The Birth of a New Palladium Bull Market

Commodities / Palladium May 21, 2014 - 03:05 PM GMTBy: Jeff_Clark

If I asked you why you think I’m bullish on platinum and palladium, you’d probably point to the strikes in South Africa, the world’s largest producer of platinum. Or maybe the geopolitical conflicts with Russia, the largest supplier of palladium. Maybe you’d even mention that some technical analysts say the palladium price has “broken out” of its trading range.

If I asked you why you think I’m bullish on platinum and palladium, you’d probably point to the strikes in South Africa, the world’s largest producer of platinum. Or maybe the geopolitical conflicts with Russia, the largest supplier of palladium. Maybe you’d even mention that some technical analysts say the palladium price has “broken out” of its trading range.

These are all valid points—but they’re reasons why a trader might be bullish. When the strikes end, or Russia ends its aggression, or short-term price momentum eases, they’ll sell.

And that will be a mistake.

Because underneath the headlines lies an irreparable situation with the PGM (Platinum Group Metals) market, one that will last at least several years and probably more like a decade. This market is teetering on the edge of a supply crunch, one more perilous than many investors realize. As the issues outlined below play out, prices will be forced higher—which signals that we should diversify into the “other” precious metals now.

The basic problem is that platinum and palladium supply is in a structural deficit. It won’t be resolved when the strikes end or Russia simmers down. Here are six reasons why…

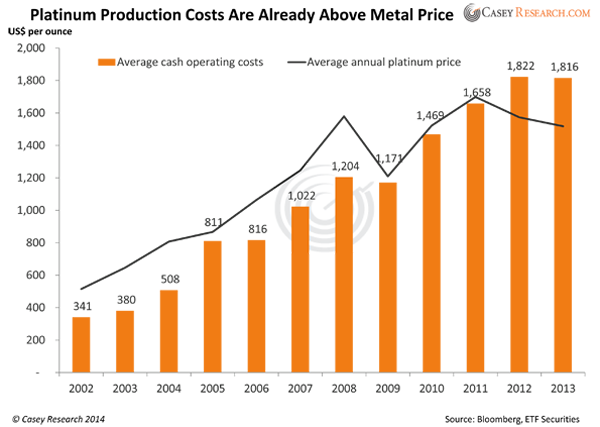

#1. Producers Won’t Meet the Cost of Production

The central issue of the striking workers in South Africa is wages. In spite of company executives offering to double wages over the next five years, workers remain on the picket line.

Regardless of the final pay package, wages will clearly be higher. And worker pay is one of the biggest costs of production. And the two largest South African producers (Anglo American and Impala), which supply 69% of the world’s platinum, are already operating at a loss.

Once the strike settles, costs will rise further. Throw in ongoing problems with electric power supply, high regulations, and past labor agreements, and there is virtually no chance costs will come down.

This dilemma means that platinum prices would need to move higher for production to be maintained anywhere near “normal” levels. Morgan Stanley predicts it will take at least four years for that to occur.

And if the price of the metal doesn’t rise? Companies will have no choice but to curtail production, making the supply crunch worse.

#2. Inventories Are Near the Bottom of the Barrel

One reason platinum price moves have been muted during the work stoppage is because there have been adequate stockpiles. But those are getting low.

Impala, the world’s second-largest platinum producer, said the company is now supplying customers from its inventories.

In March, Switzerland’s platinum imports from strike-hit South Africa plummeted to their lowest level in five-and-a-half years, according to the Swiss customs bureau.

Since producers can’t currently meet demand, some customers are now obtaining metal from other sources, including buying it in the open market.

As inventories decline, supply from producing companies will need to make up the shortfall—and they’ll have little ability to do that.

#3. The Strikes Will Make Recovery Difficult and Prolonged

Companies are already strategizing how to deal with the fallout from the worst work stoppage since the end of apartheid in 1994…

- Amplats said it might sell its struggling Rustenburg operations. Even if it finds a buyer, the new operator will inherit the same problems.

- Impala said that even if the strike ends soon, its operations will remain closed until at least the second half of the year.

- Some companies have announced they may shut down individual shafts. This causes a future problem because some of these mines are a couple of miles deep and would require a lot of money to bring back online—which they may balk at doing with costs already so high.

- It’s not being advertised, but a worker settlement will almost certainly result in layoffs since some form of restructuring will be required. This could trigger renewed strikes and set in motion a vicious cycle that further degrades production and makes labor issues insurmountable.

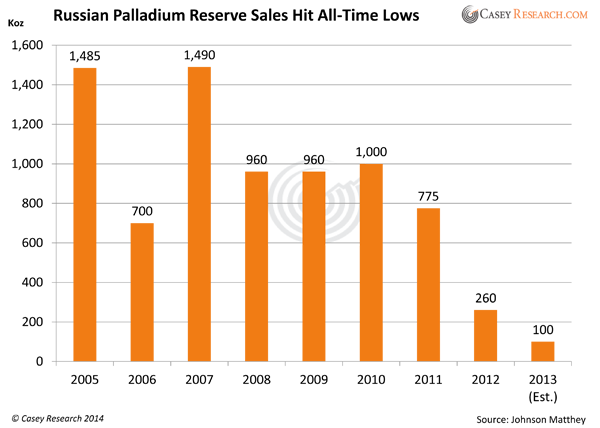

#4. Russian Palladium Is Already in a Supply Crunch

When it comes to palladium, Russia matters more than South Africa, since it provides 42% of global supply. Remember: palladium demand is expected to rise more than platinum, due to new auto emissions control regulations in Asia.

