The Fiscal Land Mine of Chicago

Politics / US Debt May 02, 2014 - 06:19 PM GMTBy: Jeff_Berwick

Wendy McElroy writes: Chicago dances on the edge of a fiscal cliff.

Wendy McElroy writes: Chicago dances on the edge of a fiscal cliff.

It is the third largest city in the US with a population of 2,714,856 as of mid-2012. It is the economic engine of Illinois. If Chicago falls, especially into bankruptcy, then the entire state is likely to do so as well. Illinois won’t declare bankruptcy because federal law prohibits the option. But insolvency would raise many of the same questions as bankruptcy. For example, who gets paid first, or at all? And how much on the dollar? If other cities stumble, as they would, then whether Illinois officially declares bankruptcy may be a matter of semantics.

The fiscal land mine of Chicago

In early March, Moody’s Investors Service downgraded Chicago's credit rating from A3 to Baa1. The rating is just three rungs above “junk-bond.” With the exception of Detroit, Chicago now has the worst credit rating of any large US city. The reason cited by Moody's: unfunded pension liabilities for city employees.

A March 7th Wall Street Journal article announced that Chicago's 2015 balloon payment on its $19.4 billion pension debt will be $1.07 billion. The payment is one-third of Chicago's entire operating budget. According to WSJ, “The pension payment could cover salaries for 4,300 police officers or the resurfacing of 16,000 blocks of roads in the city... Meantime, the required pension contribution for Chicago schools this year is tripling to $613 million... Chicago's pension funds are only half as well-funded as even Detroit's, if you can believe it, and could run dry by 2020.” The pension shortfall amounts to $7,100 per Chicagoan.

Moody's is threatening another downgrade unless Chicago 'fixes' the pension fiasco; a lower rating would mean higher interest on the city's debt. There are two ways out: cut expenses or raise revenues.

Cutting expenses means cutting jobs or reducing benefits, or both. The average city employee receives wages and benefits that the average private worker only dreams about. The watchdog Illinois Policy Institute reported that “teachers who retired between July 1, 2011, and June 30, 2012, after 30 or more years on the job could expect starting average annual benefit payments of $72,693… After 10 years of cost-of-living adjustments, this pension is $97,693 annually.”

Job and benefit reductions are rigidly opposed by public sector unions, especially by the power-wielding teachers' union. Union support makes or breaks political careers in Illinois. That means the legislators who set the pensions through Illinois law are not likely to take the political risk of reducing them; they face an election in November and Democrats would like to maintain their current two house super-majority. It means Chicago Mayor Rahm Emanuel who could cut jobs is reluctant to do so; he is up for re-election in February. Politicians are more likely to bleed taxpayers and investors instead.

Raising revenues is what remains. On March 12th, Breitbart ran the headline, “Mayor Rahm Emanuel Warns of Doubled Property Taxes to Fund Spiraling Pension Costs.” Emanuel added, “if something else isn't done.”

A variety of “something else” has already been tried; the situation gets worse. For example, in February, Chicago's city council approved a $500 million issuance of commercial paper and $900 million of general-obligation bonds. The WSJ article commented, "There's little to stop politicians from pouring the proceeds into pensions – or later reneging on this unsecured debt if it were to file for bankruptcy." There is precedent; Detroit intends to repay similar bonds at 20 cents on the dollar.

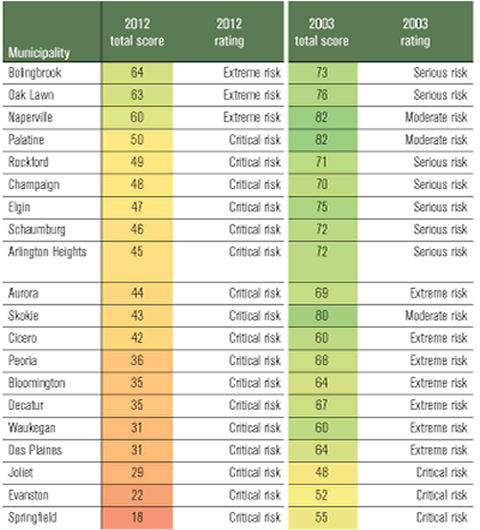

As Chicago goes, so goes Illinois

Chicago is only one of many cash-strapped cities in Illinois, which are choking on their pension liabilities. According to an Illinois Policy Institute report the capital city of Springfield now dedicates all property taxes to pay the pensions of police, teachers and other city workers; and that after slashing its police department by almost 15 percent. Other cities are raising taxes. Peoria, for example, added new water and utility taxes, and doubled its garbage fees.

