Future For Gold As Uncertain As It Is Certain. Silver Will Lead/Follow

Commodities / Gold and Silver 2014 May 17, 2014 - 04:36 PM GMTBy: Michael_Noonan

Based on several thousand years of history, and based on the last 100 years of fiats, gold will continue to rise as a store of value, and almost all fiats will fail, massively. Which fiats will continue? The Yuan and the Ruble, for two. The Panama Balboa is another possibility, but Panama will have to do some sorting out to get rid of the fiat US dollar, its paper currency. The official money of account is the Panama balboa, but it ceased printing around 1941, in favor of the US dollar. This little Central American country has been making preparations to disassociate from the fiat Federal Reserve Notes.

Based on several thousand years of history, and based on the last 100 years of fiats, gold will continue to rise as a store of value, and almost all fiats will fail, massively. Which fiats will continue? The Yuan and the Ruble, for two. The Panama Balboa is another possibility, but Panama will have to do some sorting out to get rid of the fiat US dollar, its paper currency. The official money of account is the Panama balboa, but it ceased printing around 1941, in favor of the US dollar. This little Central American country has been making preparations to disassociate from the fiat Federal Reserve Notes.

For all the gold China has been accumulating this past decade, it is unlikely that China will back the yuan by gold. It would be too problematic for what it would do to its economy. Russia has been a lesser buyer of gold, but it also has tremendous reserves that it mines every year, adding to its holdings. Its natural gas resource has taken center stage as a backing for the ruble. Russia will also unlikely want to back the ruble by gold.

There have been numerous articles from reliable sources that have been calling for a new gold-backed currency to replace the waning Federal Reserve petrodollar as the world's reserve currency, many thinking a gold-backed yuan as a prime candidate. In this regard, gold's future is uncertain. It will undoubtedly play a significant role, but not likely linked to one specific country as a new world reserve currency.

From the solidifying financial and economic ties between China and Russia, China and several other natural resource rich countries, and the BRICS alliance, a strong possibility lies in contractual ties amongst all these countries, and not a single nation gold-backed currency. A perfect example is what will likely be concluded next week between China and Russia, the largest ever natural gas deal.

The deal is between Russia's Gazprom and China National Petroleum Corporation. All that needs to be finalized is the price. What will decidedly not be a part of the deal is any Federal Reserve Dollar as a part of the pricing mechanism, nor any use of the fiat "dollar." Expect to see more and more international dealings by Eastern and BRICS nations that preempt the soon-to-be-former world reserve "dollar."

Obama does not "speak softly," nor does he carry a "big stick." ["Speak softly and carry a big stick," was first used by Theodore Roosevelt when he wanted Congress to increase the amount of money he needed to carry out and define his foreign policy, using "diplomacy" backed by military might, America's [outdated] foreign policy to this day.] So Obama's sanctions and threats against Russia ring hollow, and all parties concerned know it.

Russia has more than enough natural resources and more than enough willing customers to not worry about Obama, the US, or its fiat "dollar." Russia's Ministry of Finance has already announced plans to use the ruble in all future contracts as Russia takes more steps toward "de-dollarization." China has been acting in a similar capacity as it has been making deals with several other countries, outside of the "dollar."

Prior to the Rothschild elites forcing the US into official bankruptcy in 1933, [from which point in time forward, the US has been owned by a few select international bankers...a fact about which almost all American remain ignorant], prior to 1933, the US used gold as a backing in it contracts with other nations, so there is a viable history for using gold, and any other natural resource, [oil, copper, natural gas, as a few other examples] as an integral part of contracts and foreign exchange.

The deal with China may require backing with gold, to some degree, as a guarantee. There may be a clause that exchanges yuan or rubles for gold, silver, copper, etc, without the necessity of any country having a gold-backed currency. A soon-to-be relegated-to- third-world-status country, like the United States, would not be able to participate, by virtue of the fact that it will be unable to bring anything to the bargaining table. All other countries will engage based upon a relatively hard currency and/or a natural resource to act as collateral.

China, Russia, Panama, other BRICS, Turkey, Iran, et al, can keep their fiat currency, but simply back up any contract with acceptable collateral, oil for gold, gold or some acceptable equivalent for whatever is being sold. This will eliminate the stronghold that the US and UK have maintained for the past century, and the military might will become a whisper of what it used to be. For now, however, the military remains very much a tool of desperation as the once mighty West continues its unabated slide into a decline from which it cannot recover.

