When All You Have Left Is the Cost of Breakfast at McDonald’s

Personal_Finance / Pensions & Retirement Jul 23, 2014 - 03:45 PM GMTBy: Don_Miller

When I was 20 years old, I sat through my first day of a business law course at Northwestern University. The professor began by writing two words on the blackboard (in the prehistoric days of blackboards and chalk): Caveat emptor. He raised his voice and said, “Let the buyer beware!” I’m here to echo his warning, but this time it’s about annuities.

When I was 20 years old, I sat through my first day of a business law course at Northwestern University. The professor began by writing two words on the blackboard (in the prehistoric days of blackboards and chalk): Caveat emptor. He raised his voice and said, “Let the buyer beware!” I’m here to echo his warning, but this time it’s about annuities.

Annuities are at the top of the list of complicated products that often profit insurance companies without adequately compensating the buyer in return. Put plainly, sometimes you don’t get what you thought you paid for.

And, while annuities are often described as a “transfer of risk,” which is basically correct, owning an annuity will not transfer the risk of one of the greatest hazard’s to a retiree’s financial security: inflation. Inflation isn’t the only risk to worry about—lack of liquidity and insurance company default should also top your list of concerns—but it can be the most treacherous for someone with an annuity-heavy portfolio.

Will an annuity protect your lifestyle? In the short term, it might. If you believe the Federal Reserve when it says it will keep inflation at 2% or less, perhaps it will for a period of time. Even then, inflation will eat away at the buying power of your annuity payout fairly quickly. You are contractually guaranteed income; however, that does not guarantee your lifestyle.

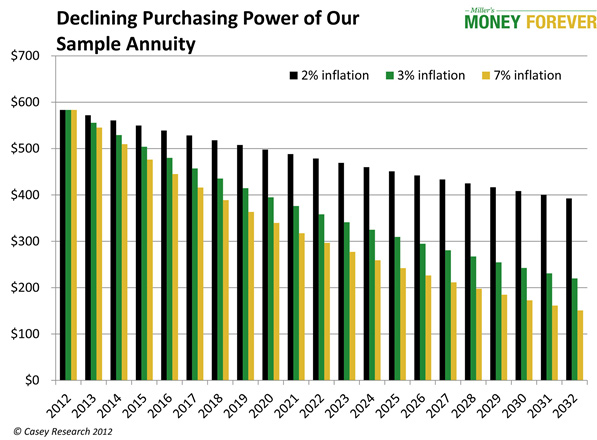

To see the effect, my analysts and I charted the purchasing power of a single premium immediate lifetime annuity with installment refund, which pays $583.33 per month. We’ve compared several inflation scenarios: the currently tame 2% inflation rate; the long-run average of about 3%; and the possibility of things getting considerably worse at 7% inflation. We’re not even talking about hyperinflation—just reasonable estimates.

Even at the low 2% inflation rate, your $583.33 benefit would only have the purchasing power of $392.56 after 20 years. In the 7% inflation scenario, the purchasing power would be down to $150.74. Let’s put this into context.

The average US electricity bill is around $103.67. The average cellphone bill is $111. According to the USDA, an elderly household of two that’s being extremely thrifty could get its monthly grocery bill down to as low as $357.30 per month. In total, that’s $571.97 – leaving just enough for a McDonald’s breakfast.

Right off the bat, that isn’t so bad. The annuity takes care of the cellphones, the electricity, the groceries, and leaves a little extra. However, after 20 years at 2% inflation and a purchasing power of $392.56, the benefit would only be enough to pay for the thrifty grocery budget, leaving only $35.26 left over. Though your annuity benefits are the same, prices have risen, so now you have less purchasing power.

After 20 years of 3% inflation, it gets even worse. With $219.85 in purchasing power, you’ll have to weigh either purchasing 2/3 of your usual groceries against paying the electricity and phones. You won’t be able to do it all. By the third year, you will need to add funds to your annuity payment to cover those expenses.

And under the 7% scenario, you’ll only be able to pay for the electricity bill with less than $50 in purchasing power left over. That’s hardly the lifetime income most annuity buyers had in mind.

Furthermore, consider that our assumptions are a little optimistic. In all likelihood, your electricity and grocery bills will probably rise faster than the rate of inflation. If that’s the case, then you’d be in real trouble.

So, while annuities promise guaranteed income, they certainly do not guarantee what that income will afford you in the future.

Annuity policies can be structured with inflation protection, but those options are expensive in terms of the lower initial payments. With benefits starting so much lower, you would have to live an exceptionally long time to make them work out.

Depending on your circumstances, an annuity might play a useful role in your long-term financial plans. There is much to be said for transferring some risk to a quality insurance company. However, transfering one risk without planning for another could be catastrophic. Even something like a 5% inflation rider might not protect you if higher inflation rates become a reality. If a considerable portion of your portfolio is in annuities, then another portion needs to be balanced to fight inflation, with holdings such as precious metals.

While it’s impossible to make the risk of inflation go away, there are a few simple things you can do to minimize it:

- Never hold a very large portion of your portfolio in annuities. If high inflation picks up you could be entirely cleaned out.

- If you’re holding annuities, make sure that another part of your portfolio is geared to hedge against inflation.

Now, I’m not shouting caveat emptor just for the heck of it. As a retirement advocate and senior editor at Miller’s Money Forever my mandate is transparent financial education for seniors, conservative investors and anyone serious about building a rich retirement. That’s why my team of analysts and I have put together a free, comprehensive special report called Annuities De-Mystified—Three Simple Tools for Choosing the Right Annuity. Get the full truth on annuities by downloading your complimentary copy of Annuities De-Mystified today.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Casey Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.