Quite apart from the cities of Illinois, there is the state as a whole. A February 8th, 2013 article in Business Insider explained, “Illinois's five state-level pensions...report current accrued liabilities at $146 billion, but the state has set aside only $63 billion to cover future benefits... [T]he $83 billion shortfall in unfunded liabilities leaves the state’s pensions only 43% funded, on average. Unfortunately, the real numbers are far worse.” (Note: those official estimates are a year old and the situation worsens daily.)

Moody's recently adopted a new methodology by which to assess debt and risk. When it “discounts future liabilities using the more reasonable rate of return on high-grade corporate bonds (about 4% today), current accrued liabilities tally to more like $272 billion. These figures drop the official 43% funding ratio to only 24%.” This means Illinois has the most underfunded pension system in America. Dividing the total liabilities by the number of Illinois residents, every person is liable for $22,294.

Illinois tops various other lists as the worst state in the Union, or close to it. Illinois' dubious distinctions include:

- the fastest growth of any state in food stamp recipients ( June 2013);

- 5th in foreclosures. 1 in 811 housing units received a filing (Feb. 2014);

- 4 of its last 7 governors were convicted and imprisoned;

- it has the 3rd highest unemployment rate, 8.9 percent (Jan. 2014);

- it has the 4th most regressive tax system (Jan. 2013);

- its sum total state corporate income tax is 9.5% (2013).

Illinois: Run Far, Run Fast

According to Forbes (Feb. 8, 2013), “Most of the top-10 states people are leaving are located in the Northeast and Great Lakes regions, including Illinois (60%), New York (58%), Michigan (58%), Maine (56%), Connecticut (56%) and Wisconsin (55%).” Illinois is first in the raw numbers of people leaving and second to New Jersey in the ratio of those leaving to total population. This ranking occurred in 2012 as well.

Southern and western states are the most popular destinations for a variety of reasons including greater economic opportunity and personal freedom, lower taxes and better climate. But those leaving should ask themselves: is anywhere in the US far enough away from Chicago if the city and then the state collapse financially? Taxpayers United President Jim Tobin predicts, ““Illinois will be the first state to go bankrupt, unless pension reforms are implemented.” Only it cannot legally declare bankruptcy and escape its debts. Whatever will happen, Tobin believes will occur sometime about 2015.

Whatever the timing, whichever patches are slapped on the system, Chicago's economic meltdown would effect not only Illinois but all of America. Chicago is also the economic engine of the MidWest. The federal government is unlikely to abandon an entire region, especially one dominated by Democrats. Obama is unlikely to abandon Chicago as long as Emanuel, his former White House Head of Staff and close friend, is mayor. What does “unlikely to abandon” mean in specific terms? Probably bailouts, in some form. The flood of money and legal privilege will be a further drag on those islands of opportunity to which economic refugees have fled. Other cities teetering on the same fiscal cliff will fall.

It is an exaggeration, but not an outrageous one, to say: as Chicago goes, so goes America.

In any case, if something else isn't done, Mayor Emanuel is warning that he'll have to double property taxes to fund the payment.

The municipal pension fund isn't the only pension in failure in Chicago. The city's teachers' pensions are also widely understood to be one of the worst funded in the country. The teachers' pension fund will require a tripling of its required contribution.

Michael Pagano, dean of the College of Urban Planning and Public Affairs at the University of Illinois at Chicago, though, warns that just raising taxes and cutting services won't fix the problem.

"I don't think either one is even a possibility. Everybody's going to have to give something," Pagano said in December.

Meanwhile, the State of Illinois already comes in at second place in the number of citizens moving out of state. Outward migration for The Land of Lincoln ranked second only to New Jersey in 2013.

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2014 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeff Berwick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.