The time frame between now and then remains an unknown, and it is very likely that the elites will cause major disruptions, like Ukraine, aiming for what it knows best, profitable war. Countries and people suffer, but the Rothschild formula for creating chaos, leading to war, provides incredible wealth for themselves.

With the US Gestapo Homeland Security purchasing billions of bullets, 7,000 NATO personal defense weapons, aka the kind of assault weapons used by civilians that the Obama/United Nations wants to outlaw, and now the Department of Agriculture wanting to buy submachine guns, it is very apparent that the elite-controlled corporate federal government is preparing for war...against Americans in their own country. This will not end well, and perhaps for the first time, the ravages of war will be confined to the US.

Over a year ago, we were going to do an article on the Department of Homeland Security, [If you guess the Homeland to be secured is the US, you would be wrong. The Homeland to be secured, at all costs, is the corporate federal government.] The reason for not doing the article was the content, the fact that Homeland Security has hundreds of "camps" around the country, where, thanks to the Bush Patriot Act and Obama's National Defense Authorization Act, on top of the 1933 amendment to the Trading With The Enemy Act, [the Amendment made U S citizens the enemy within their own country...read the Act.], the corporate federal government can declare anyone an enemy and held without rights of any kind, and for any duration. Think of Guantanamo Bay coming to roost on US soil.

There was more. Homeland Security has also purchased tens of thousands of caskets, stacked up, row after row after row. Draw your own conclusion as for whom they are intended. No country at war has a history of bringing back war victims to be buried in special camps.

The uncertainty for the role of gold has yet to be defined. Expectations for a gold-backed currency may be misplaced. It could happen, but it seems unlikely that the largest holders of gold have an interest in putting themselves at an economic disadvantage by pricing out their exports. However, within whatever the realm of uncertainty for gold's specific role is, it will undoubtedly remain pivotal. Rising from the ashes of central banker suppression for the past several decades, it is certain that the price will go higher.

Will it be $10,000, or as high as $50,000 the ounce, the price range so often speculated on as its next level of price reality? Who knows? It will be determined by a freer market than it has been for over eight decades, or more. Regardless of where the prices of both gold and silver finally reach, it should not matter to anyone who is prepared.

The best way to participate is to be prepared. The best way to be prepared is to already own physical gold and silver. The handwriting is on the wall. Western fiats are destined to fail, not next week, not next month, maybe not even this year, but failure is coming, and the unelected European "officials" are doing whatever they can to steal whatever they can get away with.

In the United States, the foreign-owned Federal Reserve has been stealing wealth through the harder to detect, but equally as insidious inflation. With the fiat Federal Reserve Note worth about 3 cents today, relative to 1913 dollars, that means the Fed stole 97 cents of every dollar over the past century. If you do not understand inflation, it is the debasement of money, and the value debased goes to the benefit of the issuer. The Fed does nothing if it is not for its own benefit.

Expectations that gold would respond to the Rothschild-inspired, US-led Ukrainian situation have been proven wrong. For as long as the US/UK/EU troika can exert any degree of control over those governed, for as long as central bankers control all Western countries and fiat purse strings, gold and silver will remain in their bottoming phase, and the bottoming process can last for longer than most expect. Neither gold nor silver appear to be turning up, and for that look, we turn to our favorite topic, charts.

If gold or silver appear to be unresponsive to known news, be it how much China is buying, potential war breakout in Ukraine, financially flagging EU, the US losing control on so many fronts, it is because both are still under the control of relatively unseen forces that continue to exert pressure, like a helium-filled balloon being kept under water.

Many say that the charts are irrelevant, but no one is pointing to anything else that is. For as long as we have been following markets via charts, those of gold and silver have told the most accurate story in the face of news and events that would suggest otherwise.

