The Falling US Dollar is No Friend to the US Financials

Stock-Markets / Banking Stocks May 09, 2008 - 12:52 AM GMTBy: Donald_W_Dony

The affects of the declining U.S. currency goes beyond simply providing inflationary pressures, stronger foreign currencies and high gold prices, it also has a direct impact on how portfolios should be weighted. Since the beginning of the waterfall drop of the world's reserve currency, funds have rotated into energy stocks and out of financials. And this action is never favourable for the S&P 500.

The affects of the declining U.S. currency goes beyond simply providing inflationary pressures, stronger foreign currencies and high gold prices, it also has a direct impact on how portfolios should be weighted. Since the beginning of the waterfall drop of the world's reserve currency, funds have rotated into energy stocks and out of financials. And this action is never favourable for the S&P 500.

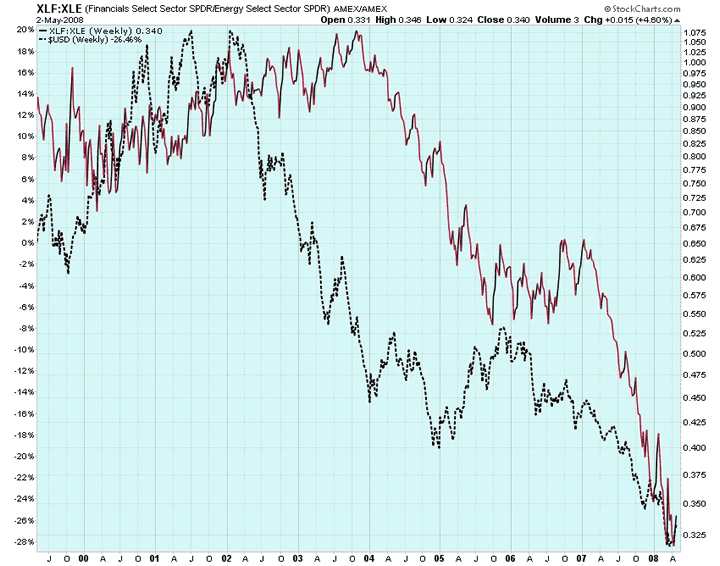

The connection to the plunging U.S. dollar and the performance of U.S. financials can be seen in chart 1. The dotted line is the price of the U.S. Dollar Index since 1999. The red line is a ratio of the Financial sector ETF (XLF) and the Energy sector ETF )XLE). The chart illustrates that as the dollar rose in the 1990s, U.S. financials had better performance then the energy sector. however, when the greenback started to drop, the flow of funds began to shift and favour the energy sector.

Approximately 18 months after the peak in the currency (January 2002), the energy sector was out performing financials. This relationship occurred again in 2005 and 2006. During the brief U.S. dollar bounce in 2005, financials, once again, took control over the energy sector as funds rotated back toward the U.S. banks and insurance companies. The lag time was about 12 months. As the dollar resumed its long-term downward path in early 2006, the energy sector, once again, trumped the financials by the 1st quarter of 2007.

Bottom line: The falling U.S. dollar creates an inflationary environment which is beneficial to commodity-driven sectors and normally a hindrance to paper-based industries such as financials. The large cap U.S. industrials and technology sectors typically follows a similar path as to the financials.

Investment approach: Portfolios should be weighted toward commodity-driven sectors and indexes over financials as long as the U.S. dollar continues to slide. Portfolio holdings in the S&P 500 should remain underweighted to natural resource-based indexes such as Brazil, Mexico and Canada.

Extensive U.S. policy changes are needed before the greenback can be expected to reverse its downward course. Higher interest rates, massive reduction in the debt and an increase in taxes will provide an upward stimulus to the currency but prove politically unpopular. The dollar can therefore be expected to fall for the foreseeable future.

More research is available in the May newsletter. Go to www.technicalspeculator.com and click on member login. Follow the links to the latest research report.

Your comments are always welcomed.

By Donald W. Dony, FCSI, MFTA

www.technicalspeculator.com

COPYRIGHT © 2008 Donald W. Dony

Donald W. Dony, FCSI, MFTA has been in the investment profession for over 20 years, first as a stock broker in the mid 1980's and then as the principal of D. W. Dony and Associates Inc., a financial consulting firm to present. He is the editor and publisher of the Technical Speculator, a monthly international investment newsletter, which specializes in major world equity markets, currencies, bonds and interest rates as well as the precious metals markets.

Donald is also an instructor for the Canadian Securities Institute (CSI). He is often called upon to design technical analysis training programs and to provide teaching to industry professionals on technical analysis at many of Canada's leading brokerage firms. He is a respected specialist in the area of intermarket and cycle analysis and a frequent speaker at investment conferences.

Mr. Dony is a member of the Canadian Society of Technical Analysts (CSTA) and the International Federation of Technical Analysts (IFTA).

Donald W. Dony Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.