Stock Market Smart Money – All Out or More to Go?

Stock-Markets / Stock Markets 2014 Apr 21, 2014 - 04:20 PM GMTBy: PhilStockWorld

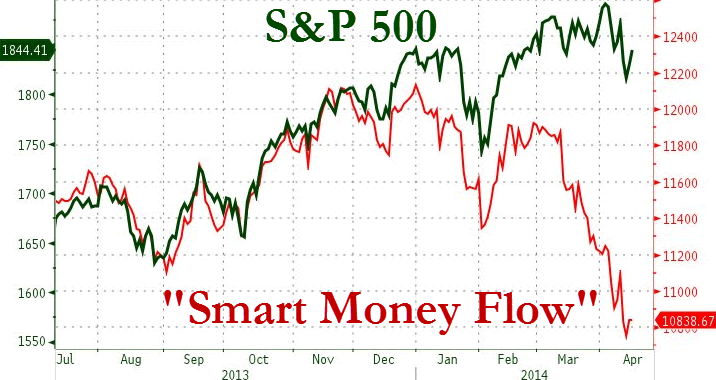

This has been the flow of Bloomberg's "Smart Money Flow Indicator" and, as Zero Hedge wonders: Just who is soaking up what the smart money is selling? Company Buybacks, Johnny 5 (tradebots) or the Greater-Fool Retail Investors?

This has been the flow of Bloomberg's "Smart Money Flow Indicator" and, as Zero Hedge wonders: Just who is soaking up what the smart money is selling? Company Buybacks, Johnny 5 (tradebots) or the Greater-Fool Retail Investors?

What is clear is the institutional investors, the so-called "smart money" are dumping shares like there's a crash – only there isn't any apparent crash – the indexes are pretty much holding on fine, making their losses back on low-volume days while steadily selling off on higher-volume days, which needs to a massive net outflow of "smart money" replaced by a steady supply of "dumb money".

Of course, there's no money dumber than the Fed, who buy and buy and buy and buy and then, when it's hard to remember a time when they weren't buying – they buy some more.

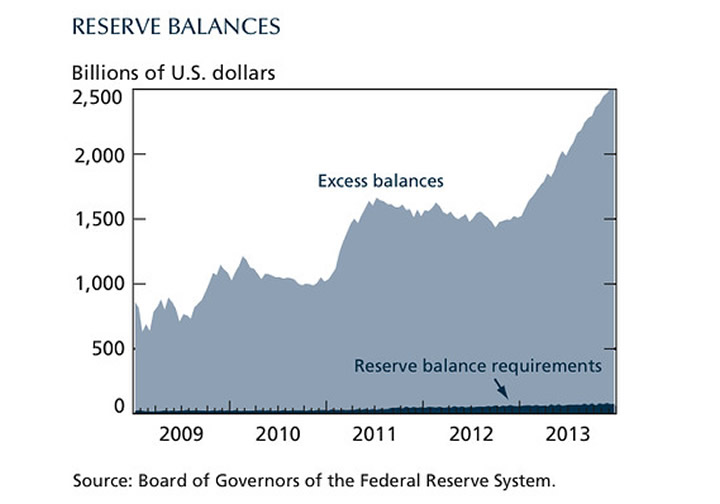

Rather than show you the Fed's $4Tn balance sheet again – let's take a look at where the money went. Oh, there it is – right in the banks balance sheets! The Fed has essentially borrowed money, on your behalf, and GIVEN it to their member banks at 0.25% interest (ie. FREE) who CLEARLY are not lending it out.

And why should they? They can simply turn around and buy TBills by leveraging their cash 10x (banks can do that) and collect 3% for 10 years X 10 = 30% while the Fed charges them 0.25% for a 29.75% annual profit on every dollar. Why then, should they lend it to you? Why should they offer you interest on your deposits when the Fed gives them all the money they want for free?

Banks USED to perform an important economic function that would save and protect your hard-earned money and your money was then lent out to other hard-working people so they could buy homes and cars and invest in businesses. Not any more, now banks only lend to Corporations and people with pristine credit (auto companies have to do their own lending), although they do let you buy things with Credit Cards that charge 12% interest plus another quarter-point to the retailer, of course.

