Gold And Silver - Gann, Cardinal Grand Cross, A Mousetrap, And Wrong Expectations

Commodities / Gold and Silver 2014 Apr 20, 2014 - 12:49 PM GMT W D Gann has long been recognized as an astute market trader, and followers of Gann have been trying to figure out his genius. The best way to describe how he made so many successful market calls is, in a word, astrology. Having died in 1955, we did not know him, but we were fortunate enough to have met and befriended his assistant, Robert Courter. He, too, has since died, but he confirmed what many who study Gann know, that William Delbert Gann was an extraordinary astrologer, exceptional.

W D Gann has long been recognized as an astute market trader, and followers of Gann have been trying to figure out his genius. The best way to describe how he made so many successful market calls is, in a word, astrology. Having died in 1955, we did not know him, but we were fortunate enough to have met and befriended his assistant, Robert Courter. He, too, has since died, but he confirmed what many who study Gann know, that William Delbert Gann was an extraordinary astrologer, exceptional.

The Square of Nine, the Circle of 360, his Hexagon, and Master Charts were all based on astrology. He did not openly admit that in his newsletters and writings, but he often mentioned "wheels within wheels," which was how the planets revolved around the Sun. Most people believe astrology to be akin to reading tea leaves or using a Ouija board, and he did not want to be put into that category.

We will not get into astrology and the markets, but we have observed direct correlations between planetary movements and price action in stocks and futures. Not being astrologically adept, we leave it to others but acknowledge its validity. The point in mentioning Gann and astrology is next week's big astrological event, a Cardinal Grand Cross.

Between April 20th through April 23rd, there are four days of supreme astrological intensity. They are bookended by the Full Lunar Eclipse, just passed on the 15th, and an Annular Solar Eclipse on the 29th. [Anyone can do an internet search to understand some of the terms below, like we just did to find out what a Blood Moon is.]

Essentially, on 23 April, Pluto will be 180 degrees, [opposite] from Jupiter, and Mars will be 180 degrees from Uranus. All will be in the 13th degree of their respective Sun signs, forming a cross shape, thus the Cardinal Grand Cross. As the term implies, "opposition," usually entails a major polarizing effect.

What can happen? The Ukrainian situation igniting that leads to war would be one example. Anyone interested can look up more. We just wanted to mention it because it could have an impact on world events, and to let people that from an astrological view, it was known ahead of time. [Not a specific event, but the basis for one.]

Gann was mentioned to tie in a highly respected market guru with market astrology. Plus. we have witnessed market moves that were known to be timed to planetary aspects, in advance, and as recently as last week.

■4/15. Full Lunar Eclipse aka a 'Blood Moon' (4 consecutive Blood Moons throughout 2014 and 2015)

■4/20. Easter Sunday (Roman Catholic & Eastern Orthodox)

■4/20. Uranus squares Jupiter

■4/20. Pluto opposes Jupiter

■4/20. T-square peaks: Jupiter-Uranus-Pluto

■4/21. Uranus-Pluto square (#5 of 7)

■4/21. Grand Trine peaks: Venus-Jupiter-Saturn

■4/22. Jupiter squares Mars

■4/22. GRAND CROSS PEAKS: MARS-JUPITER-URANUS-PLUTO (2014's most powerful astrological event!)

■4/23. Uranus opposes Mars

■4/23. Pluto square Mars

■4/23. T-square peaks: Mars-Uranus-Pluto

■4/29. Solar Eclipse (Annular)

Source: AstroShaman.com

You would think that how the fundamentals have been so misleading to so many in the PMs community, that more would pay attention to what the market says and less to what others have to say about the markets. It is like building a better mousetrap and expecting people to come flocking to buy it, which they do not. Why not? Creatures of habit may be the simplest answer.

We see charts as the "improved mousetrap," as it were, and superior as a tool for market timing over fundamentals, or any other similar undertaking, for relating to what and when to buy in the markets. Still, there are not that many converts who pay more attention to what the market is saying. The one thing we know for sure is, regardless of whatever one has in the form of expectations, they are always subordinate to the final arbiter over price, and that is the market itself.

