Strong U.S. Dollar Rally Could Pull Rug From Under Gold and Silver

Commodities / Gold and Silver 2014 Apr 21, 2014 - 04:40 PM GMTBy: Clive_Maund

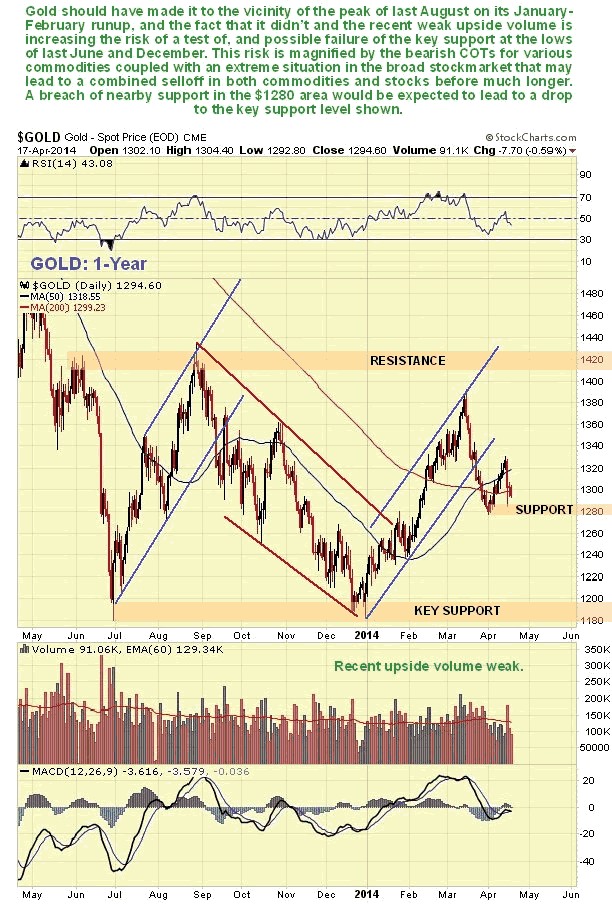

In the context of the magnitude of the rally from the December lows that preceded it, gold's reaction from its March highs, see 1-year chart below, seems like a reasonable correction, although there have been some factors indicating that this is not a normal healthy reaction, such as the high downside volume, particularly in stocks.

In the context of the magnitude of the rally from the December lows that preceded it, gold's reaction from its March highs, see 1-year chart below, seems like a reasonable correction, although there have been some factors indicating that this is not a normal healthy reaction, such as the high downside volume, particularly in stocks.

Gold was expected to make it to the resistance shown in the $1420 area, it didn't, and that's a negative, especially as the COT exploded to extreme readings at the March peak, indicating that the rally from the December lows may have been a relief rally in an ongoing bearmarket, and if it was, it implies that the price will proceed to break down beneath its lows of last June and December. Given the potential seriousness of the crisis in the Ukraine, it is surprising that gold is not doing better. Gold could turn up from the support at $1280, but if this fails, we are likely to see a retest of the lows above $1180. The volume pattern is not favorable however, as already mentioned, and nor is the general commodity COT, which we will come to later, which suggests that commodities will go down with stocks a little later in the year, in a depressing rerun of what we saw in 2008.

