Volatile Markets Shake U.S. Economy

Stock-Markets / Financial Markets 2014 Aug 04, 2014 - 06:47 PM GMTBy: Harry_Dent

Volatile markets are shaking the U.S. economy and geopolitical conflicts are intensifying. This is bad news.

Volatile markets are shaking the U.S. economy and geopolitical conflicts are intensifying. This is bad news.

Iraq is falling into civil war, like Syria did after the Arab Spring across North Africa; Israel is invading Gaza; a Malaysia airliner was shot down over Ukraine — by who knows whom; and two Ukrainian fighter jets were shot down by Russian rebels.

But no problem! The markets go down for a day (on July 17) and then bounce right back up like nothing was happening at all.

The markets have gone nuts!

Even Janet Yellen, after saying there is no bubble, is warning of bubbles in select sectors like small cap stocks and biotech.

Major stock analysts are saying that stocks are fairly valued at 17 times earnings. Small cap stocks (at 26 times earnings) aren’t seeing their earnings grow any faster than larger cap stocks. They’re getting just 6% growth and even that’s slowing.

What are these people thinking? This is what I call an “economy of nut cases and sheep.”

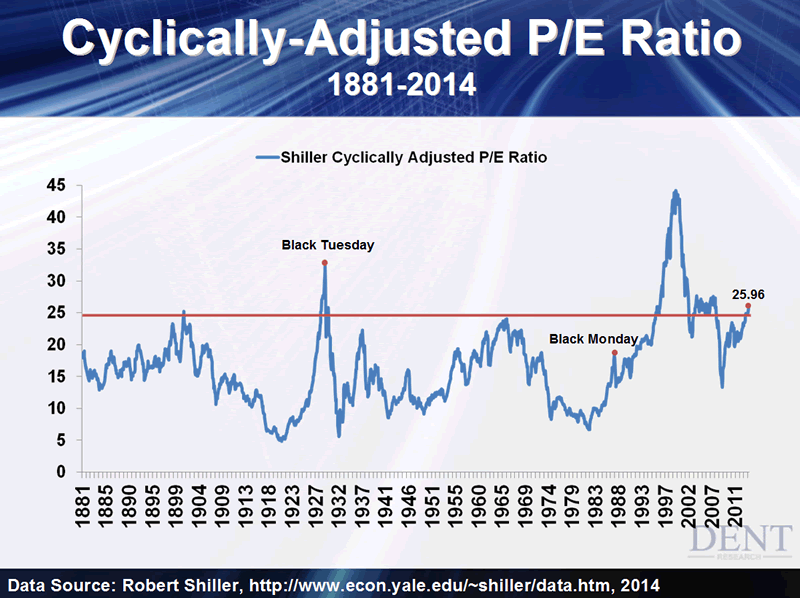

Robert Shiller’s innovative, cyclically-adjusted model for measuring price-to-earnings ratios, which uses the average real earnings of the past 10 years, shows that stocks are highly overvalued (and getting more so). In fact, current valuations correspond to most of the greatest stock tops over the last century.

See for yourself…

Yes, such ratios were higher in the tech bubble that peaked in March 2000. But that was the greatest bubble in modern history. The second greatest was the auto and farm bubble of the Roaring 20s, which culminated on Black Tuesday.

But those are what I call rare and primary bubbles that see the combination of very strong demographic trends and surging technology penetrations like automobiles and the Internet. Don’t expect a repeat.

That’s not to say we’re not in a bubble right now. It IS to say that the market is now high on the fumes of its own success and will come crashing down soon enough.

My opinion of this is confirmed when I consider the Geopolitical Cycle, which alternates between positive and negative every 17 to 18 years. (An economic cycle always fluctuates between growth and recession.) During negative cycles, like the one we’re in now (from 2001 to 2019), stocks have roughly half the valuations than they do during the positive cycle.

Basically, this means that we’re extremely overvalued for this point in the negative Geopolitical Cycle. Only if we were in the positive cycle could we expect to see a repeat of the 1920s and 2000s bubbles and valuations.

Markets may go up some more, but we’re heading into the worst part of the Geopolitical Cycle, so stay very cautious. With worsening demographic trends and unprecedented debt ratios around the world, every day the market goes higher, the riskier things get.

When bubbles burst, it can be very violent. The first crash in May of 2000 saw a 40% drop of the Nasdaq bubble. It’s better to get out of a bubble like this a bit too early than a bit too late.

Harry

Follow me on Twitter @HarryDentjrHarry studied economics in college in the ’70s, but found it vague and inconclusive. He became so disillusioned by the state of the profession that he turned his back on it. Instead, he threw himself into the burgeoning New Science of Finance, which married economic research and market research and encompassed identifying and studying demographic trends, business cycles, consumers’ purchasing power and many, many other trends that empowered him to forecast economic and market changes.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.