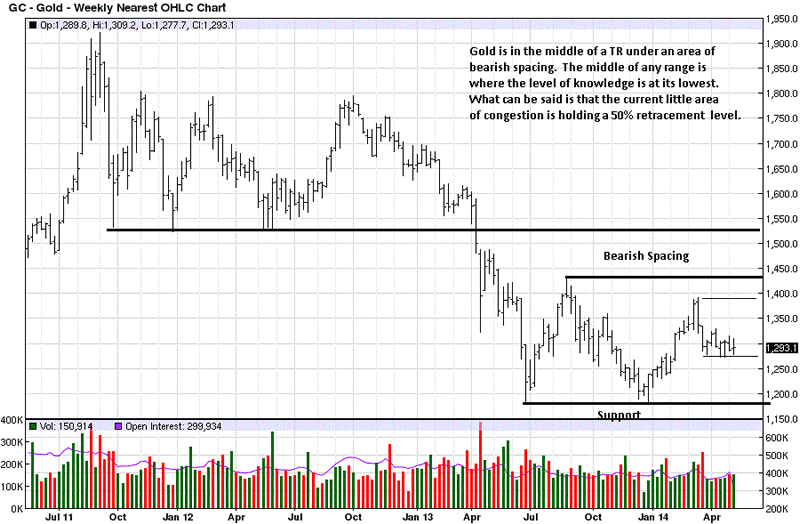

Before gold can rally, it has to first turn the trend from down to up. We see no evidence of a change in trend. The bearish spacing is repeated, again, as a reminder that it represents a weak market within its down trend. How anyone can posit a bullish scenario from what the charts show flies in the face of known facts, as depicted in the charts.

The biggest fact upon which almost all can agree is that the trend remains down.

Within that context, there are slight signs of bottoming activity, such as the current two month TR holding near a 50% retracement of the last swing low to swing high. For this to occur in a down market is a plus; not enough to turn the trend, but what could lead to a change in trend. Also, within the past two months the weekly closes are clustering, a sign of a pause before the previous trend resumes, or a resting period that can begin a market turn.

For now, there is no confirmation, either way.

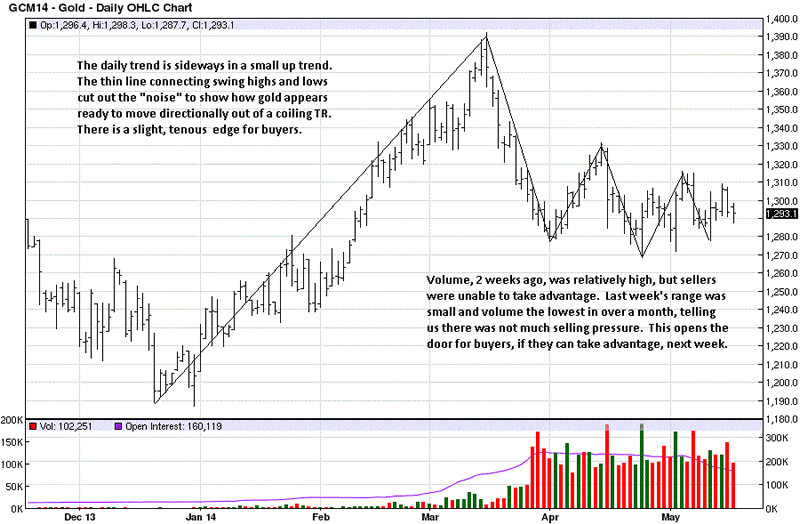

The shorter perspective of a daily chart indicates a recent up trend that has turned neutral. The most important elements for reading developing market activity in any charts are price and volume. Everything else can almost be ignored.

Three weeks ago was the 3rd highest volume of the month, occurring on a lower close, indicating sellers "won" the battle for that day. Volume is important. The volume increase should lead to a lower market. Yet, when you look at that specific day, it was an inside day, relative to the previous up day. The question to ask then is, why did all of that increase in volume not take out the low of the previous day, and why was that day's range slightly narrower? While sellers won the battle that day, in context to the increased volume, it was buyers that prevented the effort of the sellers from achieving a lower level.

Friday was a lower low, but notice this time, volume declined, and the close was mid-range the bar, a stand-off between buyers and sellers, but more of an edge to buyers for stopping the momentum of the sellers.

Price closed just about dead center of the two month TR, and that says balance. From balance comes unbalance, and the further price moves along the RHS, [Right Hand Side], of a TR, the closer is the TR resolve, in either direction. Instead of having to guess in which direction price may move, it is better to be prepared for either event and then act accordingly.

