Bitcoin Implications of Lack of Price Action

Commodities / Bitcoin Apr 22, 2014 - 10:31 AM GMTBy: Mike_McAra

In short: we support short speculative positions in the Bitcoin market at the moment.

In short: we support short speculative positions in the Bitcoin market at the moment.

Reuters posted an article supposedly giving some insight into how things had worked (or not worked) at Mt. Gox and providing us with Mark Karpeles’ (the CEO of the exchange) profile. We read:

Karpeles wanted to be liked, three former employees say. He bought lunch for the entire staff and spent thousands of dollars on gadgets and equipment to make the office more "fun" - exercise balls for chairs, beer steins and robots. Late last year, in the middle of increasingly strained times for Mt. Gox, he spent an afternoon putting up a hammock in the recreation room.

But staff found it galling that the boss was buying these goodies even while he refused to give pay raises. They also became frustrated as they waited for Karpeles to authorise decisions or make progress on simple tasks. Developers, stuck without direct access to the Mt. Gox source code, resorted to playing video games, people inside the company at the time say.

Employees were also concerned that Karpeles' tight grip on all company affairs was causing a bottleneck: he was the only person who could access the exchange's bank accounts and bitcoin holdings and resolve requests by traders to cash out.

Former employees say they asked Karpeles to share the passwords to Mt. Gox's bitcoin wallets in case he became incapacitated or unable to access the data. He refused, leaving him as the only person able to piece together the passwords, written on paper stored at his home, the office, and an undisclosed location.

This is not the first time we hear unfavorable accounts of Karpeles’ activities as CEO. Looking back, it seems like the exchange was fraught with problems. On the other hand, it’s easy to say so in retrospect. Right now it is obvious that Bitcoin investors using Mt. Gox’s services were not aware of the extent of troubles in which the company was.

If it was really weird to hear Mt. Gox say they had lost all the customer money, it now seems that the internal mess at the exchange might have made it possible for such an event to occur. Whether it was theft, fraud or something else remains for the Tokyo District Court to establish.

Let’s move on to the charts.

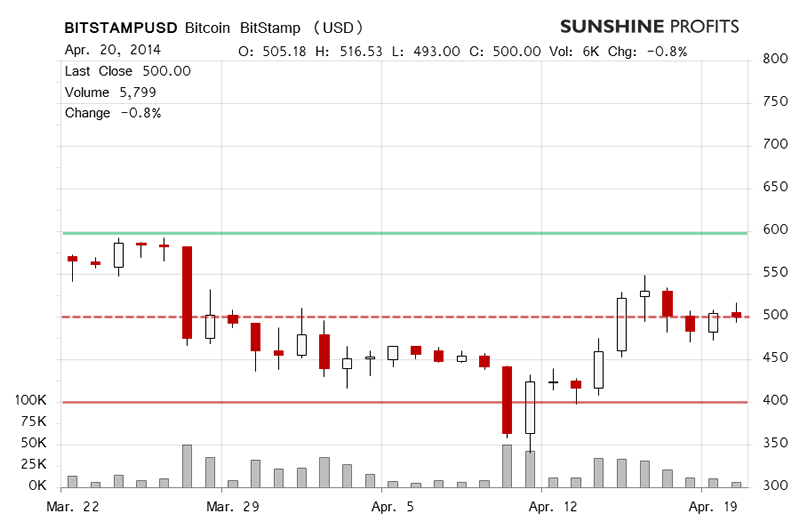

On BitStamp not much happened over the weekend. The volume was not huge and the price moves amounted to stabilization at $500 (dashed red line on the chart). The outlook remained unchanged based on the action from Friday to Sunday.

Today, we’ve seen a continuation of this trend (this is written at 7:15 a.m. EDT) with weak trading and not much happening at all. The lack of developments is a development in its own right, and what we’re seeing now is in line with what we wrote in our Bitcoin commentary on Apr. 14:

The short-term outlook remains bearish, although we might still see some appreciation. We expect it to be followed by either strong declines or a period of stagnation and, afterwards, depreciation.

Stagnation it is, but we’re still betting on a move down to follow in the near future.

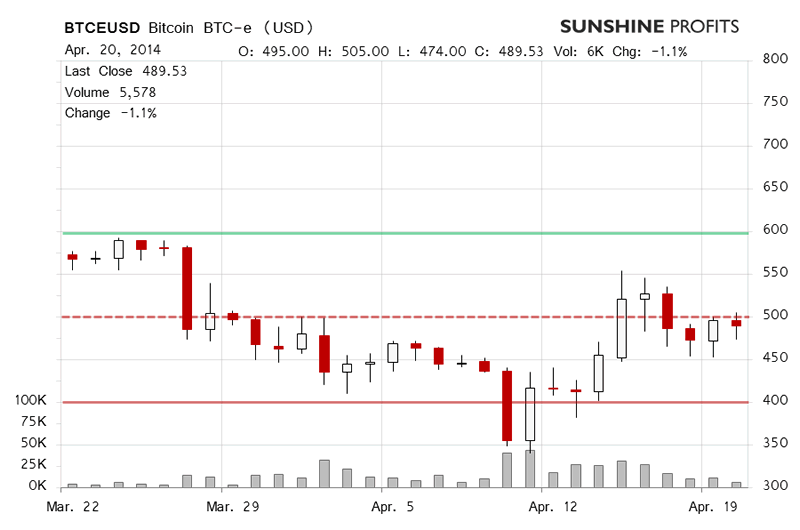

What we saw on BTC-e over the weekend was consistent with the implications for BitStamp. Bitcoin stabilized slightly below $500 (dashed red line on the chart) which was marginally more bearish for the short term than what we saw on BitStamp.

If there is a difference, we’ve seen it today, not in the price, since Bitcoin is also down on BTC-e, but in volume as the trading has been visibly weaker today than it was yesterday. Our bet here would be that the stagnation on BTC-e will be followed by depreciation stronger (not much but still) than on BitStamp.

Summing up, in our opinion short speculative positions are the way to go now.

Trading position (short-term, our opinion): short, stop-loss at $550. We’re expecting to see a period of stagnation now before another move down.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.