Japanese Stock Market Still Leads – You Need To Look Close

Stock-Markets / Japanese Stock Market Jul 07, 2014 - 03:41 AM GMTBy: Submissions

Forex Kong writes: We’ve all got a thesis ( or at least I hope you do ) as to how we see things moving in the future. Some base it on their knowledge of fundamentals, others purely from a technical perspective and then fewer still - those who attempt to take both disciplines into account, to formulate a picture of things to come.

Forex Kong writes: We’ve all got a thesis ( or at least I hope you do ) as to how we see things moving in the future. Some base it on their knowledge of fundamentals, others purely from a technical perspective and then fewer still - those who attempt to take both disciplines into account, to formulate a picture of things to come.

When you consider that trade volume in U.S Equities has dwindled some 50% since 2008, and of the 50% remaining some “70% of that” is merely HFT ( high frequency trade algo’s ) trading back and forth amongst themselves, you’ve really got to ask yourself if looking to The SP 500 for future direction really makes any sense at all.

This isn’t your father’s market.

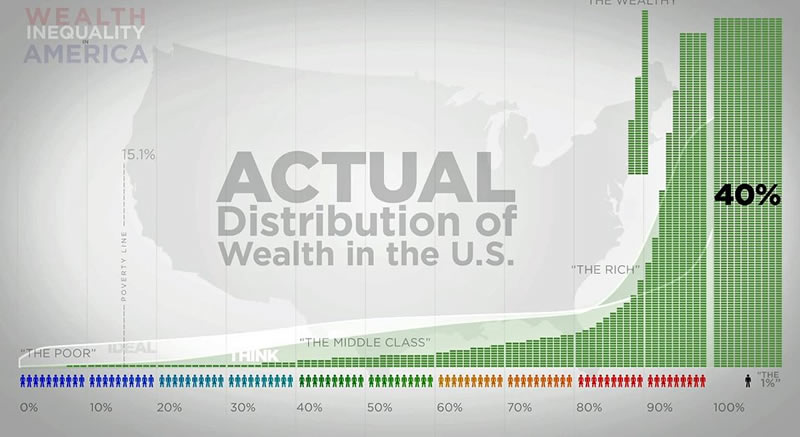

In the US, the wealthiest one percent captured 95 % of the “post-financial crisis growth” since 2009 – while the bottom 90 % became poorer.

The top the top 1 % of Americans own 40 percent of U.S. wealth, while the bottom 80% own just 7 percent of America’s wealth. This market has absolutely nothing to do with “mom n pop” anymore - as The Fed and Wall St. are essentially the only buyers / sellers.

It’s a sad state of affairs really.

I tend to look to markets “outside” the immediate influence of such factors to formulate a “more reasonable view” of reality, our current place in things, and likely moves in the future.

I look to Japan.

The Nikkei led world markets down in 2007 by a full 6 months, and it’s my belief that this time will be no different. It’s been a full 6 months now since The Nikkei topped back in late December 2013, lining up well with the expected correction coming in the U.S.

The Japanese economy is completely hooped and The BOJ has now suggested they will stop devaluing Yen until at least early 2015 “if not” later. I’ve marked some “general” elliot type / wave type numbers ( for those of you who follow that stuff ) providing a broad stroke of where we’re headed next.

For further in depth analysis of The Nikkei, it’s correlation to The SP 500 as well currencies and gold – please join us our members area at: www.forexkong.net

© 2014 Copyright Forex Kong - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.