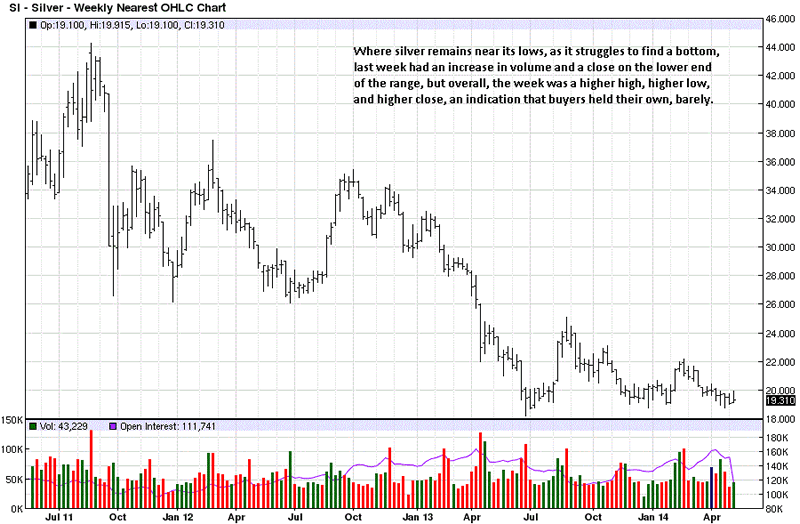

From the August 2013 swing high, price went into a protracted and labored retreat until the beginning of February 2014. After a three-week rally, from the February swing high, price once again was in a labored 12 week decline. When it takes sellers four times as long to correct a market that is in a clear down trend, it tells us sellers are generally weak.

Last week, it was mentioned that when an area is continually retested, it becomes weaker and subject to being broken, unless buyers, in this instance, can show more strength. A look at a more detailed daily chart may be helpful in getting greater clarity on the chance of silver make a new recent low.

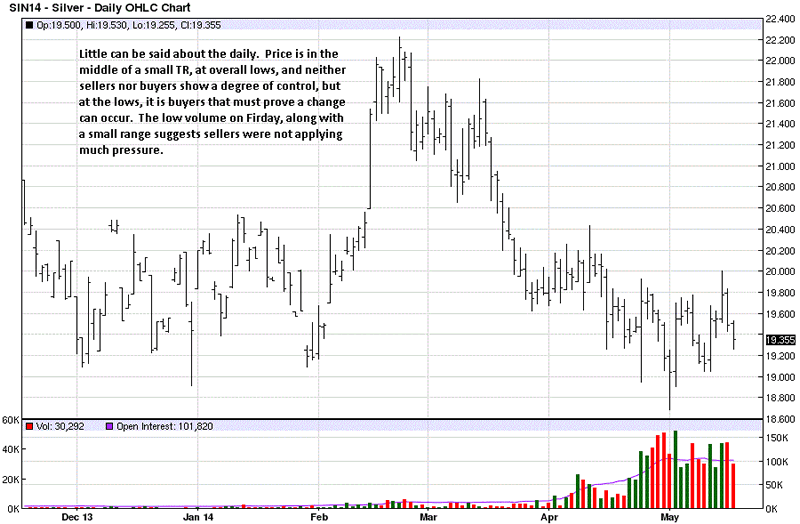

There have been a few attempts to sell silver to yet lower levels, since late April, and on each occasion, silver was able to rebound and close well on strong rally days. One would not expect to see that kind of relative strength in a down market. The decrease in trading volume on Friday indicates relative weakness by sellers for not being able to drive price lower than occurred.

Price needs to get above 20, and hold, if buyers want to wrest control from sellers. If not, sellers will see this buyer inability, and that may prompt sellers to try for new lows.

Silver will also be certain in seeing eventual higher prices. With the gold/silver ratio at the high end, favoring gold, and silver tending to lead PM rallies, silver could outperform gold to the upside, once the trends change. For this reason, silver may be the one to watch.

By Michael Noonan

Michael Noonan, mn@edgetraderplus.com, is a Chicago-based trader with over 30 years in the business. His sole approach to analysis is derived from developing market pattern behavior, found in the form of Price, Volume, and Time, and it is generated from the best source possible, the market itself.

© 2014 Copyright Michael Noonan - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Michael Noonan Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.