Shanghai Silver - Another Dog that Did Not Bark

Commodities / Gold and Silver 2014 Jul 05, 2014 - 03:47 PM GMTBy: Jesse

The 'headline numbers' for the Non-Farm Payrolls came in better than expected.

The 'headline numbers' for the Non-Farm Payrolls came in better than expected.

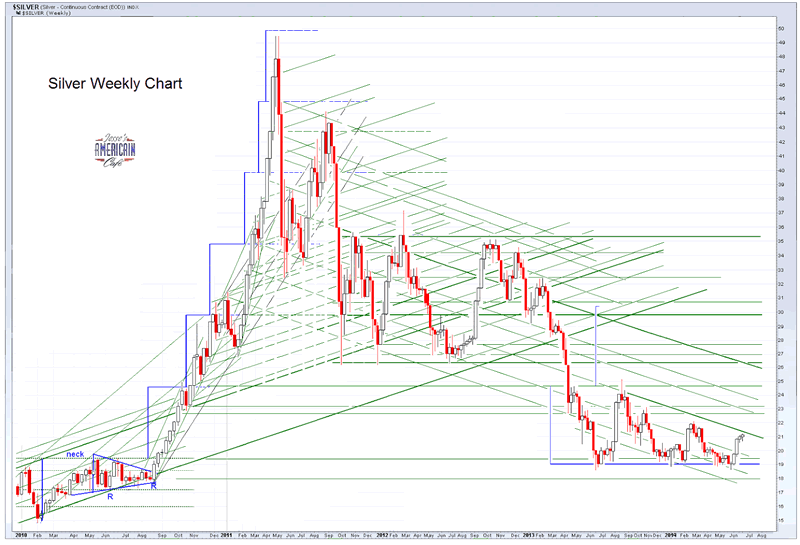

Gold and silver held their places well, and especially silver which is now the lead sled dog for my thinking. This is because July is an active month on the Comex of course but also because of the levels of physical inventory, both here and abroad.

Shanghai silver bullion inventory levels fall to lowest on record.

I took a look at the payroll numbers and did not see anything brazenly out of line. Except of course that it is not the number of jobs being added that is important, unless you are some metric toting bureaucrat trying to hit some number as a symbolic victory.

No, it is all about the quality of the jobs, especially the median wage and personal income, as it feeds into and sustains the kind of mass organic buying that boosts and sustains aggregate demand.

I noticed that some of the Neo-Keynesians have been launching their flaccid attacks on the evil Austrians.

Now, as you may know, I am certainly no Austrian economist and have quite a bit of respect for Keynes himself, if not for all of his acolytes. But the way in which the Neo-Keynesians are rallying around their phony recovery flag causes me to suspect that things behind the curtain are not going well, and that they are afraid. Not that this makes the Austrians right with their tough economic love for others less worthy, especially those of the lower classes as they would define them. There are not too many of the common people heading for Galtopia, except as servants and cogs in the wheels of the ubermenschen.

Obviously setting public policy principles top down and then doing things to achieve them directly would be the thing to do, and dropping this newest canard that objective scientific economic principles dictate anything except what their puppeteers wish them to say. But alas, that all gets lost in the noise and the humbug of modern thinking, especially the thought for pay so prevalent these days amongst the disgraced professions.

July may still prove to be an interesting month, and I suspect that before the year end we will see some pet economic theories in addition to the efficient market hypothesis shot to hell.

For the Yanks, have a pleasant holiday weekend.

And for the rest of the world, please try to carry on.

See you Sunday evening. Remember the poor souls who have none to love or care for them. You may some day find yourself amongst them. If not in this world, then perhaps in the next. As Jack Kerouac said, 'they build their own hells.' And they are locked tight, from the inside.

By Jesse

http://jessescrossroadscafe.blogspot.com

Welcome to Jesse's Café Américain - These are personal observations about the economy and the markets. In plewis

roviding information, we hope this allows you to make your own decisions in an informed manner, even if it is from learning by our mistakes, which are many.

© 2014 Copyright Jesse's Café Américain - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jesse Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.