What Will December 31, 2014 Financial Headlines Look Like?

Stock-Markets / Financial Markets 2014 Apr 23, 2014 - 05:16 AM GMTBy: EWI

The financial forecasts around the end of 2013 brimmed with optimism. Here are just a few examples:

The financial forecasts around the end of 2013 brimmed with optimism. Here are just a few examples:

- Many scoff at notion stock bubble exists -- Associated Press, Nov. 19, 2013

- Economy Entering New Year on a Roll -- Bloomberg, Dec. 25, 2013

- 'We have entered a 15- to 20-year bull market' -- CNBC, Dec. 30, 2013

- Economy poised for strong 2014 -- Atlanta Journal-Constitution, Jan. 1, 2014

- Market Prediction: Bull will keep charging in 2014 -- USA Today, Jan. 2, 2014

- Bull Market has Years Left Based on S&P 500 Valuations -- Bloomberg, Jan. 6, 2014

- Economist tells Denver audience to be aggressive over next four years -- Denver Post, Jan. 9, 2014

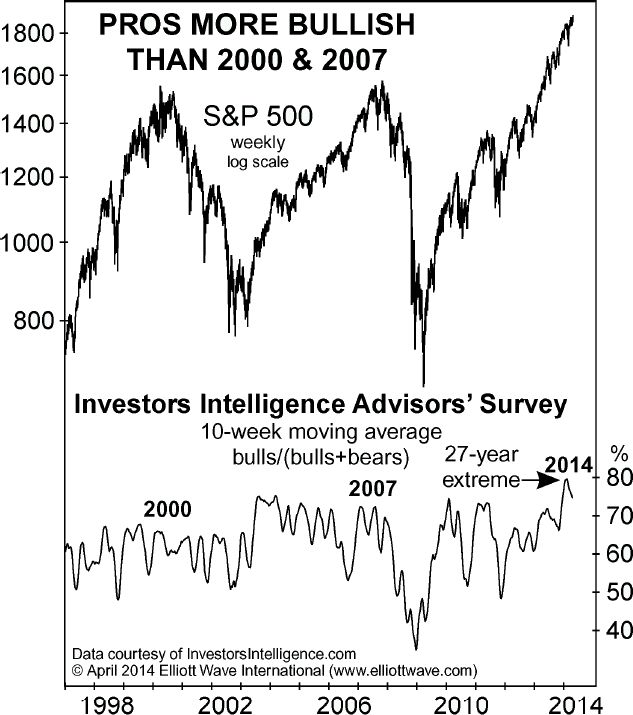

This super bullish outlook was also expressed just before the 2000 and 2007 market tops. Indeed, a chart from the April 2014 Elliott Wave Financial Forecast shows that investment pros are more bullish now than before the two prior major market peaks.

EWI's special report, The State of the U.S. Markets -- 2014 Edition notes:

Investors are even more optimistic than economists. While the overall economy barely grinds ahead in first gear, indicators of Wall Street psychology stand at historic extremes of optimism. This optimism is the only thing holding up nominal stock prices.

Market history shows that extremes in psychology always reach a turning point. The Wave Principle can help you identify when the market's trend is about to change.

It is a thrilling experience to pinpoint a turn, and the Wave Principle is the only approach that can occasionally provide the opportunity to do so.

The ability to identify such junctures is remarkable enough, but the Wave Principle is the only method of analysis that also provides guidelines for forecasting...

It is our practice to try to determine in advance where the next move will likely take the market.

Elliott Wave Principle: Key to Market Behavior, tenth edition, p. 96

Be aware that the Wave Principle has now identified what appears to be a history making market juncture.

If stock market prices unfold in the way that we expect, the financial headlines at the end of 2014 will look a lot different than last year.

EWI's free report, The State of the U.S. Markets -- 2014 Edition, helps you to anticipate the next likely major move in the market and you can get the entire 24-page report for FREE. See below for full details.

The State of the U.S. Markets -- 2014 Edition: The Most Important U.S. Investment Report You'll Read This Year Are you prepared to take advantage of the biggest opportunities -- and avoid the dangerous pitfalls -- that you will face over the rest of this year? The State of the U.S. Markets - 2014 Edition gives you valuable, independent analysis and forecasts for the U.S. financial and economic trends in 2014. It includes crucial recommendations you can act on -- instead of after-the-fact analysis that keeps you behind major turning points. You can navigate the year ahead via this blend of hard facts, analysis and unique commentary -- plus dozens of eye-opening charts and insights culled from this 24-page subscriber-level report. ($99 value; yours free!) Click here to get your FREE State of the U.S. Markets report now >> |

About the Publisher, Elliott Wave International Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.