We’re Ready to Profit in the Coming Gold Price Correction—Are You?

Commodities / Gold and Silver 2014 Jul 29, 2014 - 07:07 PM GMTBy: Casey_Research

By Laurynas Vegys

By Laurynas Vegys

Sometimes I see an important economic or geopolitical event in screaming headlines and think: “That’s bullish for gold.” Or: “That’s bad news for copper.” But then metals prices move in the opposite direction from the one I was expecting. Doug Casey always tells us not to worry about the short-term fluctuations, but it’s still frustrating, and I find myself wondering why the price moved the way it did.

As investors we’re all affected by surges and sell-offs in the investments that we own, so I want to understand. Take gold, for example. Oftentimes we find that it seems to tease us with a nice run-up, only to give a big chunk of the gains back the next week. And so it goes, up and down…

The truth is—and it really is this simple, but so obvious that people forget—that there are always rallies and corrections. The timing is rarely predictable, but big market swings within the longer-term megatrends we’re speculating on are normal in our sector.

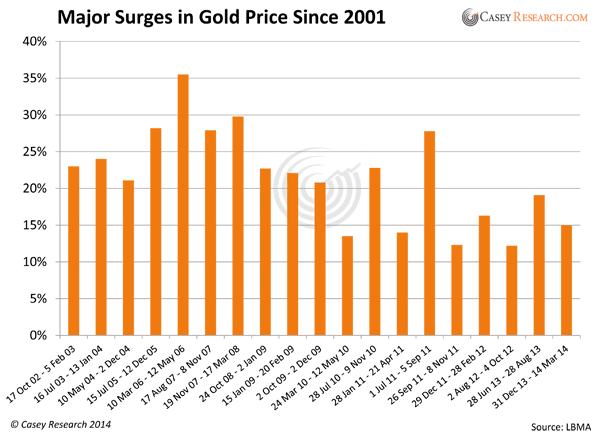

Since 2001, the gold price had 20 surges of 12% or greater, including the one that kick-started 2014. Even with last year’s seemingly endless “devil’s decline,” we got one surge. If we were to lower the threshold to 8%, there’d be a dozen more and an average of three per year, including two this year.

Here at Casey Research, we actually look forward to corrections. Why? We know we’ll pay less for our purchases—they’re great for new subscribers who missed the ground-floor opportunities years ago.

This confidence, of course, is the product of decades of cumulative experience and due diligence. We’re as certain as any investor can ever be that today’s data and the facts of history back our speculations on the likely outcomes of government actions, including the future direction of the gold price.

When you keep your eye firmly on the ball of the major trends that guide us, you can see rallies and corrections for what they are: roller-coaster rides that give us opportunities to buy and take profits. This volatility is the engine of “buy low, sell high.” Understanding this empowers the contrarian psychology necessary to buy when prices on valuable assets tank, and to sell when they soar.

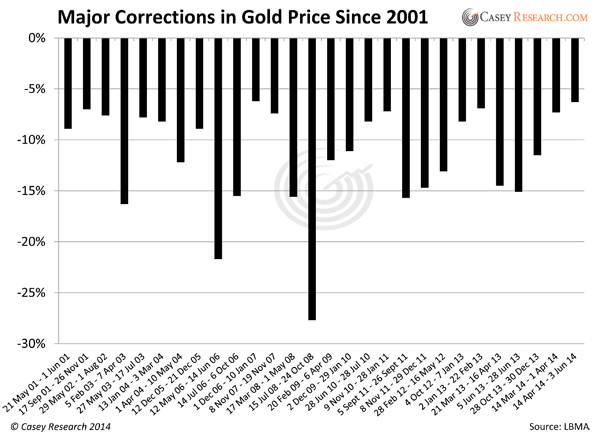

There have been plenty of opportunities to buy during the corrections in the current secular gold bull market. The following chart shows every correction of 6% or more since 2001.

As you can see, there have been 28 such corrections over the past 13 years—two per year, on average. Note that the corrections only outnumber surges because we used a lower threshold (6%). At the 12% threshold we used for surges, there wouldn’t be enough to show the somewhat periodic pattern we can see above. It’s also worth noting that our recent corrections fall well short of the sharp sell-off in the crash of 2008.

Of course, there are periods when the gold price is flat, but the point is that these kinds of surges and corrections are common.

Now the question becomes: what exactly drives these fluctuations (and the price of gold in general)?

