Securities Information Processor) in combination.

Katsuyama: I asked a question. Not what you use to route. What do you use to price trades in your matching engine on Direct Edge?

O’Brien: We use direct feeds.

Katsuyama: No.

O’Brien: Yes, we do...

Katsuyama: You use the SIP.

O’Brien: That is not true.

From there, O’Brien made the most successful attempt to make himself look a fool that I think I have ever seen (and on CNBC, that’s saying something). It was, I thought, painfully embarrassing to watch.

In my head, all I could hear was Sir Winston Churchill’s booming voice:

“Never engage in a battle of wits with an unarmed man.”

Less than 24 hours later...

(Wall Street Journal): BATS Global Markets Inc., under pressure from the New York Attorney General’s office, corrected statements made by a senior executive during a televised interview this week about how its exchanges work.

BATS President William O’Brien, during a CNBC interview Tuesday, said BATS’s Direct Edge exchanges use high-speed data feeds to price stock trades. Thursday, the exchange operator said two of its exchanges, EDGA and EGX, use a slower feed, known as the Securities Information Processor, to price trades.

Viva El Presidente!

Anyway, the interesting thing to me, once I got past the sheer insanity of it all, was the level of amazement shown by the CNBC journalists that the market could possibly be “rigged” in any way, shape, or form.

That amazement was shared by the two anchors on Bloomberg’s Market Makers show, Stephanie Ruhle and Eric Schatzker, when their turn came to take a tilt at Lewis the following day:

Ruhle (bewildered): The market is rigged? That’s a big claim!

Lewis (even more bewildered): Well it IS rigged. If you read the book, I don’t think you’d put it down and say the market’s not rigged.

Then, after a pretty good casino analogy that was interrupted by the anchors a few times, Lewis got to the crux of the issue that had been bothering me as I watched:

Lewis: Why are you so invested in the idea this is fair? Why are you even arguing about this? It’s so clear... people are front-running the market. There’s plenty of evidence in the book.

Schatzker: Their orders are being “anticipated.”

Lewis (laughing at the escalating absurdity): Anticipated and run in front of.... [The HFTs] PAY to execute the orders. Tens of millions of dollars a year. Ask yourself THAT question. Why would ANYONE pay for the right to execute someone else’s stock market order?... It’s quite obvious. That order is an opportunity to exploit, because he has advance information about the pricing in the stock market. Is that “fair”?

Ruhle: Today, when I go to execute a stock, I feel like, man, how did that get jacked right in front of me, every time? I do feel that way. But fifteen years ago when I did a trade, I was paying significantly more to do it through a specialist because of what the fees were.... Is it a different situation than when specialists were on the floor?

Lewis (with a somewhat confused look on his face): I never said THAT.

Ruhle: So has the system ALWAYS been rigged?

Lewis: Yes.

Yes.

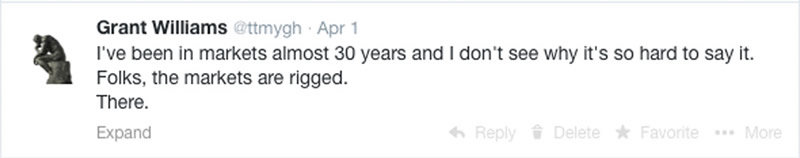

After watching these exchanges, I was so astounded that so many people could STILL live in a complete fantasy world under the illusion assumption that the markets couldn’t possibly be rigged that I turned to my friends in the Twittersphere:

That was the 2,567th tweet I have sent out and, in contrast to the nearly pathological indifference shown by the rest of the world to the previous 2,566, this one was retweeted 96 times. (Button it, Bieber! That’s an impressive number for me, OK?)

But who are these people who believe in unicorns and rainbows fair markets?

Click here to continue reading this article from Things That Make You Go Hmmm… – a free weekly newsletter by Grant Williams, a highly respected financial expert and current portfolio and strategy advisor at Vulpes Investment Management in Singapore.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.