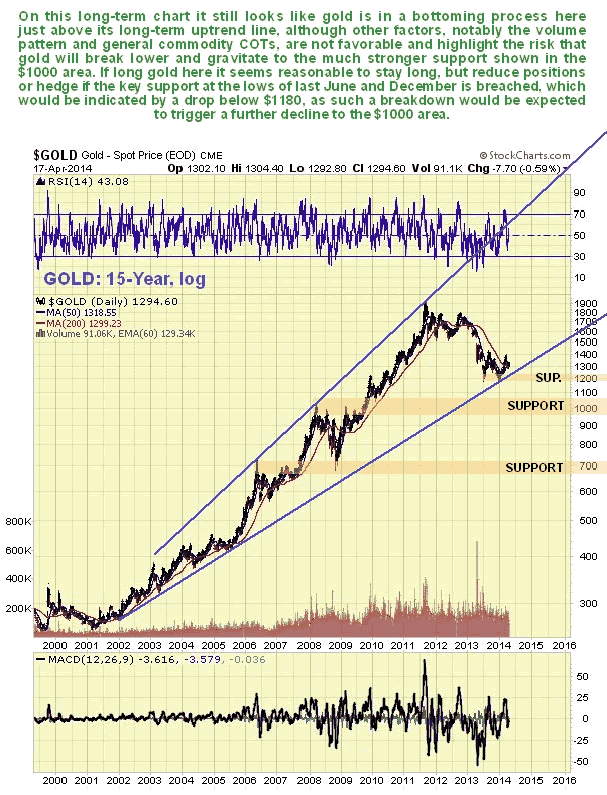

The long-term chart for gold still looks hopeful. On its 15-year chart we can see that gold still looks like it is basing above its long-term uptrend line. However if this uptrend line fails, and the nearby important support at the lows of last June and December is breached, then gold is likely to drop back to the strong support in the $1000 area. This is what Goldman Sachs is calling, and what Goldman wants it often gets, as it did a year ago, because it is an elite organization with massive power and influence. Tactically the right way to handle this is to stay long, if long, and either get out on stop if $1180 fails or hedge accordingly.

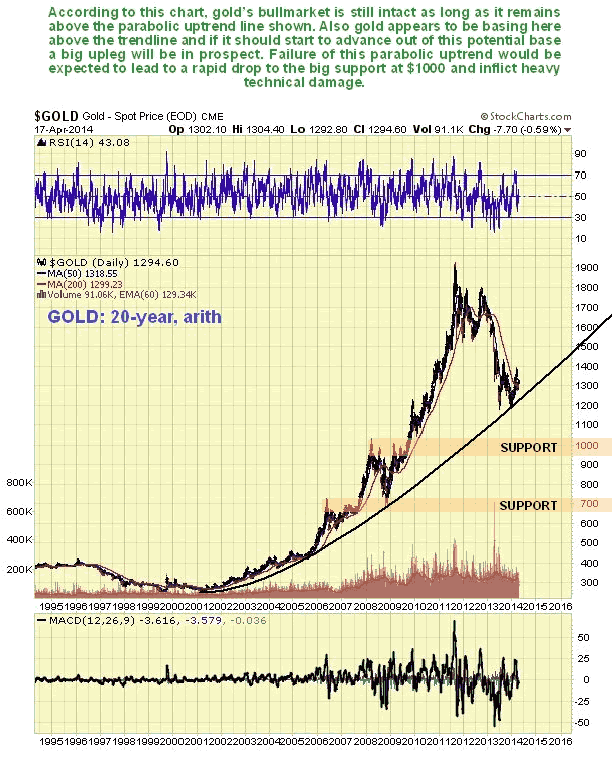

The long-term 20-year arithmetic chart for gold continues to show that this is a good point for gold to turn up, as it is still not far above its parabolic uptrend line, that could theoretically slingshot gold much higher. However, if this uptrend does fail and gold drops back to $1000, it will inflict heavy technical damage on gold, and may even imply that the world is tipping into a deflationary implosion. Massive deflationary forces are still out there, wanting as ever to correct the excesses of the past, but they are still being held at bay and worsened by insane and crassly irresponsible money printing on a scale that would certainly impress that great pioneer of inflationary excess, his imperial excellency Mr Robert Mugabe of Zimbabwe. All of this QE and global money supply expansion to avert deflation can be compared to the way the sea recedes before a tsunami, once the deflationary forces return with a vengeance, the result will be utter devastation. Once this occurs, commodities and stocks will crater.