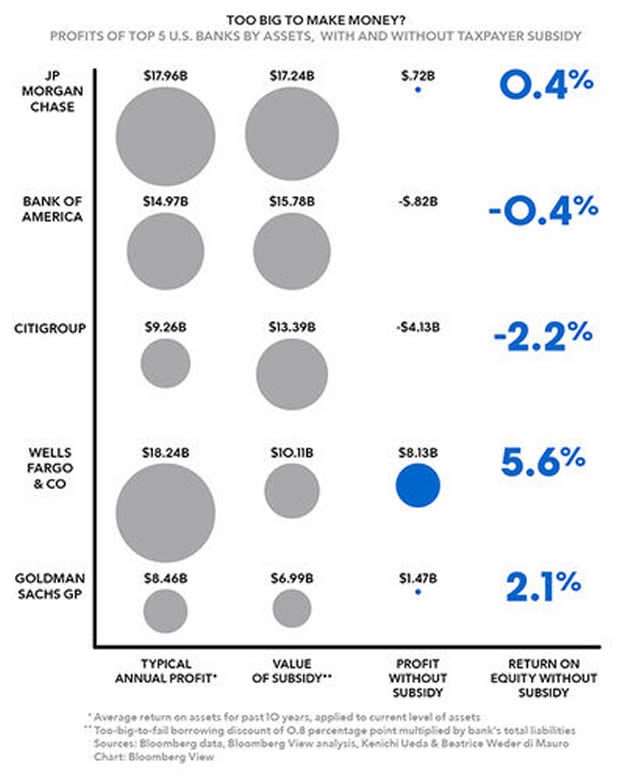

As you can see from the chart on the left (from Q1 last year), taxpayer subsidies account for essentially ALL of the Big Banks' profits. They simply wouldn't exist without us and we have it drummed into us that they are "too big to fail" so we support a system that continues to hand them tens of Billion of Dollars per month to keep them alive while, at the same time, cutting Government programs that help actual human beings survive – MADNESS!!!

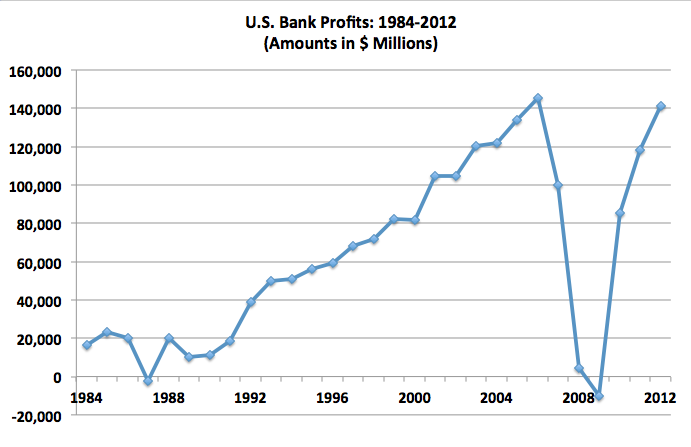

As the subsidy chart above clearly shows, the banks wouldn't be making a dime without a contstant inflow of money from the Fed and bank earnings are 1/3 of all Corporate Profits so CLEARLY, without Fed life support, our entire economy would be in obvious shambles – rather than the stealth shambles it's in now, where the bottom 80% are in a 6-year (so far) depression while the top 10% are partying like it's 1929.

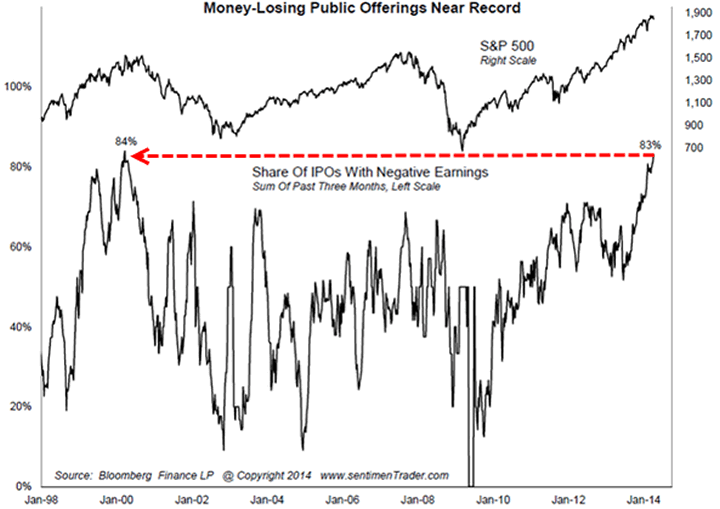

We're certainly partying like it's 1999 as we get back to the 1999 peak of 83% of all IPOs in 2014 featuring companies that have negative earnings and the money thrown at these IPO's has gone parabolic – much, much worse than it was in 1999. That's helped the Russell lead the markets for the past year, going from 800 in November 2012 to 1,200 in March – up 50% in 15 months, just like the boost in risky IPOs.

