Gold Underpinned by Surging Inflation in UK, China and Internationally

Commodities / Gold & Silver May 13, 2008 - 08:54 AM GMTBy: Mark_OByrne

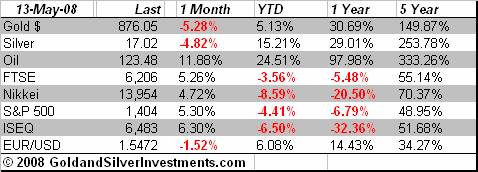

Gold was down 80 cents to $883.90 yesterday but silver was up 36 cents to $17.16. The London AM Gold Fix at 1030 GMT this morning was at $877.00, £450.18 and €566.61 (from $887.25, £453.91 and €573.60 yesterday).

Gold was down 80 cents to $883.90 yesterday but silver was up 36 cents to $17.16. The London AM Gold Fix at 1030 GMT this morning was at $877.00, £450.18 and €566.61 (from $887.25, £453.91 and €573.60 yesterday).

With the dollar stronger and oil slightly weaker, gold has come under pressure this morning but with inflationary pressures gathering throughout the global economy (see below) gold is unlikely to fall much further from these levels and after a period of consolidation (possibly shorter than expected) will likely soon recommence its bull market. However in the short term break below $874 could see us quickly challenge recent support at $864 and possibly the previous resistance at $850.

Today's Data and Influences

The tone may be set by the release of US retail sales data for April which will show if the embattled U.S. consumer has managed to keep spending. Headline sales in the US are expected to show a drop of 0.1% on the month due to very weak auto sales, which could be dollar negative and bolster gold. A few Fed members are also scheduled to speak over the day and markets will be looking to see if their remarks support the view that the FOMC has reached the end of its easing cycle and whether they have reassessed the threat posed by inflation. Other US data due for release today include business inventories for March.

Inflation Surges in UK, China and Internationally

Gold will likely be underpinned due to increasingly negative real interest rates in the U.S. and increasing inflation in the U.S. and in most economies internationally. The FTSE has come under pressure this morning after a shock increase in the cost of living in the UK where the rate of inflation in Britain leapt from 2.5% to 3% in April - the biggest increase in six years. The target rate of inflation set for the Bank of England by the Government is 2.0%. The figure is far higher than the 2.6% expected by analysts and will almost certainly stop another cut in interest rates next month despite the sharply falling housing market and slowing economy.

Gas and electricity suppliers internationally have said that prices are set to rise even further in the coming weeks as this latest surge in energy prices gets passed onto consumers. And there is not set to be any respite from surging food prices according to the IMF, World Bank and now the head of Coca Cola. The president of the Coca-Cola Company said today that high commodity and food prices were unlikely to come down anytime soon. Muhtar Kent said that prices were rising due to a 'perfect storm' of conditions including countries diversifying to ethanol, growing demand from emerging economies and weather factors.

And it is not just the western world facing these serious inflationary pressures. Middle Eastern countries and others with currency pegs to the dollar are also threatened by surging inflation. In China, prices rose 8.5% in April alone necessitating fresh monetary tightening.

Market neophytes and those unaware of financial and economic history forget that inflation is the mortal enemy of fiat currencies and paper assets such as equities and bonds. Equity indices and bond markets are likely to come under serious pressure in the coming months as the inflation genie is now well and truly out of the lamp.

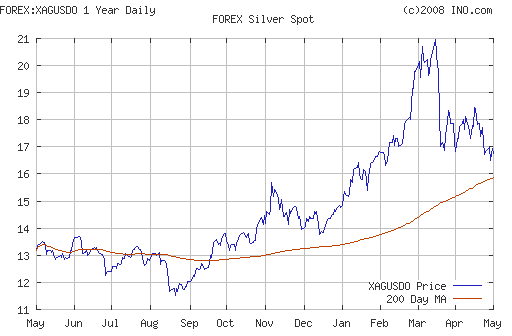

Silver

Silver is trading at $17.11/17.16 per ounce at 1200 GMT.

PGMs

Platinum is trading at $2063/2073 per ounce (1200 GMT).

Palladium is trading at $434/439 per ounce (1200 GMT).

By Mark O'Byrne, Executive Director

| Gold Investments 63 Fitzwilliam Square Dublin 2 Ireland Ph +353 1 6325010 Fax +353 1 6619664 Email info@gold.ie Web www.gold.ie |

Gold Investments Tower 42, Level 7 25 Old Broad Street London EC2N 1HN United Kingdom Ph +44 (0) 207 0604653 Fax +44 (0) 207 8770708 Email info@www.goldassets.co.uk Web www.goldassets.co.uk |

Gold and Silver Investments Ltd. have been awarded the MoneyMate and Investor Magazine Financial Analyst of 2006.

Mission Statement

Gold and Silver Investments Limited hope to inform our clientele of important financial and economic developments and thus help our clientele and prospective clientele understand our rapidly changing global economy and the implications for their livelihoods and wealth.

We focus on the medium and long term global macroeconomic trends and how they pertain to the precious metal markets and our clienteles savings, investments and livelihoods. We emphasise prudence, safety and security as they are of paramount importance in the preservation of wealth.

Financial Regulation: Gold & Silver Investments Limited trading as Gold Investments is regulated by the Financial Regulator as a multi-agency intermediary. Our Financial Regulator Reference Number is 39656. Gold Investments is registered in the Companies Registration Office under Company number 377252 . Registered for VAT under number 6397252A . Codes of Conduct are imposed by the Financial Regulator and can be accessed at www.financialregulator.ie or from the Financial Regulator at PO Box 9138, College Green, Dublin 2, Ireland. Property, Commodities and Precious Metals are not regulated by the Financial Regulator

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. Past experience is not necessarily a guide to future performance.

All the opinions expressed herein are solely those of Gold & Silver Investments Limited and not those of the Perth Mint. They do not reflect the views of the Perth Mint and the Perth Mint accepts no legal liability or responsibility for any claims made or opinions expressed herein.

Mark O'Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.