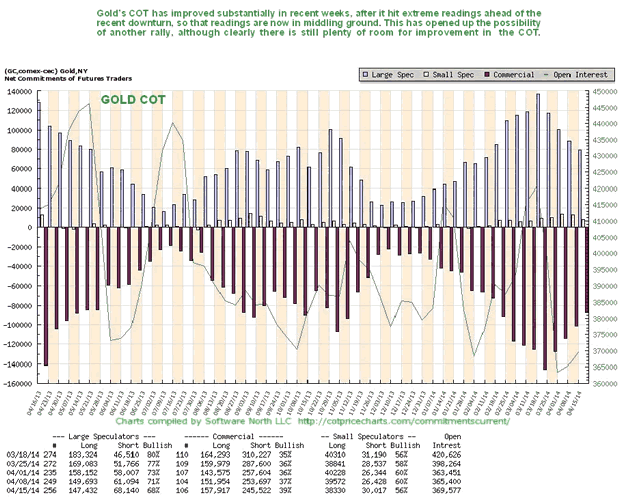

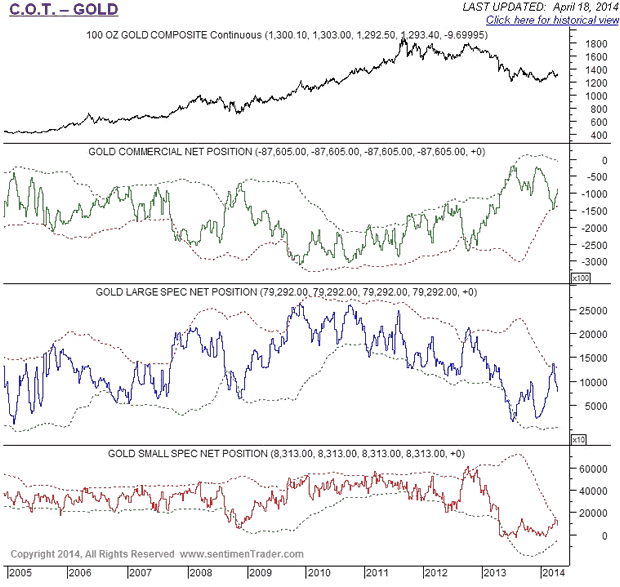

Gold COT charts have eased from their extreme readings of mid-March so that they are now in middling ground, and while this opens up the possibility of a rally, there is still considerable room for improvement on these COT charts.

Chart courtesy of www.sentimentrader.com

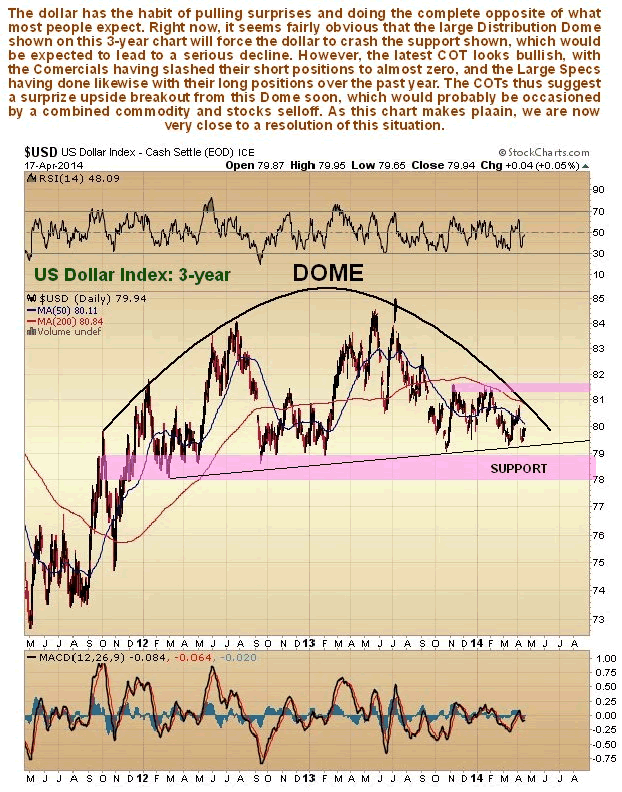

The dollar is now at a critical juncture. The view is now widespread that it will crash the key support shown on our 3-year chart for the dollar index at 78 - 79 and drop hard, which would of course be great news for gold and silver. On our chart we can see that the Distribution Dome shown looks set to force such a breakdown imminently, especially as moving averages are in bearish alignment. However, the dollar has a perverse habit of suddenly wrong footing the majority and doing the exact opposite of what they expect. So what could happen here is a surprise upside breakout from the Dome, which would be expected to lead to a powerful rally. Maybe an army of Russian gangsters will suddenly change all their rubles into dollars (lol).