We make such a distinction on the daily silver chart, at the end. For now, here is our ongoing read of developing market activity for gold and silver:

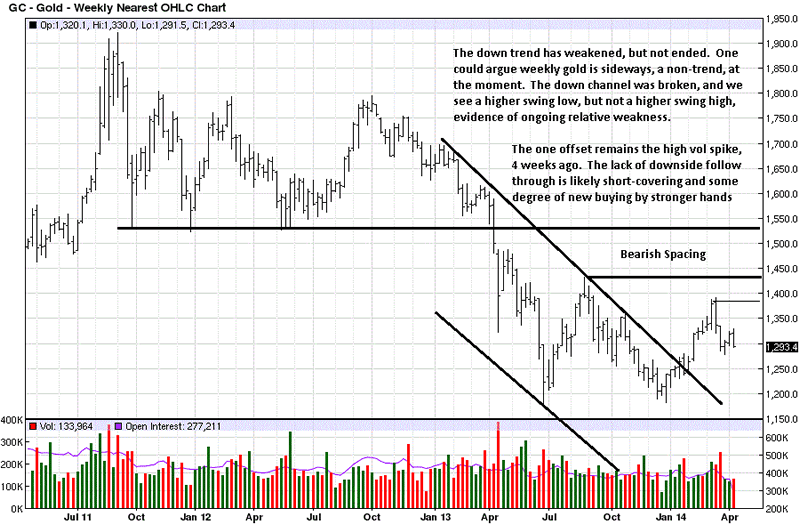

For months, we have been saying that the gold charts are not indicating a wild or even a sustained move higher. To the contrary, despite all the positive fundamentals for demand, on so many levels, price is marching to a different tune, far removed from all the known and highly constructive news about gold.

If you were to base your decision-making on news alone, one is not making any money from buying gold. Does that mean one should refrain from buying it? The best answer comes from knowing your objectives.

If you want security from the out-of-control fiat spending of all Western governments, then yes, this continues to be the time to buy gold, [and silver]. In addition to the insane and unprecedented creation of "money out of thin air," world-wide events are turning darker and darker. Gold and silver remain one of the best means for attaining financial peace of mind, and one of the best forms of wealth preservation. In this regard, price is of no consequence. Ownership is. Stay the course.

There is ample evidence that your own government sees any money you hold in banks as theirs for the taking, [Cyprus, Greece, Ireland]. Rules, laws, statutes are already in place to have your funds confiscated, if you [wrongly] believe that it cannot happen to you. Both in the US and UK, at a minimum, there have been several published stories about people's safety deposit boxes raided for their gold and silver contents.

If you do not want to be subjected to what is going on, and will surely only get worse and more widespread, than yes, buying gold and silver makes sense, not to make money, as an incorrect measure in the short-term, but to be safe and secure in protecting what you already have from being confiscated, in some manner. Obviously, owning and holding PMs means you do not keep it in some bank or [not so] safe deposit box.

If you want to be profiting from owning gold, [and silver], then no, now is not the time to be committing to the long side, in general. That is more of a function of trading, and futures and options are the typical choices. We do not trade options, so they are never a topic of the charts we discuss.

The best we can say about gold is that it may be transitioning from its protracted down trend. The signs that gold remains under pressure are still there, bearish spacing, lower swing highs, etc, and that means any buying has to be very select, or not at all, again, profit being the only objective.

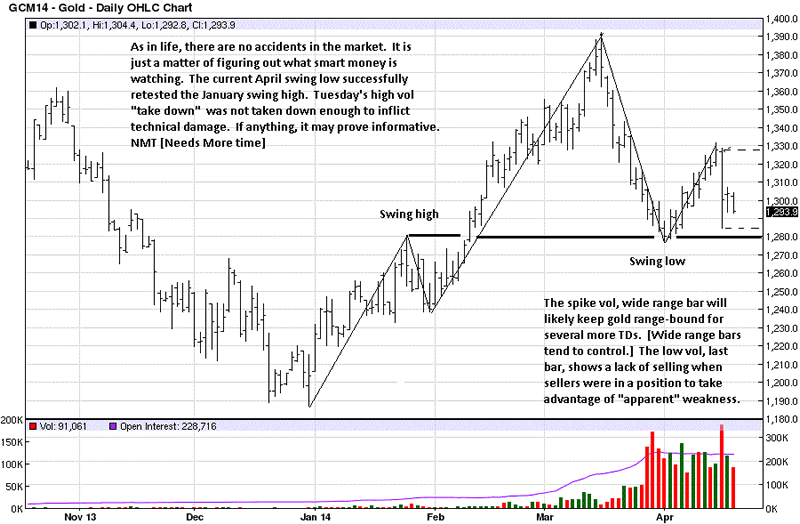

The chart comments are apt, and we will add that in addition to the high volume from four weeks ago, the very small range bar, at the low, supports the prospects that the bottoming process continues with increasing positive signs. That can change next week, if the market were to make lower lows, but unless and until that kind of event happens, we can only draw conclusions from facts that are known, and not from what may or may not happen.

For whatever reason that it happened, last week's wide range bar down on sharply higher volume may contain price activity for the next several TDs, [Trading Days]. Look at the wide range bar lower, at the beginning of April, in the weekly chart above. It captured price within its range for the next 7 trading weeks. Then, at the end of April, same chart, there were two large bars down, and with the exception of a brief rally above the first of those two bars, price has been trading with their range for the past year!

