Nickel, Palladium and Platinum Metals Outperforming in 2014

Commodities / Metals & Mining May 28, 2014 - 11:20 AM GMTBy: Jeb_Handwerger

Summary

Summary

- Platinum, Palladium and Nickel are outperforming the S&P 500 by a wide margin in 2014.

- The relative strength is fundamentally due to declining supply from key regions such as South Africa, Russia and Indonesia.

- Growth for Platinum, Palladium and Nickel is very strong especially in growing economies in Asia which need catalytic converters and stainless steel.

- China has hardly any domestic PGM or nickel production. They must import.

- Focus on advanced PGM/Nickel development projects in stable jurisdictions in North America.

Not all is bad in the metals sector. On the periodic table there are three metals in a column that I will focus on as I believe they will continue to outperform.

Nickel, Palladium and Platinum have been the outperformers in 2014. Palladium is at multi-year highs.

Platinum Group Metals (PGM's) outperformed the equity markets, 30 year bond and other metals except for nickel in 2014. Nickel is up more than 50% on the year.

Remember South Africa and Russia control the PGM market with over an 80% share of global supply.

Nickel supply was controlled by Indonesia which just announced an export ban.

PGM's and nickel are outperforming for the following 10 reasons.

- Ongoing Labor Strikes in South Africa

- Tensions with Russia and Ukraine

- Auto sales rising in China to record levels.

- China requires increasing amounts of PGM's used in catalytic converters to control air pollution.

- Indonesia which represents about 25% of global nickel supply has announced export bans. This is comparable to announcing the OPEC nations cutting off oil supply.

- In emerging economies cities are increasing in population requiriing the building of skyscrapers, pipelines, bridges and power plants which stainless steel is required.

- Economic sanctions with Russia could be adding to nickel and palladium shortage.

- Existing PGM and nickel production growth.

- China the largest growing consumer of these metals have very little from their own domestic production.

- Very few high quality and advanced mining projects in stable jurisdictions that are in the project cupboard.

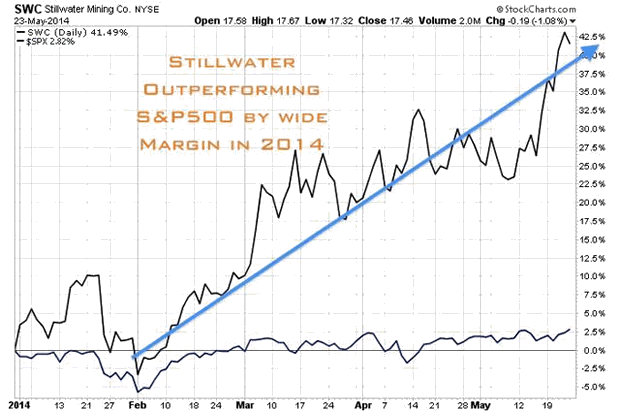

In conclusion, focus on either the Platinum (PTM), Palladium (PALL) and Nickel (JJN) ETFs tracking the commodities. If looking for leverage to PGM and nickel prices look at the large cap miners such as Stillwater Mining (SWC) which is the only US palladium producer. Stillwater is making a major breakout into new two year highs.

For more speculative investors looking for outsized gains with additional risk should now study the junior miners who control advanced PGM and nickel projects preferably with Preliminary Economic Assessments and Feasibility Studies in top notch jurisdictions. Most of these stocks are smaller cap and trading on the Canadian Exchanges and will be the focus of additional articles.

Subscribe to my free newsletter to get up to the minute updates on rare earths, uranium, gold and silver.

By Jeb Handwerger

Disclosure: Author owns no stocks mentioned.

© 2014 Copyright Jeb Handwerger - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeb Handwerger Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.