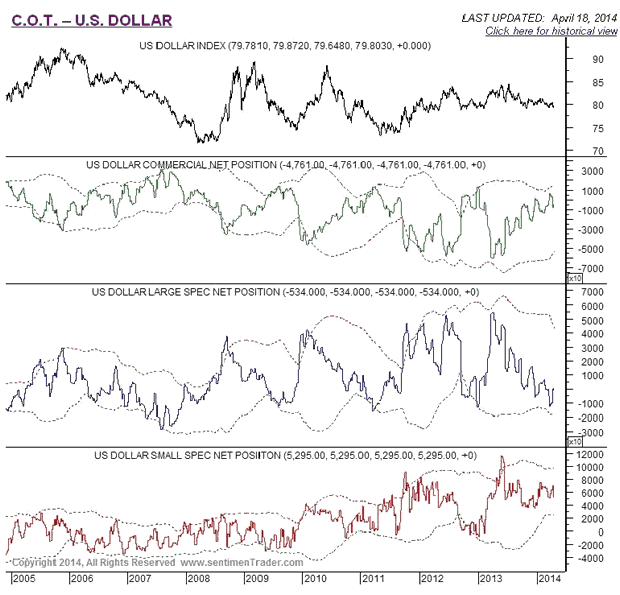

While the dollar chart does look set to break down on its charts, our suspicion that it might do the exact opposite is given credence by the latest COTs, which show that the Commercials have reduced their long positions in the dollar to a very low level, while the Large Specs have reduced their long positions to a very low level. This is bullish, and portends a probable upside breakout soon - now that will be bearish for gold and silver, and bearish for commodities generally, and we would expect for stocks too.

Chart courtesy of www.sentimentrader.com

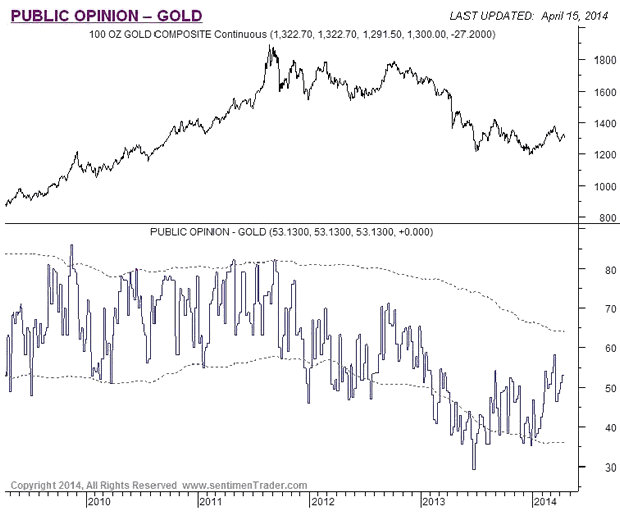

Public opinion on gold is now in middling ground, and is in itself neither bullish nor bearish...

Chart courtesy of www.sentimentrader.com

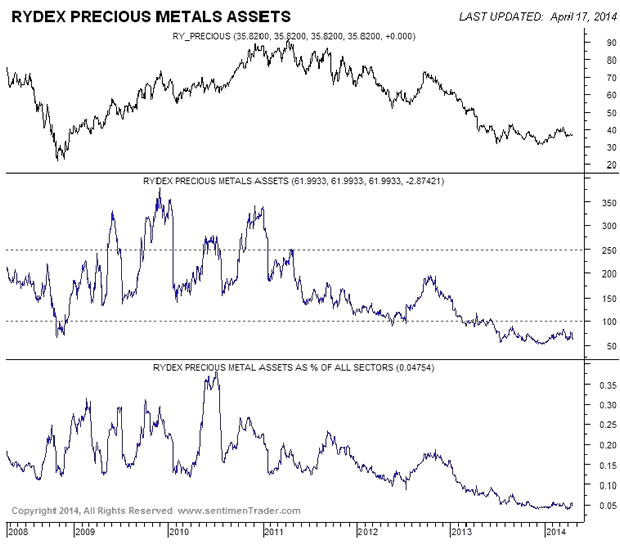

The Rydex traders have very low assets in the Precious Metals, which in itself is bullish, as they are usually wrong, but this should be weighed against all the other considerations set out here.

Chart courtesy of www.sentimentrader.com

Conclusion: if the dollar should break down soon then gold and silver are in position to start another major upleg. However COTs are indicating that instead there is a strong chance of a major dollar rally developing soon that would pull the rug out from under commodities and stocks, which would likely decline in tandem. There may be a little further upside in stocks, perhaps going into May, before this possible scenario unfolds.

By Clive Maund

CliveMaund.com

For billing & subscription questions: subscriptions@clivemaund.com

© 2014 Clive Maund - The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maunds opinions are his own, and are not a recommendation or an offer to buy or sell securities. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications.

Clive Maund Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.