It How America Grows Its Way Into Poverty

Politics / Social Issues May 01, 2014 - 04:45 PM GMTBy: Raul_I_Meijer

It was strange to see two Bloomberg articles side by side yesterday that didn’t look as if they were written in the same universe. Not Bloomberg’s fault, I think, they simply reported on an FOMC statement and incoming US economy numbers. But it was strange nonetheless. First, here’s the FOMC’s reasoning behind its decision to taper more:

It was strange to see two Bloomberg articles side by side yesterday that didn’t look as if they were written in the same universe. Not Bloomberg’s fault, I think, they simply reported on an FOMC statement and incoming US economy numbers. But it was strange nonetheless. First, here’s the FOMC’s reasoning behind its decision to taper more:

Fed Says Economy Has Picked Up As It Trims Bond Buying Further

Growth “has picked up recently,” the Federal Open Market Committee said today in a statement in Washington, hours after a government report showed gross domestic product barely grew in the first quarter. “Household spending appears to be rising more quickly.”

But as we could see absolutely everywhere in the news, growth as it is normally defined has not ‘picked up’, and there’s something about that household spending too:

Growth Freezes Up As US Business Spending, Exports Slump

The U.S. economy barely grew in the first quarter as harsh winter weather chilled investment and exports dropped. The expansion stalled even as consumer spending on services rose by the most in 14 years. Gross domestic product grew at a 0.1% annualized rate from January through March …

So much for growth. There ain’t none. It’s a mere rounding error. And if anyone ever talks about the weather again, they risk corporal punishment. I liked the comment today, I forget by whom, sorry, that the polar vortex this year has apparently decided to skip Canada, because its economy shows no signs at all of having been hurt by the cold.

Household spending got some more ‘texture’ in that quote as ‘consumer spending on services’. Wonder what those services are?! Tyler Durden is among those who figured it out:

If It Wasn’t For Obamacare, Q1 GDP Would Be Negative

… if it wasn’t for the (government-mandated) spending surge resulting from Obamacare, which resulted in the biggest jump in Healthcare Services spending in the past quarter in history and added 1.1% to GDP … [..] … real Q1 GDP (in chained 2009 dollars), which rose only $4.3 billion sequentially to $15,947 billion, would have been a negative 1.0%!

And then just now, Bloomberg runs this story, which seems a tad less innocent on their part:

Consumer Spending in U.S. Jumps by Most in Five Years

Consumer spending surged in March by the most in almost five years as warmer weather brought shoppers back to auto-dealer lots and malls, a sign the U.S. economy gained momentum heading into the second quarter. Household purchases, which account for about 70% of the economy, climbed 0.9%, the most since August 2009, after a 0.5% gain in February that was larger than previously estimated …

Hey, what did I just say about talking about the weather? More importantly, did you guys at Bloomberg completely miss the Obamacare spending bit? Or did you decide to ignore it? I know, I know, Durden’s comment covers January through March, and this number is just March, but given the above, does anyone believe the numbers are entirely unrelated? Here’s Durden again, just in, on the rise in consumer spending.

US Savings Rate Drops To 2nd Lowest Since 2008 To Pay For March Spending Spree

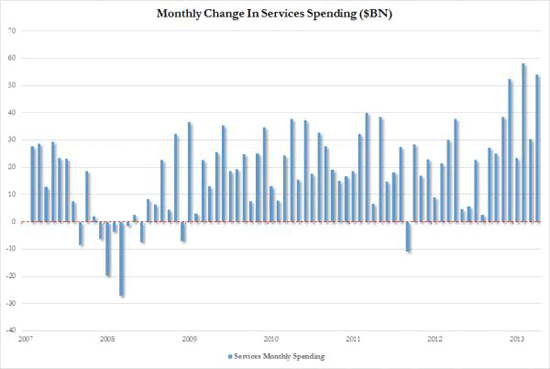

Curiously the increase in goods spending was the single biggest monthly increase also since August 2009. As for services, the systematic increase on spending over the past several months is unmistakable as far more money is allocated toward healthcare, that one major spending category which rescued Q1 GDP.

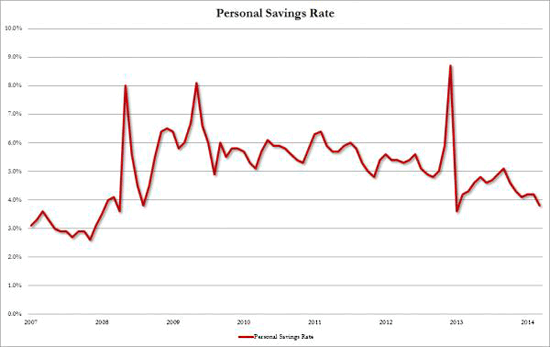

It would appear there was no “harsh weather” effect in March, even though corporations, and not to mention the Q1 GDP, can’t complain fast enough about how horrible the month and the quarter both were. End result: since spending was so much higher than income for one more month, at least according to the bean counters, the savings rate tumbled once more, and at 3.8% (down from 4.2% in February), was the second lowest since before the Lehman failure with the only exception of January 2013 after the withholding tax rule changeover.

So for all those clueless sellside economists who are praying that the March spending spree, funded mostly from savings, will continue into Q2 (because remember March is in Q1, which as we already know had an abysmal 0.1% GDP growth rate), we have one question: where will the money come from to pay for this ongoing spending spree?

And sure, income went up a little, and a few more people did buy a few more fridges and cars, as they undoubtedly always do in March, but the rise in spending has a very solid link to healthcare services, and while that may boost GDP, so do traffic accidents. And those don’t raise the standard of living either. Which leaves me still wondering why Janet Yellen et al “defended” their taper decision with referring to growth and consumer spending, i.e. a recovering economy. I’m wholly in favor of removing the stimulus related distortions from the markets, even if that means applying shock therapy, but must you guys really lie about the reasons you do it? Isn’t people’s confidence worth anything to you? Or do you feel that confidence has been shot anyway?

By Raul Ilargi Meijer

Website: http://theautomaticearth.com (provides unique analysis of economics, finance, politics and social dynamics in the context of Complexity Theory)

Raul Ilargi Meijer Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.