Gold Price - A 40 Year Perspective

Commodities / Gold and Silver 2014 May 20, 2014 - 12:59 PM GMTBy: DeviantInvestor

In broad terms, gold was in a bull market during the late 1960s and 70s, a bear market during the 80s and 90s, and back in a bull market since 2001. The important questions are:

In broad terms, gold was in a bull market during the late 1960s and 70s, a bear market during the 80s and 90s, and back in a bull market since 2001. The important questions are:

- Did gold reach a generational peak in 2011 and subsequently turn down for a decade or two?

Or

- Did gold reach an intermediate top in 2011 based on QE, dollar weakness, and high demand, correct for 2.5 years, and then begin a rally likely to persist through the end of the decade?

My answer is: Gold peaked in 2011, bottomed in June and December of 2013, and should rally for several, and probably many, years into the future.

Why?

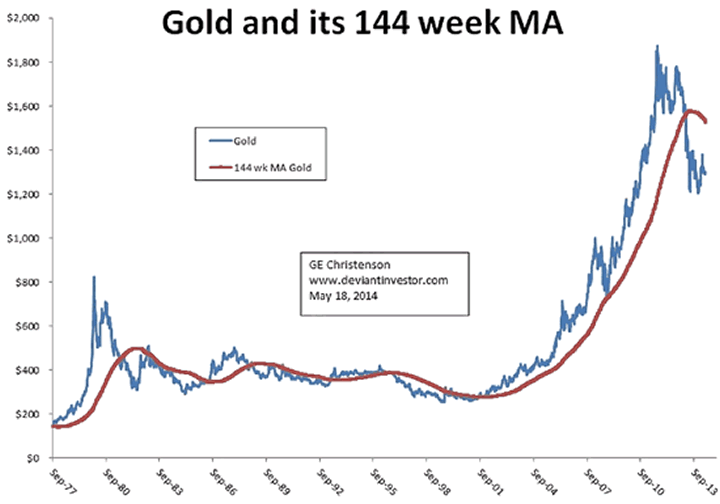

Examine the following graph of weekly gold prices since 1977 and the 144 week simple moving average shown in red. The uptrend since 2001 is clear and pronounced. The correction since 2011 is unmistakable.

Worthy of note from the spreadsheet (not shown) are:

-

The peak in January of 1980 was 9.37 standard deviations above the 144 week moving average. The numbers are similar for the 100 week and 40 week moving averages. Clearly gold was in a blow-off bubble in late 1979 and January of 1980.

-

The peak in August of 2011 was only 2.15 standard deviations above the 144 week moving average. It was an intermediate peak, but not the bubble peak that is likely to manifest within the next decade.

-

My conclusion is that gold prices were pushed too high in late 2010 and 2011 and have corrected since then. Currently gold is 15% below its 144 week moving average or about 0.6 standard deviations below that average. I don't suggest that gold prices must rally next week or even next month, but prices are very likely to be much higher next year and even higher by the next presidential election in late 2016.

What could push the price of gold LOWER?

-

Many of the TBTF banks have announced that gold prices will move sideways to down. Take this for what little it is worth.

-

The Fed and other central banks are fighting the deflationary influences in the economies of the world. Some believe those deflationary forces indicate gold prices will fall further.

-

Official US government statistics assure us that inflation is very low. Of course anyone who eats, drives a car, has medical bills, pays college tuition, or shops for groceries knows better, but official statistics show minimal inflation and some people think that means gold prices are unlikely to rise.

-

There are other reasons, but most center about the degree of control the Fed exerts over the economy, the control that the COMEX has over paper gold prices, and the Fed's desire and the government's need to keep gold prices low. Their control, power, and influence are undeniable but are probably overstated. I expect the primary gold bull market will reassert itself, regardless of central bank, government or COMEX interventions.

What will push the price of gold higher?

-

The Fed and other central banks are "printing money" and this, historically speaking, has always ended badly. Expect more consumer price inflation, declining purchasing power for currencies, and higher gold prices.

-

The US and Japanese governments are running large budget deficits and borrowing as if the credit to run bloated governments will always be available. The answer of course is that the debts will be paid with newly "printed" money and the cycle of borrow, run a deficit, borrow more, and print will repeat.

-

The US dollar, and most paper currencies, are backed by nothing more substantial than "full faith and credit" of admittedly insolvent governments.

-

The US official national debt exceeds $17.5 Trillion, which does not include unfunded liabilities that are perhaps another $100 - 200 Trillion. We all know this debt can never be repaid in dollars that are worth more than a tiny fraction of their current value. Perhaps the debt can never be repaid under any conditions other than hyperinflationary "money printing."

-

Our warfare/welfare governments are actively pursuing their own agendas and our politicians are encouraging the growth of warfare, welfare, and the size of government. It will be financed with printed dollars, euros, yen etc. The result will be decreased purchasing power of the dollar, euro and yen.

-

Geopolitical events such as a few wars here and there, more conflicts, perhaps a nuclear accident, a major earthquake, and a monetary system collapse could aggravate an already unstable financial world and accelerate the process of dollar devaluation, rising gold prices, and a shakeup in the use of the dollar as the reserve currency. Individuals and the more solvent nations will protect themselves with hard assets such as gold.

-

The citizens of China, Russia, and India and their central banks are buying gold in quantity. That demand is unlikely to decrease. The western world has been shipping a massive amount of gold to Asia for the past five years. What will happen to prices when that gold supply is restricted or terminated?

-

The Fed, central banks, and many governments want and need inflation, not deflation. They are likely to get it, and then blame their self-created inflation on the politically appropriate enemy at the moment, the current war, or some other diversion.

-

Government expenses are rising exponentially and more rapidly than revenues. Mathematically we know this cannot continue forever. Expect higher gold prices and all paper currencies to devalue against hard assets.

I could go on, but the situation is clear. Gold did NOT blow-off into a bubble high in 2011, all the drivers for continued higher gold prices are still valid, demand is huge, supply will be restricted when the western central banks run out of gold or choose to terminate "leasing" into the market, and government expenses, "money printing" and bond monetization are out of control and accelerating.

Gold prices will climb a wall of worry in the years ahead.

You may be interested in my comments on Silver and 2011 - here.

GE Christenson aka Deviant Investor If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2014 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.