But Russia’s mines are also in trouble…

- Ore grades at Russia’s major mines, including the Norilsk mines, are reported to be in decline.

- New mines will take as long as 10 years to come online. It could take a decade for Russian production to rebound—if Russia even has the resources to do it. This stands in stark contrast to global demand for palladium, which has grown 35.8% since 2004.

- Russia’s aboveground stockpile of palladium appears to have dwindled to near extinction. The precise amount of the country’s reserves is a state secret, but analysts estimate stockpiles were 27-30 million ounces in 1990.

Take a look at reserve sales today:

Many analysts believe that since palladium reserve sales have shrunk, Russia has sold almost all its inventory. As unofficial confirmation, the government announced last week that it is now purchasing palladium from local producers. This paints a sobering picture for the world’s largest supplier of palladium—and is very bullish for the metal’s price.

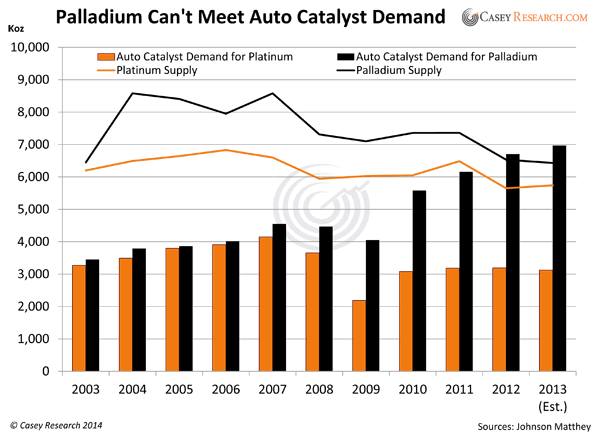

#5. Demand for Auto Catalysts Cannot Be Met

The greatest use of PGMs is in auto catalysts, which help reduce pollution. Platinum has long been the primary metal used for this purpose and has no widely used substitute—except palladium.

But that market is already upside down.

Palladium is cheaper than platinum, but replacing platinum with palladium requires some retooling and, on a large scale, would worsen the supply deficit.

As for platinum (which does work better than palladium in higher-temperature diesel engines), auto parts manufacturers are expected to use more of it than is mined this year, for the third straight year.

Some investors may shy away from PGMs because they believe demand will decline if the economy enters a recession. That could happen, but tighter emissions controls and increasing car sales in Asia could negate the effects of declining sales in weakening Western economies.

For example, China is now the world’s top auto-producing country. According to IHS Global, auto sales in China are projected to grow 5% annually over the next three years. PricewaterhouseCoopers forecasts that sales of automobiles and light trucks in China will double by 2019. That will take a lot of catalytic converters. This trend largely applies to other Asian countries as well. It’s important to think globally when considering demand.

The key, however, is that supply is likely to fall much further than demand.

#6. Investment Demand Has Erupted

Investment demand for platinum rose 9.1% last year. The increase comes largely from the new South African ETF, NewPlat. At the end of April, all platinum ETFs held nearly 89,000 ounces—a huge amount when you consider it was zero as recently as 2007.

Palladium investment fell 84% last year—but demand is up sharply year-to-date due to the launch of two South African palladium ETFs, pushing global palladium holdings to record levels. And like platinum, there was no investment demand for palladium seven years ago.

Growing investment demand adds to the deficit of these metals.

The Birth of a 10-Year Bull Market

Add it all up and the message is clear: by any reasonable measure, the supply problems for the PGM market cannot be fixed in the foreseeable future. We have a rare opportunity to invest in metals that are at the beginning of a potential 10-year bull run.

Platinum and palladium prices may drop when the strikes end, but if so, that will be a buying opportunity. This market is so tenuous, however, that an announcement of employees returning to work may be too little, too late. We thus wouldn’t wait to start building a position in PGMs.

GFMS, a reputable independent precious metals consultancy, predicts the palladium price will hit $930 by year-end and that platinum will go as high as $1,700. But that will just be the beginning; the forces outlined above could easily push prices to double over the next few years.

At that point, stranded supplies might start coming back online—but not until after major, sustained price increases make it possible.

The RIGHT Way to Invest

In my newsletter, BIG GOLD, we cover the best ways to invest in the metals themselves (funds and bullion), but for the added leverage of investing in a profitable platinum/palladium producer, I have to hand the baton over to Louis James, editor of Casey International Speculator.

You see, most PGM stocks are not worth holding, so you have to be very diligent in making the right picks. Remember, the dire problems of the PGM miners are one reason we’re so bullish on these metals. However, Louis has found one company in a very strong position to benefit from rising prices—and its assets are not located in either South Africa or Russia.

It’s the only platinum mining stock we recommend, and you can get its name, our full analysis, and our specific buy guidance with a risk-free trial subscription to Casey International Speculator today.

If you give it a try today, you’ll get three investments for the price of one: Your Casey International Speculator subscription comes with a free subscription to BIG GOLD, where you’ll find two additional ideas on how to invest in the PGMs.

If you’re not 100% satisfied with our newsletters, simply cancel during the 3-month trial period for a full refund—but whatever you do, make sure you don’t miss out on the next 10-year bull market. Click here to get started right now.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Casey Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.