I know, I'm old (51) and cranky and I lived through the 1999 crash on the front lines so perhaps I give too much weight to it when I see the same pattern being repeated and the same mistakes being made. Perhaps I'm too cautious and I should just close my eyes and belive in the Fed Fairy to fix everything for ever and ever because THIS TIME is different and companies don't need to make money to justify giving them 20-100x valuations – you just have to BELIEVE!

We WANT to believe, really we do but we're still "Cashy and Cautious" and, unlike the people on CNBC this morning, we know Europe is actually closed today and that they are flashing last Thursday's positive market moves as if they were live and we know oil contracts roll over tomorrow and the June contracts are at $103.30 but CNBC is still showing the May contracts at $104.20, as if they were the active ones.

We'll wait for more earnings to pass final judgment but we can amuse ourselves by shorting the Nikkei (/NKD) below the 14,600 line (Shanghai fell 1.5% today, plunging into the close while Hong Kong was on holiday) – because, if you think our banks are on life support, you should check out CHINA!!!

Also, Japan's Trade Deficit jumped 400% in March as rising oil prices and lower than expected exports led to Japan's worst March Deficit – EVER! Money market watchers say Bank of Japan Governor Haruhiko Kuroda risks crippling the foundation of the nation's financial system to achieve his inflation target.

The outstanding balance of interbank lending in the so-called call market tumbled 17% this year to 14.1 trillion yen on April ll, the least since January 2003 when the central bank was conducting its first round of easing through bond purchases. The decline in trading makes the money market vulnerable to shocks in times of crisis by increasing volatility.

Can Kuroda print more Yen than Yellen can Dollars? No, he can't. Japan is already printing 10% of their GDP in bailout Dollars – that would be like the US handing $1.7Tn a year to the banks, instead of the mere $600Bn we give them now. Proportionally, Japan has us beat but, every time Janet or the other Fed heads push the tapering deadline back another quarter, the BOJ has to come up with another 3% of their GDP to compensate. They're already up to 10% – at what point is it "too much"?

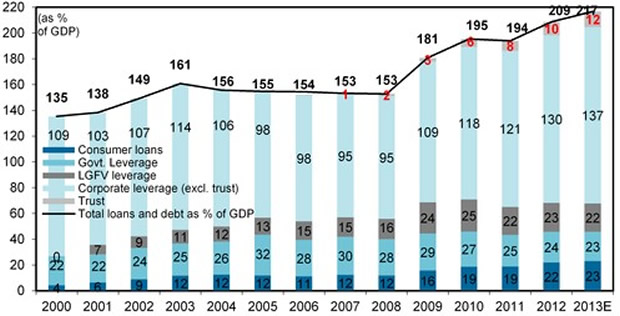

And, of course, no one knows what China is really doing but I doubt it's good. We've been watching the bad loans pile up in China and now, to prevent a panic, Premier Li Keqiang plans to introduce immediate deposit insurance to comfort the nation's savers but, in the bond market, it's being taken as a signal that there must be some banks that are about to collapse and bond rates have jumped 20% in the past year (from 2 to 2.4%). Credit default swaps are also up 10%, to 89.5 basis points as Chinese debt tops 220% of their GDP in Q1.

Sour debt at lenders increased for the ninth straight quarter at the end of last year to 592.1 Billion yuan, the highest level since 2008, data compiled by China Banking Regulatory Commission show. New non-performing loans amounted to more than 60 Billion yuan in the first two months of this year, compared with 100 Billion yuan for all of 2013, China Business News reported on April 9th, citing unidentified people in the banking industry.

Sorry to be boring but I still think it's smarter to watch and wait before we jump in and start bottom-fishing. Earnings seasons will give us plenty of opportunties to pick up companies for very nice discounts and, if not, we certainly know how to make our own discounts

Let's be careful out there!

- Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2014 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PhilStockWorld Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.