In tackling this, we need to recognize the fact that not all “drivers” are created equal. Some transient events, such as military conflicts, political crises, quarterly GDP reports, etc., trigger short-lived upswings or downturns (like some of those illustrated in the charts above). Others relate to the underlying trends that determine the direction of prices long term. Hint: the latter are much more predictable and reliable. Major financial, economic, and political trends don’t occur in a vacuum, so when they seem to become apparent overnight, it’s the people watching the fundamentals who tend to be least surprised.

Here are some of the essential trends we are tracking…

The Demise of the US Dollar

Gold is priced around the world in United States dollars, so a stronger US dollar tends to push gold lower and a weaker US dollar usually drives gold higher. With the Fed’s money-printing machine (“quantitative easing”) having been left on full throttle for years, a weaker dollar ahead is a virtual certainty.

At the same time, the US dollar’s status as reserve currency of the world is being pushed ever closer to the brink by the likes of Russia and China. Both have been making moves that threaten to dethrone the already-precarious USD. In fact, a yuan-ruble swap facility that excludes the greenback as well as a joint ratings agency have already been set up between China and Russia.

The end of the USD’s reign as reserve currency of the world won’t end overnight, but the process has been set in motion. Its days are all but numbered.

The consequences are not favorable for the US and those living there, but they can be mitigated—or even turned into opportunities to profit—for those who see what’s coming. Specifically, this big-league trend is extremely bullish for real, tangible assets, especially gold.

Out-of-Control Government Debt and Deficits

Readers who’ve been with us for a while know that another major trend destined for some sort of cataclysmic endgame can be seen in government fiscal policy: profligate spending, debt crises, currency crises, and ultimately currency regime change. This covers more than the demise of the USD as reserve currency of the world (as mentioned above); it also covers a loss of viability of the euro, and hyperinflationary outcomes for smaller currencies around the world as well.

It’s worth noting that government debt was practically nonexistent, by modern standards, halfway through the 20th century. It has seen a dramatic increase with the expansion of government spending, worldwide.

The US government has never been as deep in debt as it is today, with the exception of the periods of World War II and its immediate aftermath, having recently surpassed a 100% debt-to-GDP ratio.

Such an unmanageable debt load has made deficits even worse. Interest payments on debt compound, so in time, interest rates will come to dominate government spending. Neither the dollar nor the economy can survive such a massive imbalance so something is bound to break long before the government gets to the point where interest gobbles up 80%+ of the budget.

Gold Flowing from West to East

The most powerful trend specifically in gold during the past few years has been the tidal shift in the flow of gold from West to East. China and India are the names of the game with the former having officially overtaken the latter as the world’s largest buyer of gold in 2013. Last year alone, China imported over 1,000 tonnes of gold through Hong Kong and mined some 430 tonnes more.

China hasn’t updated its government holdings of gold since it announced it had 1,054 tonnes in 2009, but it’s plain to see that by now there is far more gold than that, whether in central bank vaults or private hands. Just adding together the known sources, China should have over 4,000 tonnes of monetary gold, and that’s a very conservative estimate. That would put China in second place in the world rankings of official gold holdings, trailing only the United States. The Chinese government supports this accumulation of gold, so this can be seen as a step toward making the Chinese renminbi a world currency—which would have a lot more behind it than US T-bills.

India presents just as strong a bullish case, if only slightly tainted with Indian government’s relentless crusade to rein in the country’s current account deficit by maintaining the outrageously high (i.e., 10%) import duty on gold and silver. Of course, this just means more gold smuggling, which casts official Indian stats into question, as more and more of the industry moves into the black and grey markets. World Gold Council research estimates that 75% of Indian households would either continue or increase their gold buying in 2014. Even without gold-friendly policies in place, this figure is extremely bullish for gold and in line with the big picture we’re betting on.

So What?

Nobody can predict when the next rally will occur nor the depth of the next sell-off. I can promise you this: as an investor you’ll be much happier about those surges if you stick to buying during the corrections. But it has to be for the right reasons, i.e., buying when prices drop below reasonable (if not objective) valuation, and selling when they rise above it. Focusing on the above fundamental trends and not worrying about short-term triggers can help.

Profiting from these trends is what we dedicate ourselves to here. Under current market conditions, that means speculating on the best mining stocks that offer leverage to the price of gold.

Here’s what I suggest: test-drive the International Speculator for 3 months with a full money-back guarantee, and if it’s not everything you expected, just cancel for a prompt, courteous refund of every penny you paid. Click here to get started now.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Casey Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.