Buy Gold at $70 Below Melt Value...

Commodities / Gold and Silver Stocks 2014 May 11, 2014 - 06:27 PM GMTBy: DailyWealth

Dr. Steve Sjuggerud writes: It's the best legal way to BUY and SELL gold that I've ever seen...

Dr. Steve Sjuggerud writes: It's the best legal way to BUY and SELL gold that I've ever seen...

Right now, we have an incredible window of opportunity... There's a way you can buy gold at roughly $70 off melt value – a 6% discount.

It's the best way to buy gold right now.

This investment is also the best way to sell gold... because when you sell this investment, you will NOT pay the usual taxes that you would normally pay on gold.

Even better, chances are good that you will not only be able to buy at a discount to melt value, but you will be able to sell it at a premium as well.

Lastly, it's easy to do... This investment trades in the U.S., just like a stock. Let me give you the full story...

In 1961, the Central Fund of Canada (CEF) was born... and in 1983, it re-defined its mandate to become the "Sound Monetary Fund."

The Central Fund of Canada made a commitment to hold gold and silver... nothing else. Gold makes up 59% of the fund, and silver is 41% of the fund.

It primarily holds gold and silver bullion in a bank vault in Canada. It doesn't buy, sell, or trade. It simply sits on its precious metals in Canada.

Importantly, the Central Fund of Canada is organized as a closed-end fund, which means that it has a fixed amount of shares outstanding. This gives us an opportunity to buy gold at a discount today...

You see, when gold is "hot," investors pile into gold investments like this fund. And because the Central Fund of Canada has a fixed number of shares, increased demand forces it to trade for a premium above the melt value of gold.

Gold was "hot" for over a decade recently...

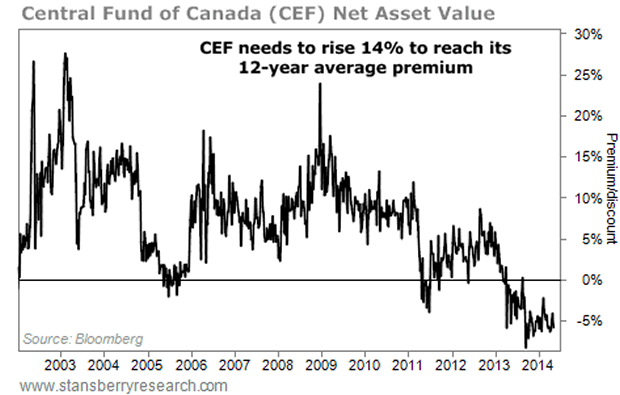

Since investors loved gold – and the security and simplicity of buying bullion in a Canadian vault through the stock market – the Central Fund of Canada traded for an average premium of 7% over the last 12 years.

But lately, gold has been out of favor...

Sentiment is so negative toward gold that the Central Fund of Canada – which usually trades at a 7% premium to its liquidation value – is now trading at a 6% discount to its liquidation value. That's a remarkable change. And remember, it only holds precious metals in bullion form in bank vaults in Canada. So you are buying gold at a discount to melt value.

Take a look:

Today, you can buy it at a 6% discount... At today's gold price, that's like buying gold for about $70 off – that's crazy!

I expect that when gold gets "hot" again, this fund will return to trading at a premium. If CEF goes from 6% discount to a 5% premium, you will have gained 11 percentage points. That's sort of like "free" income – a hidden high yield!

There's another big benefit here, too... When it comes time to pay income taxes on this, you won't have to pay what you would normally pay on gold...

Generally with gold investing, you pay a flat 28% "collectibles" tax. However, the Central Fund of Canada is unique. So you'll pay taxes at your normal, long-term capital-gains rate (15% for most people). (You will have to fill out one extra, but simple, form at tax time.)

In sum, the Central Fund of Canada is the absolute best way to BUY and SELL gold.

You can buy gold and silver at a 6% discount to liquidation value through this fund... with the potential to sell at a premium in the future.

And instead of paying the usual 28% tax on gold, you will instead pay your long-term capital-gains tax rate (which is 15% for many people).

If you're interested in gold, you have to check out this fund. It's the best way to own gold today.

Good investing,

Steve

Editor's note: If you'd like more insight and actionable advice from Dr. Steve Sjuggerud, consider a free subscription to DailyWealth. Sign up for DailyWealth here and receive a report on the five must-read books on investing. This report will show you several of the DailyWealth team's "must read" books, which will help you become a better investor right away. Click here to learn more.

The DailyWealth Investment Philosophy: In a nutshell, my investment philosophy is this: Buy things of extraordinary value at a time when nobody else wants them. Then sell when people are willing to pay any price. You see, at DailyWealth, we believe most investors take way too much risk. Our mission is to show you how to avoid risky investments, and how to avoid what the average investor is doing. I believe that you can make a lot of money – and do it safely – by simply doing the opposite of what is most popular.

Customer Service: 1-888-261-2693 – Copyright 2013 Stansberry & Associates Investment Research. All Rights Reserved. Protected by copyright laws of the United States and international treaties. This e-letter may only be used pursuant to the subscription agreement and any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of Stansberry & Associates Investment Research, LLC. 1217 Saint Paul Street, Baltimore MD 21202

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Daily Wealth Archive

|

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.