Few Believe Gold Price Can Shine

Commodities / Gold and Silver 2014 Jun 23, 2014 - 04:10 PM GMTBy: Submissions

Bob Loukas writes: Considering that Gold has risen $80 off its low and the precious metals Miners have screamed higher, it's surprising how little bullish cheering we've heard. My discussion forum, Bull & Bear Talk, is very sensitive to Gold, but has barely seen an uptick in traffic during this move. In past moves out of Investor Cycle Lows, Bull and Bear Talk has had an immediate surge in traffic and a significant rise in the number of excited posts.

Bob Loukas writes: Considering that Gold has risen $80 off its low and the precious metals Miners have screamed higher, it's surprising how little bullish cheering we've heard. My discussion forum, Bull & Bear Talk, is very sensitive to Gold, but has barely seen an uptick in traffic during this move. In past moves out of Investor Cycle Lows, Bull and Bear Talk has had an immediate surge in traffic and a significant rise in the number of excited posts.

This is just a small sampling of sentiment, but I think it's telling. We've had a 3 year bear market in Gold that has battered and beaten the bulls into complete submission. All speculative interest and fond memories of the past bull market have been completely erased. This lack of interest was evident in the recent 3rd test of the bear market low – the volume and volatility was much lower than during the first two retests. The bear market has achieved its goal – to clear sentiment on a longer timeframes and lay the foundation for a real change in trend. The view of Gold and its sentiment on longer timeframes is a picture perfect example of the ebb & flow of Cycles.

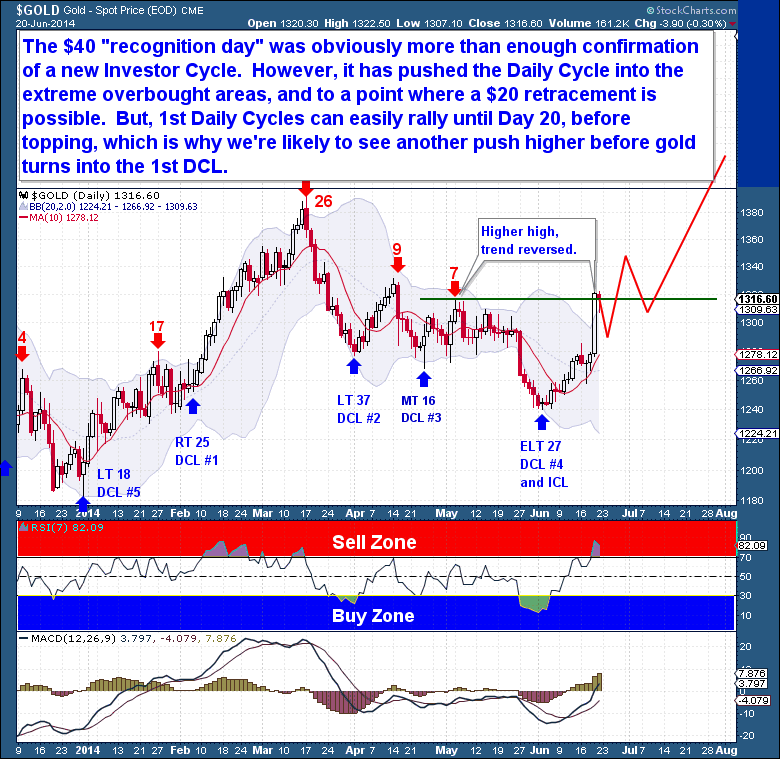

The $40 "recognition day" last week was obviously more than enough confirmation to declare a new Daily Cycle (Daily Cycle is 24-28 trading days), but it was powerful enough for declaration of a new Investor Cycle (Investor Cycle is 22-26 Weeks) as well. This is the development we’ve patiently waited for. However, on shorter time frames, Gold has pushed the Daily Cycle into an extremely overbought state, so a $20 or more retracement is possible.

This is only a problem for short term traders; a decision to take a new position now at such overbought levels could mean entering just as the market cools off. Nobody ever said that trading is easy, and determining when to enter a fast-moving asset is a frequent dilemma. Getting the trend right is only part of the challenge. Gold's 1st Daily Cycle typically rallies until day 18-20 before topping, so on day 13 here we’re likely to see another push higher before Gold turns down into its 1st Cycle Low. There is no way of knowing how powerful the remainder of the Cycle will be, but the average 1st Daily Cycle adds 10%. If that happens this time, Gold will top at around $1,364.