Because price closed well off the low of last Tuesday's sell-off, the sharply higher volume, and price at important support, tells us buyers are defending the 1280 area as support.

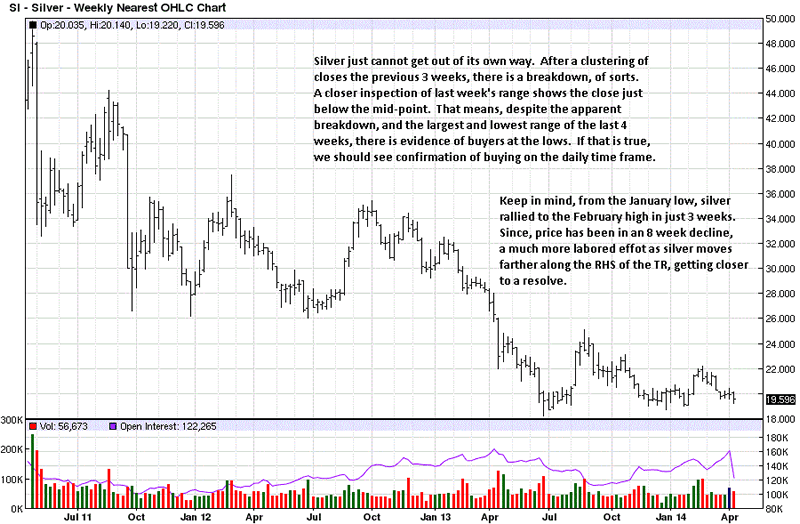

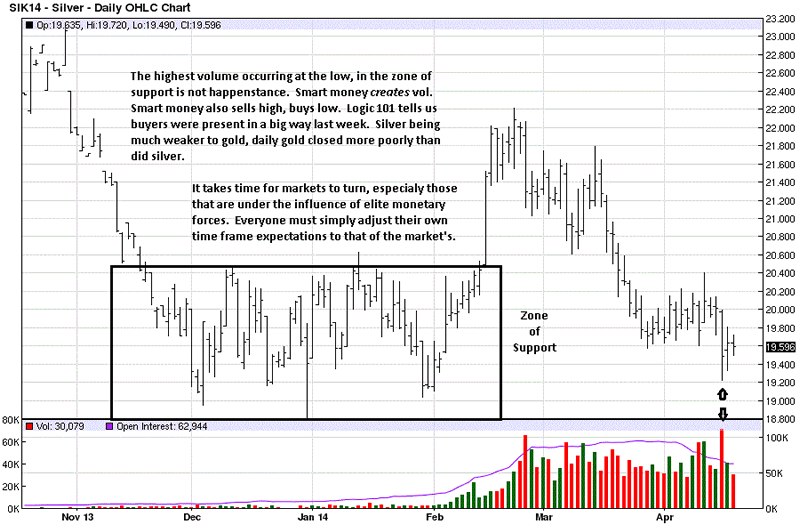

Silver keeps trying. It is like the Little Engine That Could: "I think I can, I think I can..." One day, now sooner than later, it will move higher and get over the hill. As you view the daily chart, you can see price moving farther and farther along the RHS, [Right Hand Side] of the ongoing TR, [Trading Range]. The farther along price moves on the RHS, the closer it gets to reaching a final resolve, or a breaking free of the TR. That it is occurring at such a low-level, and at important support, an upside breakout is more likely. However, it is still possible for one more move lower to totally wash out weak hands and trigger sell stops, at the same time.

Combined with comments on the weekly TR, you can see that silver just had a break to the downside of its recent little TR. We see it as a positive development because of how it happened: wide range, highest contract volume, close off the low, and no downside follow-through for next two TDs.

Forget about your own expectations for higher prices, at least in the sense of wanting higher prices as soon as possible. It is the market that determines where price trades and for how long. Higher prices are coming! This is where all the developing fundamentals are put into a context, but the timing for when price will justify the fundamental expectations is determined by market activity. That activity, as just described, and as we have been saying for over a year, is saying, quite clearly, neither silver nor gold are showing evidence of an imminent move higher.

Adjust your expectations to what the market is saying, and you will lower your anxiety level for disappointment and align yourself for what is. The definitions of is is that which is going on, right now, and not what is in your own mind, re gold and silver.

By Michael Noonan

Michael Noonan, mn@edgetraderplus.com, is a Chicago-based trader with over 30 years in the business. His sole approach to analysis is derived from developing market pattern behavior, found in the form of Price, Volume, and Time, and it is generated from the best source possible, the market itself.

© 2013 Copyright Michael Noonan - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Michael Noonan Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.