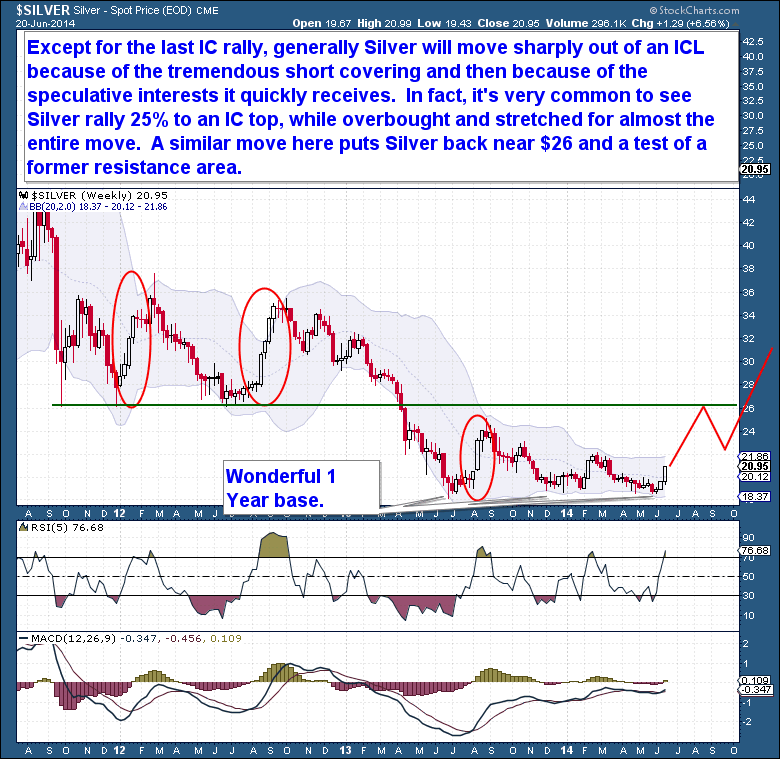

While the prescious metals Miners are looking good, Silver looks potentially explosive. Traders were caught flat footed and overly short, as is often the case at Investor Cycle Lows. The current 5% surge has come primarily on short covering, and Silver's massive short position will need to be reversed. The process of unwinding has only just begun, and it should provide enough fuel for Silver to move closer to the $23 level.

Beyond short covering, speculators will determine where Silver eventually tops. If price continues to rise, speculators should begin to jump on the bandwagon and it will be interesting to see how far Silver gets pushed in the current Investor Cycle. From a historical standpoint, it's very common to see Silver rally at least 20% – and typically close to 30% – in any given Investor Cycle. In some cases, it did so while overbought for almost the entire move. A similar move now would put Silver near $26, a level that tests former support.

I hope people keep their emotions contained while seeing these potential price projections. I’m not a believer in picking targets, especially ones 20%-30% above current levels, because doing so can serve to fuel a trader’s bias while diverting focus from the price action at hand. It can also encourage a “can’t lose” mentality and a tendency to over-trade or overleverage a move. This can lead to being whipsawed out of positions and to undue stress even as positions do well. Trading is more about execution that anything else, and proper timing (Cycles) of the markets is a key to success.

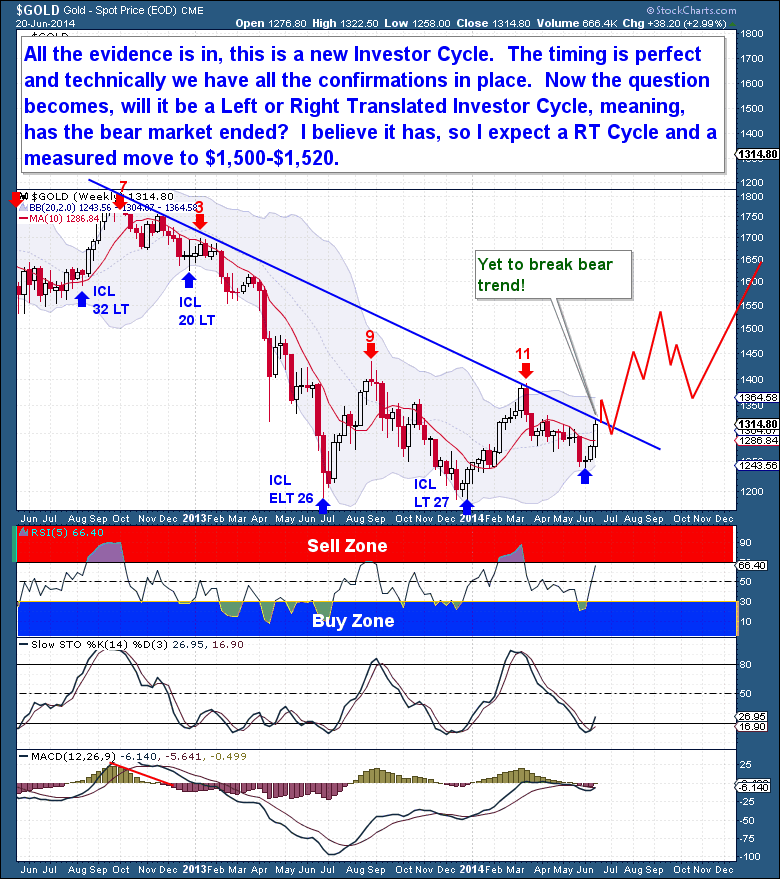

From an Investor Cycle standpoint, we’ve yet to break the bear market trend-line. That’s OK, because Gold is the slowest in this sector to react and it’s only 14 days into what should be a 6 month Cycle. What a new Investor Cycle shows, however, is the potential ahead – a normal Investor Cycle can add up to 20% in gains before topping out.

From a technical standpoint, the $1,500 area stands out as a potential top for Gold's coming move. At $1,500, Gold would test a key bear market resistance level and the point where bulls unsuccessfully mounted a defense. For the investors who trade on the Investor Cycle timeframe, we've finally got the turn and confirmation we’ve patiently waited for. All of that said, however, please remember that in investing, there are no guarantees. I will never stop repeating this phrase. But with a confirmed new Investor Cycle in play, the odds have dramatically shifted and the bulls should now be calling the action.

The Financial Tap publishes two member reports per week, a weekly premium report and a midweek market update report. The reports cover the movements and trading opportunities of the Gold, S&P, Oil, $USD, and US Bond Cycles. Along with these reports, members enjoy access to two different portfolios and trade alerts. Both portfolios trade on varying timeframes (from days, weeks, to months), there is a portfolio to suit all member preferences.

You're just 1 minute away from profitable trades! please visit http://thefinancialtap.com/landing/try#

By Bob Loukas

© Copyright Bob Loukas 2014

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.